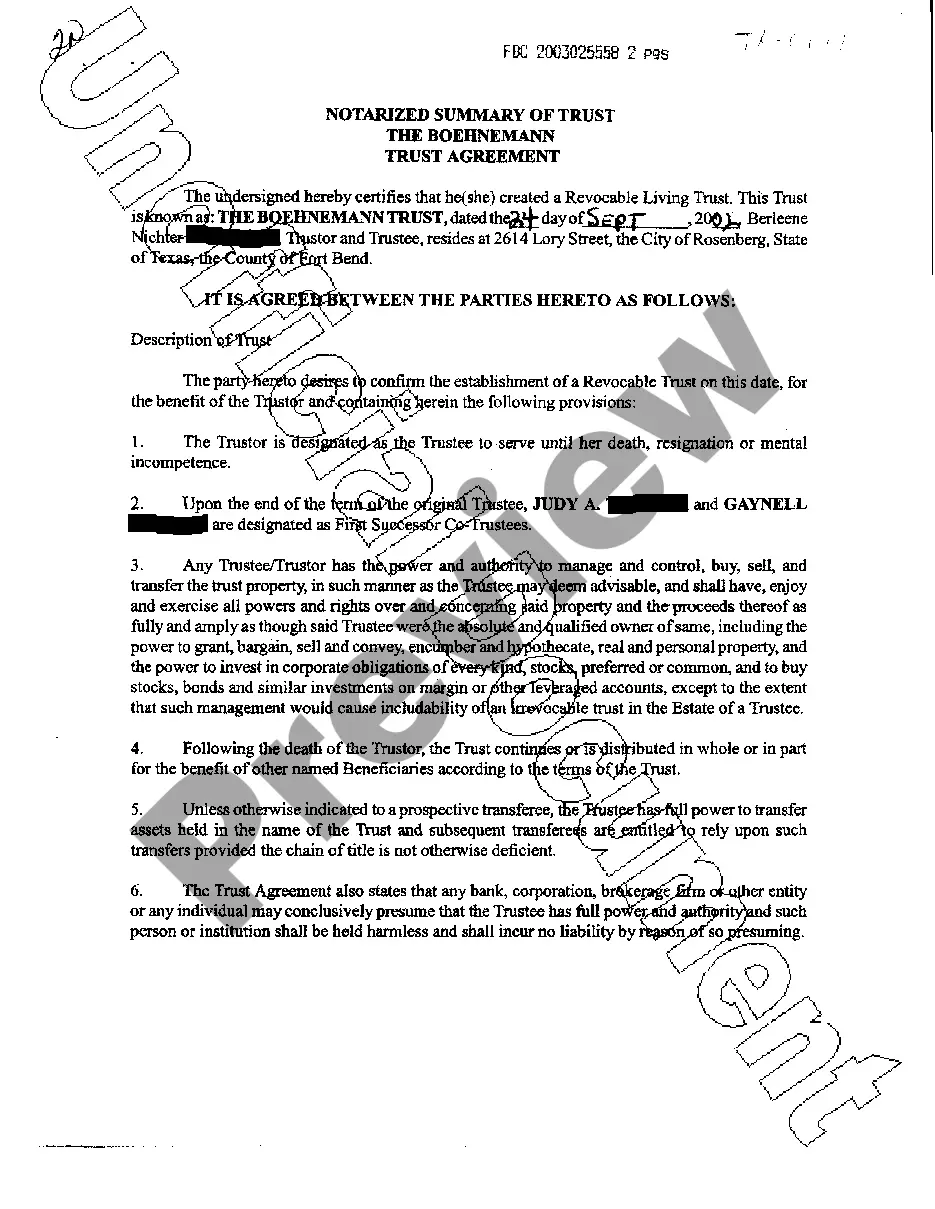

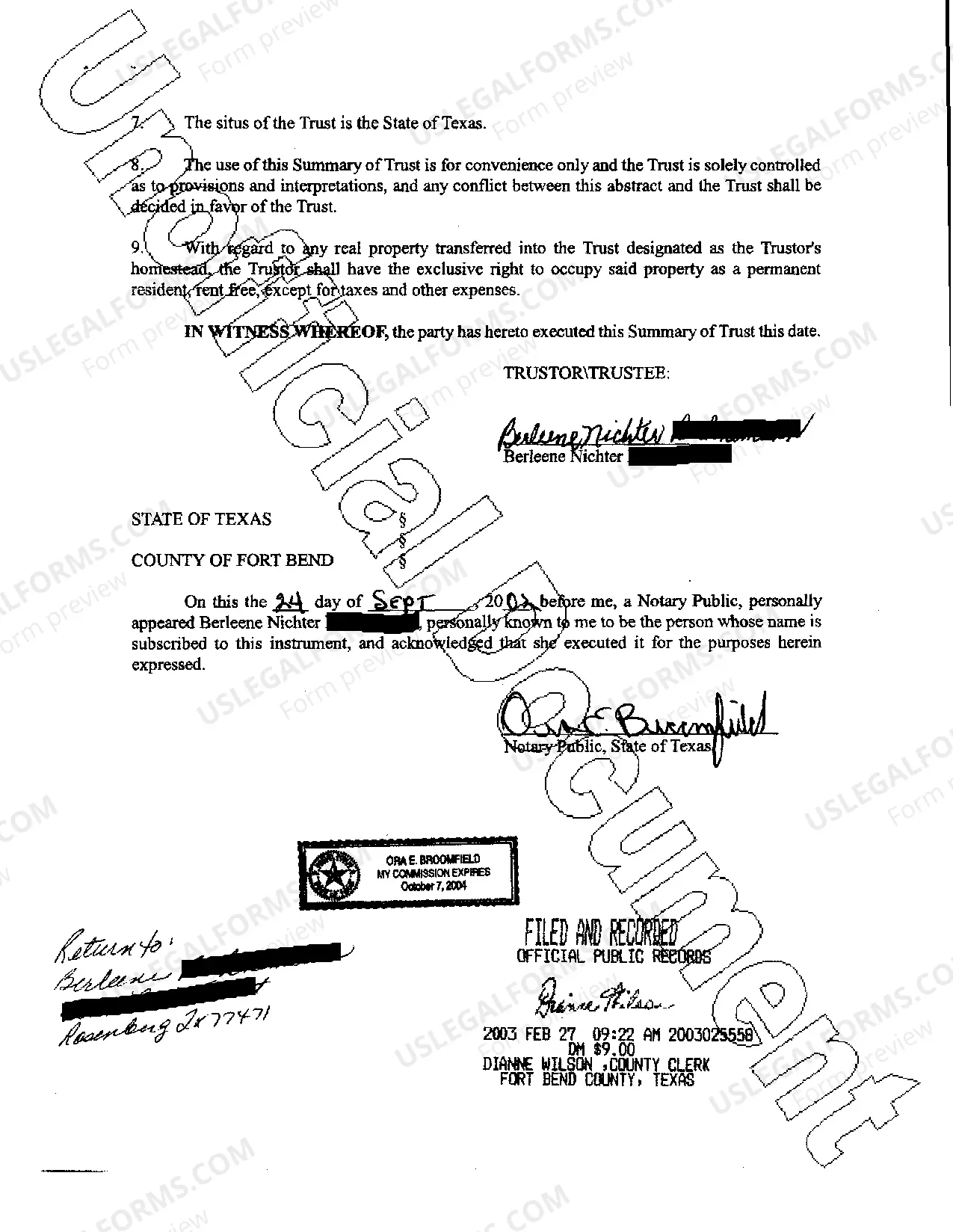

A Grand Prairie Texas Trust Agreement is a legally binding contract made between a trustee and a beneficiary. It outlines the terms and conditions under which the trustee will manage and distribute assets or properties owned by the beneficiary for their benefit. This agreement ensures the protection of the beneficiary's assets and provides a clear framework for the trustee's responsibilities and limitations. The Grand Prairie Texas Trust Agreement is governed by the laws of Texas and must comply with the applicable state statutes. It is important to note that there may be variations in trust agreements based on specific circumstances and objectives. Here are different types of Grand Prairie Texas Trust Agreements: 1. Revocable Trust: A revocable trust allows the trustee to modify or terminate the trust during the lifetime of the settler (the individual creating the trust). This provides flexibility and control for the settler, who can also serve as the trustee. 2. Irrevocable Trust: An irrevocable trust cannot be altered or terminated by the settler once it is executed. This type of trust offers asset protection since once assets are transferred into the trust, they are no longer considered part of the settler's estate. 3. Living Trust: A living trust, also known as an inter vivos trust, is created during the settler's lifetime and becomes effective immediately. It avoids probate, a legal process that validates a will, and allows for ease of asset management and distribution. 4. Testamentary Trust: A testamentary trust is established through a will and comes into effect upon the death of the settler. This type of trust ensures that specified assets are managed and distributed as per the settler's wishes. 5. Special Needs Trust: A special needs trust is created to provide financial support for individuals with disabilities while preserving their eligibility for government benefits. It allows a trustee to manage assets on behalf of the beneficiary, ensuring essential needs are met without jeopardizing public assistance. 6. Charitable Trust: A charitable trust is established for philanthropic purposes and benefits a charitable organization or cause. It can provide tax advantages to the settler while supporting a specific charitable mission. 7. Spendthrift Trust: A spendthrift trust is designed to protect the beneficiary's assets from creditors or potential financial mismanagement. The trust's terms limit the beneficiary's access to the trust's principal or income, preventing it from being quickly spent or seized by creditors. In summary, a Grand Prairie Texas Trust Agreement is a comprehensive legal document that enables the efficient management and distribution of assets for the benefit of the beneficiaries. With several types of trust agreements available, individuals can select the one that aligns with their specific needs, whether it is for estate planning, asset protection, charitable giving, or supporting loved ones with special needs.

Grand Prairie Texas Trust Agreement

Description

How to fill out Grand Prairie Texas Trust Agreement?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to draft such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Grand Prairie Texas Trust Agreement or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Grand Prairie Texas Trust Agreement in minutes using our reliable service. If you are already a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our platform, make sure to follow these steps before obtaining the Grand Prairie Texas Trust Agreement:

- Be sure the template you have chosen is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of cases the paper can be used for.

- In case the form you chosen doesn’t meet your needs, you can start again and look for the suitable document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Grand Prairie Texas Trust Agreement once the payment is through.

You’re all set! Now you can go ahead and print out the form or fill it out online. Should you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.