San Antonio Texas Trust Agreement

Description

How to fill out Texas Trust Agreement?

Finding validated templates that conform to your local laws can be difficult unless you utilize the US Legal Forms library.

It is an online collection of over 85,000 legal documents catering to both individual and business requirements as well as various real-life situations.

All files are accurately classified by usage area and jurisdiction, making it as straightforward as ABC to find the San Antonio Texas Trust Agreement.

Organizing your paperwork to remain tidy and in compliance with legal standards is critically important. Leverage the US Legal Forms library to always have vital document templates available for any needs right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the correct one that satisfies your needs and entirely aligns with your local jurisdiction guidelines.

- Search for an alternative template, if necessary.

- Should you notice any discrepancy, utilize the Search tab above to obtain the appropriate one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

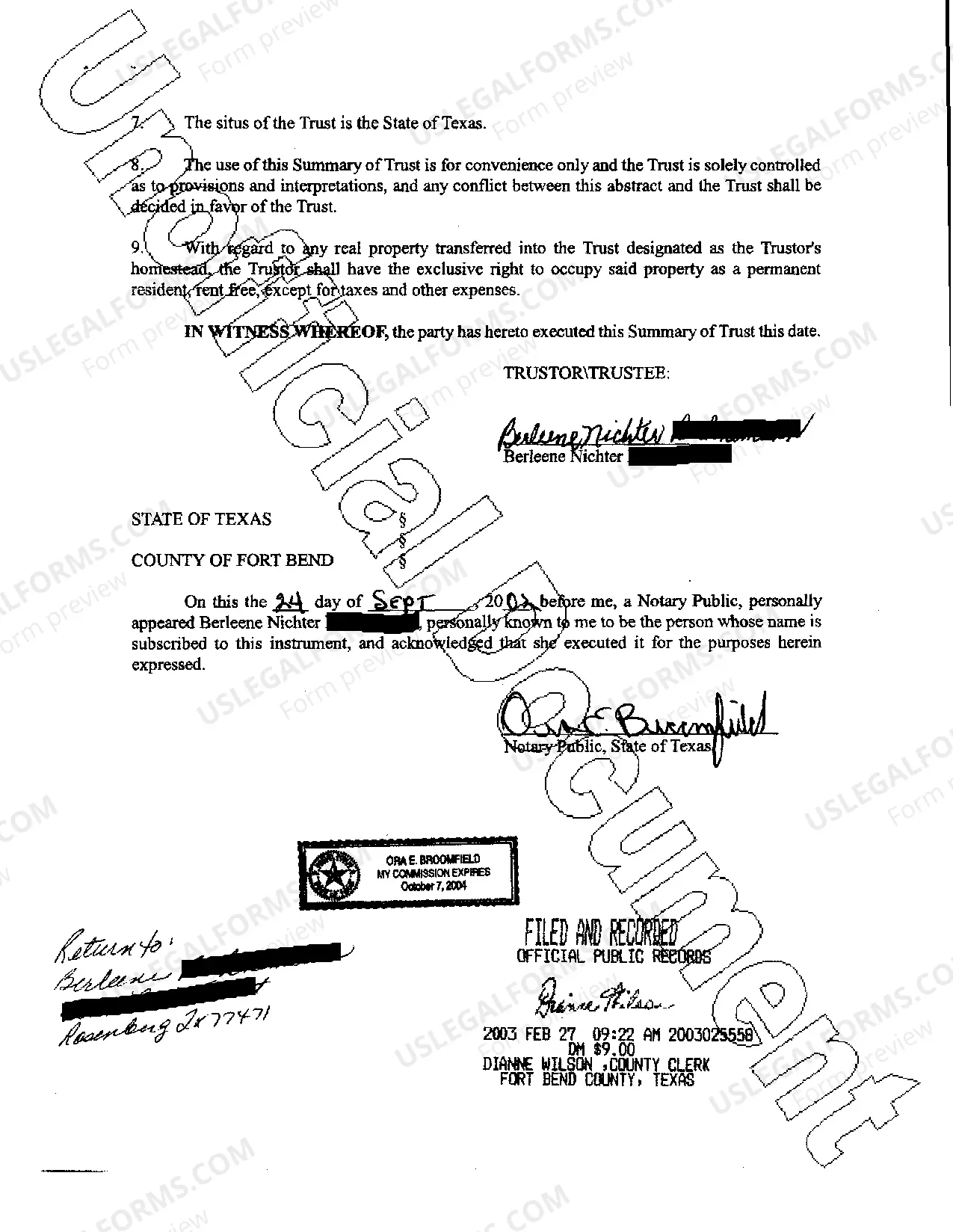

Create the trust document. You can get help from an attorney or use Willmaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document?such as your house or car?to reflect that you now own the property as trustee of the trust.

Under Texas trust laws, the following are required for a valid trust to be formed: The Settlor must have a present intent to create a trust. The Settlor must have capacity to convey assets to the trust. The trust must comply with the Statute of Frauds.

Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome ? and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death.

The trust deed is the founding document of a trust and is a public document which is lodged with the Master of the High Court.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

A trust is not probated and does not become public record. Your beneficiaries, assets, and trust terms remain private. Trusts are also more difficult to contest than wills, providing greater security. A living trust keeps you in control of your assets during life and after death.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

A trust is not a legal entity in Texas. It is a relationship whereby a trustee acts as the agent for two classes of beneficiaries, income beneficiaries and remainder beneficiaries.