Sugar Land Texas Trust Agreement is a legally binding document that outlines the formation, rules, and responsibilities associated with creating a trust in Sugar Land, Texas. It serves as a safeguard for individuals to manage and protect their assets, while also ensuring the smooth distribution of wealth to beneficiaries. In Sugar Land, Texas, there are various types of trust agreements to cater to different needs and circumstances. Some common types include: 1. Living Trust Agreement: A living trust, also known as an inter vivos trust, allows individuals to transfer their assets and property into a trust while they are alive. This type of trust agreement enables individuals to maintain control over their assets during their lifetime and stipulate the terms for asset distribution upon their death. 2. Revocable Trust Agreement: A revocable trust agreement grants the creator, also known as the granter or settler, the flexibility to modify or revoke the trust during their lifetime. This type of trust provides asset protection, tax planning benefits, and avoids probate. 3. Irrevocable Trust Agreement: An irrevocable trust agreement, once established, cannot be altered or revoked without the consent of the beneficiaries. It offers greater asset protection and estate tax benefits but limits the granter's control over the assets. This type of trust is commonly used for Medicaid planning, charitable giving, and minimizing estate taxes. 4. Testamentary Trust Agreement: A testamentary trust agreement is created through a person's will and comes into effect upon their death. It allows individuals to designate certain assets to be held in trust for beneficiaries, typically minors or individuals who may not be able to manage their inheritance independently. 5. Special Needs Trust Agreement: A special needs trust agreement is designed to provide financial support and protection for individuals with disabilities. It ensures that the beneficiaries can receive assets without affecting their eligibility for government assistance programs. 6. Charitable Trust Agreement: A charitable trust agreement allows individuals to donate assets to a specific charitable organization or cause. This type of trust provides tax advantages for both the donor and the charity. In summary, Sugar Land Texas Trust Agreement is a crucial legal instrument that provides individuals in Sugar Land, Texas, with the means to protect and manage their assets according to their specific needs and goals. Whether it is a living trust, revocable trust, irrevocable trust, testamentary trust, special needs trust, or charitable trust, each type serves a distinct purpose in ensuring the effective administration and distribution of assets.

Sugar Land Texas Trust Agreement

Category:

State:

Texas

City:

Sugar Land

Control #:

TX-C177

Format:

PDF

Instant download

This form is available by subscription

Description

Trust Agreement

Sugar Land Texas Trust Agreement is a legally binding document that outlines the formation, rules, and responsibilities associated with creating a trust in Sugar Land, Texas. It serves as a safeguard for individuals to manage and protect their assets, while also ensuring the smooth distribution of wealth to beneficiaries. In Sugar Land, Texas, there are various types of trust agreements to cater to different needs and circumstances. Some common types include: 1. Living Trust Agreement: A living trust, also known as an inter vivos trust, allows individuals to transfer their assets and property into a trust while they are alive. This type of trust agreement enables individuals to maintain control over their assets during their lifetime and stipulate the terms for asset distribution upon their death. 2. Revocable Trust Agreement: A revocable trust agreement grants the creator, also known as the granter or settler, the flexibility to modify or revoke the trust during their lifetime. This type of trust provides asset protection, tax planning benefits, and avoids probate. 3. Irrevocable Trust Agreement: An irrevocable trust agreement, once established, cannot be altered or revoked without the consent of the beneficiaries. It offers greater asset protection and estate tax benefits but limits the granter's control over the assets. This type of trust is commonly used for Medicaid planning, charitable giving, and minimizing estate taxes. 4. Testamentary Trust Agreement: A testamentary trust agreement is created through a person's will and comes into effect upon their death. It allows individuals to designate certain assets to be held in trust for beneficiaries, typically minors or individuals who may not be able to manage their inheritance independently. 5. Special Needs Trust Agreement: A special needs trust agreement is designed to provide financial support and protection for individuals with disabilities. It ensures that the beneficiaries can receive assets without affecting their eligibility for government assistance programs. 6. Charitable Trust Agreement: A charitable trust agreement allows individuals to donate assets to a specific charitable organization or cause. This type of trust provides tax advantages for both the donor and the charity. In summary, Sugar Land Texas Trust Agreement is a crucial legal instrument that provides individuals in Sugar Land, Texas, with the means to protect and manage their assets according to their specific needs and goals. Whether it is a living trust, revocable trust, irrevocable trust, testamentary trust, special needs trust, or charitable trust, each type serves a distinct purpose in ensuring the effective administration and distribution of assets.

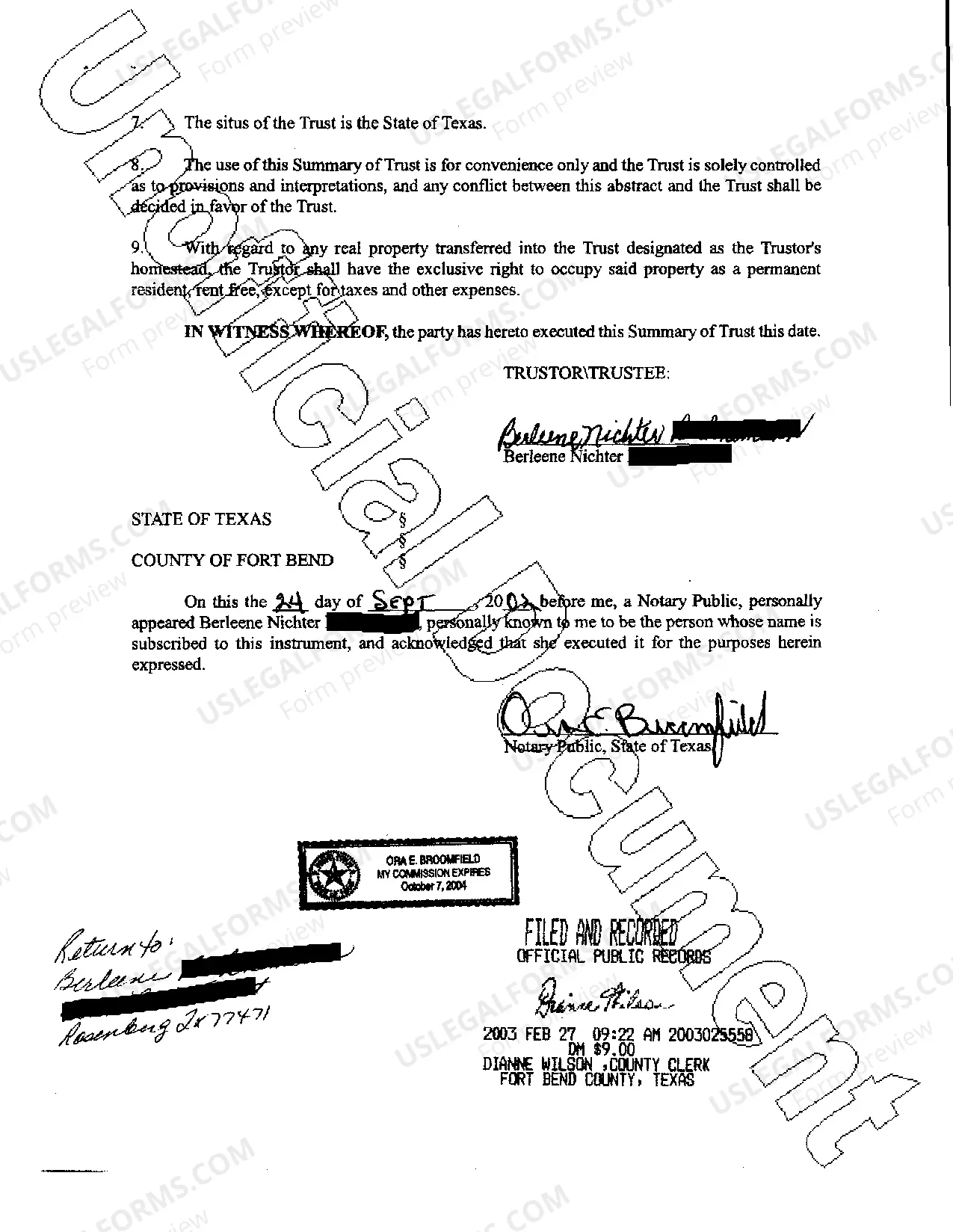

Free preview

How to fill out Sugar Land Texas Trust Agreement?

If you’ve already utilized our service before, log in to your account and download the Sugar Land Texas Trust Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Sugar Land Texas Trust Agreement. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!