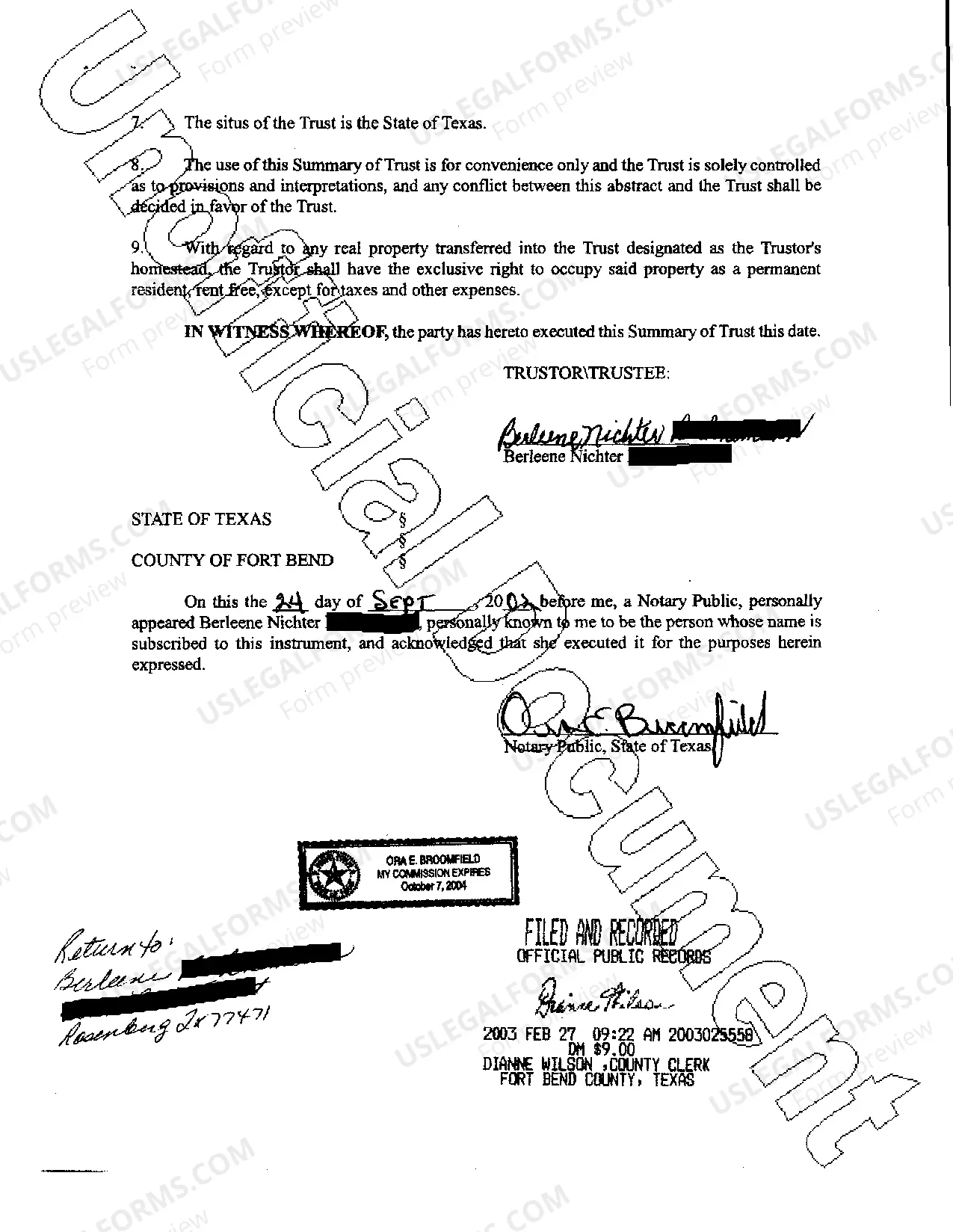

The Wichita Falls Texas Trust Agreement is a legally binding contract that outlines the terms and conditions for managing and distributing assets held in trust. Trust agreements are commonly used in estate planning to ensure that assets are protected and transferred according to the granter's wishes. In Wichita Falls, Texas, there are various types of trust agreements available to individuals and families. These include: 1. Revocable Living Trust: This type of trust agreement allows the granter (the person creating the trust) to retain control over their assets during their lifetime. They can make changes or revoke the trust at any time. Upon the granter's death, the assets are distributed to the beneficiaries as specified in the agreement, bypassing the probate process. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked once it is created. This type of trust agreement offers additional asset protection as the assets transferred to the trust are considered separate from the granter's estate. It is commonly used for tax planning purposes and can provide benefits such as reducing estate taxes. 3. Special Needs Trust: A special needs trust is designed to benefit individuals with disabilities while preserving their eligibility for government assistance programs. This type of trust agreement ensures that the disabled person's assets are managed and distributed in a way that does not jeopardize their eligibility for benefits such as Medicaid or Supplemental Security Income (SSI). 4. Charitable Trust: A charitable trust allows individuals to donate their assets to a charitable organization or cause. This trust agreement provides tax advantages for the granter while supporting charitable endeavors. The assets held in a charitable trust are used for the specified purpose outlined in the agreement, benefiting the designated charitable cause. In summary, the Wichita Falls Texas Trust Agreement is a comprehensive legal document that governs the management and distribution of assets held in trust. Depending on individual needs and goals, different types of trust agreements such as revocable living trusts, irrevocable trusts, special needs trusts, and charitable trusts can be established. These agreements provide individuals with a flexible and efficient means of protecting assets, minimizing taxes, and ensuring the seamless transfer of wealth.

Wichita Falls Texas Trust Agreement

Description

How to fill out Wichita Falls Texas Trust Agreement?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Wichita Falls Texas Trust Agreement or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Wichita Falls Texas Trust Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Wichita Falls Texas Trust Agreement would work for your case, you can select the subscription option and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!