An Austin Texas Irrevocable trust Distribution of trust property refers to the process of transferring or dispersing the assets held within an irrevocable trust in Austin, Texas. Irrevocable trusts are legal arrangements created to protect assets and ensure their efficient distribution to beneficiaries according to the granter's wishes. The distribution of trust property typically occurs after the granter passes away or when specific criteria outlined in the trust agreement are met. The distribution process involves several key steps and considerations, ensuring compliance with legal requirements and the trust's provisions. First, it is essential to identify the trust assets, including real estate, financial holdings, investments, and personal property. Once identified, these assets must be valued to determine their worth and potentially obtain appraisals for more accurate assessments. The distribution of trust property may occur in various ways depending on the trust's specific provisions. It could entail outright distributions, where beneficiaries receive their share of the assets directly without any restrictions. Alternatively, the trust may provide for distributions in staggered installments, which can be useful for ensuring long-term financial security or preventing irresponsible spending. In some cases, the trust agreement may stipulate that distributions are conditional upon meeting certain requirements or milestones. For example, beneficiaries may receive their shares upon reaching a certain age, completing a specific educational program, or achieving a predetermined financial milestone. Another type of distribution is an income interest distribution, where beneficiaries receive regular income generated by the trust assets while leaving the principal untouched. This can be advantageous for beneficiaries who need ongoing financial support while preserving the trust's assets for future generations. Furthermore, the trust document may outline discretionary distributions, granting the trustee or a designated party the authority to distribute assets as they see fit based on the beneficiaries' needs and circumstances. This approach allows flexibility in adapting to changing situations and ensuring the trust's overall objectives are met effectively. It is crucial to note that the distribution of trust property must comply with legal requirements and taxation laws in Austin, Texas. Therefore, it is advisable to consult with trust attorneys and tax professionals to ensure proper compliance and minimize potential tax implications. In summary, the Austin Texas Irrevocable trust Distribution of trust property refers to the process of transferring assets held within an irrevocable trust according to the trust agreement's provisions. Different types of distributions may include outright distributions, staggered installments, conditional distributions, income interest distributions, and discretionary distributions. Compliance with legal requirements and tax regulations is essential throughout the distribution process.

Austin Texas Irrevocable trust Distribution of trust property

Description

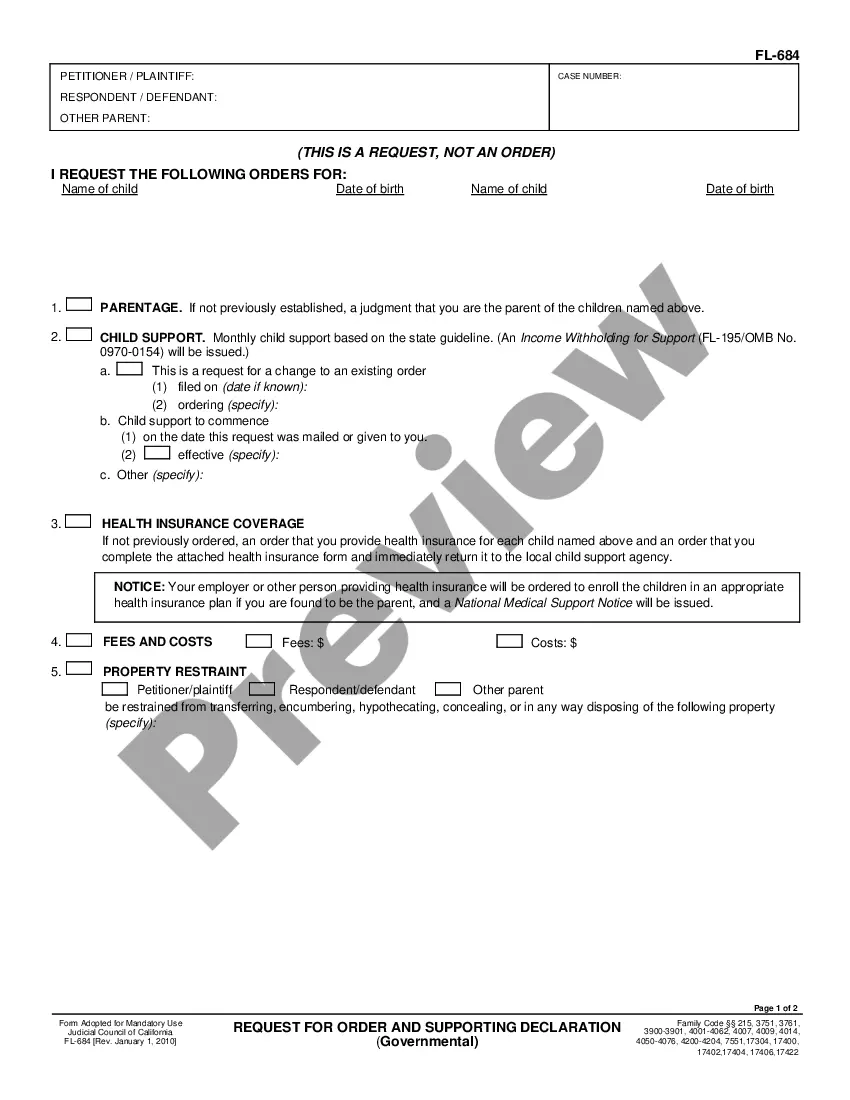

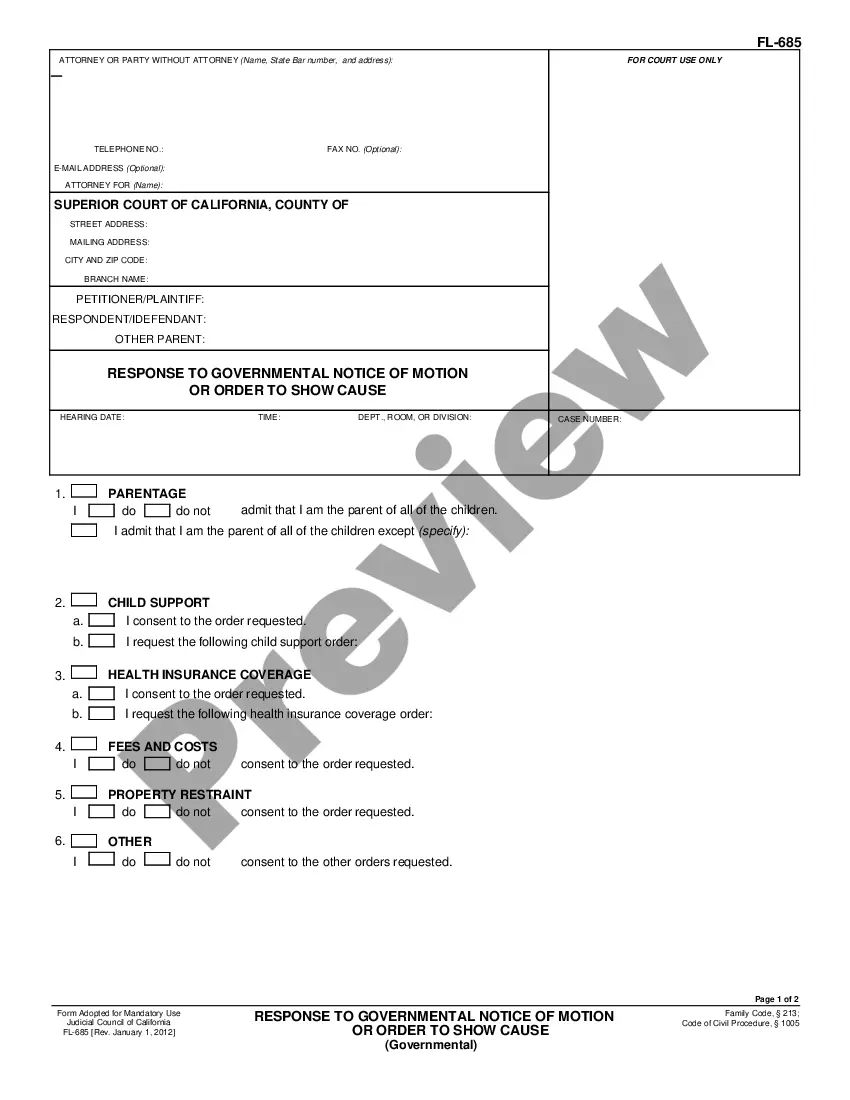

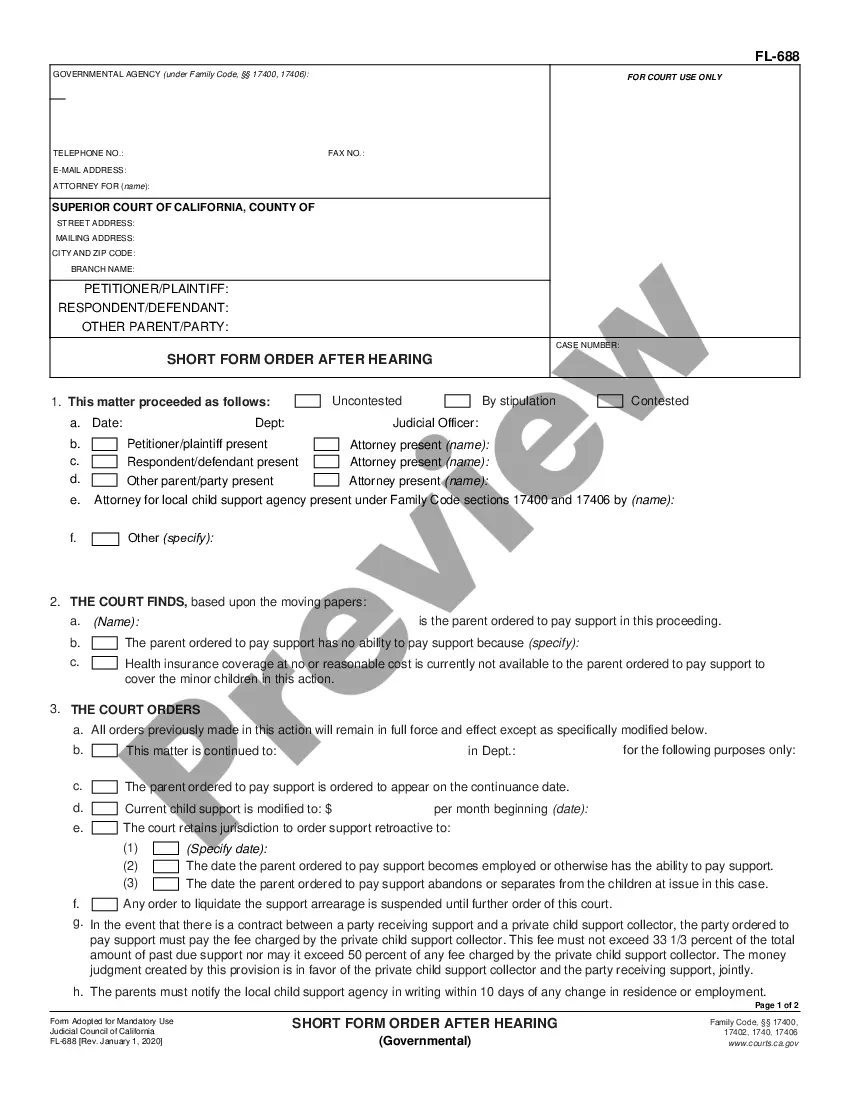

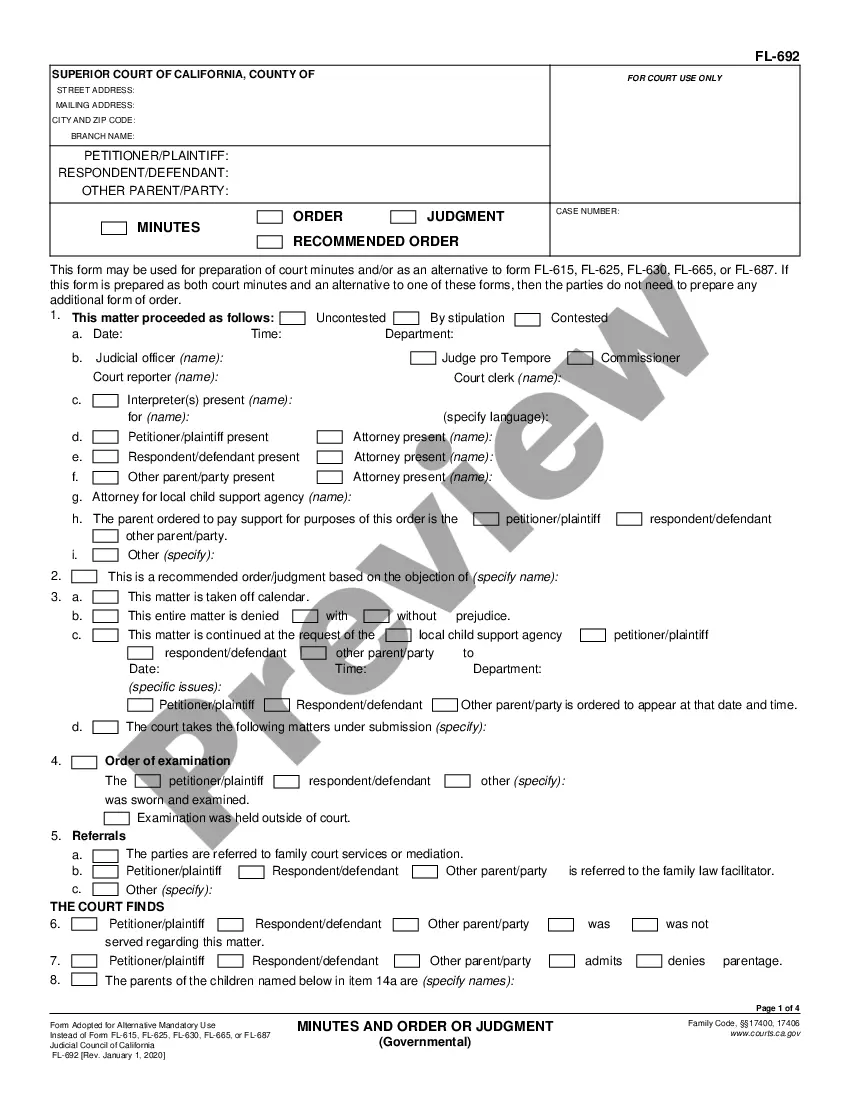

How to fill out Austin Texas Irrevocable Trust Distribution Of Trust Property?

If you are looking for a valid form, it’s impossible to choose a better platform than the US Legal Forms website – one of the most extensive libraries on the web. With this library, you can find thousands of form samples for company and individual purposes by types and states, or key phrases. With the high-quality search option, getting the latest Austin Texas Irrevocable trust Distribution of trust property is as easy as 1-2-3. In addition, the relevance of every file is confirmed by a team of expert lawyers that on a regular basis review the templates on our platform and revise them according to the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Austin Texas Irrevocable trust Distribution of trust property is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the form you want. Check its information and use the Preview function to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the appropriate file.

- Affirm your choice. Select the Buy now button. Next, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the received Austin Texas Irrevocable trust Distribution of trust property.

Each and every template you save in your user profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to have an additional copy for editing or creating a hard copy, you may return and download it once again at any time.

Take advantage of the US Legal Forms professional collection to get access to the Austin Texas Irrevocable trust Distribution of trust property you were looking for and thousands of other professional and state-specific templates in a single place!