The Bexar Texas Irrevocable Trust Distribution of Trust Property refers to the process by which the assets held within an irrevocable trust in Bexar County, Texas are distributed to the beneficiaries designated by the trust settler. This distribution typically occurs once certain conditions or events specified in the trust document are met. There are various types of distribution methods that can be specified within the Bexar Texas Irrevocable Trust. These types include: 1. Outright Distribution: The trust assets are distributed directly to the beneficiaries in their entirety, without any restrictions or ongoing trust management. 2. Periodic Distribution: The trust assets are distributed to the beneficiaries in periodic installments, such as monthly, quarterly, or annually, according to a predetermined schedule or a trustee's discretion. 3. Income Distribution: The trust assets generate income, such as dividends, interest, or rental payments, which is distributed to the beneficiaries while leaving the principal amount intact within the trust. 4. Specific Purpose Distribution: The trust assets are distributed for specific purposes outlined in the trust document, such as education, healthcare, housing, or business investments for the beneficiaries. 5. Conditional Distribution: The trust assets are distributed to the beneficiaries upon the occurrence of certain specified conditions, such as reaching a certain age, completing a certain qualification, or achieving a particular milestone. When it comes to the distribution process, it is crucial to adhere strictly to the terms and instructions laid out in the Bexar Texas Irrevocable Trust document. The trustee, who is responsible for managing and overseeing the trust administration, plays a vital role in ensuring a smooth and fair distribution process. Their responsibilities include accurately identifying and valuing the trust assets, determining the eligibility of beneficiaries for distribution, and executing the necessary legal and financial procedures for the transfer of assets. To initiate the distribution process, the trustee will typically provide the beneficiaries with a notice of the impending distribution, outlining the details of the distribution method being employed and any applicable tax implications. The beneficiaries may also be required to submit any necessary documentation or forms to facilitate the transfer of assets. In summary, the Bexar Texas Irrevocable Trust Distribution of Trust Property involves the allocation and transfer of assets held within an irrevocable trust to the beneficiaries according to the specified terms and conditions outlined in the trust document. The distribution methods can vary depending on the trust's provisions, and it is crucial to ensure compliance with legal requirements throughout the distribution process.

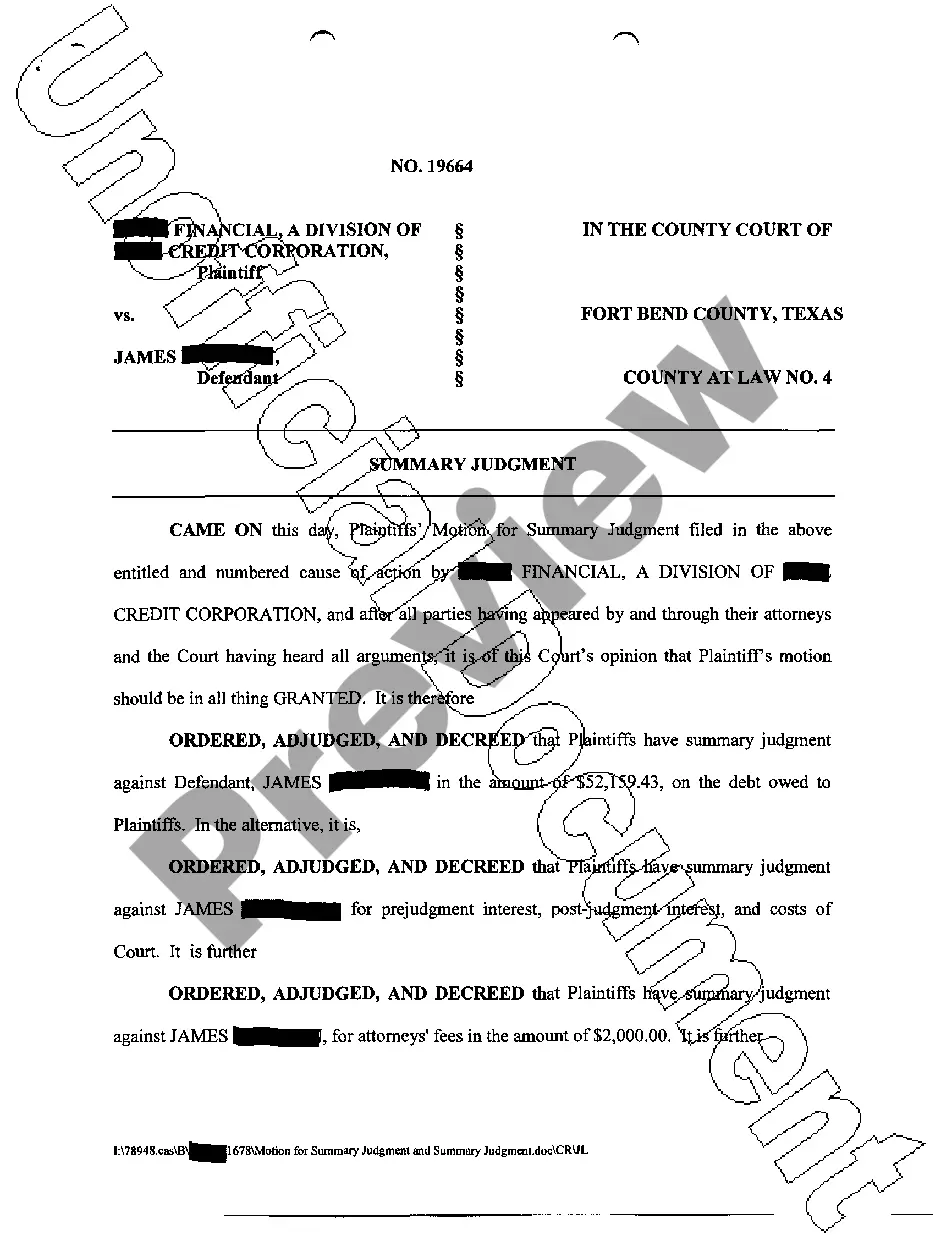

Bexar Texas Irrevocable trust Distribution of trust property

Description

How to fill out Bexar Texas Irrevocable Trust Distribution Of Trust Property?

Are you looking for a reliable and inexpensive legal forms supplier to get the Bexar Texas Irrevocable trust Distribution of trust property? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Bexar Texas Irrevocable trust Distribution of trust property conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is good for.

- Start the search over in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Bexar Texas Irrevocable trust Distribution of trust property in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online for good.