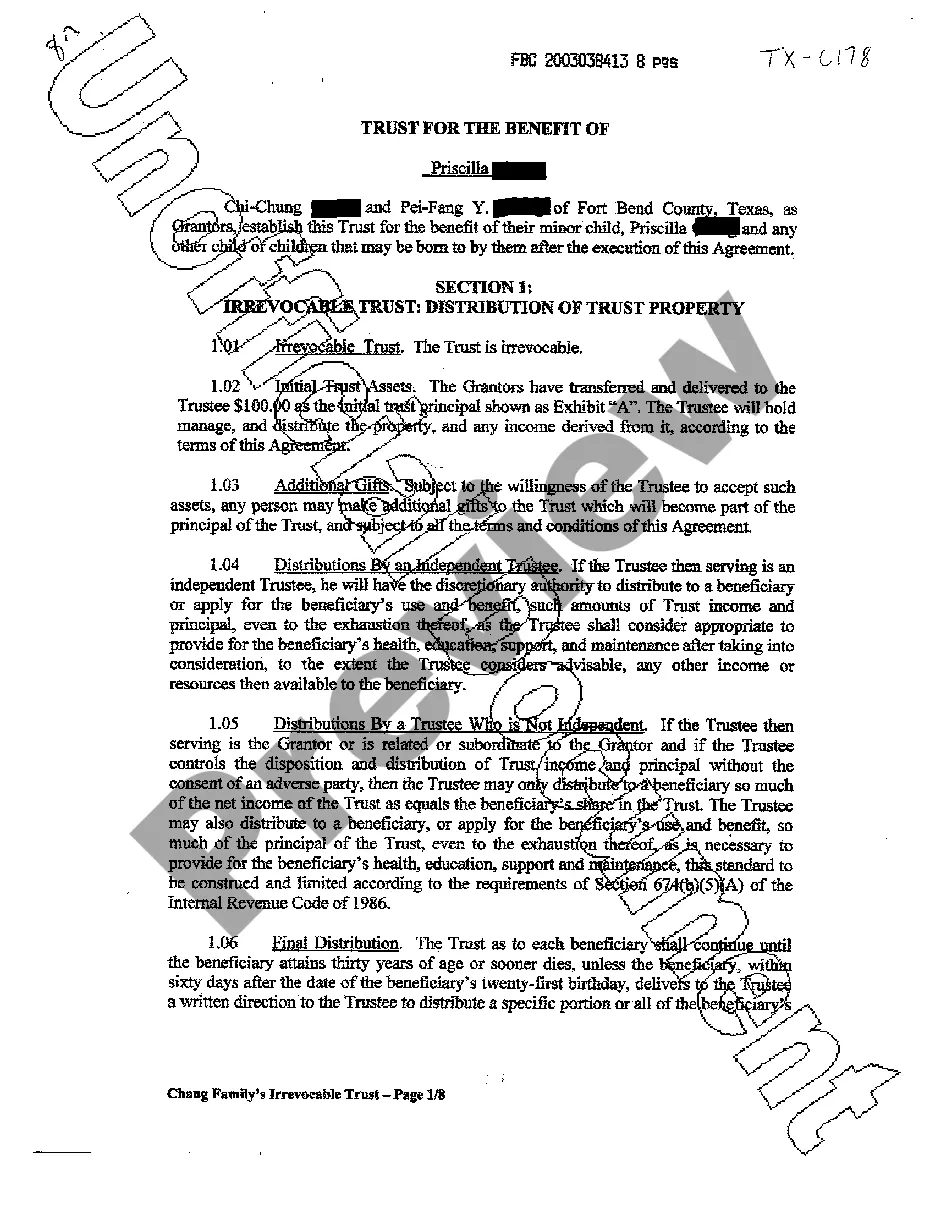

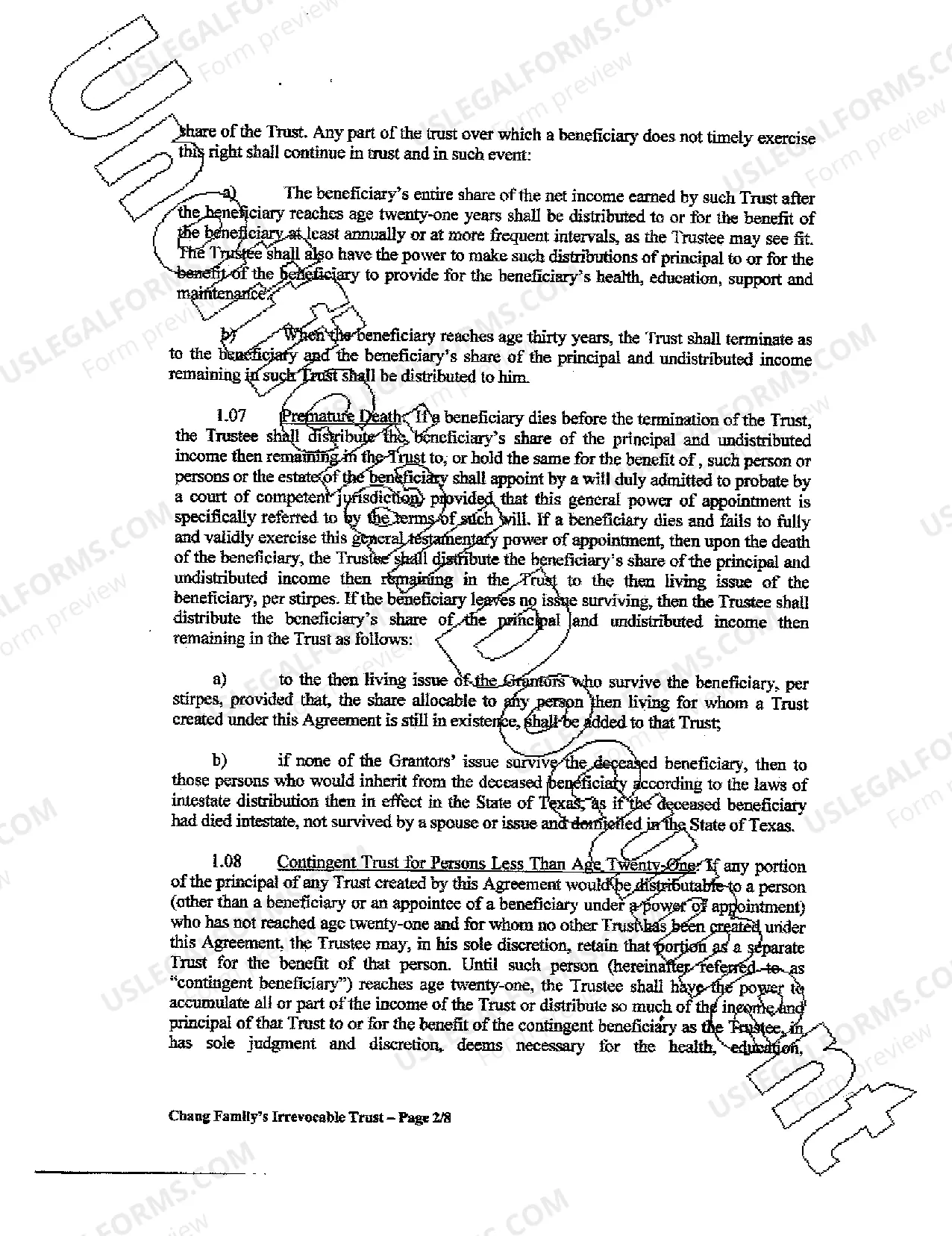

College Station, Texas Irrevocable Trust Distribution of Trust Property: A Comprehensive Overview In College Station, Texas, an Irrevocable Trust Distribution of Trust Property is a legal process through which assets held in an irrevocable trust are disbursed to beneficiaries. Irrevocable trusts are designed to safeguard and manage assets while providing specific instructions for their distribution. This form of trust provides a variety of benefits such as asset protection, estate tax minimization, and controlled asset distribution. There are different types of College Station, Texas Irrevocable Trust Distribution of Trust Property, and some common ones include: 1. Discretionary Distributions: In this form of distribution, the trustee has the discretion to determine when and how the trust assets are distributed among beneficiaries. This allows for flexibility in meeting beneficiaries' needs, such as educational expenses, medical bills, or general financial support. 2. Fixed Distributions: With fixed distributions, the trust document specifies a predetermined amount or percentage that should be distributed to beneficiaries at particular intervals, often on an annual or monthly basis. Fixed distributions provide a sense of certainty and regular income for beneficiaries. 3. Age-Based Distributions: Age-based distributions involve distributing trust assets to beneficiaries based on certain milestones or age thresholds. For example, the trust document may state that a beneficiary receives a lump sum when they turn 21, and subsequent distributions at ages 30 and 40. This type of distribution allows for gradual wealth transfer and can be useful in case beneficiaries lack financial maturity. 4. Specialized Distributions: Specialized distributions cater to unique circumstances mentioned in the trust document. They can include distributions based on specific events like marriage, purchasing a home, starting a business, or achieving certain educational milestones. Such distributions acknowledge the beneficiary's specific needs and aspirations. 5. Charitable Distributions: Irrevocable trusts may also include provisions for charitable distributions, allowing the trustee to donate a portion of the trust assets to charitable organizations or causes. This can contribute to both tax benefits and fulfilling philanthropic goals. It is essential to work closely with an experienced attorney specializing in trust law to draft a thorough trust document that adequately dictates the distribution of trust property. This legal expert can ensure that the trust document adheres to both state and federal laws, operates effectively, and fulfills the granter's intentions. When it comes to College Station, Texas Irrevocable Trust Distribution of Trust Property, beneficiaries, trustees, and granters need to understand the various distribution options available to them. They should consider their financial objectives, the needs of beneficiaries, and the long-term sustainability of the trust while making distribution decisions. Overall, the College Station, Texas Irrevocable Trust Distribution of Trust Property allows granters to protect and effectively manage their assets for the benefit of future generations. By utilizing different distribution methods, trustees can fulfill the granter's wishes and support the financial well-being of beneficiaries while maintaining control and ensuring the trust's longevity.

College Station Texas Irrevocable trust Distribution of trust property

State:

Texas

City:

College Station

Control #:

TX-C178

Format:

PDF

Instant download

This form is available by subscription

Description

Irrevocable trust Distribution of trust property

College Station, Texas Irrevocable Trust Distribution of Trust Property: A Comprehensive Overview In College Station, Texas, an Irrevocable Trust Distribution of Trust Property is a legal process through which assets held in an irrevocable trust are disbursed to beneficiaries. Irrevocable trusts are designed to safeguard and manage assets while providing specific instructions for their distribution. This form of trust provides a variety of benefits such as asset protection, estate tax minimization, and controlled asset distribution. There are different types of College Station, Texas Irrevocable Trust Distribution of Trust Property, and some common ones include: 1. Discretionary Distributions: In this form of distribution, the trustee has the discretion to determine when and how the trust assets are distributed among beneficiaries. This allows for flexibility in meeting beneficiaries' needs, such as educational expenses, medical bills, or general financial support. 2. Fixed Distributions: With fixed distributions, the trust document specifies a predetermined amount or percentage that should be distributed to beneficiaries at particular intervals, often on an annual or monthly basis. Fixed distributions provide a sense of certainty and regular income for beneficiaries. 3. Age-Based Distributions: Age-based distributions involve distributing trust assets to beneficiaries based on certain milestones or age thresholds. For example, the trust document may state that a beneficiary receives a lump sum when they turn 21, and subsequent distributions at ages 30 and 40. This type of distribution allows for gradual wealth transfer and can be useful in case beneficiaries lack financial maturity. 4. Specialized Distributions: Specialized distributions cater to unique circumstances mentioned in the trust document. They can include distributions based on specific events like marriage, purchasing a home, starting a business, or achieving certain educational milestones. Such distributions acknowledge the beneficiary's specific needs and aspirations. 5. Charitable Distributions: Irrevocable trusts may also include provisions for charitable distributions, allowing the trustee to donate a portion of the trust assets to charitable organizations or causes. This can contribute to both tax benefits and fulfilling philanthropic goals. It is essential to work closely with an experienced attorney specializing in trust law to draft a thorough trust document that adequately dictates the distribution of trust property. This legal expert can ensure that the trust document adheres to both state and federal laws, operates effectively, and fulfills the granter's intentions. When it comes to College Station, Texas Irrevocable Trust Distribution of Trust Property, beneficiaries, trustees, and granters need to understand the various distribution options available to them. They should consider their financial objectives, the needs of beneficiaries, and the long-term sustainability of the trust while making distribution decisions. Overall, the College Station, Texas Irrevocable Trust Distribution of Trust Property allows granters to protect and effectively manage their assets for the benefit of future generations. By utilizing different distribution methods, trustees can fulfill the granter's wishes and support the financial well-being of beneficiaries while maintaining control and ensuring the trust's longevity.

Free preview

How to fill out College Station Texas Irrevocable Trust Distribution Of Trust Property?

If you’ve already used our service before, log in to your account and save the College Station Texas Irrevocable trust Distribution of trust property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your College Station Texas Irrevocable trust Distribution of trust property. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!