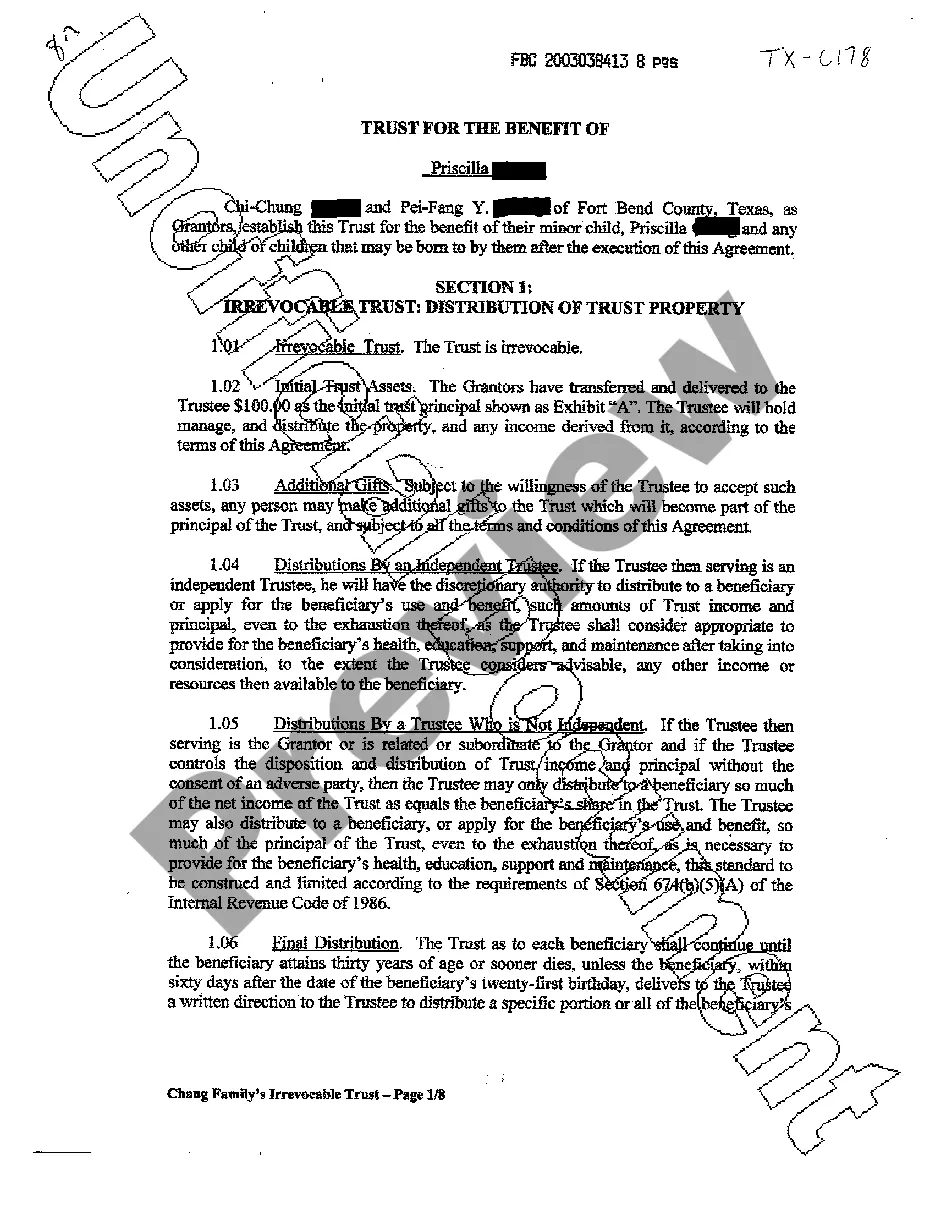

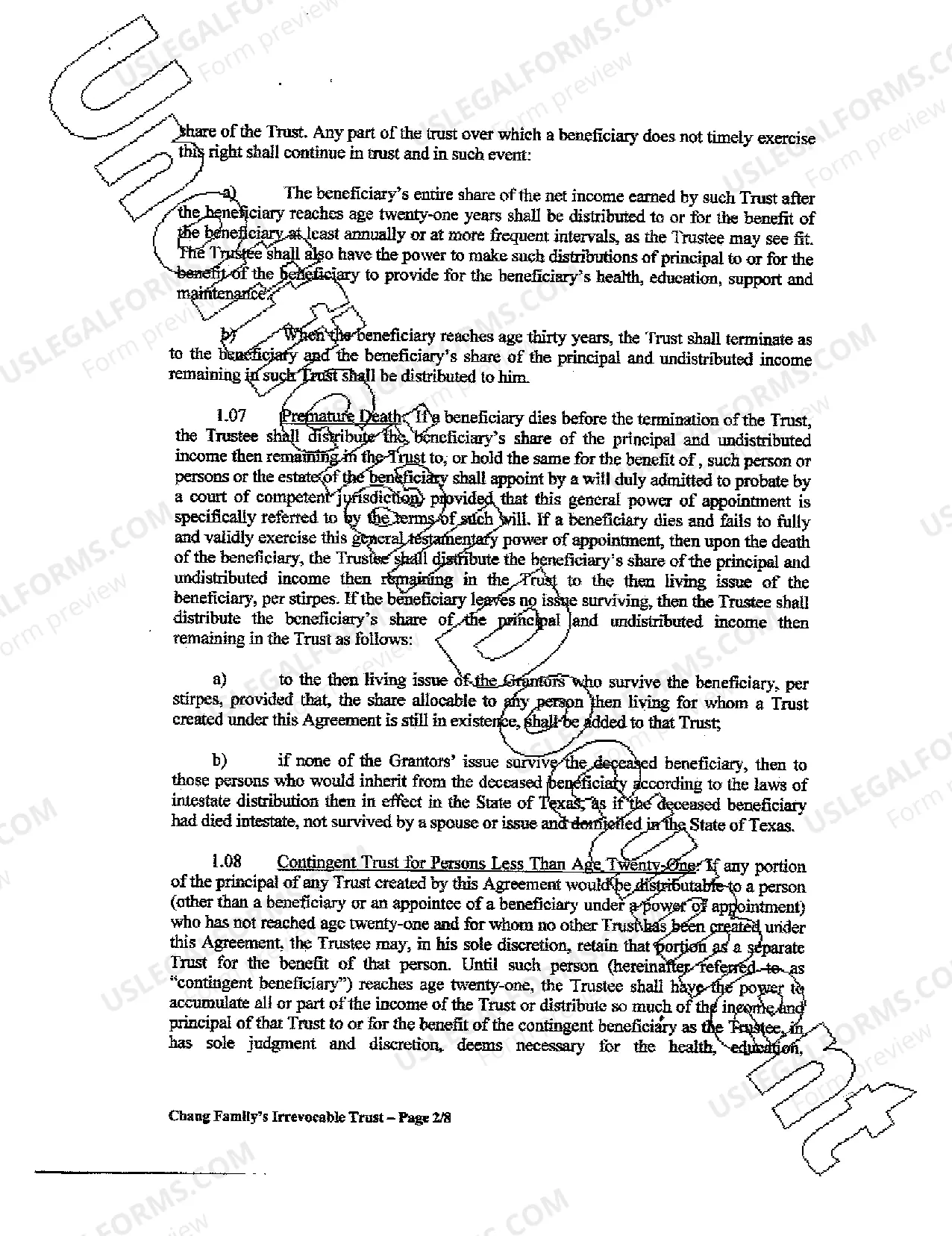

Frisco Texas Irrevocable Trust Distribution of Trust Property: A Comprehensive Explanation When it comes to estate planning, an irrevocable trust is a popular choice for many residents of Frisco, Texas. This legal arrangement allows individuals to protect and manage their assets while also benefiting their designated beneficiaries in the long run. However, understanding the distribution of trust property within a Frisco Texas irrevocable trust is crucial to ensuring the intended goals are met. The distribution of trust property in Frisco Texas irrevocable trusts refers to the process of allocating the assets held within the trust to the beneficiaries as determined by the trust document. It involves the transfer of property rights from the trust creator, known as the granter or settler, to the beneficiaries. This transition can occur during the lifetime of the granter or after their passing, depending on the terms outlined in the trust agreement. The distribution of trust property within a Frisco Texas irrevocable trust can take various forms depending on the goals and purposes of the trust. Some common types include: 1. Income Distributions: Trust assets may generate income from investments, rental properties, or other sources. The trust document can specify how much of this income should be distributed to the beneficiaries on a regular basis, typically monthly or annually. Income distributions can provide beneficiaries with financial support or supplement their existing income. 2. Principal Distributions: Unlike income distributions, which involve the trust's earnings, principal distributions involve the actual transfer of assets held within the trust to the beneficiaries. These distributions can occur at predetermined intervals or under specific circumstances, such as when beneficiaries reach a certain age, achieve certain milestones, or face financial hardship. Principal distributions grant beneficiaries ownership and control over the trust assets. 3. Hybrid or Blended Distributions: Some irrevocable trusts in Frisco Texas combine both income and principal distributions to satisfy the needs and objectives of the granter and beneficiaries. These hybrid or blended distributions provide a balance between providing regular income to beneficiaries while also allowing for the transfer of specific assets or portions of the principal in the trust. 4. Discretionary Distributions: In certain Frisco Texas irrevocable trusts, the trustee is granted discretion when it comes to distribution decisions. This means that the trustee has the authority to determine when, how, and how much property to distribute based on the beneficiaries' best interests. Discretionary distributions are often used when beneficiaries are young or have specific needs that may change over time. 5. Charitable Distributions: In some cases, the trust creator may include provisions for distributions to charitable organizations as part of their overall estate plan. This ensures that a portion of their trust property is dedicated to supporting causes they care about. It is important to note that Frisco Texas irrevocable trusts can be customized to meet the unique requirements of each granter and their beneficiaries. The type and frequency of distributions are typically outlined in the trust agreement, and the appointed trustee is responsible for overseeing and facilitating these distributions in accordance with the trust's terms and applicable laws. In conclusion, a Frisco Texas irrevocable trust distribution of trust property involves the orderly transfer of assets from the trust to beneficiaries, taking into account the specific instructions and intentions of the trust creator. By understanding the various types of distributions available, granters can tailor their irrevocable trusts to safeguard their wealth while providing long-term benefits to their loved ones and charitable causes.

Frisco Texas Irrevocable trust Distribution of trust property

Description

How to fill out Frisco Texas Irrevocable Trust Distribution Of Trust Property?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for legal solutions that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Frisco Texas Irrevocable trust Distribution of trust property or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Frisco Texas Irrevocable trust Distribution of trust property adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Frisco Texas Irrevocable trust Distribution of trust property is suitable for you, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!