Harris Texas Irrevocable Trust Distribution of Trust Property: An In-depth Explanation In the realm of estate planning, a popular option to ensure the smooth transfer of assets to beneficiaries and protect them from estate taxes is an Irrevocable Trust. Harris, Texas, like many jurisdictions, recognizes and regulates the establishment and administration of such trusts. Understanding the crucial aspect of Harris Texas Irrevocable Trust Distribution of Trust Property is vital for both trust creators (also known as granters or settlers) and beneficiaries. What is a Harris Texas Irrevocable Trust? An Irrevocable Trust is a legal entity established by a settler to transfer their assets into a separate entity, managed by a trustee, for the benefit of one or more beneficiaries. As the name implies, once the trust is established, it generally cannot be revoked or modified without the consent of all parties involved. This characteristic ensures the stability and long-term protection of the assets and offers potential tax advantages and asset protection features. Distribution of Trust Property: The distribution of trust property refers to the process by which assets held within an irrevocable trust are disbursed to beneficiaries according to the guidelines established by the settler. It is important to note that the distribution of trust property must conform to the terms and conditions mentioned in the trust document. These terms essentially outline how and when the assets are to be distributed among the beneficiaries. Types of Harris Texas Irrevocable Trust Distribution: 1. Discretionary Distributions: In this type of distribution, the trustee has the discretion to distribute trust assets to one or more beneficiaries based on their immediate need or upon their request. The trustee has the authority to determine the amount and frequency of distributions, considering factors such as financial well-being, educational needs, medical expenses, or any other intents specified by the settler. This flexible approach allows the trustee to adapt to the changing circumstances and individual needs of the beneficiaries. 2. Specific Distributions: Unlike discretionary distributions, specific distributions are based on clear instructions provided by the settler in the trust document. These instructions identify specific assets or sums of money that are to be distributed to designated beneficiaries. This type of distribution is particularly helpful when the settler desires to allocate a particular asset, such as a family heirloom or a specific amount of money. 3. Mandatory Distributions: Some irrevocable trusts, especially those established for the benefit of minor beneficiaries or for certain charitable purposes, may have mandatory distributions. These entities require the trustee to distribute a predetermined amount or percentage of the trust property at specific intervals or when certain conditions are met. Mandatory distributions ensure that the beneficiaries receive a regular and consistent stream of income or assets. 4. Residual Distributions: After fulfilling all other obligations mentioned in the trust document, the remaining assets within the trust can be distributed as residual distributions. Residual distributions typically occur when all other beneficiaries named in the trust have received their due shares. In such cases, the residual assets are distributed among other recipients, which may include additional beneficiaries or charitable organizations, as specified by the settler. Conclusion: Harris Texas Irrevocable Trust Distribution of Trust Property involves the careful execution of a trust plan's provisions, ensuring the intended transfer of assets among beneficiaries. The flexibility and varying types of distributions provide ample choices for settlers to precisely allocate their assets based on beneficiaries' needs, circumstances, and the purpose for establishing the trust. Understanding these distribution options and exploring them with the guidance of experienced legal professionals can help trust creators structure their irrevocable trusts effectively.

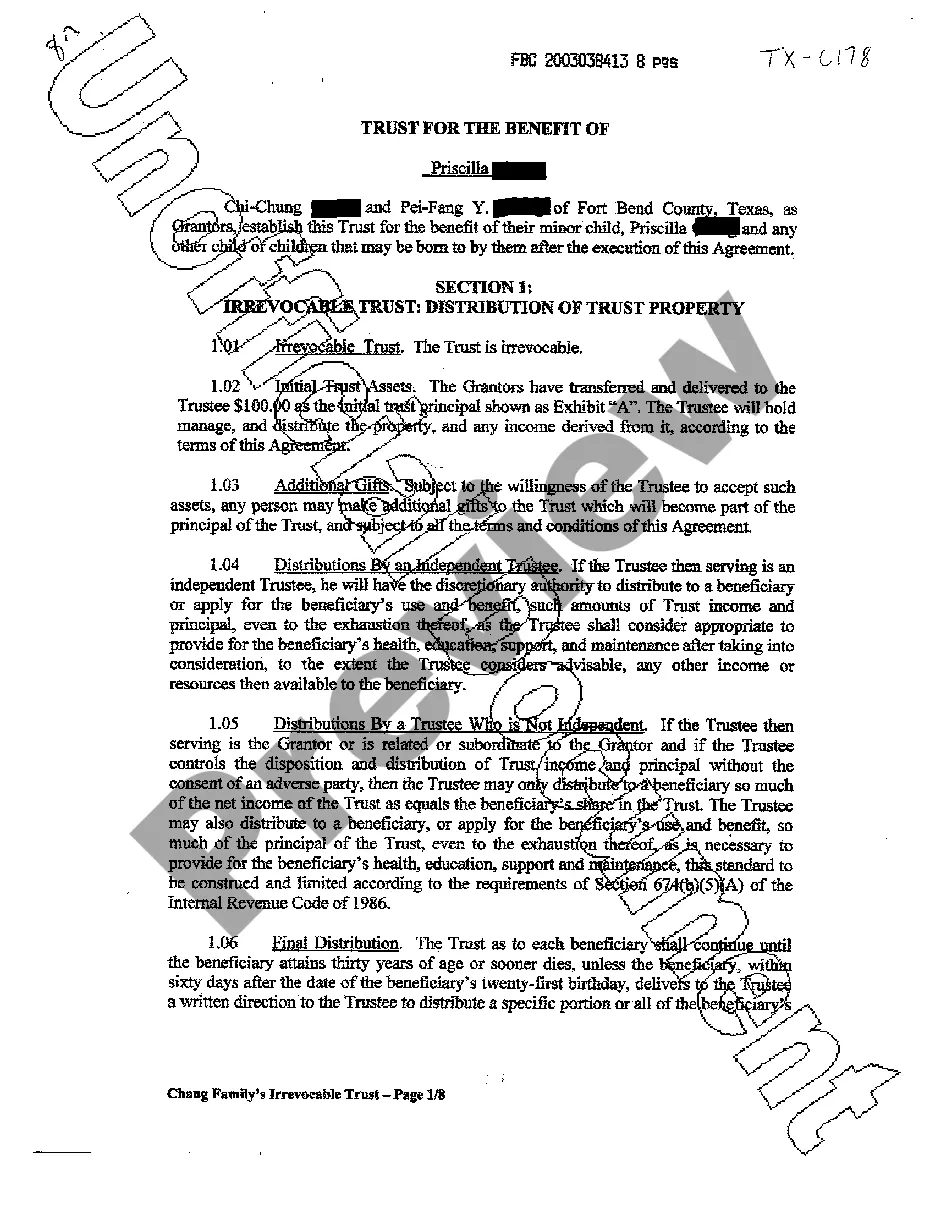

Harris Texas Irrevocable trust Distribution of trust property

State:

Texas

County:

Harris

Control #:

TX-C178

Format:

PDF

Instant download

This form is available by subscription

Description

Irrevocable trust Distribution of trust property

Harris Texas Irrevocable Trust Distribution of Trust Property: An In-depth Explanation In the realm of estate planning, a popular option to ensure the smooth transfer of assets to beneficiaries and protect them from estate taxes is an Irrevocable Trust. Harris, Texas, like many jurisdictions, recognizes and regulates the establishment and administration of such trusts. Understanding the crucial aspect of Harris Texas Irrevocable Trust Distribution of Trust Property is vital for both trust creators (also known as granters or settlers) and beneficiaries. What is a Harris Texas Irrevocable Trust? An Irrevocable Trust is a legal entity established by a settler to transfer their assets into a separate entity, managed by a trustee, for the benefit of one or more beneficiaries. As the name implies, once the trust is established, it generally cannot be revoked or modified without the consent of all parties involved. This characteristic ensures the stability and long-term protection of the assets and offers potential tax advantages and asset protection features. Distribution of Trust Property: The distribution of trust property refers to the process by which assets held within an irrevocable trust are disbursed to beneficiaries according to the guidelines established by the settler. It is important to note that the distribution of trust property must conform to the terms and conditions mentioned in the trust document. These terms essentially outline how and when the assets are to be distributed among the beneficiaries. Types of Harris Texas Irrevocable Trust Distribution: 1. Discretionary Distributions: In this type of distribution, the trustee has the discretion to distribute trust assets to one or more beneficiaries based on their immediate need or upon their request. The trustee has the authority to determine the amount and frequency of distributions, considering factors such as financial well-being, educational needs, medical expenses, or any other intents specified by the settler. This flexible approach allows the trustee to adapt to the changing circumstances and individual needs of the beneficiaries. 2. Specific Distributions: Unlike discretionary distributions, specific distributions are based on clear instructions provided by the settler in the trust document. These instructions identify specific assets or sums of money that are to be distributed to designated beneficiaries. This type of distribution is particularly helpful when the settler desires to allocate a particular asset, such as a family heirloom or a specific amount of money. 3. Mandatory Distributions: Some irrevocable trusts, especially those established for the benefit of minor beneficiaries or for certain charitable purposes, may have mandatory distributions. These entities require the trustee to distribute a predetermined amount or percentage of the trust property at specific intervals or when certain conditions are met. Mandatory distributions ensure that the beneficiaries receive a regular and consistent stream of income or assets. 4. Residual Distributions: After fulfilling all other obligations mentioned in the trust document, the remaining assets within the trust can be distributed as residual distributions. Residual distributions typically occur when all other beneficiaries named in the trust have received their due shares. In such cases, the residual assets are distributed among other recipients, which may include additional beneficiaries or charitable organizations, as specified by the settler. Conclusion: Harris Texas Irrevocable Trust Distribution of Trust Property involves the careful execution of a trust plan's provisions, ensuring the intended transfer of assets among beneficiaries. The flexibility and varying types of distributions provide ample choices for settlers to precisely allocate their assets based on beneficiaries' needs, circumstances, and the purpose for establishing the trust. Understanding these distribution options and exploring them with the guidance of experienced legal professionals can help trust creators structure their irrevocable trusts effectively.

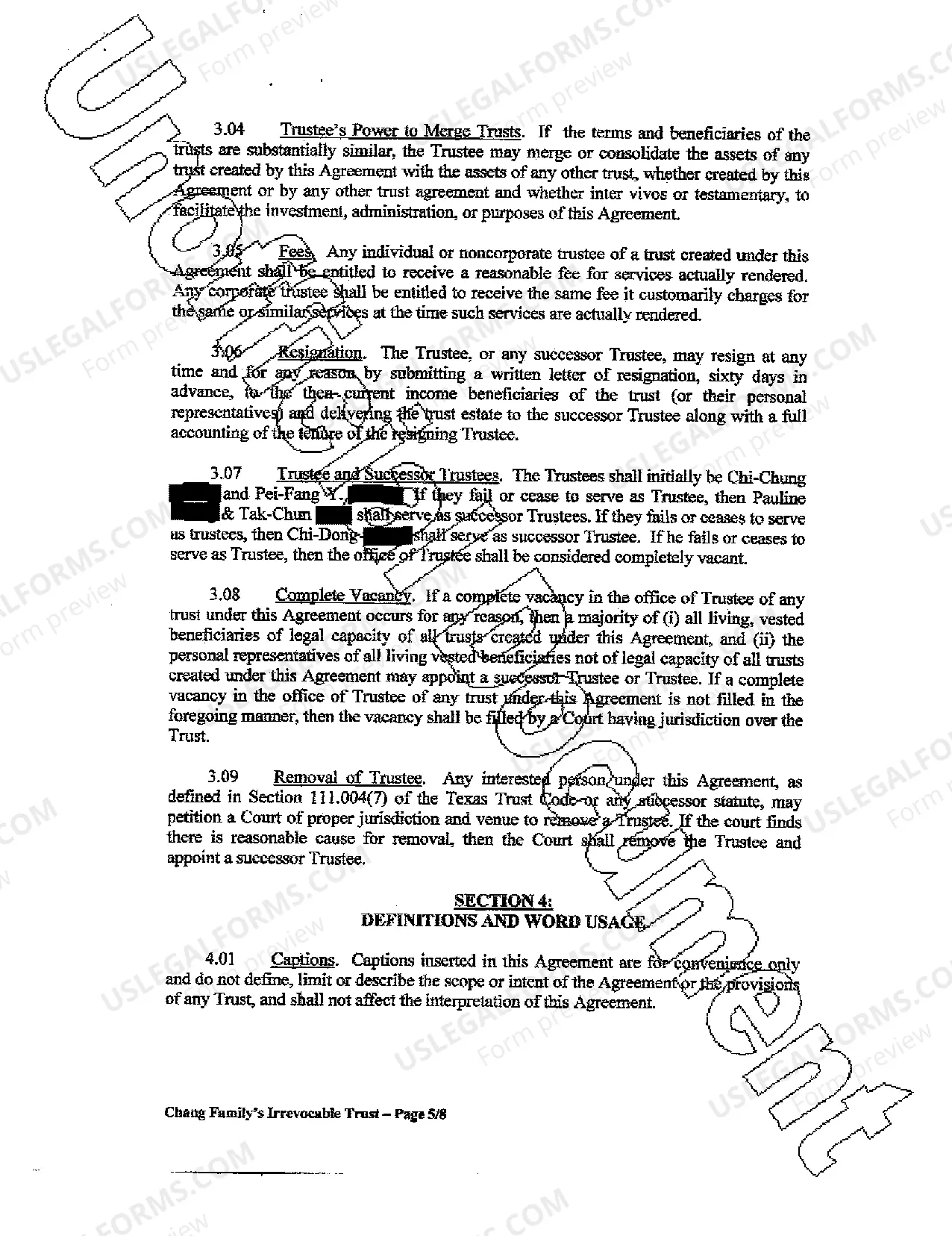

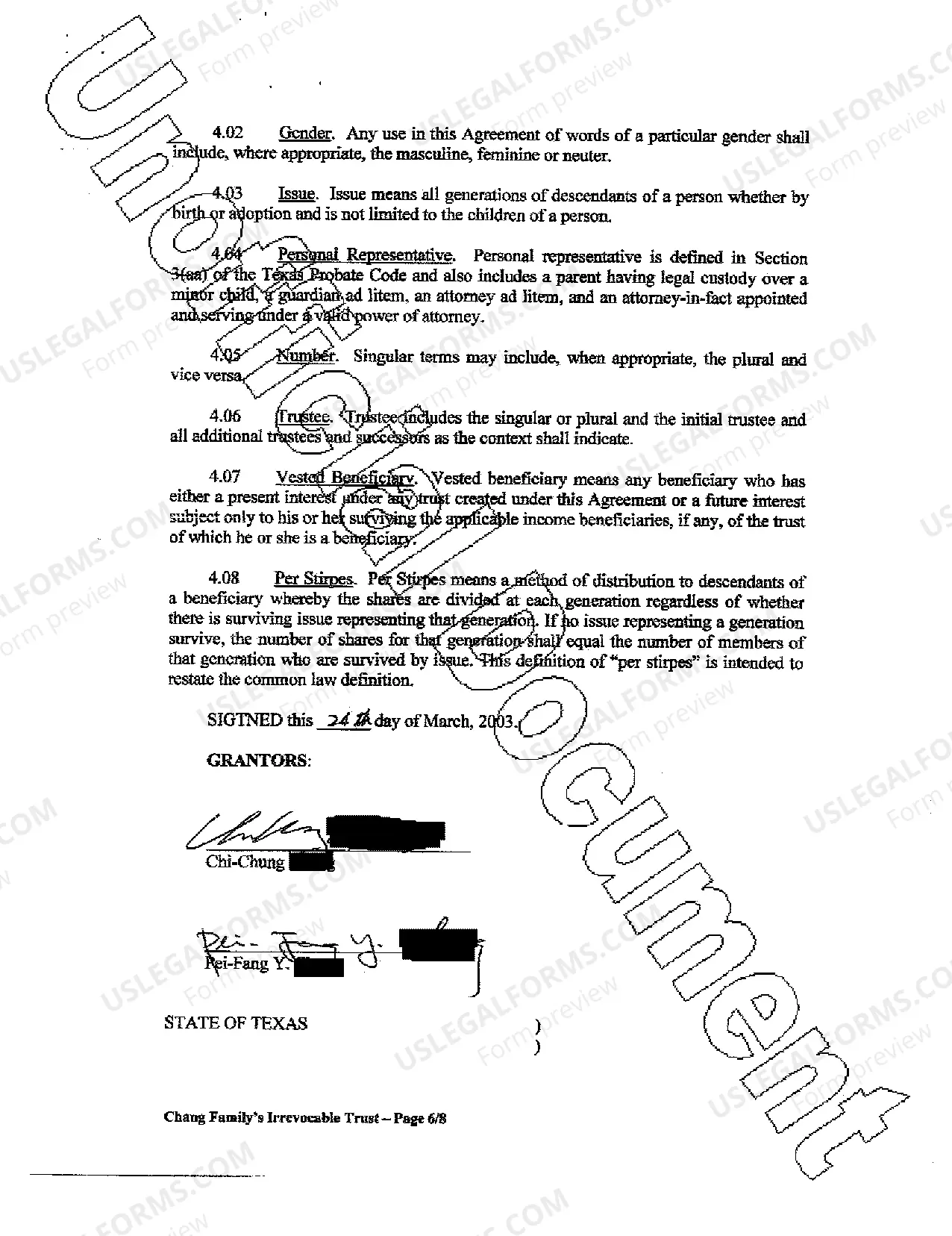

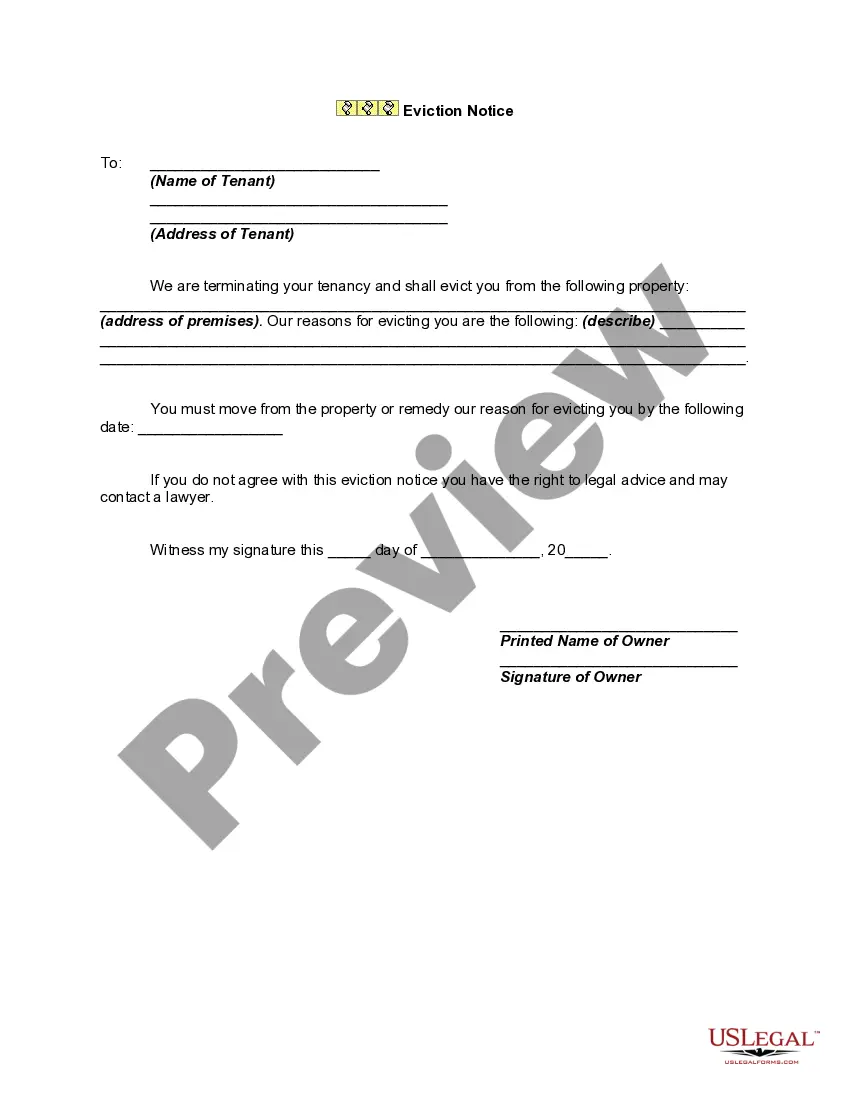

Free preview

How to fill out Harris Texas Irrevocable Trust Distribution Of Trust Property?

If you’ve already used our service before, log in to your account and download the Harris Texas Irrevocable trust Distribution of trust property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Harris Texas Irrevocable trust Distribution of trust property. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!