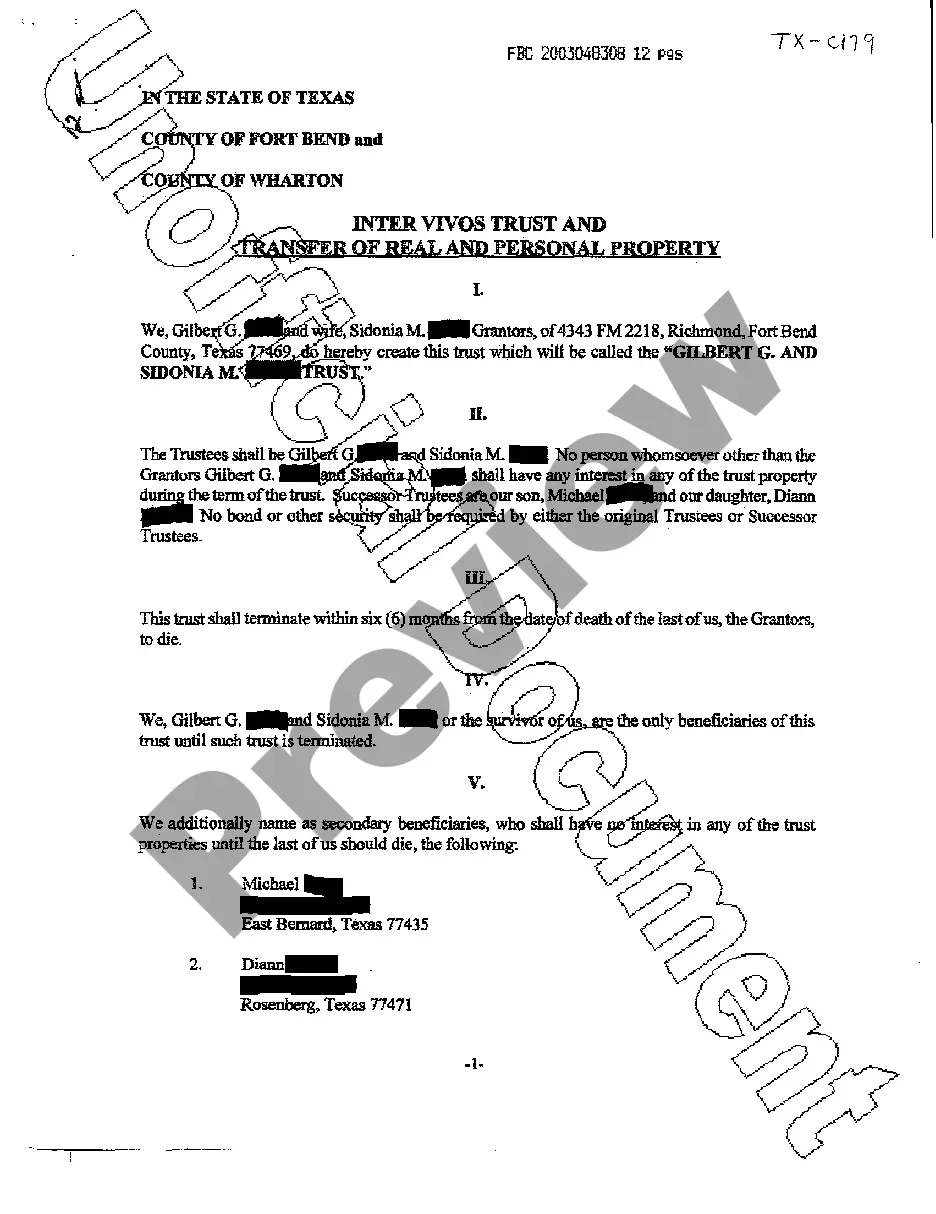

An Irrevocable Trust is a legally binding agreement that cannot be altered or revoked without the consent of all parties involved, including the granter and beneficiaries. In Irving, Texas, the distribution of trust property from an Irrevocable Trust follows specific guidelines and regulations, ensuring the assets are distributed according to the granter's wishes. Here, we will delve into the intricacies of Irving Texas Irrevocable Trust Distribution of trust property and explore different types of trust distributions. Irving, Texas offers a robust environment for estate planning, making it an ideal location for creating Irrevocable Trusts. These types of trusts are popular among individuals who seek to secure their assets, protect their wealth, minimize estate taxes, or ensure the well-being of their loved ones. When it comes to the distribution of trust property, several factors come into play. The first step involves the granter's initial setup of the trust, where they determine the terms and conditions for the distribution of assets. Commonly, beneficiaries receive distributions upon reaching a specific age, achieving certain milestones, or at a predetermined interval. One prominent type of distribution from an Irrevocable Trust is discretionary distributions. This means that the trustee has the authority to distribute trust property to beneficiaries as they see fit. The trustee, after carefully considering the beneficiaries' needs and financial circumstances, can allocate assets accordingly. Discretionary distributions often grant flexibility and the ability to adapt to changing circumstances. Another type of distribution is mandatory distributions. In this case, the granter may specify that beneficiaries receive distributions at predetermined intervals or milestones, such as reaching a certain age, completing their education, or purchasing property. Mandatory distributions provide a structured framework for the distribution of trust property, ensuring the beneficiaries receive assets on a set schedule or for specified purposes. In some instances, the granter may establish specific purposes for trust distributions. For example, a trust may be created to provide for a loved one's education, medical needs, or housing. In these cases, the trustee is obligated to distribute the trust assets towards achieving these specific purposes. This type of distribution ensures that the trust property is used for a designated objective and safeguards the intended beneficiaries' well-being. Furthermore, the distribution of trust property can include income distributions. If the Irrevocable Trust generates income through investments or other sources, beneficiaries may be entitled to receive a portion or all of the generated income. Income distributions can provide ongoing financial support to the beneficiaries, ensuring their financial independence. Irrevocable Trust Distribution of trust property in Irving, Texas, is subject to both state and federal laws. It is essential to consult with a knowledgeable estate planning attorney or financial advisor to navigate the legal requirements, guidelines, and tax implications associated with trust distributions. In summary, the distribution of trust property from an Irrevocable Trust in Irving, Texas, involves various types of distributions, including discretionary, mandatory, specific-purpose, and income distributions. Each type serves a particular purpose, ensuring the beneficiaries' needs and the granter's intentions are met. Understanding these distribution types is crucial in developing an effective estate planning strategy that protects assets, minimizes taxes, and secures the financial future of loved ones.

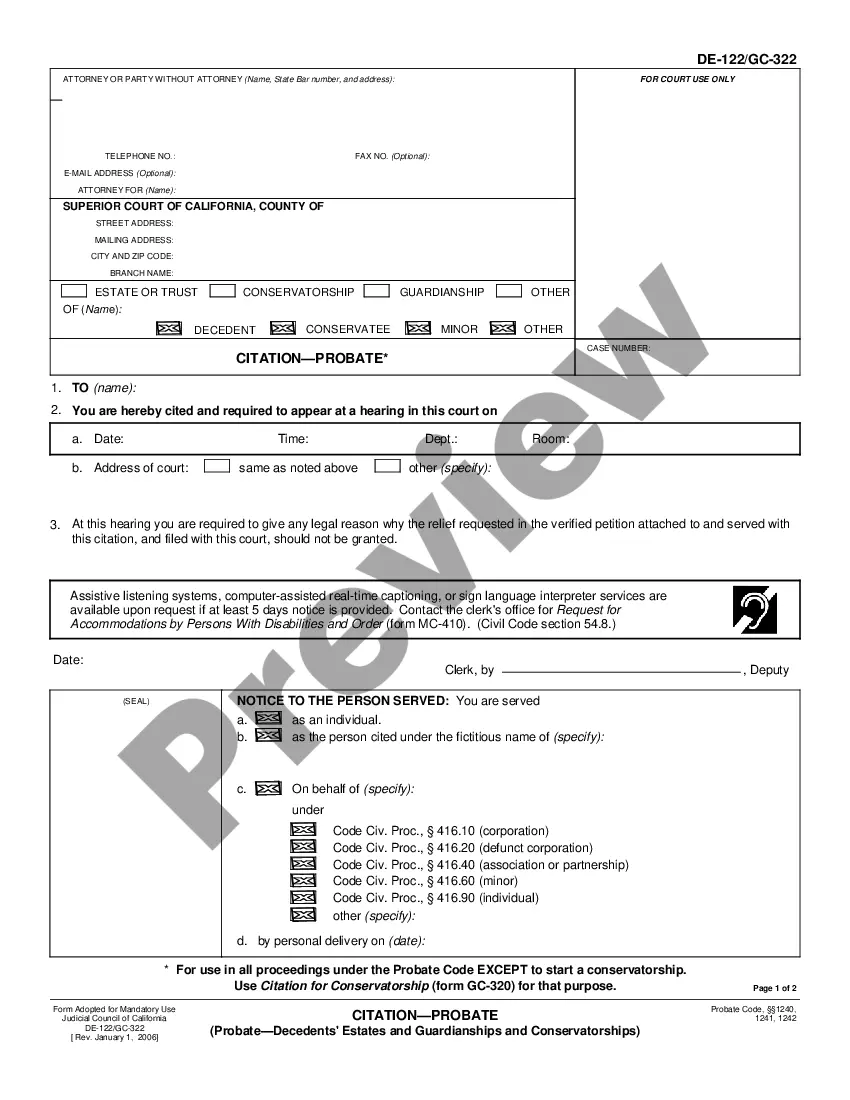

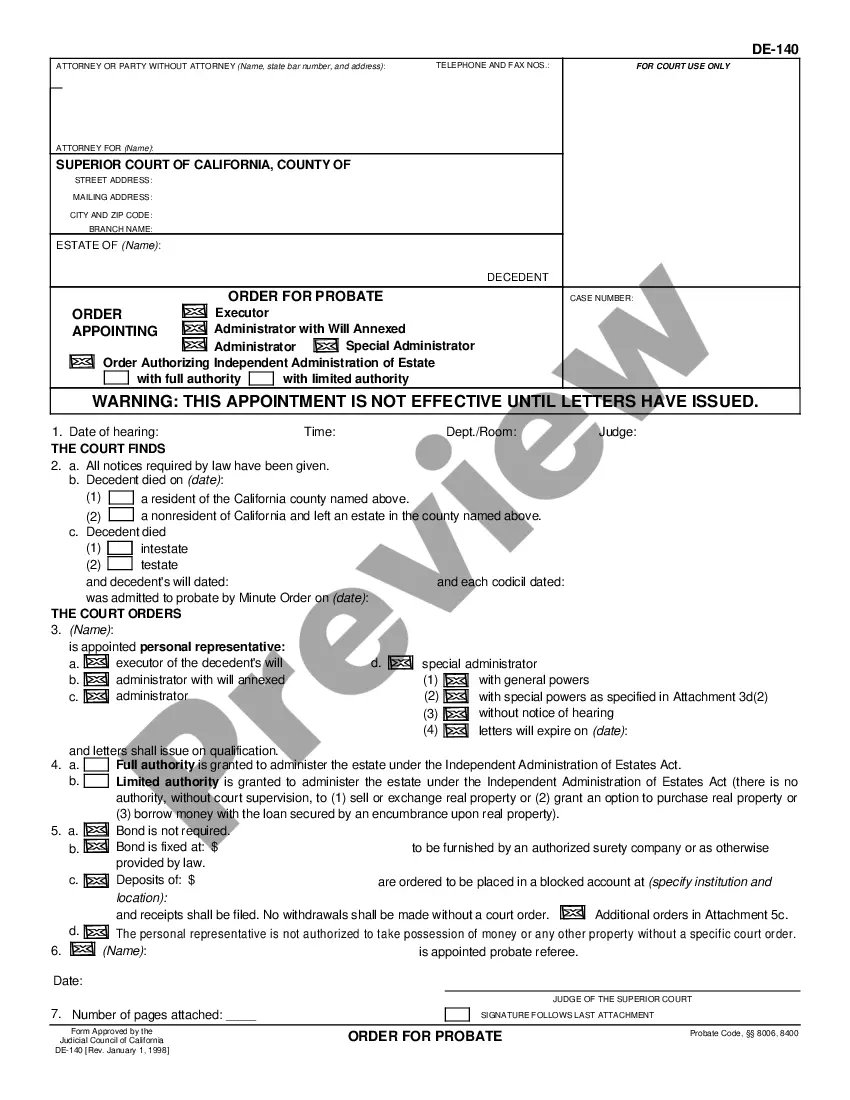

Irving Texas Irrevocable trust Distribution of trust property

Description

How to fill out Irving Texas Irrevocable Trust Distribution Of Trust Property?

Do you need a reliable and inexpensive legal forms provider to get the Irving Texas Irrevocable trust Distribution of trust property? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Irving Texas Irrevocable trust Distribution of trust property conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Irving Texas Irrevocable trust Distribution of trust property in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online for good.