McKinney, Texas Irrevocable Trust Distribution of Trust Property: Explained In McKinney, Texas, an irrevocable trust is a legal arrangement that allows a granter to transfer ownership and control of assets to a trust for the benefit of designated beneficiaries. Once established, an irrevocable trust cannot be revoked or modified without the consent of all beneficiaries and the trustee. One crucial aspect of such a trust is the distribution of trust property, which determines how the assets are allocated. There are various types of distributions that can occur within an irrevocable trust in McKinney, Texas. These distributions are designed to serve specific purposes and meet the needs of the beneficiaries. Here are a few types of McKinney, Texas irrevocable trust distribution of trust property: 1. Income Distributions: Irrevocable trusts may provide for regular income distributions to beneficiaries. This can be in the form of monthly or annual payments from the trust's earnings or investment proceeds. Income distributions can provide beneficiaries with a stable source of income while preserving the principal assets within the trust. 2. Principal Distributions: Unlike income distributions that involve regular payments, principal distributions involve the distribution of the trust's assets themselves. These distributions are typically made when beneficiaries require a lump sum amount for a specific purpose, such as funding education, purchasing a home, or starting a business. Principal distributions must be managed carefully by the trustee to ensure the long-term viability of the trust. 3. Specific Purpose Distributions: Irrevocable trusts may have provisions for specific purpose distributions, wherein assets are allocated to meet predetermined objectives. These objectives could include charitable donations, funding medical expenses, or assisting beneficiaries in times of financial hardship. Specific purpose distributions ensure that the trust assets are used for designated purposes and in alignment with the granter's intentions. 4. Contingency Distributions: Irrevocable trusts can also incorporate contingency distributions to address specific circumstances. These distributions occur when certain predetermined conditions are met. For example, a trust might provide for a distribution of assets if a beneficiary graduates from college, gets married, or reaches a specific age. Contingency distributions allow for flexibility while ensuring the trust's purpose and intention are upheld. 5. Trustee's Discretionary Distributions: In some cases, the trustee of an irrevocable trust in McKinney, Texas may have discretionary powers to make distributions based on the unique circumstances of beneficiaries. This allows the trustee to consider individual needs, unforeseen situations, and changes in circumstances that may require a departure from the predetermined distribution plan. The trustee exercises these distribution powers with careful consideration and adherence to fiduciary responsibilities. In conclusion, the distribution of trust property is a critical aspect of an irrevocable trust in McKinney, Texas. It involves allocating income, principal, or specific assets within the trust to meet the beneficiaries' needs and fulfill the granter's intentions. Various types of distributions, including income distributions, principal distributions, specific purpose distributions, contingency distributions, and discretionary distributions, ensure that the trust's assets are safeguarded and utilized effectively. It is essential to consult with a qualified estate planning attorney or financial advisor to fully understand the provisions and implications of the McKinney, Texas Irrevocable trust Distribution of Trust Property.

McKinney Texas Irrevocable trust Distribution of trust property

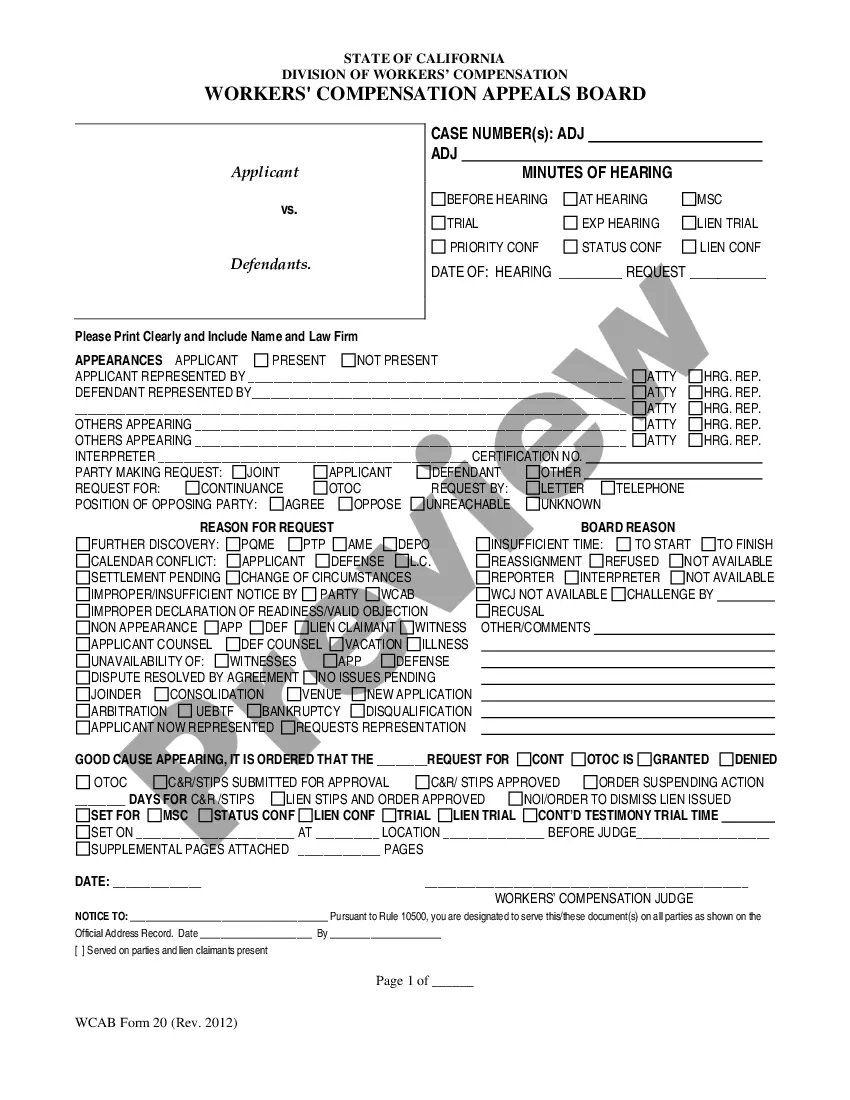

Description

How to fill out McKinney Texas Irrevocable Trust Distribution Of Trust Property?

Make use of the US Legal Forms and obtain immediate access to any form template you require. Our beneficial platform with thousands of document templates makes it simple to find and get almost any document sample you want. You can export, fill, and sign the McKinney Texas Irrevocable trust Distribution of trust property in just a few minutes instead of surfing the Net for hours looking for the right template.

Utilizing our library is a superb strategy to improve the safety of your document submissions. Our professional attorneys regularly review all the documents to ensure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you obtain the McKinney Texas Irrevocable trust Distribution of trust property? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Open the page with the template you require. Make certain that it is the form you were looking for: check its name and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Save the document. Choose the format to get the McKinney Texas Irrevocable trust Distribution of trust property and revise and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy document libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the McKinney Texas Irrevocable trust Distribution of trust property.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!