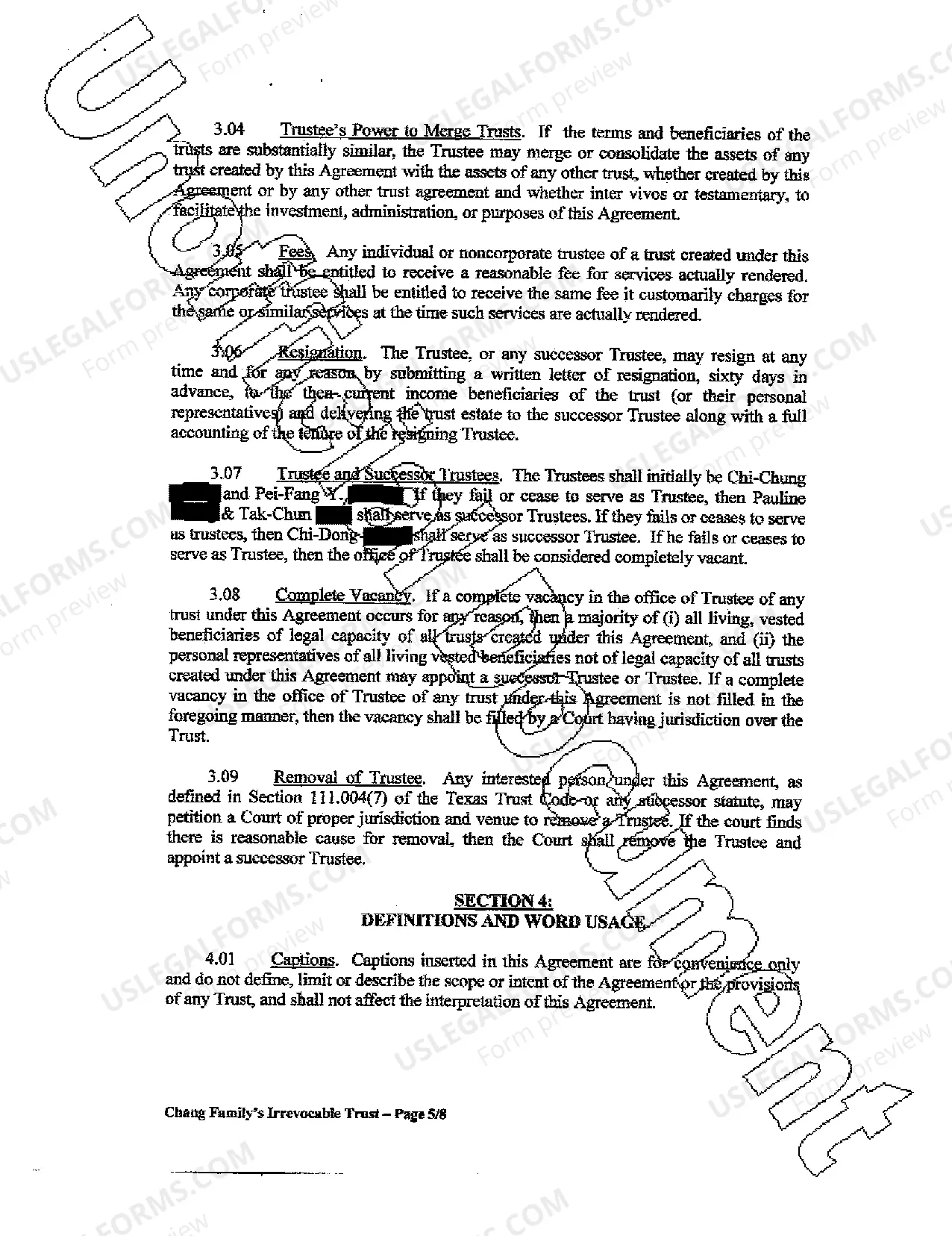

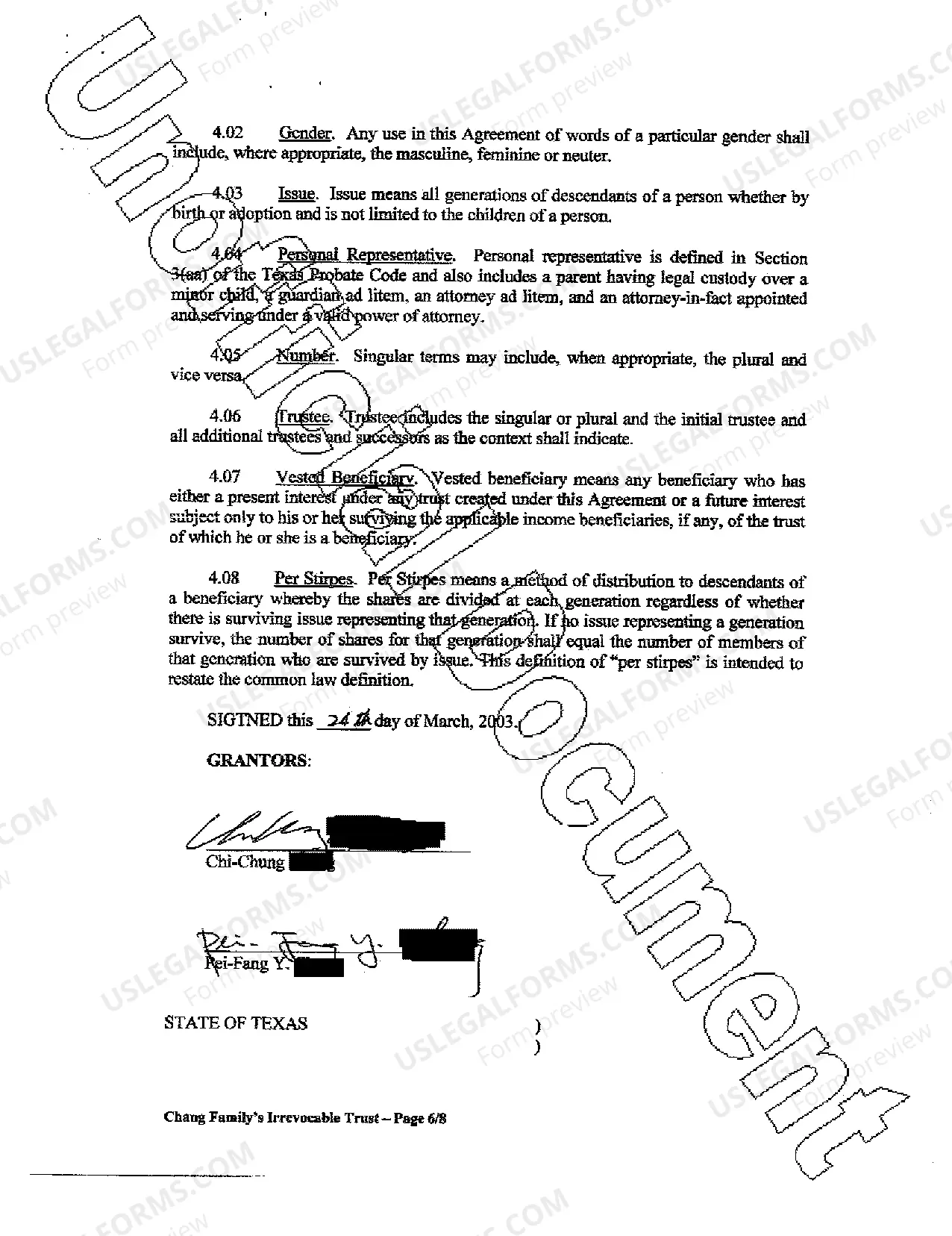

A Pasadena Texas irrevocable trust is a legal arrangement in which the creator (known as the granter) places assets into a trust that cannot be altered or revoked without the consent of the beneficiaries and a court's approval. The purpose of such a trust is to provide estate planning and asset protection benefits. The distribution of trust property in a Pasadena Texas irrevocable trust is a crucial aspect of the trust's administration. The granter must carefully outline the terms and conditions under which the assets will be distributed to the beneficiaries. The terms can vary based on the granter's preferences and goals, but generally, the distribution occurs under specific circumstances. There are different types of Pasadena Texas irrevocable trust distribution of trust property, including: 1. Income Distributions: This type of distribution is based on the income generated by the trust's assets. The beneficiaries receive regular payments or disbursements from the trust's earnings, which can be monthly, quarterly, or annually. The amount distributed may be a fixed percentage or a specified dollar amount agreed upon in the trust document. 2. Fixed Period Distributions: Some irrevocable trusts have provisions that specify the distribution of trust property for a specific period. For example, the granter may direct that the beneficiaries receive specific assets or a portion of assets upon reaching a certain age or milestone. 3. Discretionary Distributions: This type of distribution gives the trustee the authority to decide when and how much to distribute to each beneficiary. The trustee evaluates the beneficiaries' needs, circumstances, and the purpose of the trust, and then makes distribution decisions accordingly. 4. Special Needs Distributions: If a beneficiary has special needs or disabilities, the trust can be structured to distribute assets specifically for their care and support. Money can be used to pay for medical expenses, therapies, education, housing, or any other necessities to ensure the beneficiary's well-being. 5. Charitable Distributions: Some Pasadena Texas irrevocable trusts are designed with charitable purposes in mind. In such cases, the trust may be required to distribute trust assets to specific charities or establish charitable foundations. The distribution of trust property can be complex, and it requires careful attention to detail and legal compliance. The trustee must diligently follow the terms outlined in the trust document to ensure that the beneficiaries receive their rightful share of the assets. Consulting with an experienced attorney specializing in trust administration can provide additional guidance on the various types of distributions and how they align with the specific goals and objectives of a Pasadena Texas irrevocable trust.

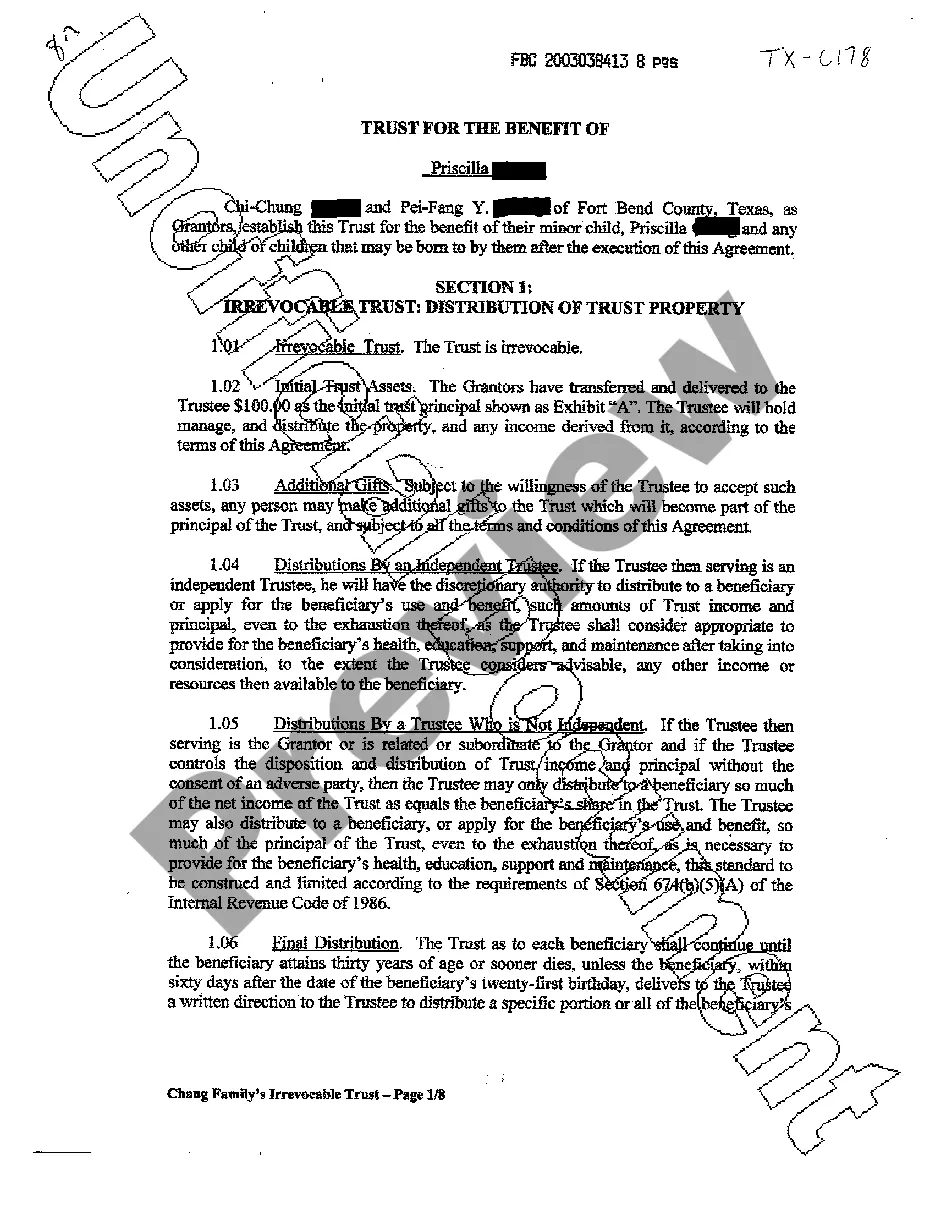

Pasadena Texas Irrevocable trust Distribution of trust property

State:

Texas

City:

Pasadena

Control #:

TX-C178

Format:

PDF

Instant download

This form is available by subscription

Description

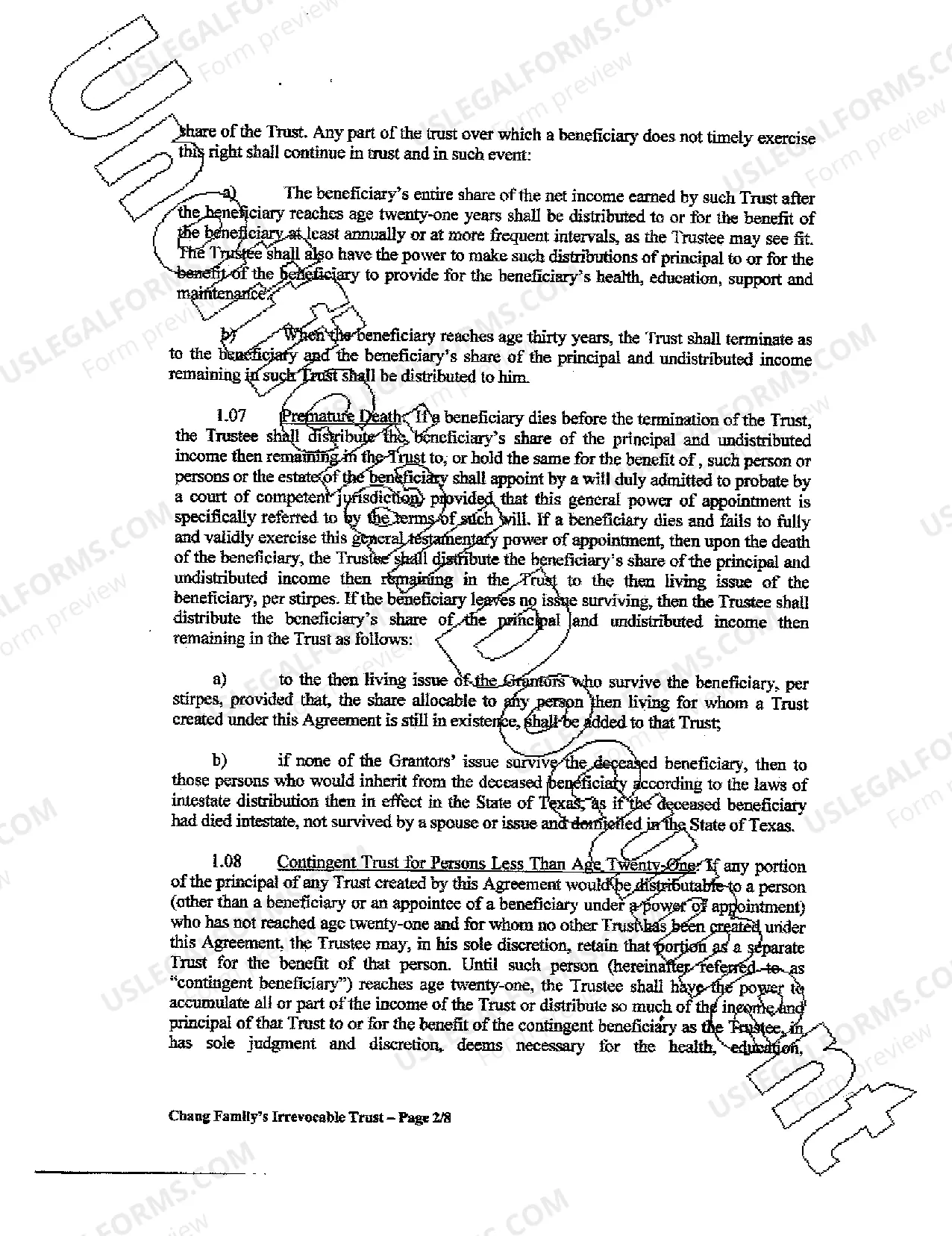

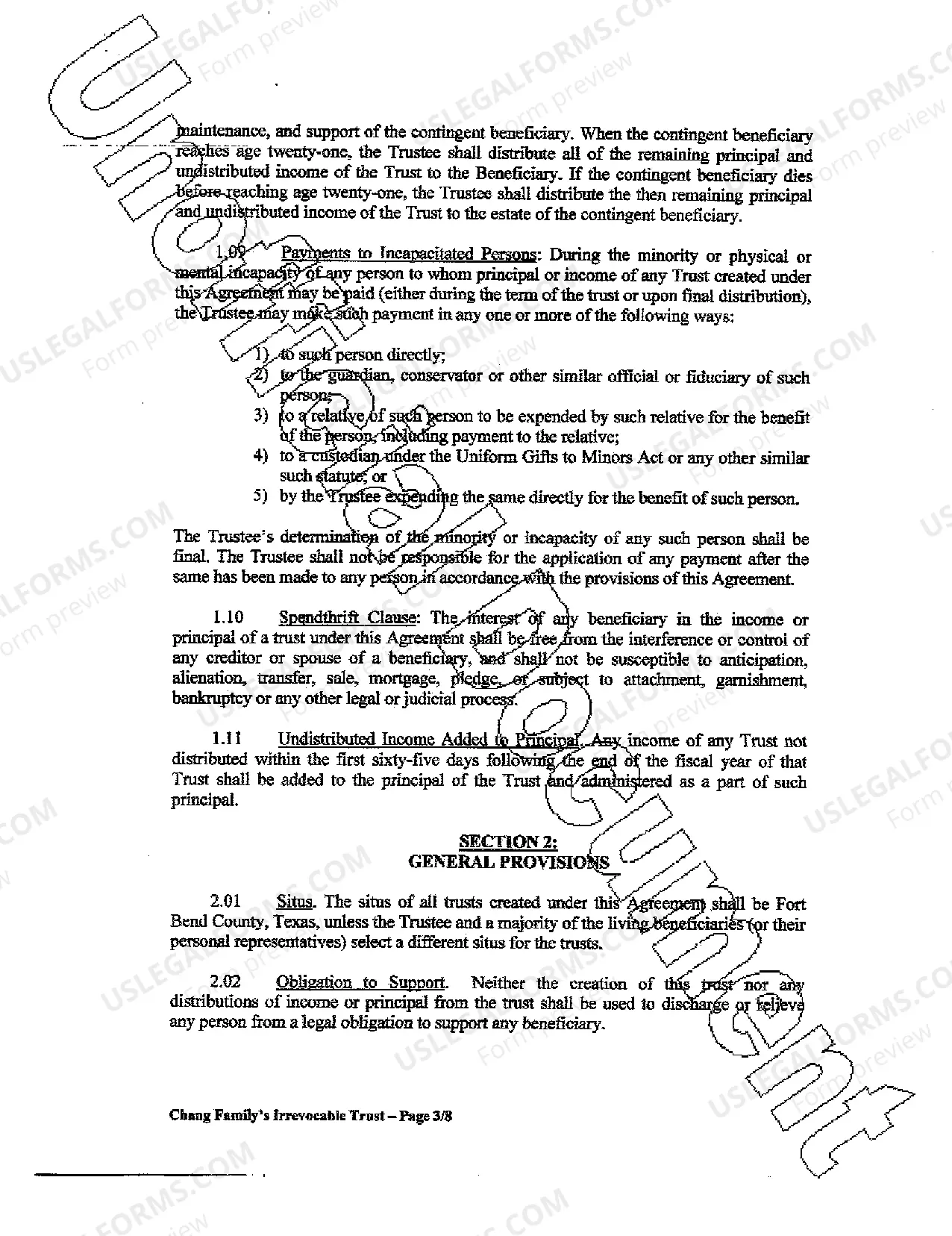

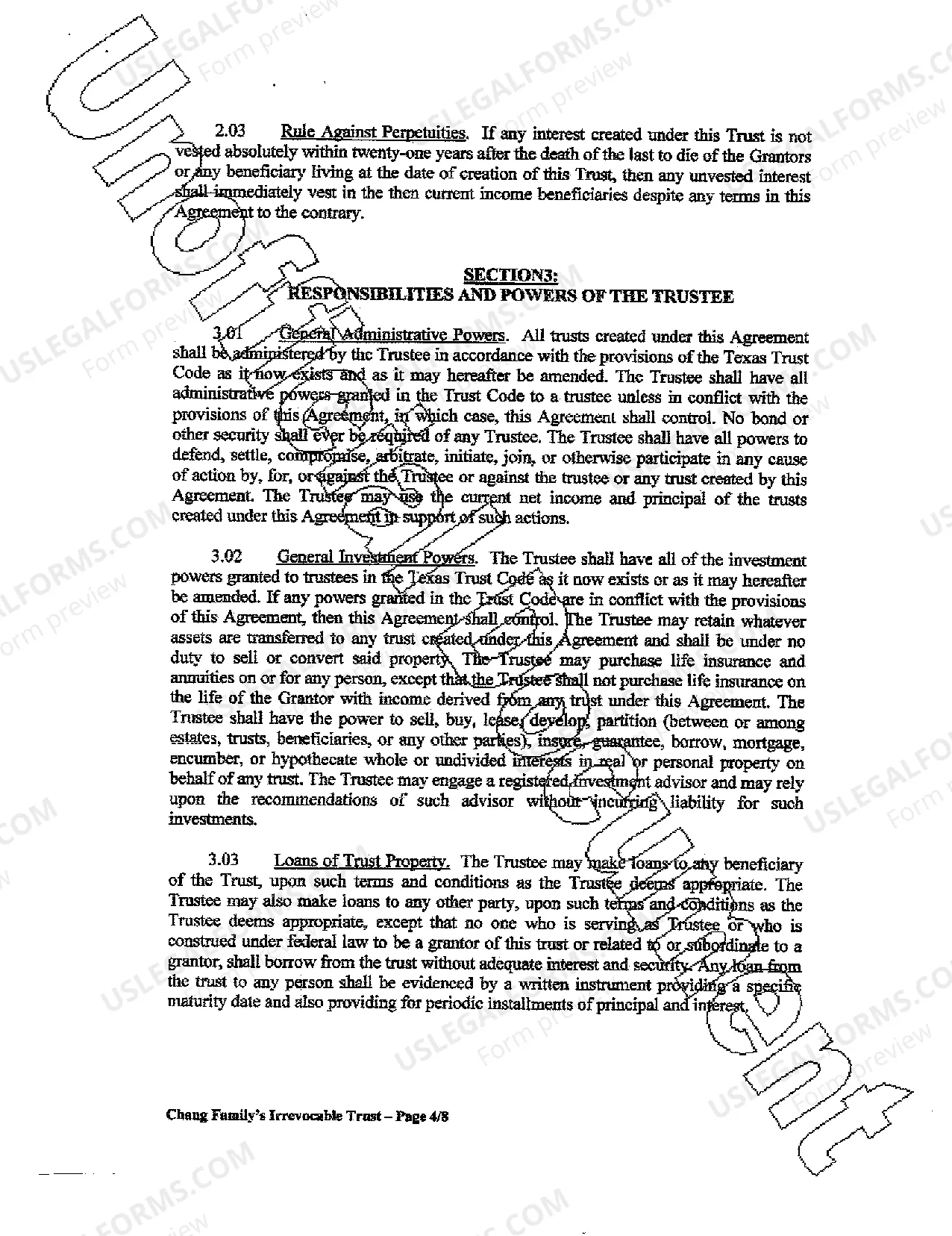

Irrevocable trust Distribution of trust property

A Pasadena Texas irrevocable trust is a legal arrangement in which the creator (known as the granter) places assets into a trust that cannot be altered or revoked without the consent of the beneficiaries and a court's approval. The purpose of such a trust is to provide estate planning and asset protection benefits. The distribution of trust property in a Pasadena Texas irrevocable trust is a crucial aspect of the trust's administration. The granter must carefully outline the terms and conditions under which the assets will be distributed to the beneficiaries. The terms can vary based on the granter's preferences and goals, but generally, the distribution occurs under specific circumstances. There are different types of Pasadena Texas irrevocable trust distribution of trust property, including: 1. Income Distributions: This type of distribution is based on the income generated by the trust's assets. The beneficiaries receive regular payments or disbursements from the trust's earnings, which can be monthly, quarterly, or annually. The amount distributed may be a fixed percentage or a specified dollar amount agreed upon in the trust document. 2. Fixed Period Distributions: Some irrevocable trusts have provisions that specify the distribution of trust property for a specific period. For example, the granter may direct that the beneficiaries receive specific assets or a portion of assets upon reaching a certain age or milestone. 3. Discretionary Distributions: This type of distribution gives the trustee the authority to decide when and how much to distribute to each beneficiary. The trustee evaluates the beneficiaries' needs, circumstances, and the purpose of the trust, and then makes distribution decisions accordingly. 4. Special Needs Distributions: If a beneficiary has special needs or disabilities, the trust can be structured to distribute assets specifically for their care and support. Money can be used to pay for medical expenses, therapies, education, housing, or any other necessities to ensure the beneficiary's well-being. 5. Charitable Distributions: Some Pasadena Texas irrevocable trusts are designed with charitable purposes in mind. In such cases, the trust may be required to distribute trust assets to specific charities or establish charitable foundations. The distribution of trust property can be complex, and it requires careful attention to detail and legal compliance. The trustee must diligently follow the terms outlined in the trust document to ensure that the beneficiaries receive their rightful share of the assets. Consulting with an experienced attorney specializing in trust administration can provide additional guidance on the various types of distributions and how they align with the specific goals and objectives of a Pasadena Texas irrevocable trust.

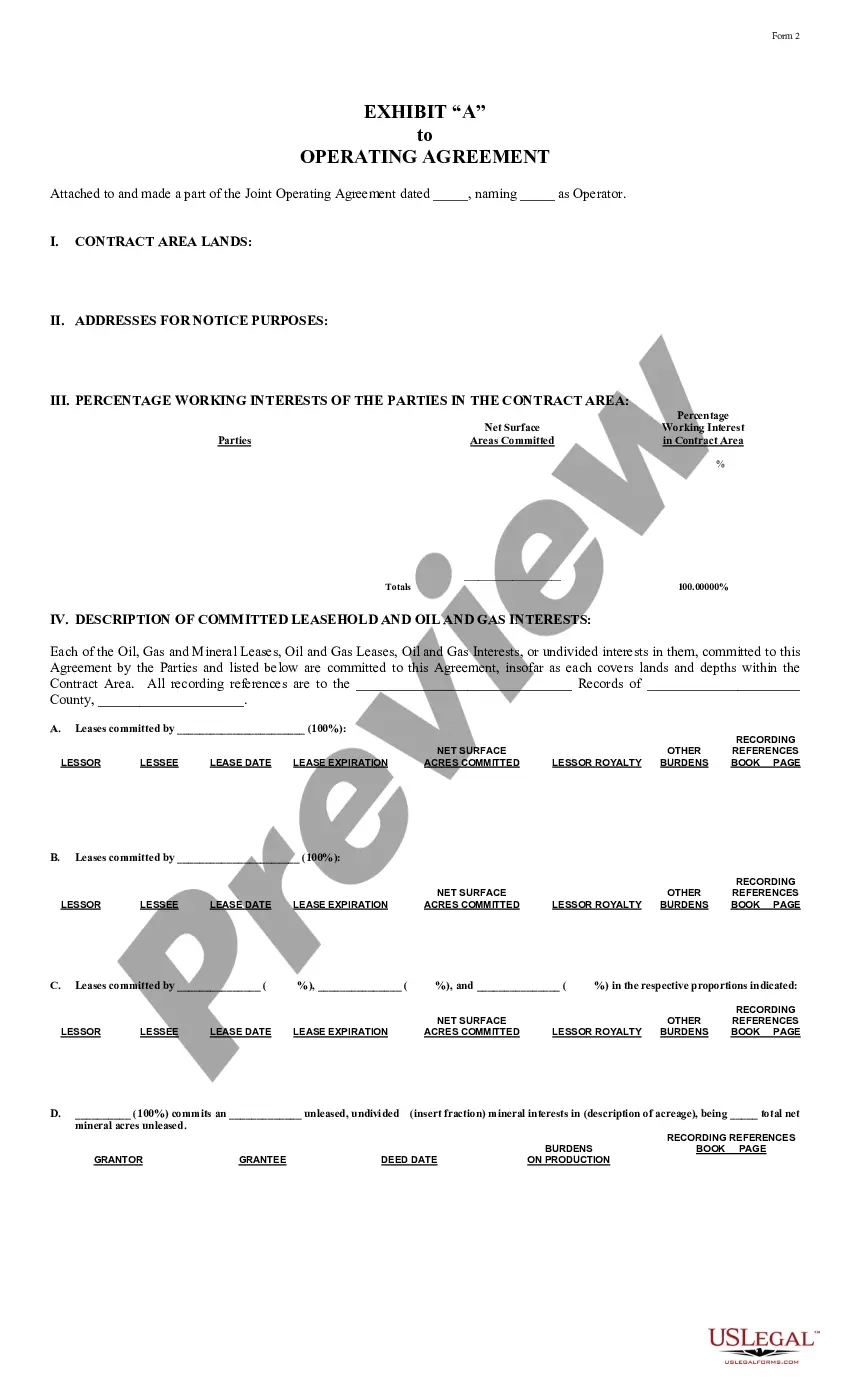

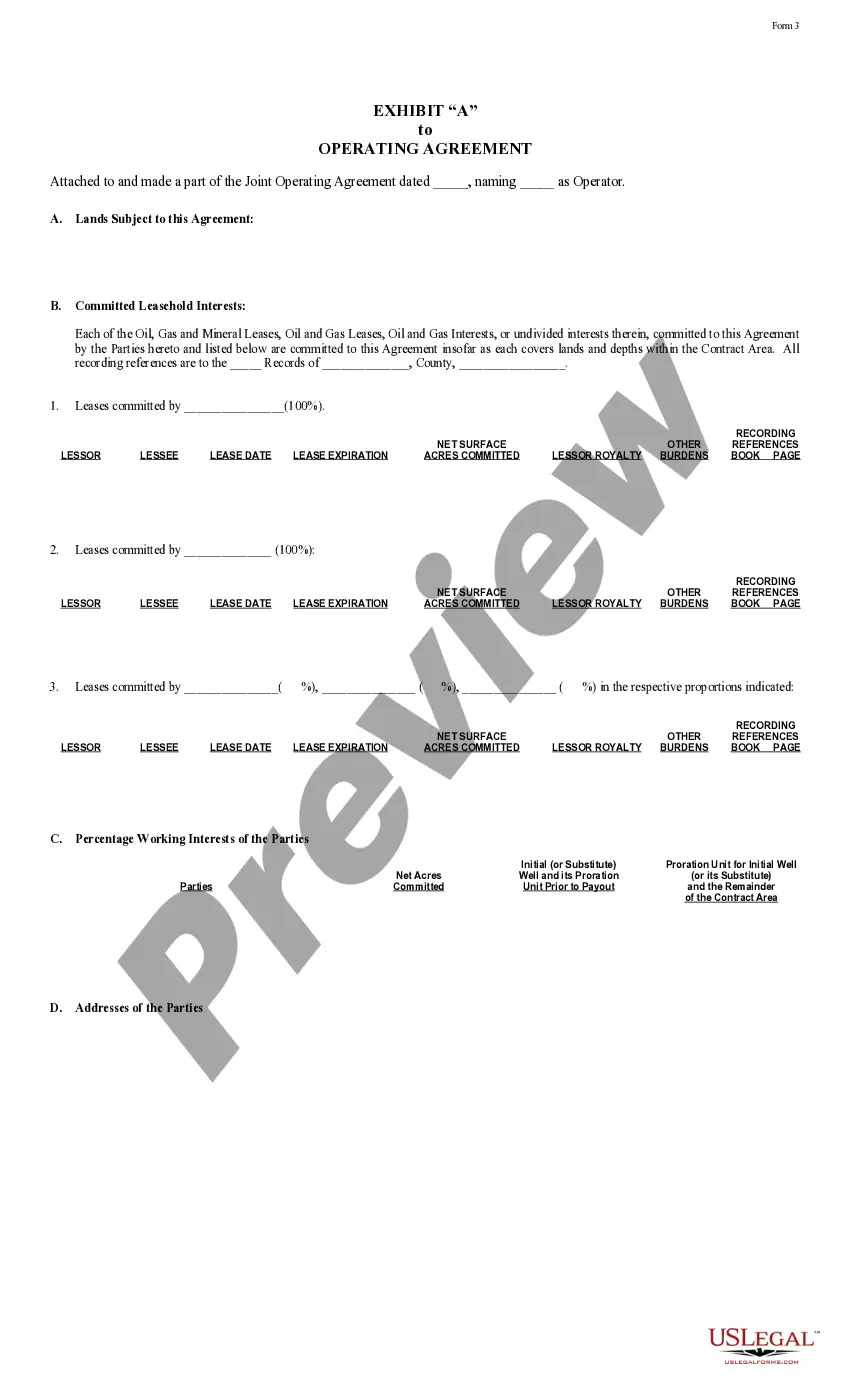

Free preview

How to fill out Pasadena Texas Irrevocable Trust Distribution Of Trust Property?

If you’ve already used our service before, log in to your account and download the Pasadena Texas Irrevocable trust Distribution of trust property on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Pasadena Texas Irrevocable trust Distribution of trust property. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!