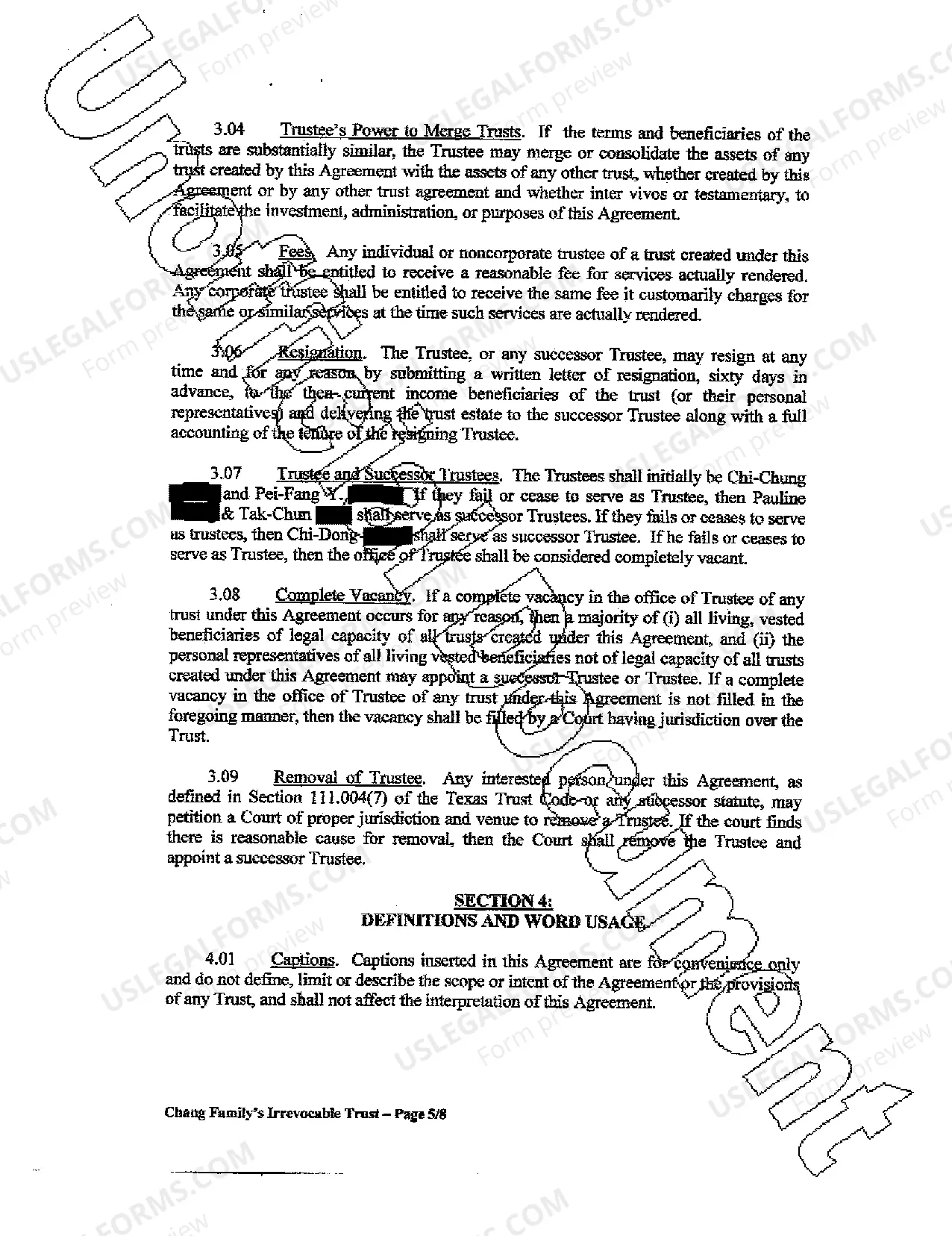

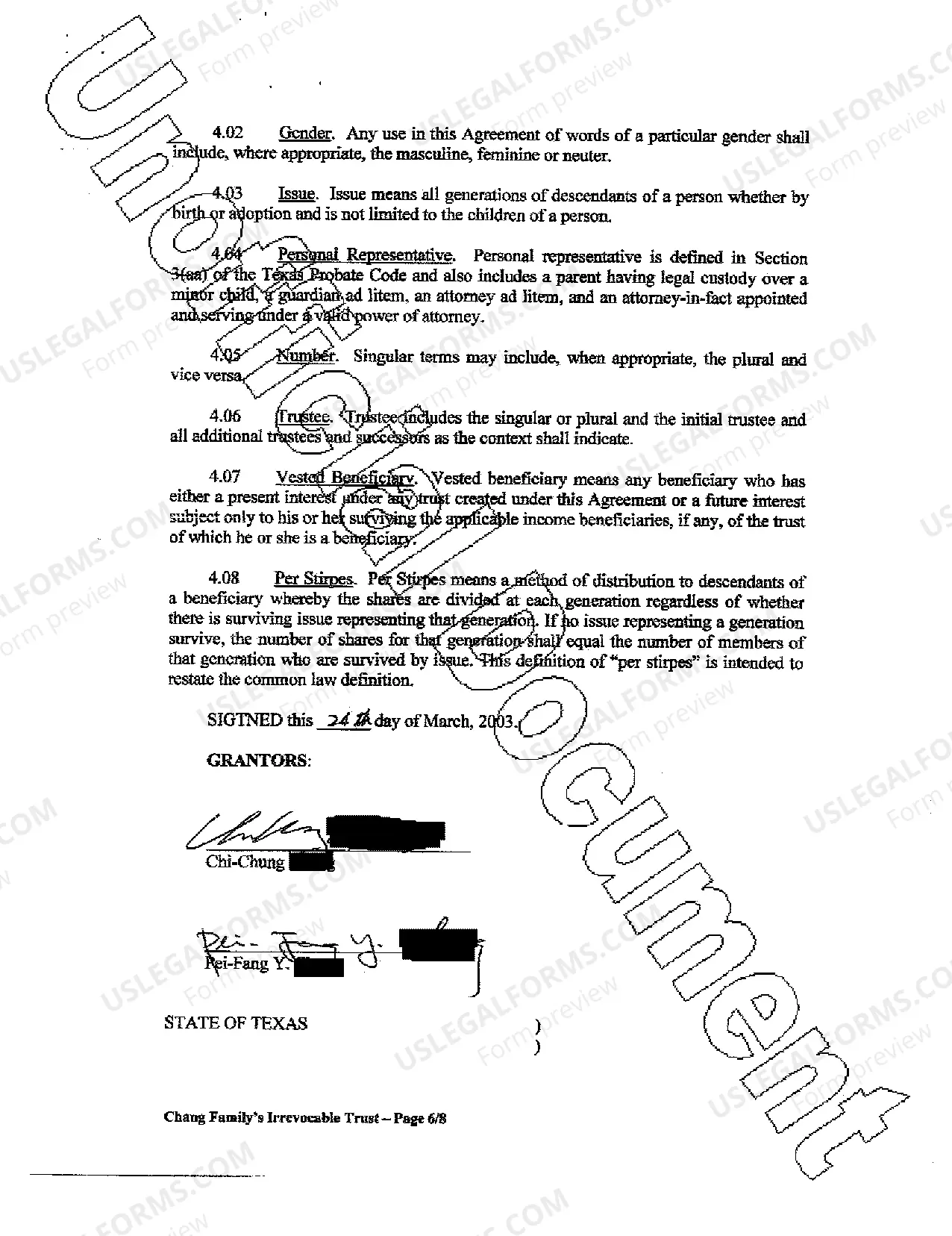

Sugar Land, Texas Irrevocable Trust Distribution of Trust Property: Exploring Different Types In Sugar Land, Texas, the distribution of trust property plays a crucial role in the administration of irrevocable trusts. Irrevocable trusts are an estate planning tool used to preserve assets, provide for beneficiaries, and minimize estate taxes. Understanding the various types of distribution in irrevocable trusts is essential for both settlers and beneficiaries alike. Let's delve into the details of what the Sugar Land, Texas Irrevocable Trust Distribution of Trust Property entails, highlighting key terms along the way. 1. Mandatory Income Distributions: One type of distribution commonly encountered in an irrevocable trust is the mandatory income distribution. In this arrangement, the trust document specifies that a certain percentage or amount of income generated by the trust's assets must be distributed to beneficiaries on a regular basis. The trustee is bound by the trust's terms and obligated to make these mandatory distributions. 2. Discretionary Distributions: Another type of distribution seen in Sugar Land irrevocable trusts is discretionary distribution. Here, the trustee has the discretion to distribute income or principal from the trust as they deem appropriate. The distribution decisions depend on factors such as the beneficiary's needs, health, and education requirements, ensuring more flexibility in meeting their changing circumstances. 3. Specific Bequests: Some irrevocable trusts may include specific bequests, which refer to the distribution of specific assets or properties to designated beneficiaries. For example, a trust might designate a specific piece of real estate or a valuable piece of artwork to be distributed to a particular beneficiary upon a predetermined event or timeframe. 4. Residual Distributions: Residual distributions refer to the remaining assets of the trust that are distributed to beneficiaries after all other distributions have been made. These distributions usually occur upon the termination of the trust or when all specific bequests and other obligations have been fulfilled. 5. Charitable Distributions: Irrevocable trusts often include provisions for charitable distributions, enabling settlers to support causes they feel passionate about. These distributions may involve donating a percentage of the trust assets or specific properties to qualified charitable organizations in accordance with applicable tax laws. 6. Generation-Skipping Distributions: In certain cases, an irrevocable trust may establish generation-skipping distributions. This allows for the transfer of trust assets directly to the next generation beneficiaries, typically grandchildren or great-grandchildren, bypassing the children of the settler. This strategy provides tax benefits and long-term planning opportunities by minimizing estate taxes in multiple generations. Understanding the nuances of Sugar Land, Texas Irrevocable Trust Distribution of Trust Property is crucial for both settlers and beneficiaries to ensure the efficient and effective management of trust assets. By considering the different types of distributions available, individuals can tailor their trust documents to meet their unique goals and fulfill their wishes for the future. Whether it is mandatory income distributions, discretionary decisions, specific bequests, residual dispersal, charitable contributions, or generation-skipping provisions, each has its significance in the overall trust administration process. Seek guidance from a qualified estate planning professional to navigate through the process and make informed decisions.

Sugar Land Texas Irrevocable trust Distribution of trust property

Description

How to fill out Sugar Land Texas Irrevocable Trust Distribution Of Trust Property?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Sugar Land Texas Irrevocable trust Distribution of trust property or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Sugar Land Texas Irrevocable trust Distribution of trust property complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Sugar Land Texas Irrevocable trust Distribution of trust property is proper for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!