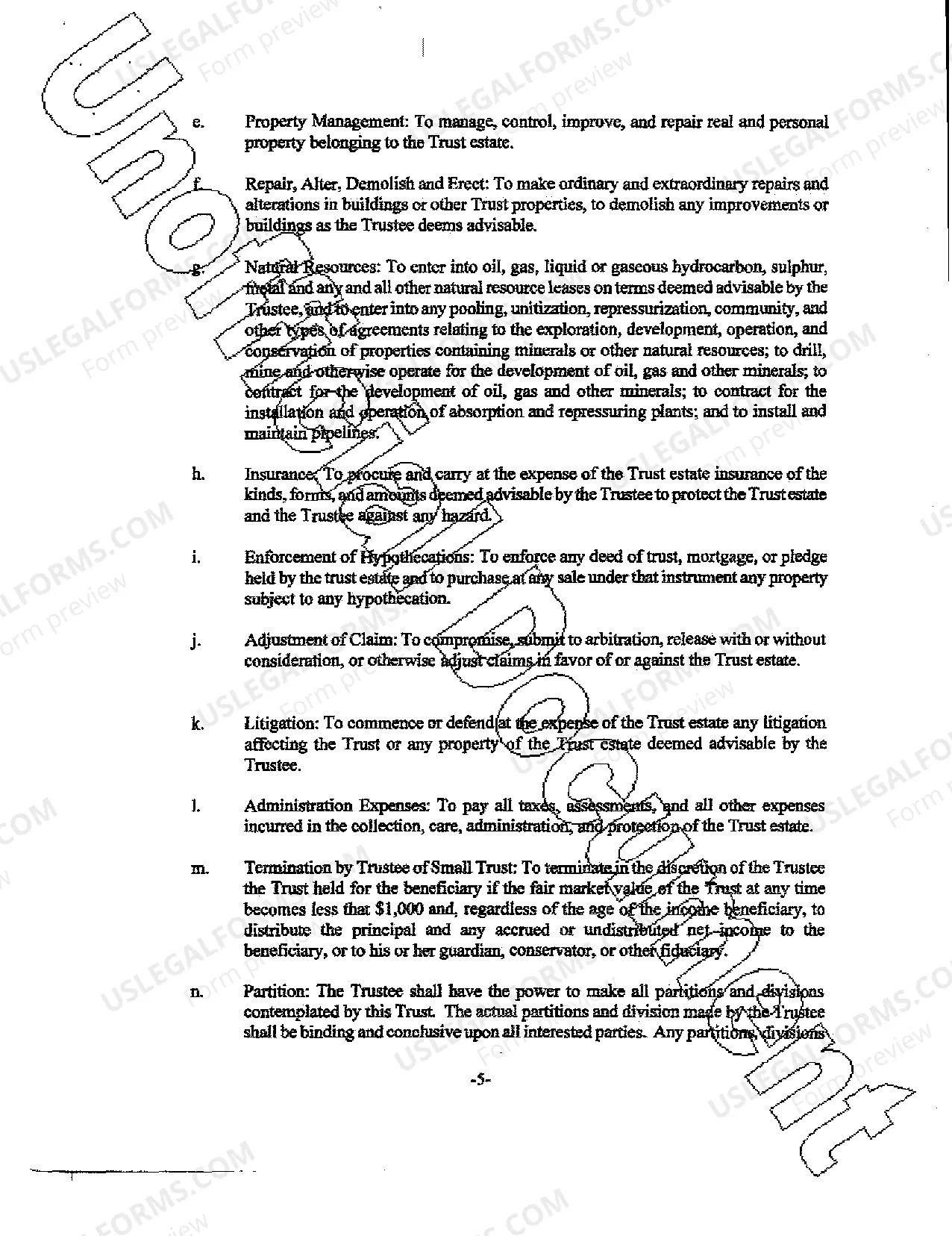

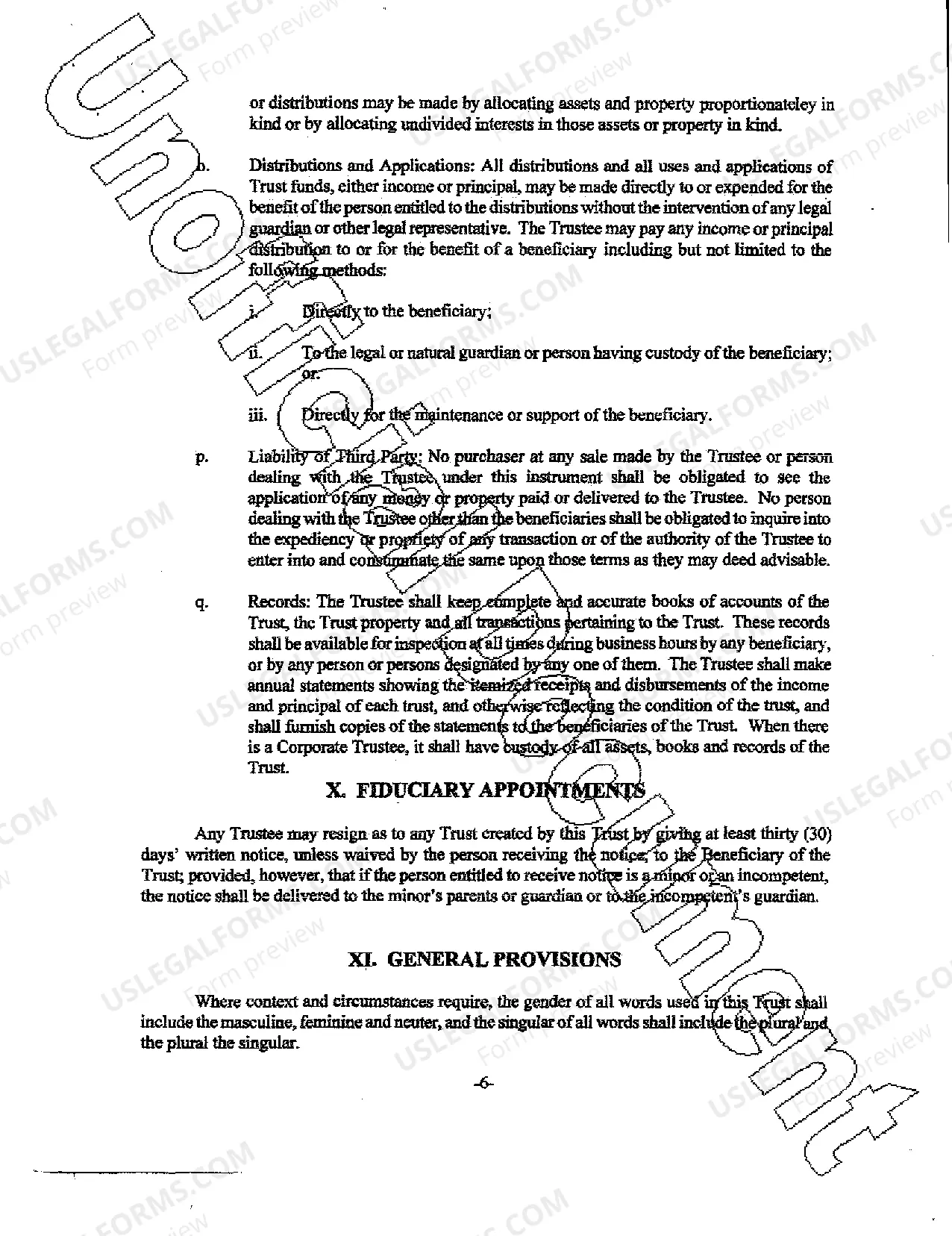

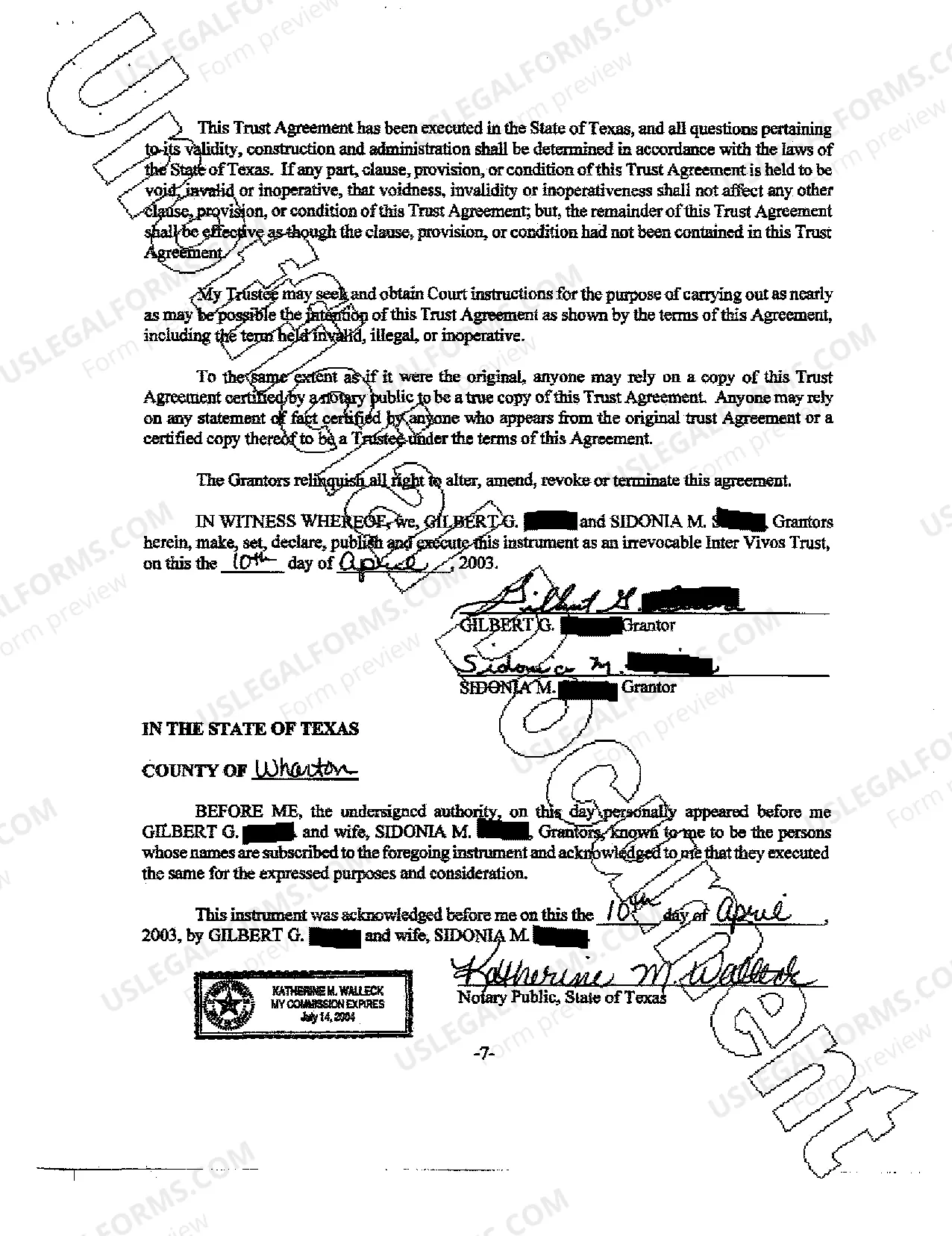

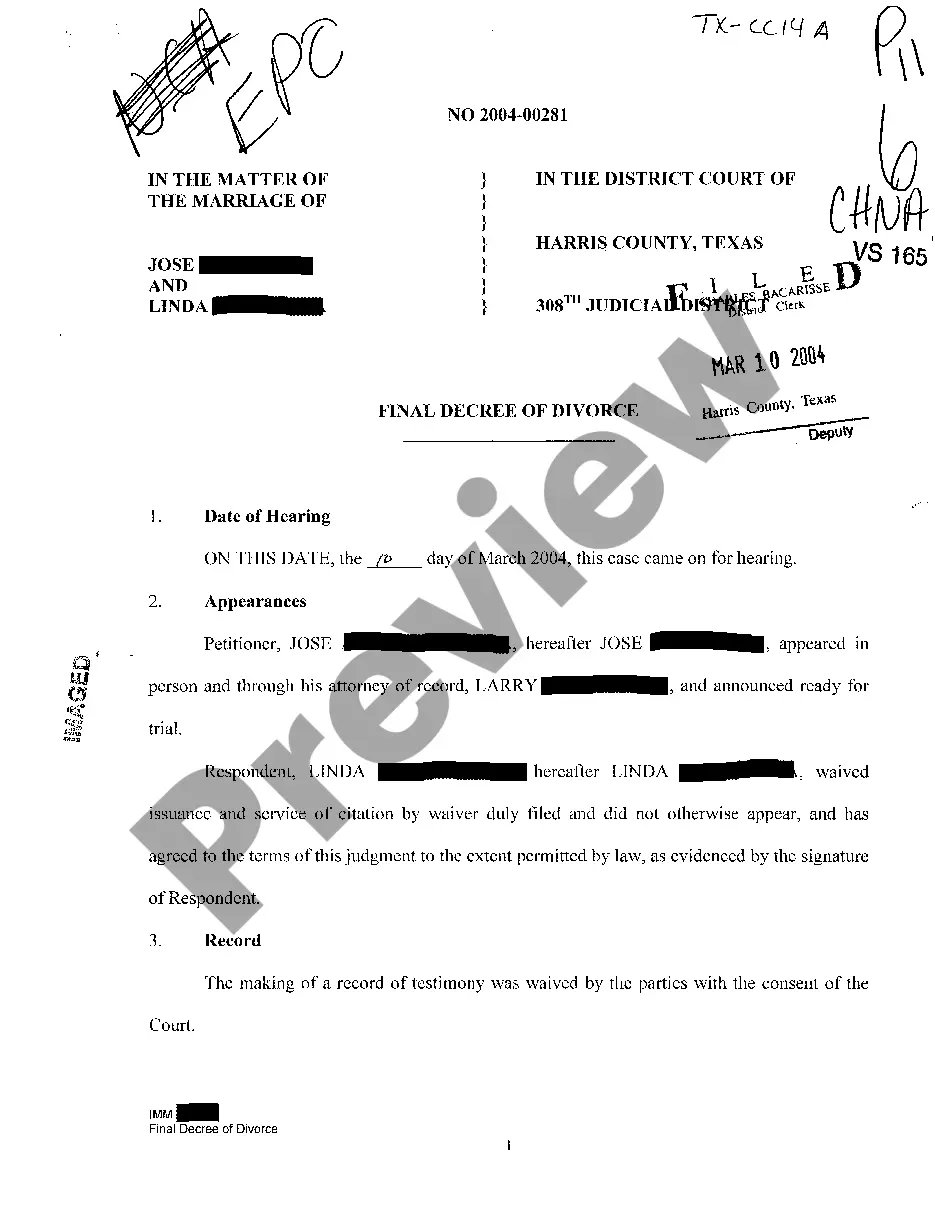

One type of common trust found in Irving, Texas is an Inter Vivos Trust. An Inter Vivos Trust, also known as a living trust or revocable trust, is a legal entity created during the lifetime of the settler (the person establishing the trust) to manage, hold, and distribute assets. These trusts are widely used in estate planning to avoid probate and ensure smooth asset transfer to beneficiaries upon the settler's death. An Irving Texas Inter Vivos Trust is a versatile estate planning tool that allows individuals to retain control over their assets and make changes to the trust terms as needed. The settler can act as the initial trustee and appoint successor trustees to oversee the trust upon their incapacity or death, ensuring continuity of management. One advantage of an Irving Texas Inter Vivos Trust is privacy. Unlike a will, which becomes public record after probate, the trust agreement and asset distribution remain private. This aspect can be valuable for individuals who prefer to keep their financial arrangements confidential. There are various types of Inter Vivos Trusts available in Irving, Texas, based on the specific goals and needs of the settler. Here are a few common types: 1. Irrevocable Inter Vivos Trust: In this trust, the settler relinquishes control over the assets and cannot change or revoke the trust terms without the consent of the beneficiaries or a court order. 2. Charitable Inter Vivos Trust: This trust is established to benefit charitable organizations, allowing the settler to provide ongoing financial support to causes they care about while receiving certain tax advantages. 3. Special Needs Inter Vivos Trust: Designed for individuals with special needs, this trust aims to provide financial support without jeopardizing their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI). 4. Family Inter Vivos Trust: This type of trust is commonly used for family estate planning, enabling the settler to transfer assets to their beneficiaries efficiently and minimize estate taxes. 5. Testamentary Inter Vivos Trust: This trust is revocable during the settler's lifetime but becomes irrevocable upon their death and acts as a testamentary substitute, ensuring seamless asset transfer. Overall, an Irving Texas Inter Vivos Trust can be an essential component of a comprehensive estate plan, providing flexibility, asset protection, and privacy while ensuring the smooth administration and distribution of assets.

Irving Texas Inter Vivos Trust

Description

How to fill out Irving Texas Inter Vivos Trust?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is a digital repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the forms are systematically organized by usage area and jurisdictional sections, making the search for the Irving Texas Inter Vivos Trust as simple as one, two, three.

Maintaining organized paperwork that adheres to legal stipulations is crucial. Utilize the US Legal Forms library to have essential document templates readily available for any requirements!

- Verify the Preview mode and form details.

- Ensure you’ve chosen the correct one that satisfies your needs and complies with your local jurisdiction's specifications.

- Search for another template, if required.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- If it fits your needs, proceed to the next step.

Form popularity

FAQ

An inter vivos trust, commonly known as a living trust, is a legal arrangement created during a person's lifetime. The primary purpose of an Irving Texas Inter Vivos Trust is to manage assets and provide a clear instruction for their distribution after death. This type of trust can bypass the lengthy probate process, ensuring your loved ones receive their inheritance more quickly. By setting up this trust, you maintain control of your assets while safeguarding them for future generations.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the terms and conditions for its use. Ambiguity can lead to confusion and disputes among heirs. While this question pertains to the UK, it underscores the importance of clarity, whether creating an Irving Texas Inter Vivos Trust or any other trust. Consulting with a professional can help parents avoid such pitfalls and ensure a smooth transition of their assets.

In Texas, most trusts, including an Irving Texas Inter Vivos Trust, do not need to be filed with the state. However, it is essential to maintain proper records and documentation for the trust, which will be beneficial in the future for both taxation and management purposes. Establishing the trust correctly from the start helps ensure its effectiveness without the need for state registration.

One disadvantage of a family trust is the potential for family disputes to arise over trust management and distributions. Also, structuring a well-functioning family trust can be complex, leading to misunderstandings among family members about their roles. To avoid these issues, consider setting up an Irving Texas Inter Vivos Trust, which can provide clarity and structure to your family's financial arrangements.

A common negative aspect of a trust is the ongoing administration and management it requires. Establishing an Irving Texas Inter Vivos Trust may involve costs, such as attorney fees and trustee fees, which can add up over time. Additionally, if the trust is not properly structured, it might not provide the desired protective benefits for your assets, leaving gaps in your estate planning.

One of the dangers associated with trust funds is the potential for mismanagement of assets. If the trustee does not act in the best interest of the beneficiaries, it could lead to significant financial losses. Moreover, the complexities around tax implications can pose challenges, particularly when setting up an Irving Texas Inter Vivos Trust. It's vital to stay informed and consider legal guidance when establishing a trust.

Setting up an inter vivos trust involves several key steps, starting with deciding on the assets you want to include. Then, you will need to draft the trust document, outlining your wishes for asset management and distribution, making sure it satisfies Texas legal requirements. For ease and accuracy, using platforms like uslegalforms can simplify this process, ensuring your Irving Texas Inter Vivos Trust is properly established and documented.

The opposite of an inter vivos trust is a testamentary trust, which is created through a will and goes into effect only after the individual's death. Unlike an Irving Texas Inter Vivos Trust, a testamentary trust requires going through the probate process, which may delay access to assets for beneficiaries. Understanding these differences can help you make informed decisions regarding your estate planning.

An example of an inter vivos trust can be a couple who places their joint assets, such as bank accounts, real estate, and investments, into an Irving Texas Inter Vivos Trust. This allows them to manage the assets collaboratively while also specifying how these will be distributed to their heirs upon their deaths. Such a trust can simplify matters for survivors and provide clear instruction on asset management.

Yes, you can write your own trust in Texas if you follow the state’s legal requirements. However, creating an effective Irving Texas Inter Vivos Trust can be complex, and mistakes may lead to unintended consequences. Using a trusted platform like uslegalforms can guide you through the process, ensuring that your trust meets all legal standards.