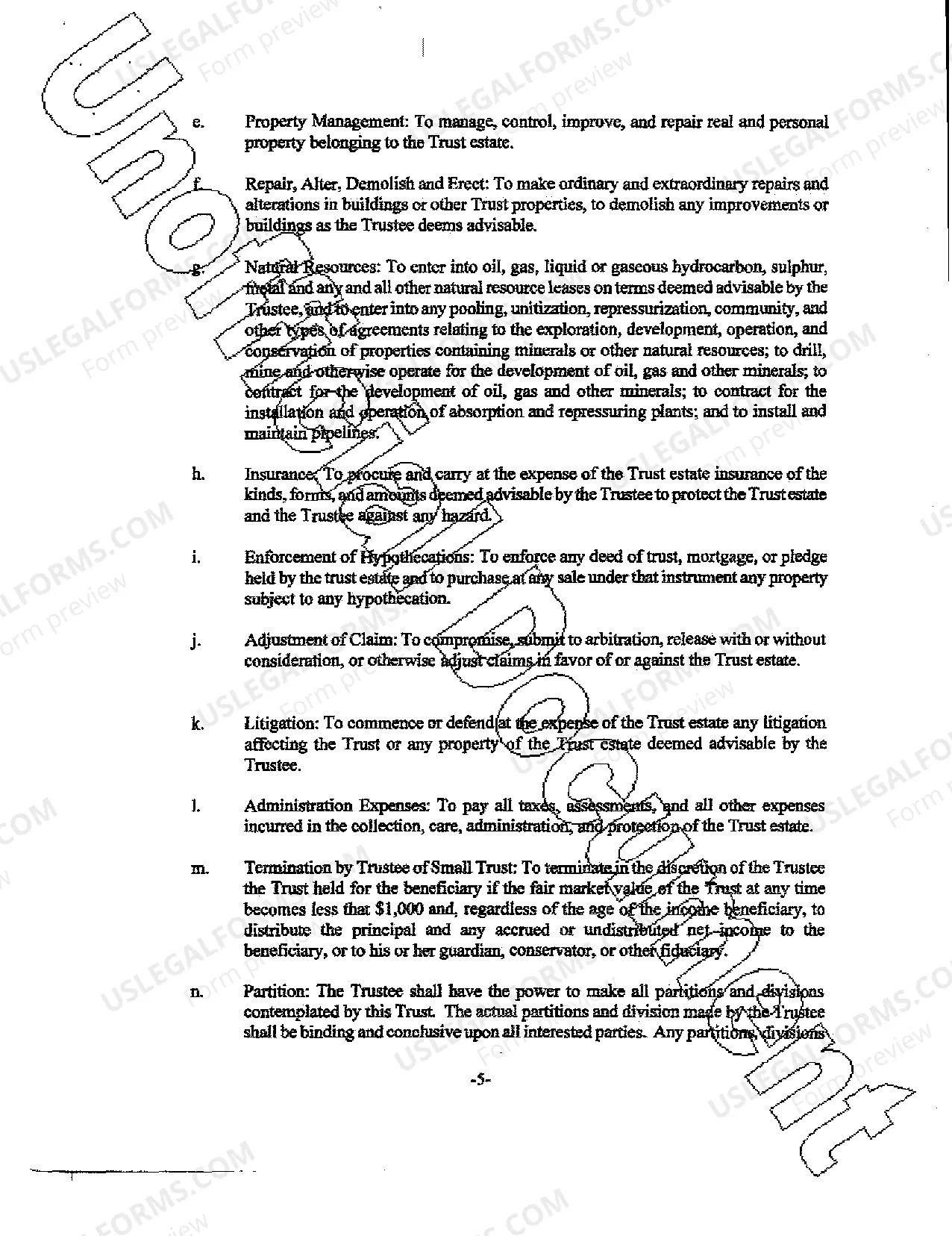

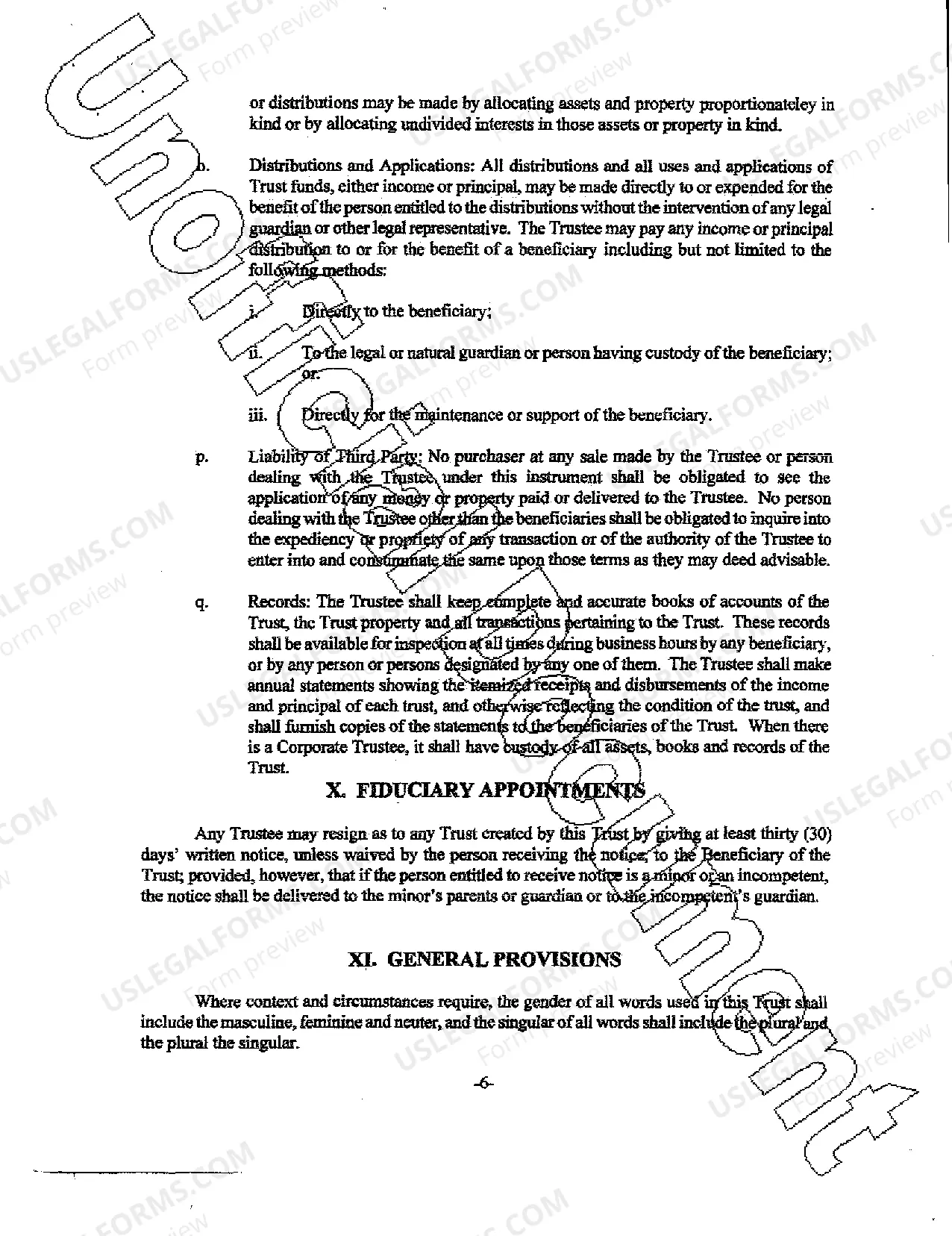

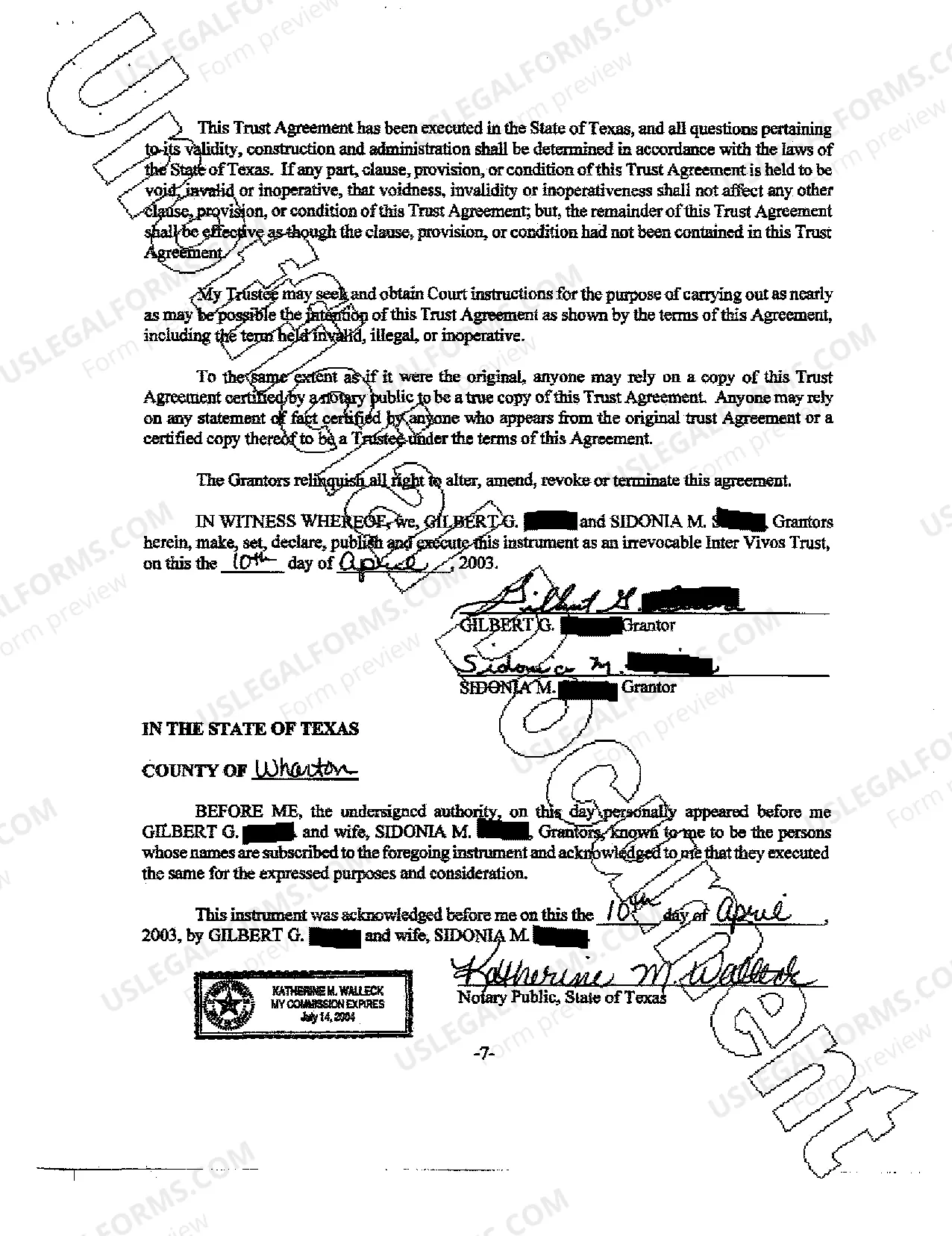

A Round Rock Texas Inter Vivos Trust, also known as a living trust, is a legal instrument that allows individuals to transfer their assets into a trust during their lifetime. This type of trust is created by a Granter, who is the individual transferring the assets, and managed by a Trustee, who is responsible for overseeing the trust and distributing the assets as per the Granter's instructions. In Round Rock, Texas, Inter Vivos Trusts are a popular estate planning tool as they offer several advantages. One key benefit is the ability to avoid probate, which is the legal process of distributing assets after a person's death. By establishing an Inter Vivos Trust, individuals can ensure a more efficient transfer of assets without the need for court intervention, saving time and money for their beneficiaries. There are different types of Round Rock Texas Inter Vivos Trusts, each designed to suit different needs and goals. One common type is a revocable living trust, which allows the Granter to modify, revoke, or terminate the trust at any time during their lifetime. This type of trust provides flexibility and allows for changes as circumstances evolve. Another type of Inter Vivos Trust is an irrevocable living trust. Once this trust is created, the Granter relinquishes control over the assets placed in the trust. Irrevocable trusts are often used for advanced estate planning purposes, such as minimizing estate taxes, protecting assets from creditors, or providing for special needs beneficiaries. A third type of Inter Vivos Trust is a testamentary trust. Unlike revocable and irrevocable living trusts, testamentary trusts are created through the provisions of a person's will and only come into effect after their death. These trusts are popular for individuals who want to control the distribution of their assets after they pass away. Furthermore, Round Rock Texas Inter Vivos Trusts can be customized to include specific instructions regarding the management and distribution of assets, such as providing for minor children, funding education or healthcare expenses, or supporting charitable causes. It is important to consult with an experienced attorney specializing in estate planning in Round Rock, Texas, to understand the different types of Inter Vivos Trusts available and select the most appropriate one based on individual circumstances and objectives. This legal professional can guide individuals through the process of creating a trust, ensuring it is properly funded and legally binding, and provide ongoing advice on trust management to ensure the Granter's wishes are carried out effectively.

Round Rock Texas Inter Vivos Trust

Description

How to fill out Round Rock Texas Inter Vivos Trust?

Locating certified templates tailored to your regional regulations can be challenging without utilizing the US Legal Forms database.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the papers are systematically organized by category of use and jurisdiction, making it straightforward to find the Round Rock Texas Inter Vivos Trust.

Maintaining documents organized and compliant with legal regulations is of paramount significance. Leverage the US Legal Forms library to always have vital document templates at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve selected the appropriate one that fulfills your requirements and aligns with your local jurisdiction stipulations.

- Seek an alternative template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the correct document.

- If it fits your needs, proceed to the next phase.

Form popularity

FAQ

You must be entitled to receive all of the trust income each year and no one else can use any of the trust capital during your lifetime. Upon your death, there will be a deemed disposition of the trust assets, giving rise to tax on any assets with accrued capital gains.

There is no definite timeframe stated in our statutes. But the reasonableness standard still mandates a distribution be made timely. In fact, a Trust that has no issues, and only cash, may be reasonably distributed within four or five months of the settlor's death, not two years.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

This includes cash, stocks, real estate, art, or insurance policies. Testamentary Trusts. A testamentary trust is a trust that is created under the terms of the grantor's will.Living Trusts. A living trust (also called an inter vivos trust), is created and funded while the grantor lives.Irrevocable Trusts.Rotten Trusts.

Trusts are not legal entities that can own, manage or sell property. It is the trustee of the trust that can hold legal title to the property on behalf or for the benefit of the beneficiaries of the trust. What this means is that a trustee has the power to sell or lease the property.

Wills must go through probate and become public record. A trust is not probated and does not become public record. Your beneficiaries, assets, and trust terms remain private. Trusts are also more difficult to contest than wills, providing greater security.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

Many assets, including IRA accounts, allow the holder to name a beneficiary that automatically receives the property upon the death of the property owner. Generally, a beneficiary designation will override the trust provisions.

An inter vivos trust is established while the person creating the trust is still living. There is a possibility that a person is a beneficiary of one of the above types of trusts when the person is a beneficiary of the trust, but his assets were not used to form the corpus of the trust.