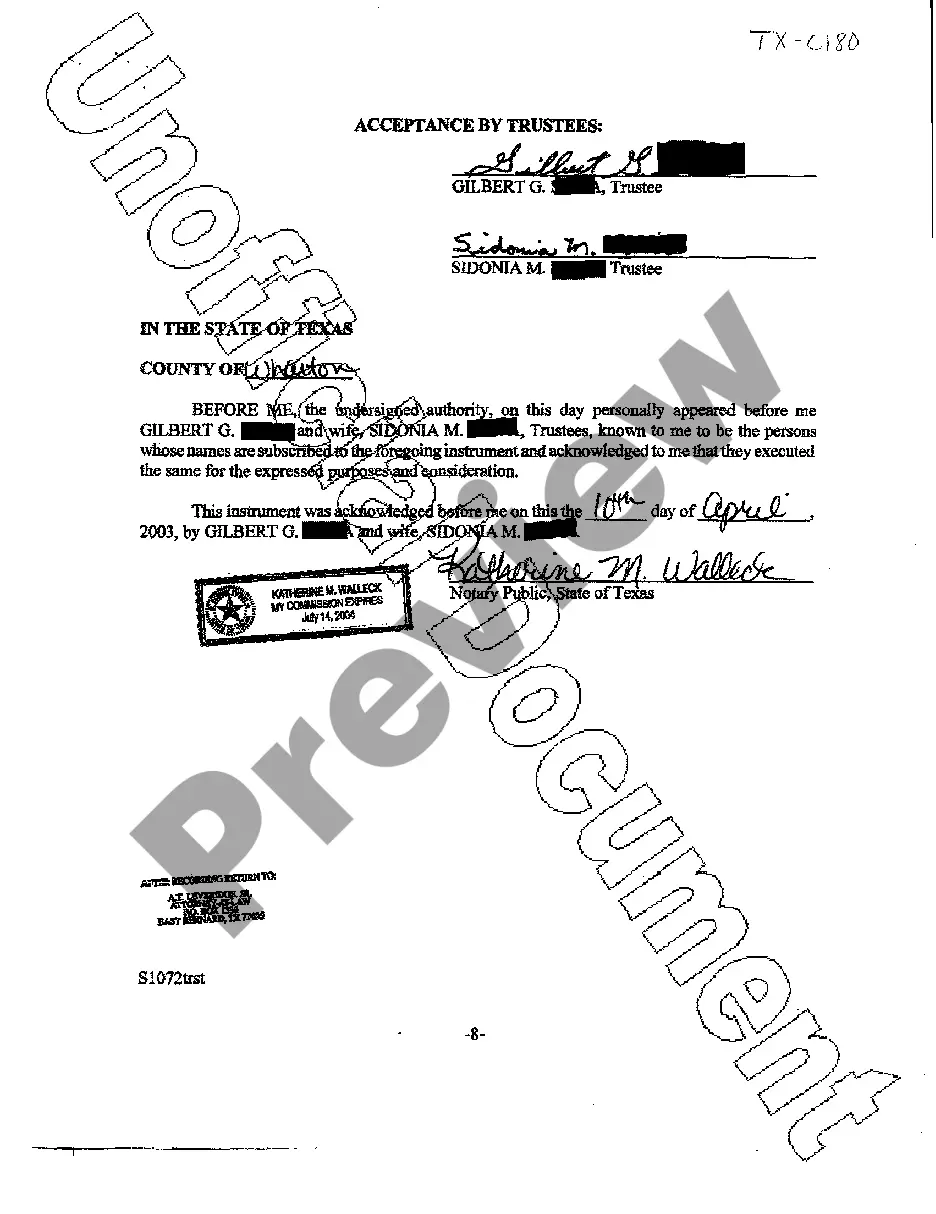

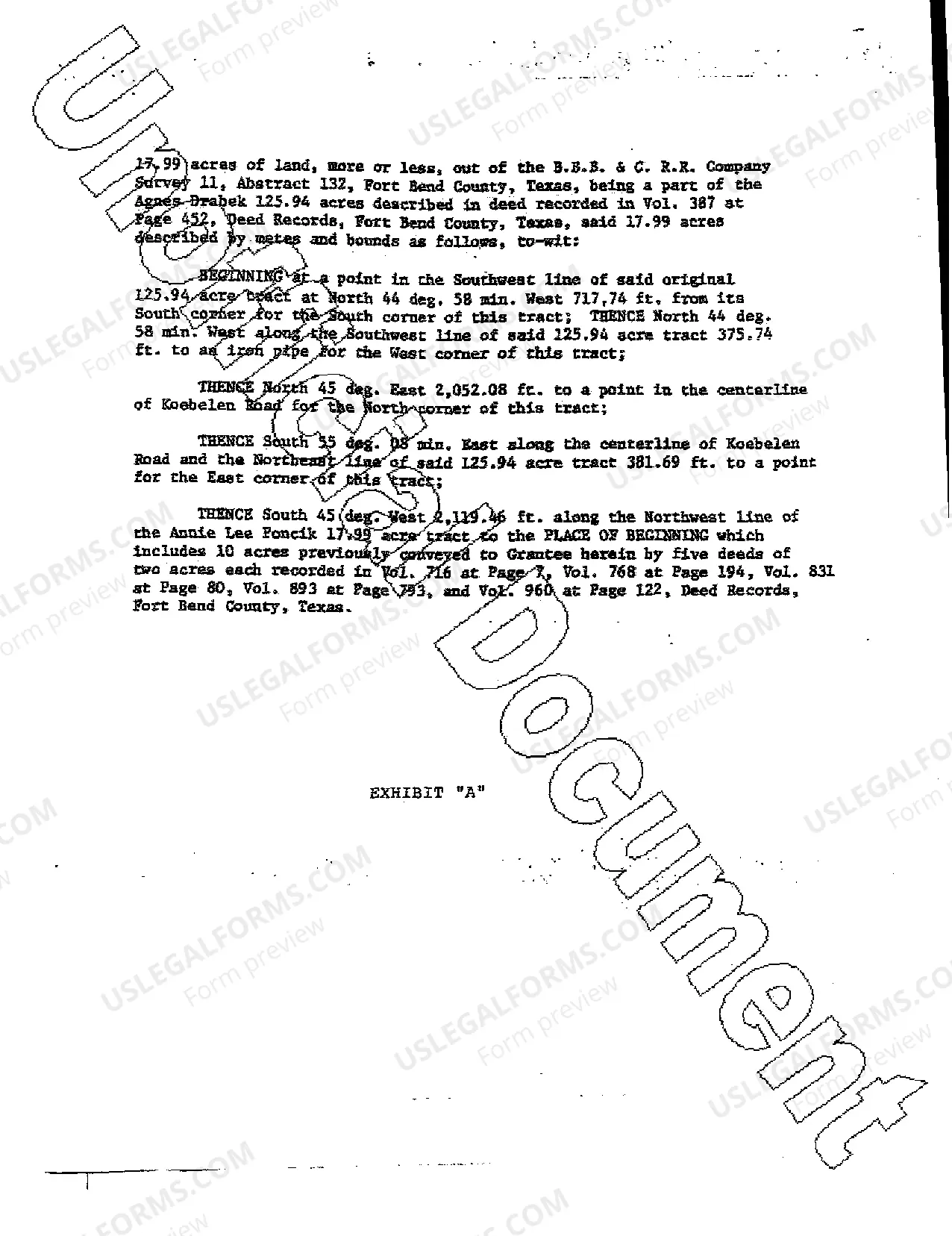

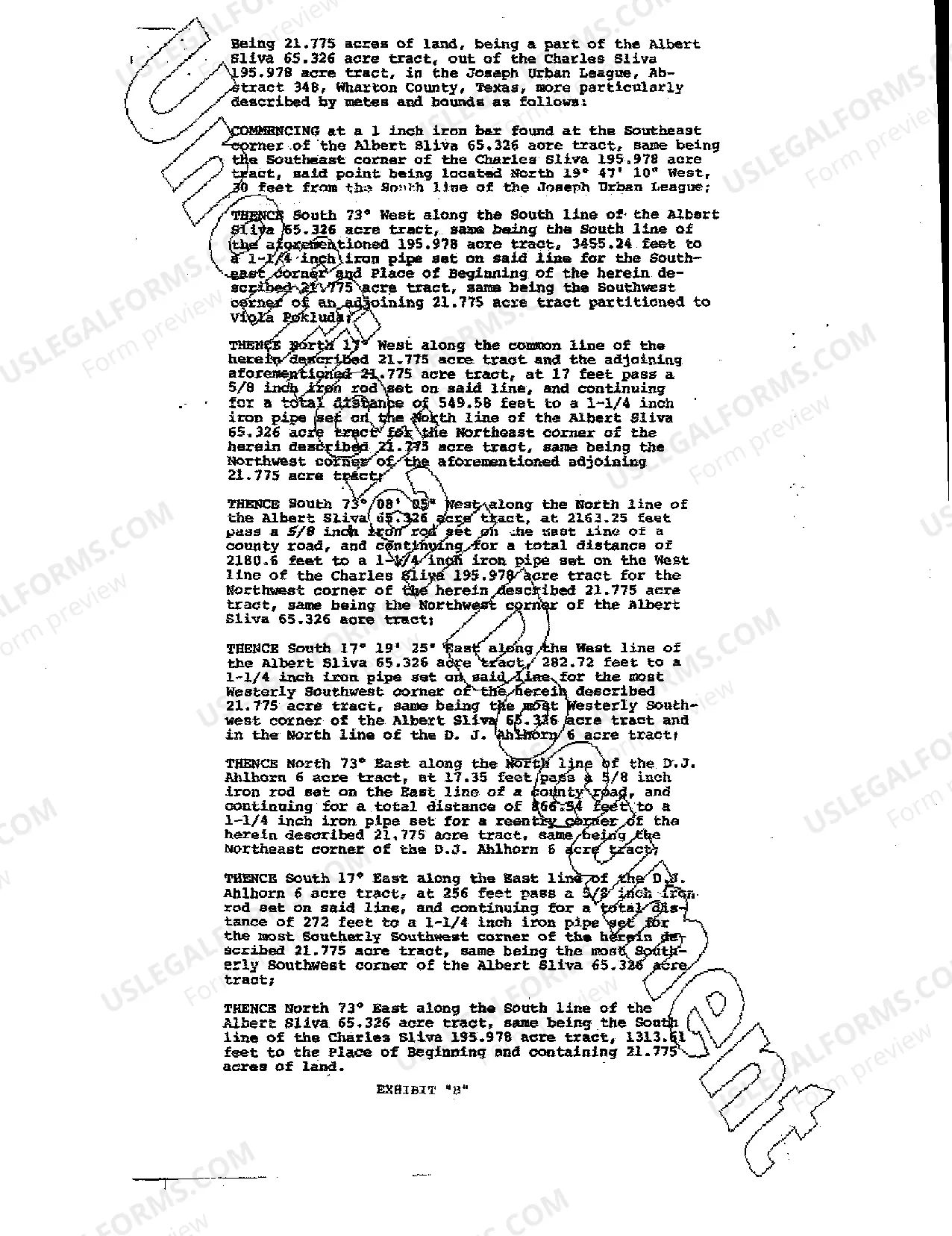

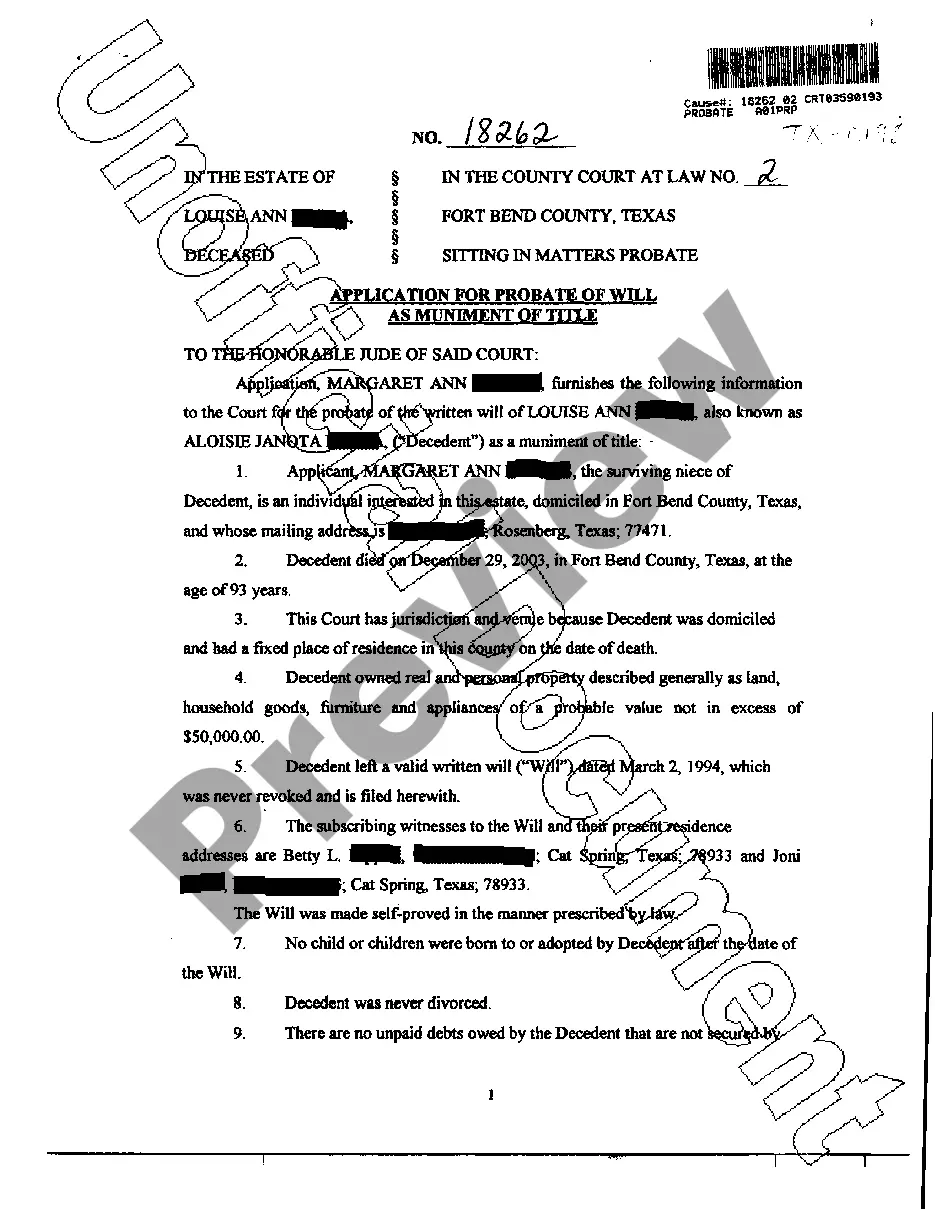

Beaumont Texas Acceptance of Trust Property by Trustees: A Comprehensive Overview In Beaumont, Texas, the acceptance of trust property by trustees is a crucial aspect of the trust management process. Trustees are entrusted with the responsibility of managing and protecting assets on behalf of beneficiaries, adhering to specific legal and ethical obligations. Understanding the concept and types of acceptance of trust property is essential to ensure effective trust administration. In this article, we will delve into the details of Beaumont Texas Acceptance of Trust Property by Trustees, highlighting its importance and outlining different types of acceptance. Acceptance of trust property refers to the formal acknowledgment and consent of trustees to take ownership and control over assets designated for the trust. It serves as a legal affirmation of their willingness to undertake fiduciary duties and responsibilities associated with the trust. By accepting trust property, trustees commit to act in the best interests of beneficiaries, exercising prudent judgment and diligence in asset management. There are several types of Beaumont Texas Acceptance of Trust Property, including: 1. Real Estate Acceptance: Real estate assets, such as land, buildings, or other immovable properties, can be transferred into a trust. Trustees accepting real estate assets must ensure appropriate documentation, including deeds, titles, and property appraisals, to establish legal ownership and protect beneficiaries' interests. 2. Financial Asset Acceptance: Financial assets encompass a wide range of investment instruments, including stocks, bonds, mutual funds, or other securities. Trustees accepting financial assets must comply with legal requirements, such as properly registering these assets in the trust's name, managing investment strategies with care, and ensuring regular monitoring and reporting. 3. Personal Property Acceptance: Personal property covers moveable assets like art, jewelry, vehicles, or collectibles. Trustees accepting personal property within a trust need to maintain proper custody, security, and documentation of these assets. Regular appraisal and insurance coverage are necessary to safeguard beneficiaries' interests. 4. Business Interest Acceptance: When a trust includes ownership interests in businesses, trustees have the responsibility to manage and protect these investments. Acceptance of business interests requires thorough due diligence to understand the businesses' financial standing, potential risks, and opportunities, ensuring adherence to trust provisions and benefiting the trust beneficiaries. Regardless of the type of trust property, the acceptance by trustees involves a series of steps and considerations: a. Legal Documentation: Trustees must obtain formal legal documentation, such as a Trust Instrument or Deed of Trust, outlining the trust's purpose, terms, and beneficiaries. b. Due Diligence: Trustees need to conduct comprehensive due diligence on the trust property, assessing its value, potential risks, and any legal or financial implications. c. Beneficiary Notification: Beneficiaries must be informed about the acceptance of trust property, ensuring transparency and building trust with all concerned parties. d. Acceptance Resolution: Trustees should adopt an explicit resolution, formally accepting the trust property, and documenting it in the trust's records or minutes. e. Insurance and Security: Trustees must ensure adequate insurance coverage and implement proper security measures to safeguard trust property and protect beneficiaries' interests. In conclusion, the Beaumont Texas Acceptance of Trust Property by Trustees is a critical process that entails formal acknowledgment and consent by trustees to manage and protect trust assets. Understanding the types of trust property and following a systematic approach to acceptance is vital to fulfill fiduciary duties and maintain the trust's integrity. Trustees must effectively communicate and coordinate with beneficiaries while abiding by legal requirements to ensure a smooth and transparent trust administration process.

Beaumont Texas Acceptance of Trust Property by Trustees

Category:

State:

Texas

City:

Beaumont

Control #:

TX-C180

Format:

PDF

Instant download

This form is available by subscription

Description

Acceptance of Trust Property by Trustees

Beaumont Texas Acceptance of Trust Property by Trustees: A Comprehensive Overview In Beaumont, Texas, the acceptance of trust property by trustees is a crucial aspect of the trust management process. Trustees are entrusted with the responsibility of managing and protecting assets on behalf of beneficiaries, adhering to specific legal and ethical obligations. Understanding the concept and types of acceptance of trust property is essential to ensure effective trust administration. In this article, we will delve into the details of Beaumont Texas Acceptance of Trust Property by Trustees, highlighting its importance and outlining different types of acceptance. Acceptance of trust property refers to the formal acknowledgment and consent of trustees to take ownership and control over assets designated for the trust. It serves as a legal affirmation of their willingness to undertake fiduciary duties and responsibilities associated with the trust. By accepting trust property, trustees commit to act in the best interests of beneficiaries, exercising prudent judgment and diligence in asset management. There are several types of Beaumont Texas Acceptance of Trust Property, including: 1. Real Estate Acceptance: Real estate assets, such as land, buildings, or other immovable properties, can be transferred into a trust. Trustees accepting real estate assets must ensure appropriate documentation, including deeds, titles, and property appraisals, to establish legal ownership and protect beneficiaries' interests. 2. Financial Asset Acceptance: Financial assets encompass a wide range of investment instruments, including stocks, bonds, mutual funds, or other securities. Trustees accepting financial assets must comply with legal requirements, such as properly registering these assets in the trust's name, managing investment strategies with care, and ensuring regular monitoring and reporting. 3. Personal Property Acceptance: Personal property covers moveable assets like art, jewelry, vehicles, or collectibles. Trustees accepting personal property within a trust need to maintain proper custody, security, and documentation of these assets. Regular appraisal and insurance coverage are necessary to safeguard beneficiaries' interests. 4. Business Interest Acceptance: When a trust includes ownership interests in businesses, trustees have the responsibility to manage and protect these investments. Acceptance of business interests requires thorough due diligence to understand the businesses' financial standing, potential risks, and opportunities, ensuring adherence to trust provisions and benefiting the trust beneficiaries. Regardless of the type of trust property, the acceptance by trustees involves a series of steps and considerations: a. Legal Documentation: Trustees must obtain formal legal documentation, such as a Trust Instrument or Deed of Trust, outlining the trust's purpose, terms, and beneficiaries. b. Due Diligence: Trustees need to conduct comprehensive due diligence on the trust property, assessing its value, potential risks, and any legal or financial implications. c. Beneficiary Notification: Beneficiaries must be informed about the acceptance of trust property, ensuring transparency and building trust with all concerned parties. d. Acceptance Resolution: Trustees should adopt an explicit resolution, formally accepting the trust property, and documenting it in the trust's records or minutes. e. Insurance and Security: Trustees must ensure adequate insurance coverage and implement proper security measures to safeguard trust property and protect beneficiaries' interests. In conclusion, the Beaumont Texas Acceptance of Trust Property by Trustees is a critical process that entails formal acknowledgment and consent by trustees to manage and protect trust assets. Understanding the types of trust property and following a systematic approach to acceptance is vital to fulfill fiduciary duties and maintain the trust's integrity. Trustees must effectively communicate and coordinate with beneficiaries while abiding by legal requirements to ensure a smooth and transparent trust administration process.

Free preview

How to fill out Beaumont Texas Acceptance Of Trust Property By Trustees?

If you’ve already utilized our service before, log in to your account and save the Beaumont Texas Acceptance of Trust Property by Trustees on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Beaumont Texas Acceptance of Trust Property by Trustees. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!