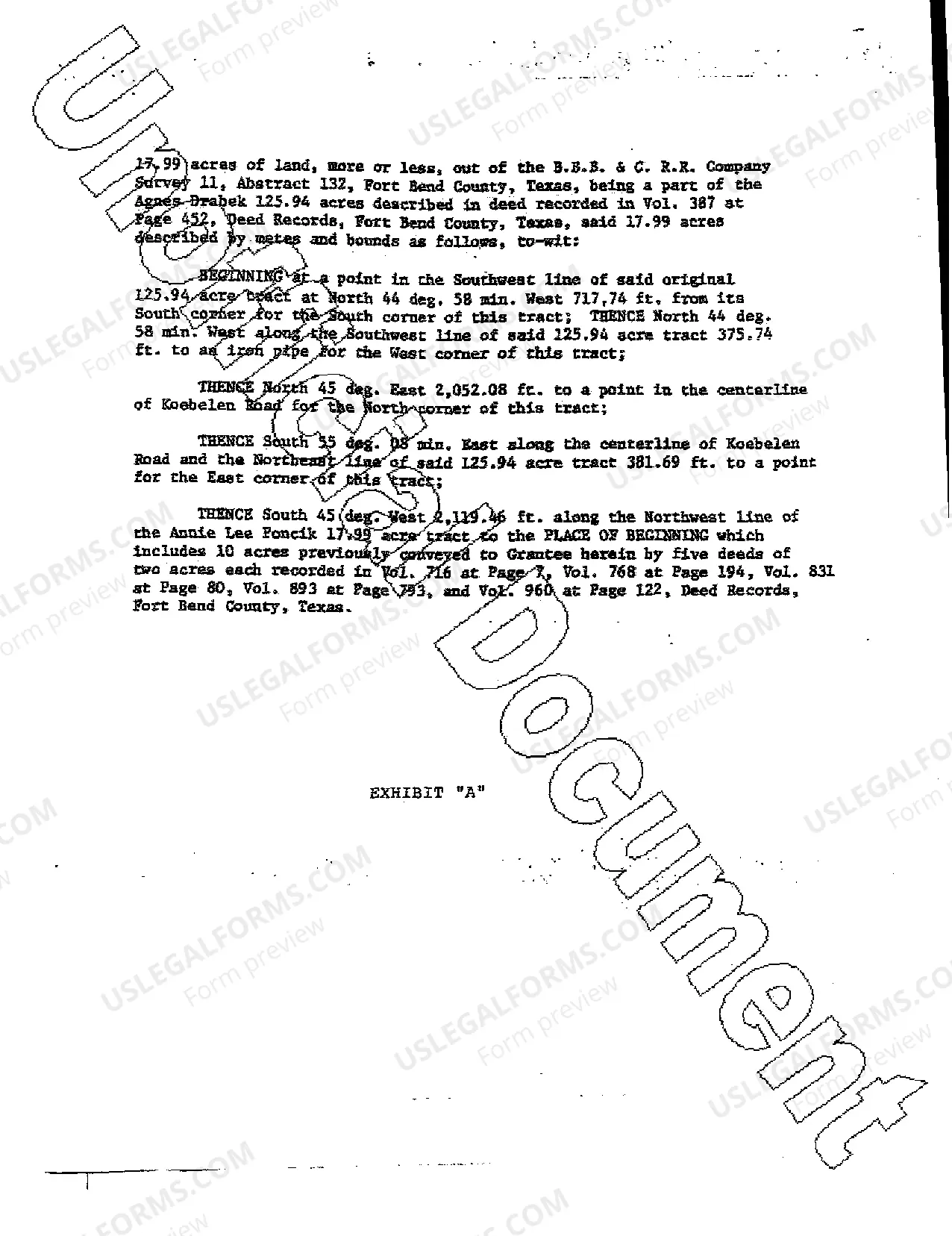

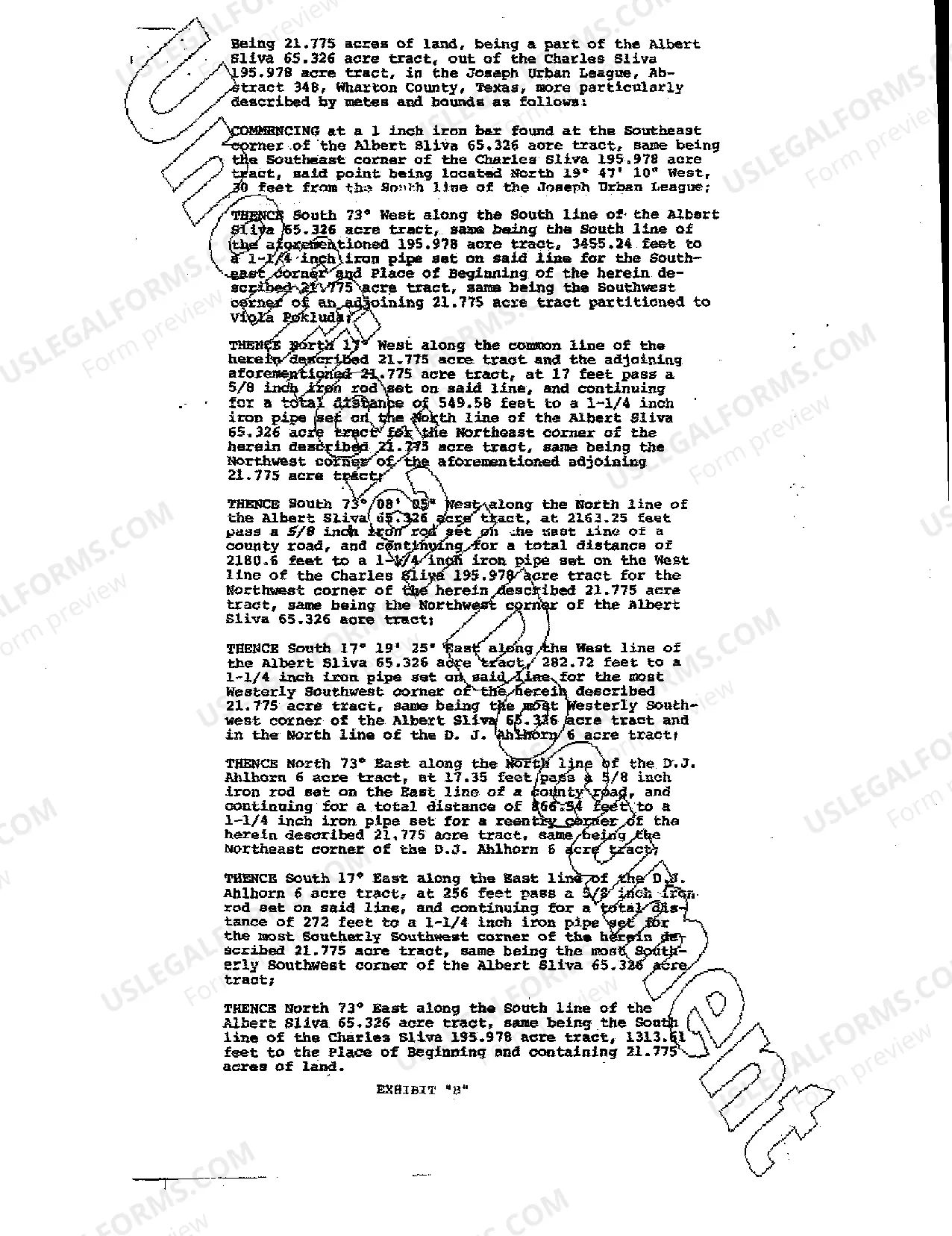

Bexar Texas Acceptance of Trust Property by Trustees is a legal process that involves the formal acknowledgment and assumption of responsibility by trustees for managing and safeguarding trust assets in Bexar County, Texas. It is essential for trustees to understand the intricacies of this process to ensure compliance with the laws and regulations governing trusts in Bexar County. When a trust is established, the trust property is typically transferred to the trustees, who are designated to manage the assets on behalf of the beneficiaries. The Acceptance of Trust Property is a crucial step that formally recognizes the trustees' agreement to take on this responsibility. This process provides legal certainty for all parties involved and establishes the trustees' fiduciary duty to act in the best interests of the trust and its beneficiaries. During the Acceptance of Trust Property process, trustees must carefully review and document the trust property's details, which may include real estate, financial investments, tangible assets, or intellectual property rights. Trustees need to ensure that the property is appropriately managed and preserved, adhering to the terms and provisions outlined in the trust instrument. The Bexar County legal system acknowledges various types of Acceptance of Trust Property by Trustees to handle different scenarios and circumstances. These may include: 1. Real Estate Trust Property: Trustees may be required to accept the transfer of real estate properties, such as residential homes, commercial buildings, or vacant land, into the trust. It is essential to perform due diligence on these properties, including title checks, lease agreements, and property valuations. 2. Financial Trust Property: Trust property may include various financial assets, such as stocks, bonds, mutual funds, or bank accounts. Trustees must ensure compliance with legal requirements, such as updating account registrations and verifying ownership details. 3. Personal Property Trust Assets: Trustees may be responsible for managing tangible personal property, including artwork, jewelry, vehicles, or collectibles. Proper inventory, appraisal, and appropriate storage or exhibition become essential for these types of trust assets. 4. Intellectual Property Trust Assets: In some cases, trust property may consist of intellectual property rights, such as patents, trademarks, copyrights, or royalties. Trustees must possess a thorough understanding of intellectual property laws to protect and maximize the value of these assets effectively. The Acceptance of Trust Property by Trustees in Bexar Texas requires a meticulous approach, involving extensive record-keeping, asset valuation, and potential court filings. Trustees are typically recommended seeking legal advice to ensure compliance with trust laws and to protect the interests of both the trust beneficiaries and the trust property itself.

Bexar Texas Acceptance of Trust Property by Trustees

Description

How to fill out Bexar Texas Acceptance Of Trust Property By Trustees?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Bexar Texas Acceptance of Trust Property by Trustees gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Bexar Texas Acceptance of Trust Property by Trustees takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Bexar Texas Acceptance of Trust Property by Trustees. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf of the individual or individuals that the trust benefits. This means that the trustee may lease, sell, or otherwise manage the property.

A Trustee is considered the legal owner of all Trust assets. And as the legal owner, the Trustee has the right to manage the Trust assets unilaterally, without direction or input from the beneficiaries.

A trustee owes a fiduciary duty of fidelity that forbids the trustee from placing himself in a situation in which there is or could be a conflict between the trustee's self interest and the trustee's duties to the beneficiaries.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

?When the beneficiary's interest is forfeited or awarded by legal adjudication 19 to the Government, the trustee is bound to hold the trust property to the extent of such interest for the benefit of such person in such manner as 20 the State Government may direct in this behalf.

Can a co-trustee act alone? The answer to this is No unless the Trust document states otherwise. In the case where the Trust does not explicitly state, the Trustee and the co-trustee should make all decisions unanimously to push the trust administration process forward.

What Is Trust Property? Trust property refers to assets that have been placed into a fiduciary relationship between a trustor and trustee for a designated beneficiary. Trust property may include any type of asset, including cash, securities, real estate, or life insurance policies.

In Texas, as elsewhere, a settlor cannot create a trust with himself or herself as both the sole trustee and sole beneficiary.

trustee can be anyone except a minor. Cotrustees must agree with other cotrustees whenever making decisions about a trust provided the trust agreement does not contain terms permitting one cotrustee to act independently.

A trustee cannot favor one beneficiary over another. The trustee must also act impartially in investing and managing trust property, while at the same time considering the differing interests of the beneficiaries.

More info

The sale or resolution gives the trustee authority to sell or transfer a power of appointment of the sheriff of Texas. The trustee is identified as Bexar County Trustee in the deed. The sheriff represents the holder of the power of appointment; its legal title is to the sheriff. The sheriff will sell title against the ward of the trust at the sheriff's discretion, without prejudice to the rights and interests of any other party. All parties have been notified of the trustee's right to sell title at the sheriff's discretion and the sheriff has no liability for the trustee's exercise of that right. The trustee holds a power of sale of the right, title or interest of the sheriff against the ward of the trust as trustee to be sold, by order of the probate court. The authority to sell title is provided to the sheriff under the power conferred by subsection (b) of Section 8 of Chapter 471 of the General Statutes.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.