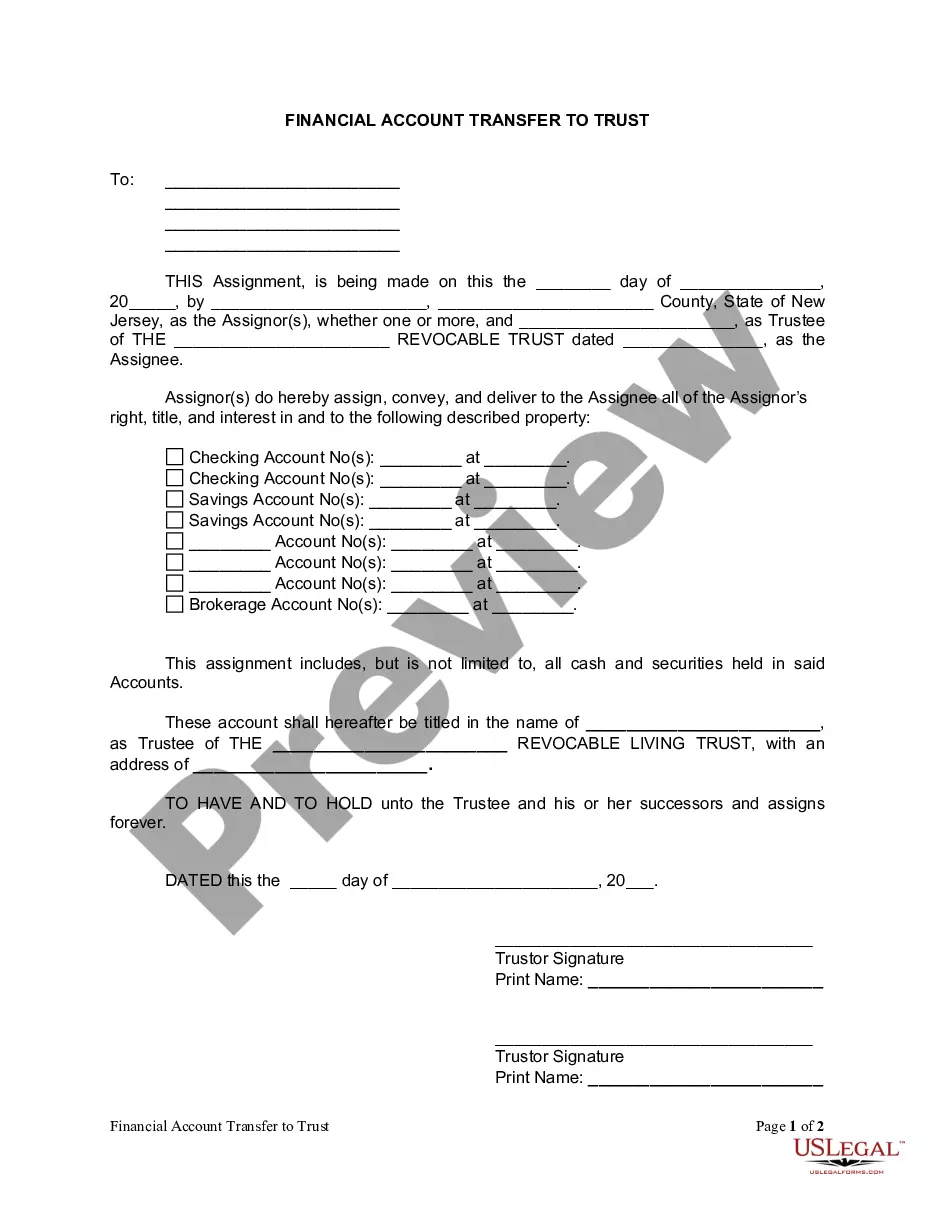

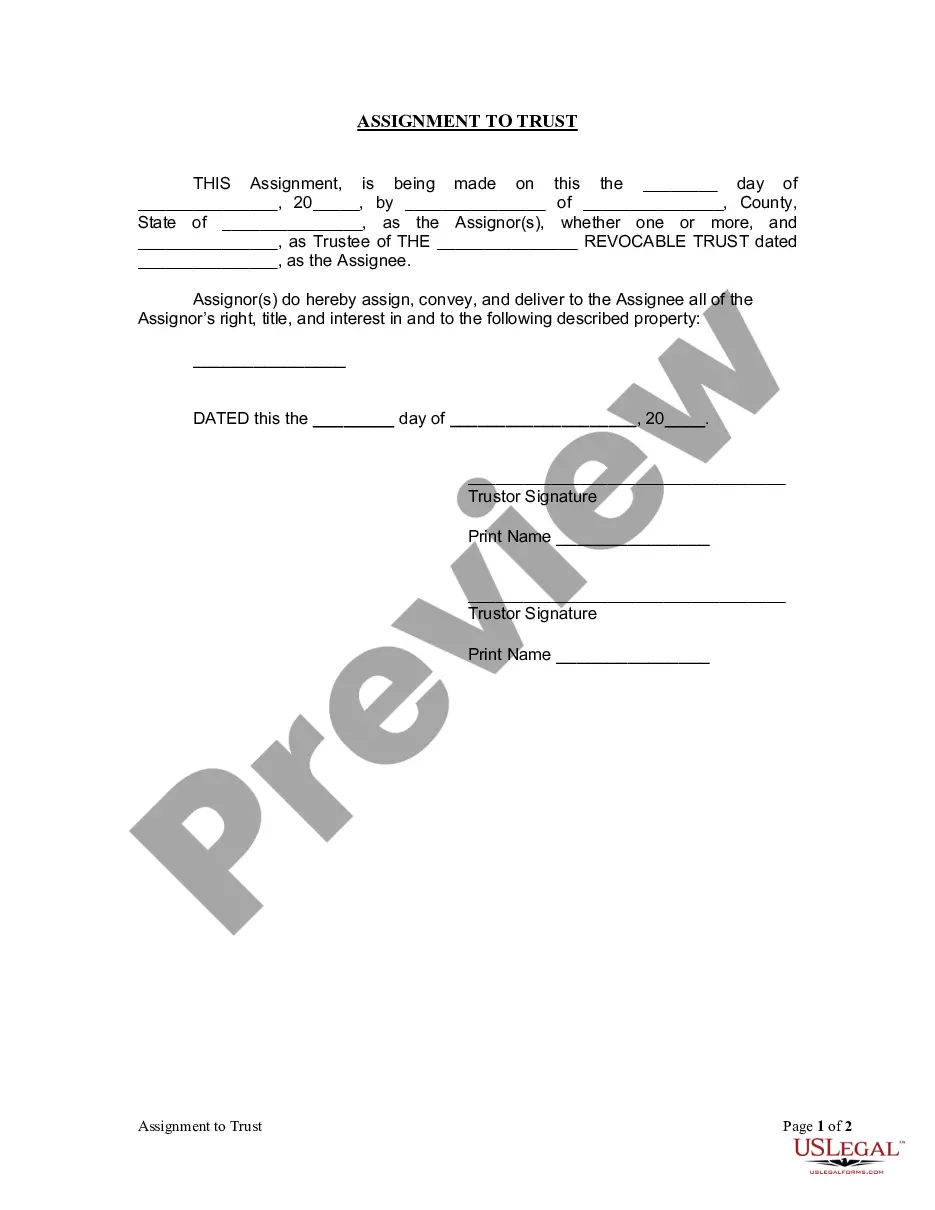

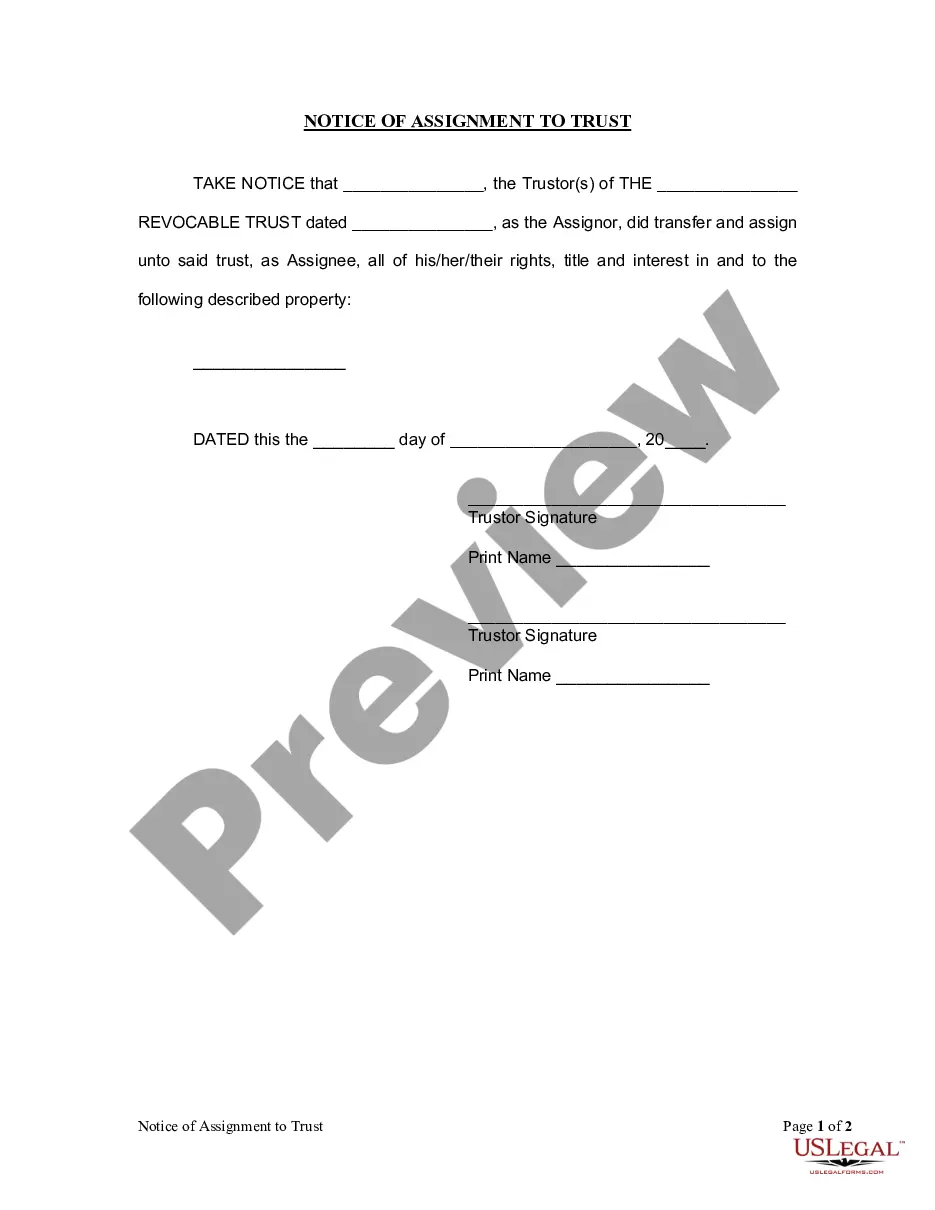

Fort Worth Texas Acceptance of Trust Property by Trustees refers to the legal process by which trustees acknowledge and accept ownership and responsibility for the assets and properties held within a trust in the city of Fort Worth, Texas. Trustees are typically appointed by the granter (also known as settler or trust or) to manage and administer the trust for the beneficiaries in compliance with the terms and conditions specified in the trust agreement. When a trustee agrees to accept the trust property, they are essentially assuming the fiduciary duty to act in the best interest of the beneficiaries and to manage the assets with prudence and diligence. The acceptance of trust property is a crucial step as it establishes the trustee's legal ownership and sets the foundation for their legal obligations and responsibilities. There are several types of Fort Worth Texas Acceptance of Trust Property by Trustees, depending on the nature of the trust and the properties involved: 1. Real Estate Acceptance: In case the trust includes real estate properties, the trustee must accept the transfer of the property titles into the trust's name. This involves filing the necessary legal documents and public records to update the ownership and ensure that the trustee has legally recognized control over the assets. 2. Financial Asset Acceptance: If the trust contains financial assets, such as stocks, bonds, or bank accounts, the trustee must accept and assume control over these assets. This may include notifying financial institutions, updating ownership details, and transferring the assets into the trust's name. 3. Personal Property Acceptance: Trusts may also hold personal belongings, such as jewelry, artwork, vehicles, or valuable collectibles. Trustees accepting personal property must ensure proper documentation, appraisal, and secure storage to protect the assets and prevent any potential disputes. 4. Business Asset Acceptance: In the case of trusts involving businesses or business interests, trustees must accept the transfer of ownership and control over the relevant business assets. This may involve obtaining necessary licenses, registrations, or complying with legal requirements specific to the operation of the business. Regardless of the type of property involved, the acceptance of trust property by trustees in Fort Worth, Texas, must adhere to local laws and regulations governing trust administration. It is crucial for trustees to consult with legal professionals experienced in trust and estate planning to ensure compliance and protect the rights and interests of the beneficiaries.

Fort Worth Texas Acceptance of Trust Property by Trustees

Description

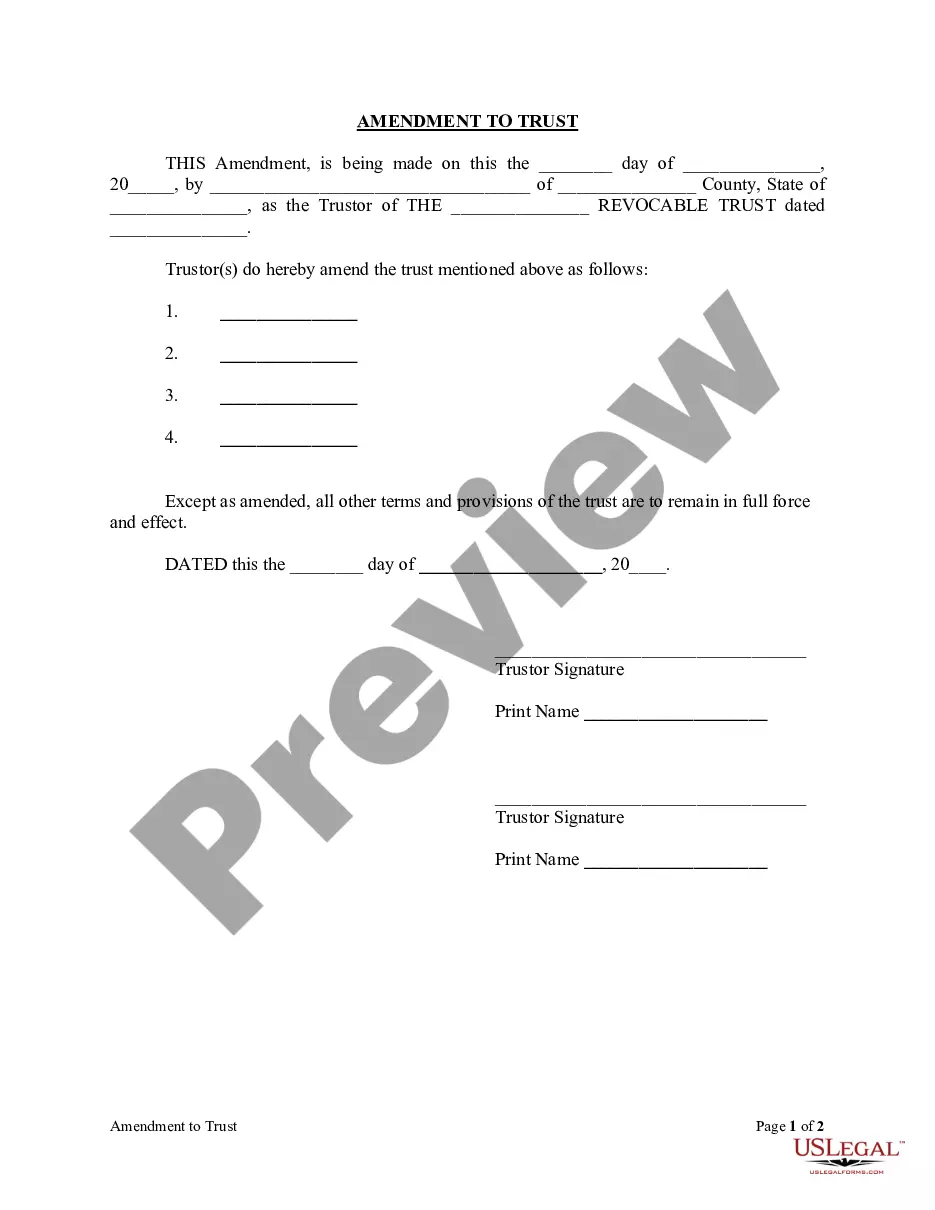

How to fill out Fort Worth Texas Acceptance Of Trust Property By Trustees?

Are you searching for a trustworthy and cost-effective supplier of legal forms to obtain the Fort Worth Texas Acceptance of Trust Property by Trustees? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our site features over 85,000 current legal document templates for personal and business applications. All templates that we provide access to are not generic and are tailored based on the specific needs of individual states and counties.

To retrieve the document, you must Log In, locate the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is this your first visit to our website? No worries. You can create an account with quick ease, but before proceeding, ensure to do the following.

Now you can set up your account. Then select the subscription plan and complete the payment. Once the payment is processed, download the Fort Worth Texas Acceptance of Trust Property by Trustees in any available format. You can return to the website any time and redownload the document at no additional cost.

Locating contemporary legal documents has never been simpler. Try US Legal Forms today, and put an end to spending hours trying to understand legal forms online for good.

- Verify if the Fort Worth Texas Acceptance of Trust Property by Trustees complies with the laws of your state and local jurisdiction.

- Read the form’s description (if available) to understand who and what the document is meant for.

- Restart the search if the form does not fit your particular circumstances.

Form popularity

FAQ

Trusts are not legal entities that can own, manage or sell property. It is the trustee of the trust that can hold legal title to the property on behalf or for the benefit of the beneficiaries of the trust. What this means is that a trustee has the power to sell or lease the property.

In Texas, as elsewhere, a settlor cannot create a trust with himself or herself as both the sole trustee and sole beneficiary.

The normal rule for trustee decision-making is that every trustee is expected to be active. 8 Where there are multiple trustees, this duty requires the trustees to act together and not delegate responsibilities to another. 9 Following from these duties is the duty to act unanimously.

Trustees should act jointly (unless the trust document specifies that they can act by majority). Trustees are jointly liable for mistakes and should therefore act together. Trustees should not normally delegate functions to each other. Legal advice should be obtained before attempting to delegate trustee functions.

Can a co-trustee act alone? The answer to this is No unless the Trust document states otherwise. In the case where the Trust does not explicitly state, the Trustee and the co-trustee should make all decisions unanimously to push the trust administration process forward.

Section 11.13 of the Texas Tax Code provides for the homestead property tax exemption generally. In order for property owned by a trust to qualify for the homestead property tax exemption, the trust must be considered a Qualifying Trust.

trustee can be anyone except a minor. Cotrustees must agree with other cotrustees whenever making decisions about a trust provided the trust agreement does not contain terms permitting one cotrustee to act independently.

Fiduciary Duties as a Trustee Duty of loyalty: You must manage trust assets for the sole benefit of beneficiaries. Self-dealing is prohibited, and you must avoid both actual and apparent conflicts of interest.

?Where the trustee is empowered to sell any trust property, he may sell the same subject to prior charges or not, and either together or in lots, by public auction or private contract, and either at one time or at several times, unless the instrument of trust otherwise directs.

Trusts are not legal entities that can own, manage or sell property. It is the trustee of the trust that can hold legal title to the property on behalf or for the benefit of the beneficiaries of the trust. What this means is that a trustee has the power to sell or lease the property.