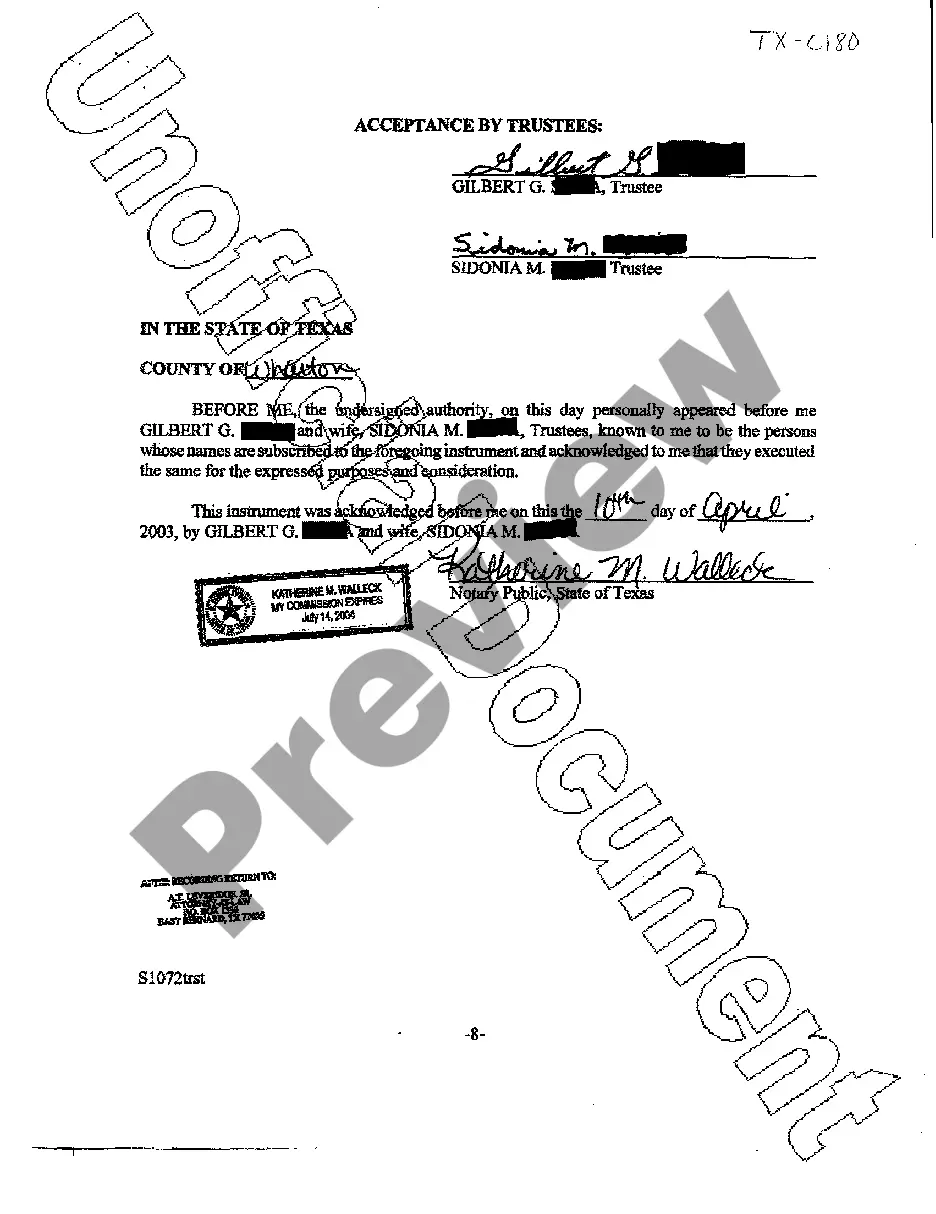

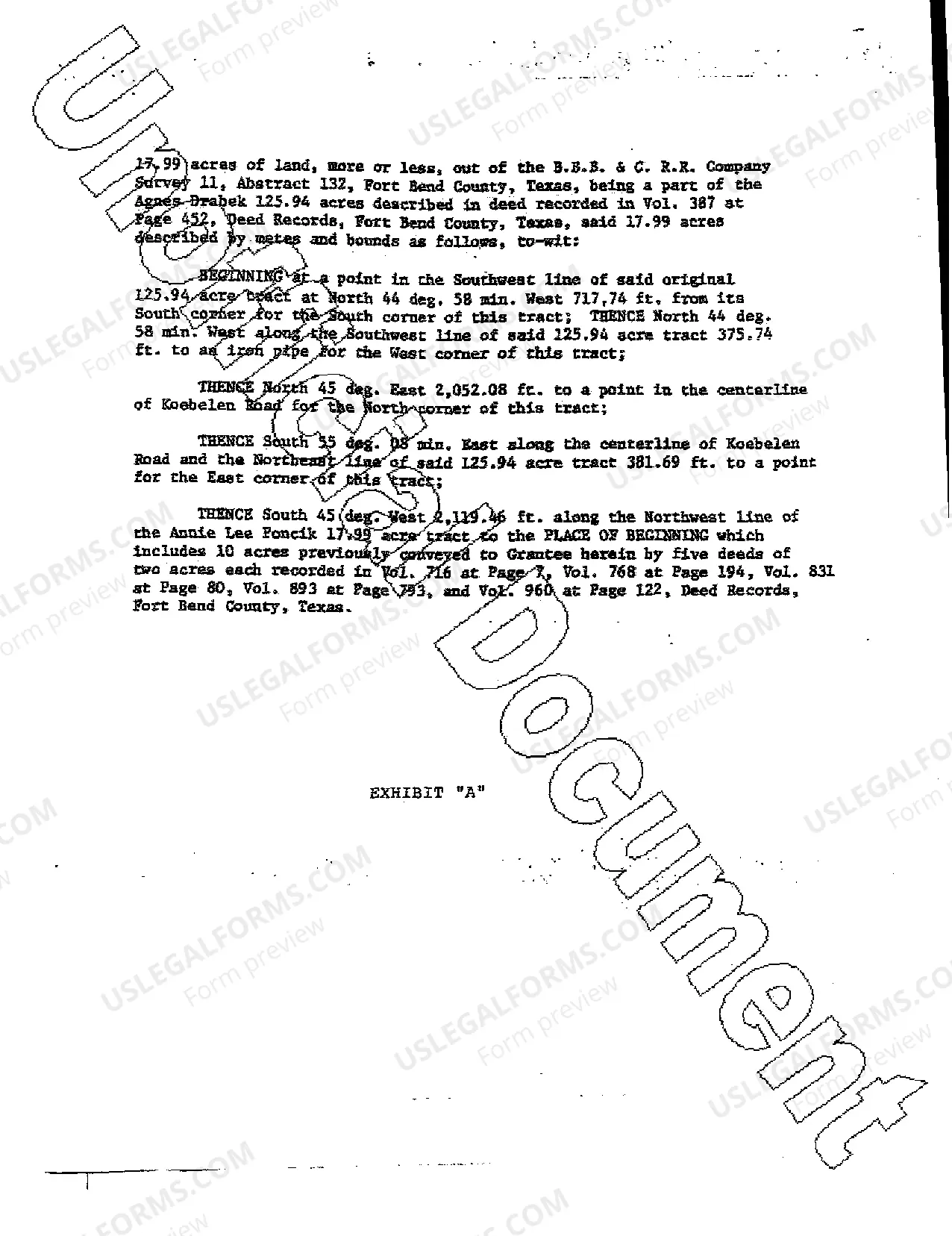

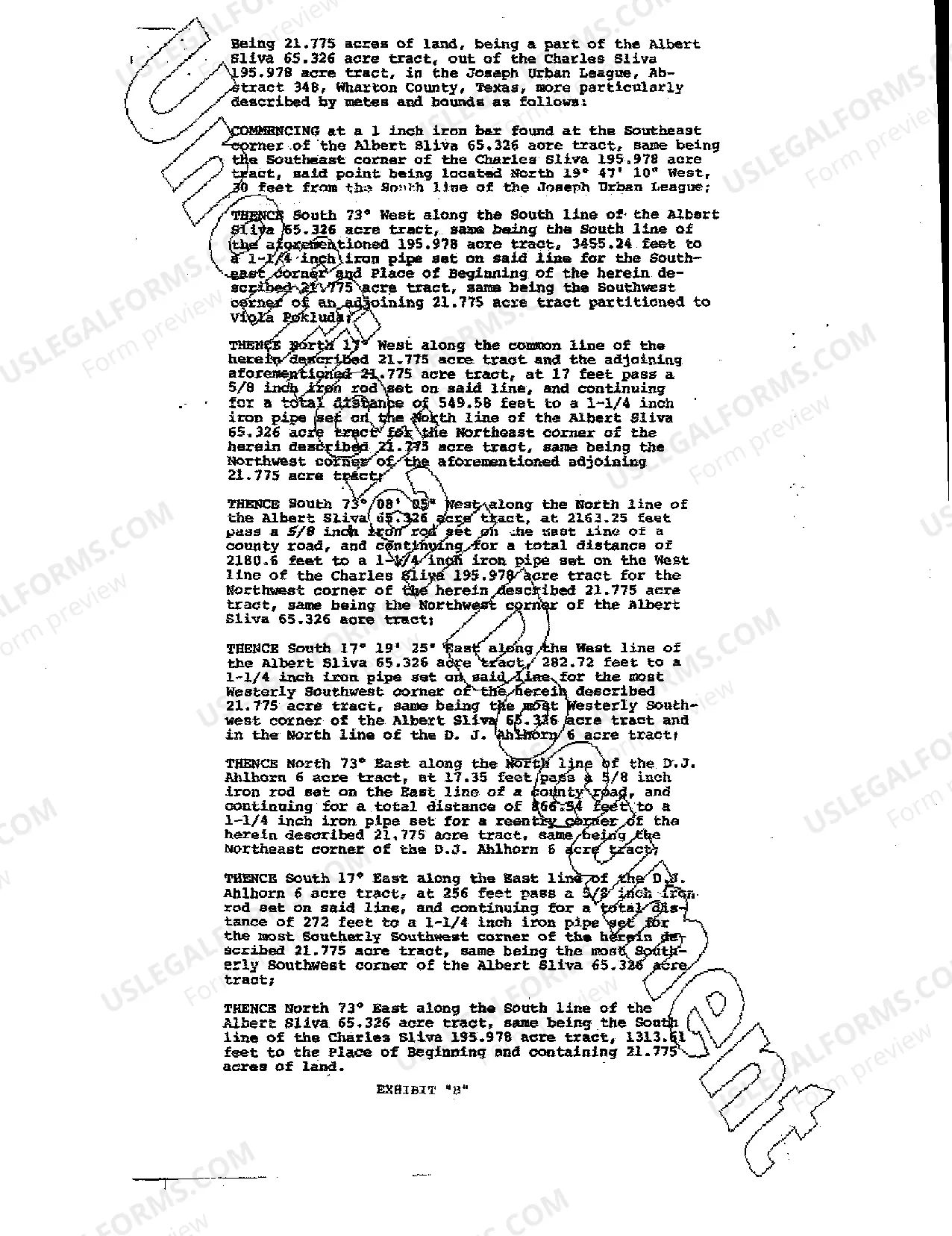

The acceptance of trust property by trustees in Grand Prairie, Texas is a legal process where trustees formally accept and assume responsibility for managing and administering assets assigned to them under a trust agreement. This process involves several important steps to ensure the proper transfer of assets and compliance with applicable laws. Trustees have a crucial role in upholding the intentions of the trust document and safeguarding the interests of the beneficiaries. Accepting trust property includes a thorough understanding of the details, terms, and conditions of the trust, as well as the assets involved. It requires diligent assessment, documentation, and adherence to legal obligations. Once appointed, trustees must demonstrate their acceptance of trust property by registering it appropriately with relevant authorities and institutions. This often involves updating ownership records, notifying financial institutions, and transferring assets to the trust's name. It is crucial for trustees to be fully aware of the specific requirements and procedures applicable in Grand Prairie, Texas, to ensure compliance. There can be different types of trust property that trustees may encounter while accepting their responsibilities in Grand Prairie, Texas. Some common categories of trust property include: 1. Real estate: This type of trust property includes land, buildings, and any improvements or structures on the land. Trustees must ensure accurate documentation and transfer of titles, deeds, and any relevant contracts or agreements. 2. Financial assets: Trust property can also consist of various financial instruments such as bank accounts, stocks, bonds, mutual funds, certificates of deposit, or retirement accounts. Trustees need to review and update records with financial institutions and ensure compliance with applicable regulations. 3. Tangible personal property: Trust property may include physical assets like vehicles, jewelry, artwork, collectibles, or household items. Trustees must appraise and safeguard these items, ensuring they are properly insured and accounted for. 4. Business interests: In cases where the trust holds business interests such as shares in a company or partnerships, trustees have responsibilities to manage and monitor these assets. They may need to participate in decision-making processes or engage professional advisors to ensure the interests of the trust and beneficiaries are protected. 5. Intellectual property: In some cases, trust property may encompass intangible assets like patents, trademarks, copyrights, or royalties. Trustees must understand the intellectual property rights involved and take appropriate actions to protect and monetize these assets in the best interest of the trust. In conclusion, the acceptance of trust property by trustees in Grand Prairie, Texas involves a detailed process of understanding, documenting, and transferring various types of assets. Trustees play a pivotal role in managing and administering these assets diligently, ensuring compliance with legal requirements and adhering to their fiduciary duties.

Grand Prairie Texas Acceptance of Trust Property by Trustees

Description

How to fill out Grand Prairie Texas Acceptance Of Trust Property By Trustees?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law background to draft such paperwork from scratch, mainly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Grand Prairie Texas Acceptance of Trust Property by Trustees or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Grand Prairie Texas Acceptance of Trust Property by Trustees quickly using our trustworthy platform. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, make sure to follow these steps prior to downloading the Grand Prairie Texas Acceptance of Trust Property by Trustees:

- Ensure the template you have chosen is suitable for your location because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if provided) of cases the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and look for the suitable document.

- Click Buy now and choose the subscription plan you prefer the best.

- with your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Grand Prairie Texas Acceptance of Trust Property by Trustees as soon as the payment is through.

You’re all set! Now you can go on and print the form or complete it online. Should you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.