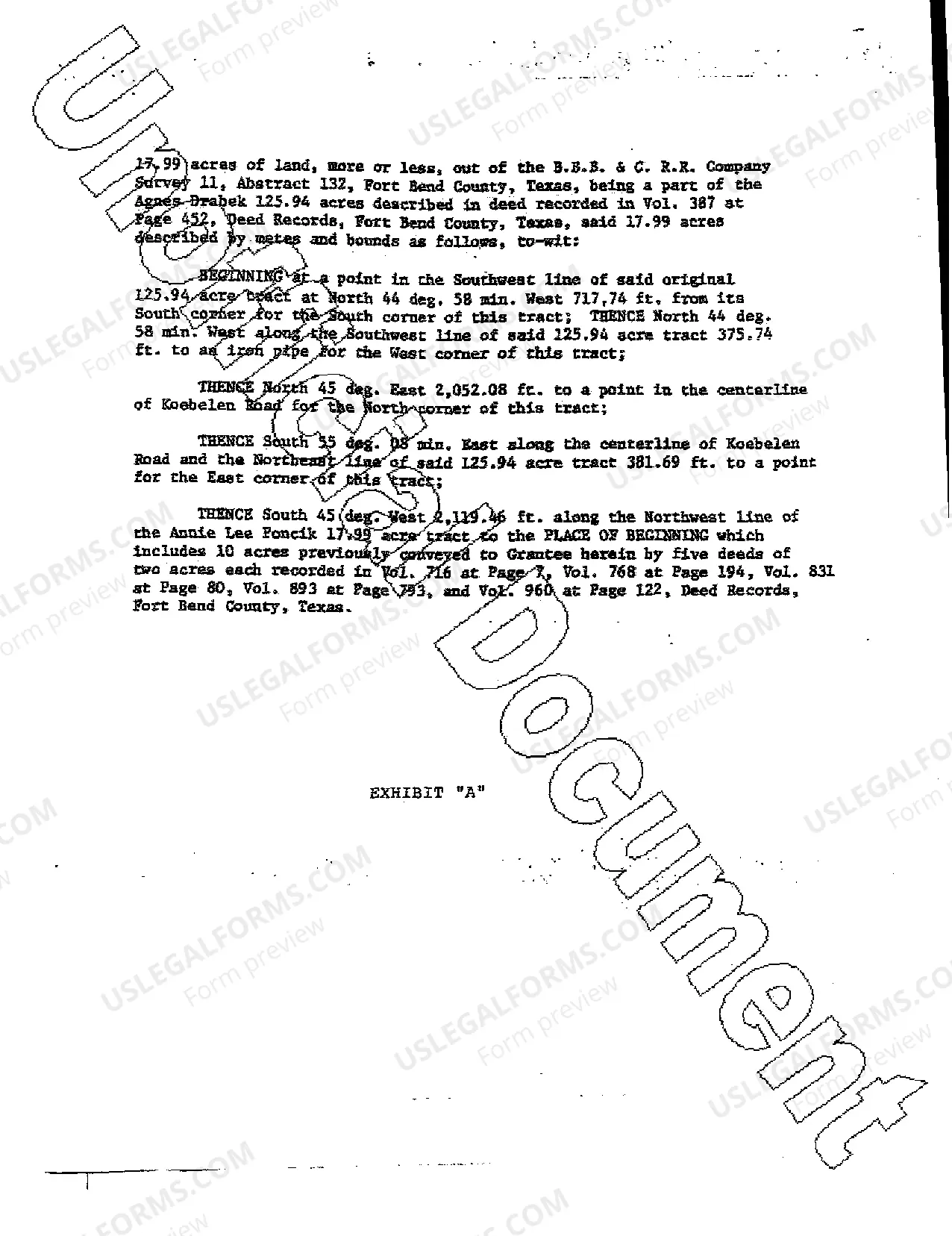

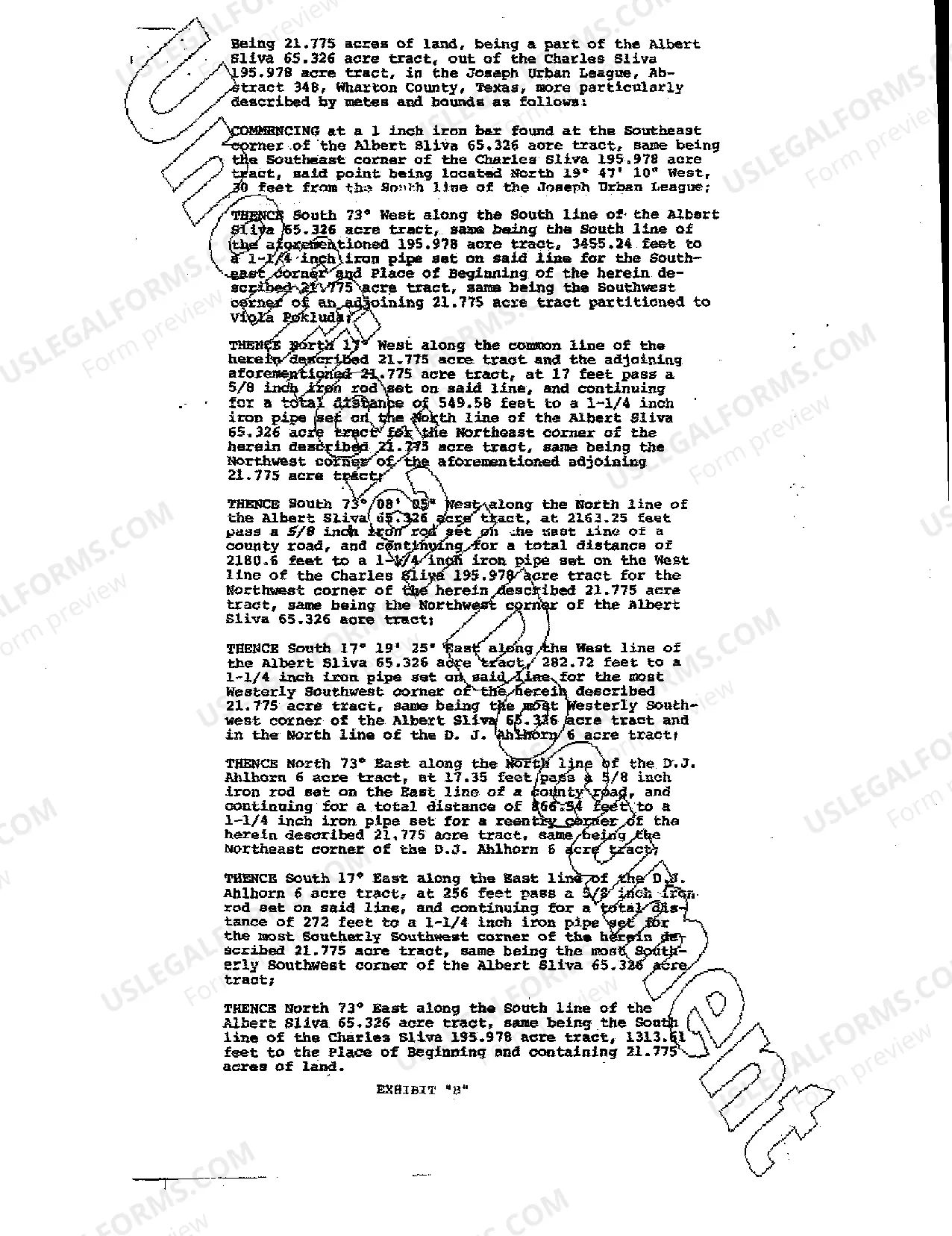

Irving Texas Acceptance of Trust Property by Trustees refers to the process and requirements for trustees in Irving, Texas, to accept the property held in trust. Trustees play a vital role in managing and safeguarding trust assets, ensuring they are distributed according to the terms of the trust agreement. Key elements involved in the process of accepting trust property by trustees in Irving, Texas include the following: 1. Legal Obligation: Trustees in Irving, Texas have a legal obligation to diligently and responsibly manage trust assets. Accepting trust property solidifies their role and signifies their commitment to fulfilling their duties and responsibilities. 2. Trust Agreement Review: Prior to the acceptance of trust property, trustees must thoroughly review the trust agreement to understand its terms and conditions. The trust agreement outlines the trustee's powers, restrictions, and guidelines to follow while managing and distributing trust assets. 3. Identification of Trust Assets: Trustees must identify and ascertain the extent and nature of the property to be placed under their management. Trust assets can include real estate, financial accounts, investments, personal belongings, or any other assets transferred into the trust. 4. Evaluation of Assets: Trustees must evaluate the trust assets to determine their fair market value. Appraisals or professional opinions may be required to ascertain the value accurately. This evaluation helps trustees in making prudent financial decisions concerning the management and distribution of trust assets. 5. Acceptance Procedures: Trustees, upon reviewing the trust agreement and evaluating the assets, must formally accept the property held in trust. Acceptance can be done through a written acceptance document, such as an acceptance of trusteeship, which acknowledges the trustees' willingness and readiness to assume responsibility for the assets. 6. Legal Compliance: Trustees must ensure their acceptance of trust property complies with all applicable laws and regulations in Irving, Texas. This includes adhering to state-specific trust laws and any federal regulations governing trustee activities. Different types of Irving Texas Acceptance of Trust Property by Trustees may include: 1. Real Estate: Trustees may be entrusted with managing and distributing various types of real estate assets, such as residential properties, commercial buildings, vacant land, or rental properties. 2. Financial Assets: Trustees may be tasked with overseeing financial assets held in trust, including bank accounts, investment portfolios, stocks, bonds, or retirement accounts. 3. Personal Property: Trustees may be responsible for safeguarding and distributing personal belongings, such as jewelry, artwork, vehicles, collectibles, or any other valuable item specified in the trust agreement. 4. Business Interests: Trustees may need to manage and administer business interests held in trust. This can involve ownership stakes in corporations, partnerships, sole proprietorship, or other business entities. Overall, the acceptance of trust property by trustees in Irving, Texas is a crucial process where trustees assume responsibility for managing, protecting, and distributing trust assets in accordance with applicable laws, the trust agreement, and the settler's wishes.

Irving Texas Acceptance of Trust Property by Trustees

Description

How to fill out Irving Texas Acceptance Of Trust Property By Trustees?

No matter your societal or occupational position, completing legal documents is a regrettable necessity in the current professional landscape.

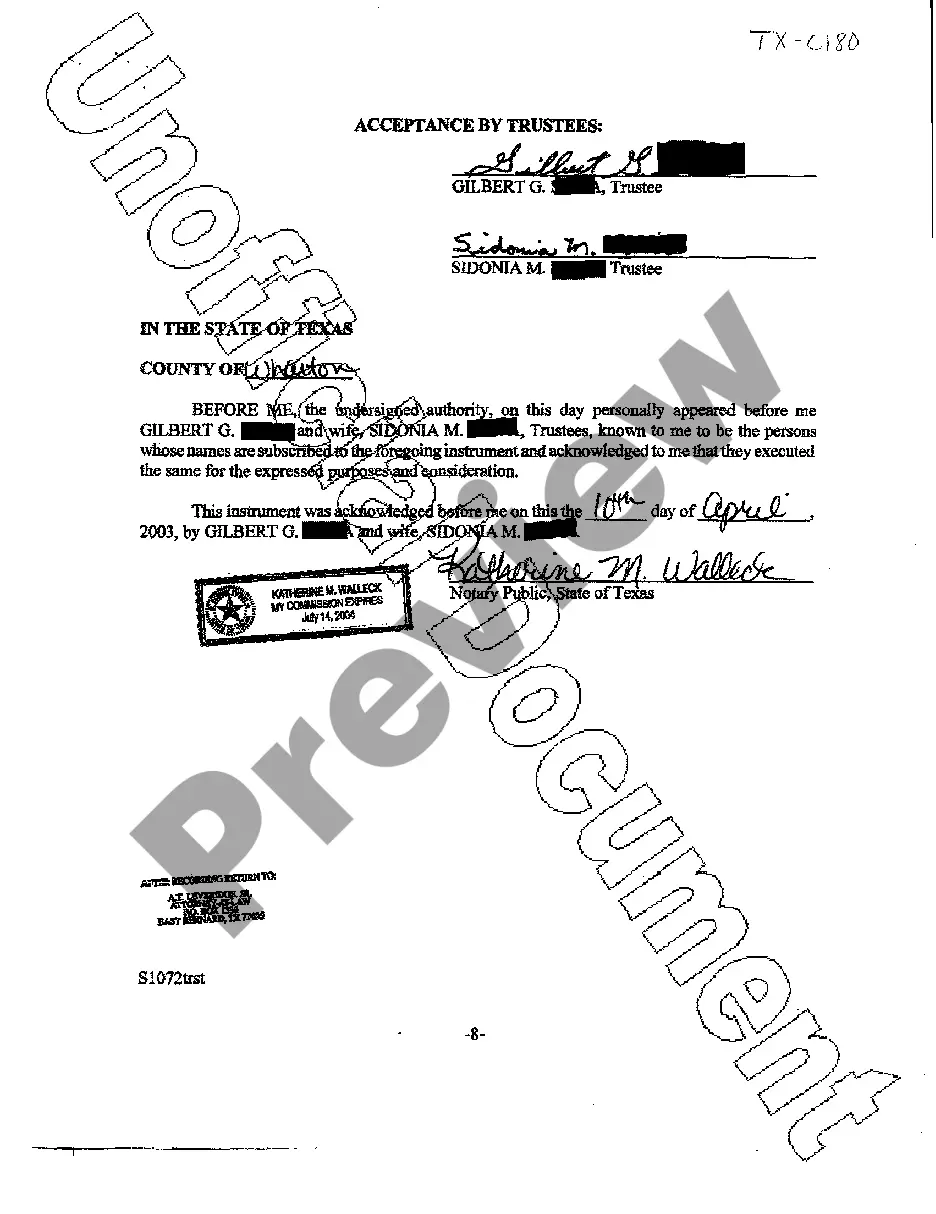

Frequently, it’s nearly unfeasible for an individual without legal training to draft such materials independently, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms comes into play.

Confirm that the document you have located is applicable to your area since regulations from one state or region may not apply to another.

Examine the form and review a brief explanation (if accessible) of the situations in which the document can be utilized.

- Our service offers an extensive directory with over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms also serves as a valuable resource for associates or legal advisors seeking to enhance their efficiency using our DIY papers.

- Whether you’re looking for the Irving Texas Acceptance of Trust Property by Trustees or another document relevant to your jurisdiction, US Legal Forms has everything you need.

- Here’s how to obtain the Irving Texas Acceptance of Trust Property by Trustees in a few minutes using our reliable service.

- If you are an existing client, you may proceed to Log In to access your required form.

- However, if you are new to our collection, make sure to follow these steps prior to downloading the Irving Texas Acceptance of Trust Property by Trustees.

Form popularity

FAQ

A letter of acceptance for a trustee is a formal document that signifies the trustee's agreement to manage the trust property. In the context of Irving Texas Acceptance of Trust Property by Trustees, this letter outlines the trustee's responsibilities and ensures they acknowledge their role. This letter provides clarity on the terms of the trust and establishes a legal agreement between the trustee and the trustor. By having a well-defined letter of acceptance, you can avoid potential disputes and ensure a smooth transition of trust management.

In Texas, establishing a trust requires a clear intention to create the trust, valid trust property, and identifiable beneficiaries. The Irving Texas Acceptance of Trust Property by Trustees is a key process that ensures the property is formally accepted by the trustee. Additionally, the trust must comply with state laws regarding capacity and purpose. Utilizing tools from USLegalForms can help streamline the process, ensuring all legal requirements are met.

A trustee in Texas generally cannot remove a beneficiary from a trust unless explicitly authorized by the trust terms or under specific circumstances outlined by law. The Irving Texas Acceptance of Trust Property by Trustees indicates that trustees must comply with the trust document and act in the best interests of all beneficiaries. If disputes arise, legal advice might be beneficial. Tools such as US Legal Forms can assist you in understanding your rights and responsibilities regarding trust management.

Yes, an executor in Texas can sell estate property without getting approval from all beneficiaries, provided they follow the will's terms. If the will grants the executor sufficient authority, they may act without needing unanimous consent. However, transparency with beneficiaries remains essential. Utilizing platforms like US Legal Forms can offer necessary documentation and guidance for executors to carry out their duties effectively.

In Texas, not all heirs must agree to sell property, but their consent is often required, especially when dealing with inherited property. The Irving Texas Acceptance of Trust Property by Trustees may create specific guidelines for selling assets within a trust. If the property is part of an estate, the executor typically needs to follow the instructions in the will. Consider consulting with US Legal Forms to navigate these complexities in property sales.

In Texas, the rules for trusts outline how trustees should manage and distribute trust property. The Irving Texas Acceptance of Trust Property by Trustees emphasizes the importance of following the terms established in the trust document. Trusts must comply with state laws to ensure proper management and are subject to legal requirements. Resources like US Legal Forms can help you draft a trust that adheres to Texas regulations.

Deciding to place your house in a trust in Texas can provide numerous benefits, such as avoiding probate and ensuring your property is managed according to your wishes after your passing. However, this decision should align with your overall estate planning goals. Consulting with an expert knowledgeable about Irving Texas Acceptance of Trust Property by Trustees can help you evaluate the best options for your situation.

Generally, a trust does not need to be formally filed in Texas unless it is a testamentary trust, which is created through a will. However, certain documents, such as deeds transferring property to the trust, must be recorded to ensure legal validity. It's important to stay informed about the requirements for Irving Texas Acceptance of Trust Property by Trustees to maintain compliance and protect your interests.

In Texas, the trustee owns the property held in a trust, but they must manage and administer it for the benefit of the beneficiaries. This fiduciary relationship means the trustee has the responsibility to act in the best interests of the beneficiaries while following the trust's terms. Understanding the distinction between ownership and control is crucial, especially when considering the Irving Texas Acceptance of Trust Property by Trustees.

One of the most common mistakes parents make when establishing a trust fund is failing to fund the trust properly. Creating the trust alone is not sufficient; it is vital to transfer the intended assets into the trust to ensure it operates as intended. Parents should also clearly communicate their wishes to their beneficiaries and review the trust regularly to adapt to any changes. Gaining insights into the Irving Texas Acceptance of Trust Property by Trustees can guide parents in avoiding such pitfalls.

More info

They do not get the power to act however they want. However, there is a power to “suspend” the duties of magistrates in cases such as this one where they seem to be acting “unwisely and contrary to the rules of procedure.” You should ask your judge if you are free to call upon you lawyer/attorney during the investigation and in the hearing on your own. This power is there especially for small claims matters. You will be contacted by the court reporter so call them first. Also, you should request a hearing time that will give you enough time to prepare for your appearance and the court will send you an attorney. Results 25 – 49 of 48 — You will need a good lawyer! David, “David Knight, Granter Trust”. 14, 2020, file photo. On March 14, 2022, more… Results 50 – 99 of 48 — If this happens to you, you may be required to pay out a portion of your damages amount.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.