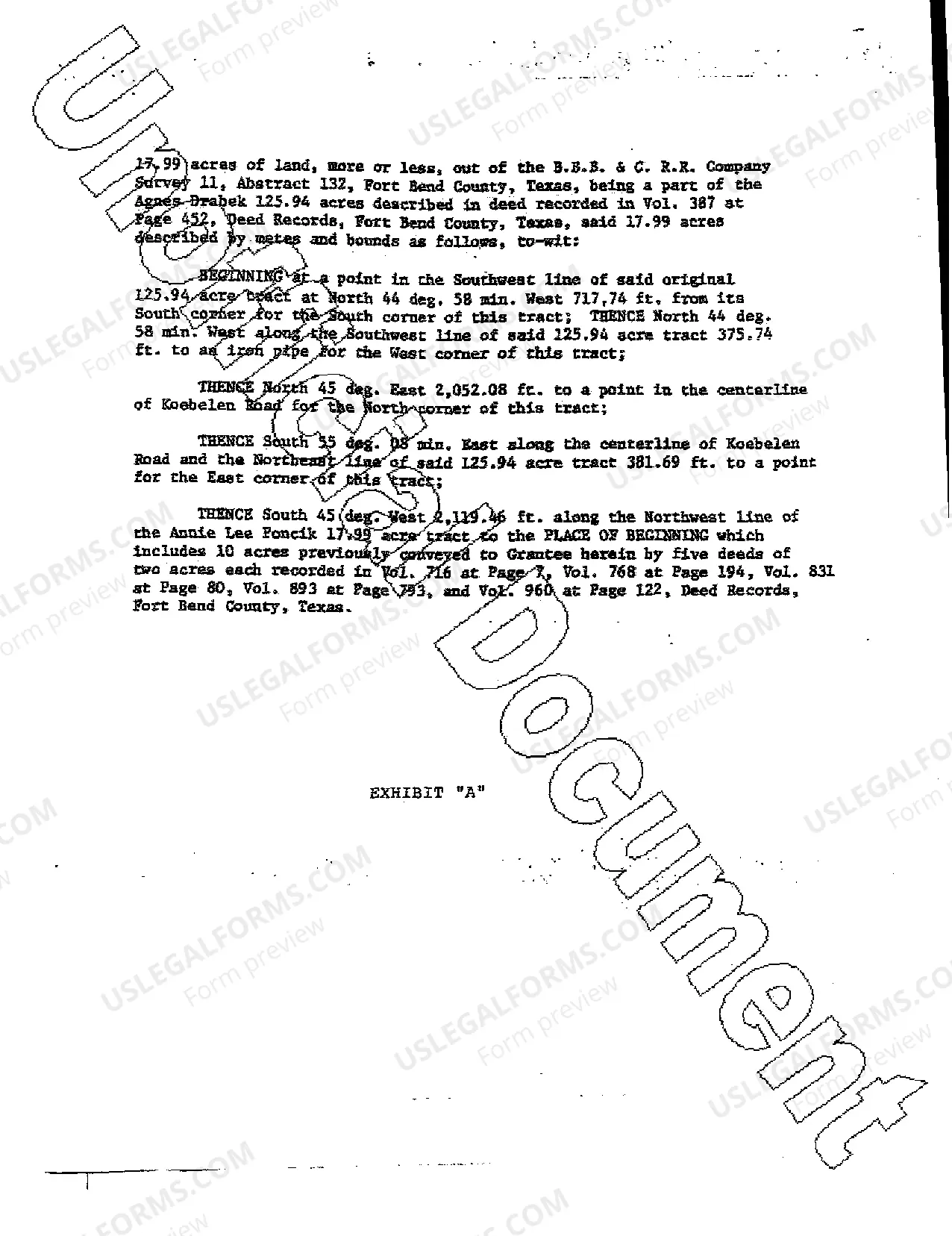

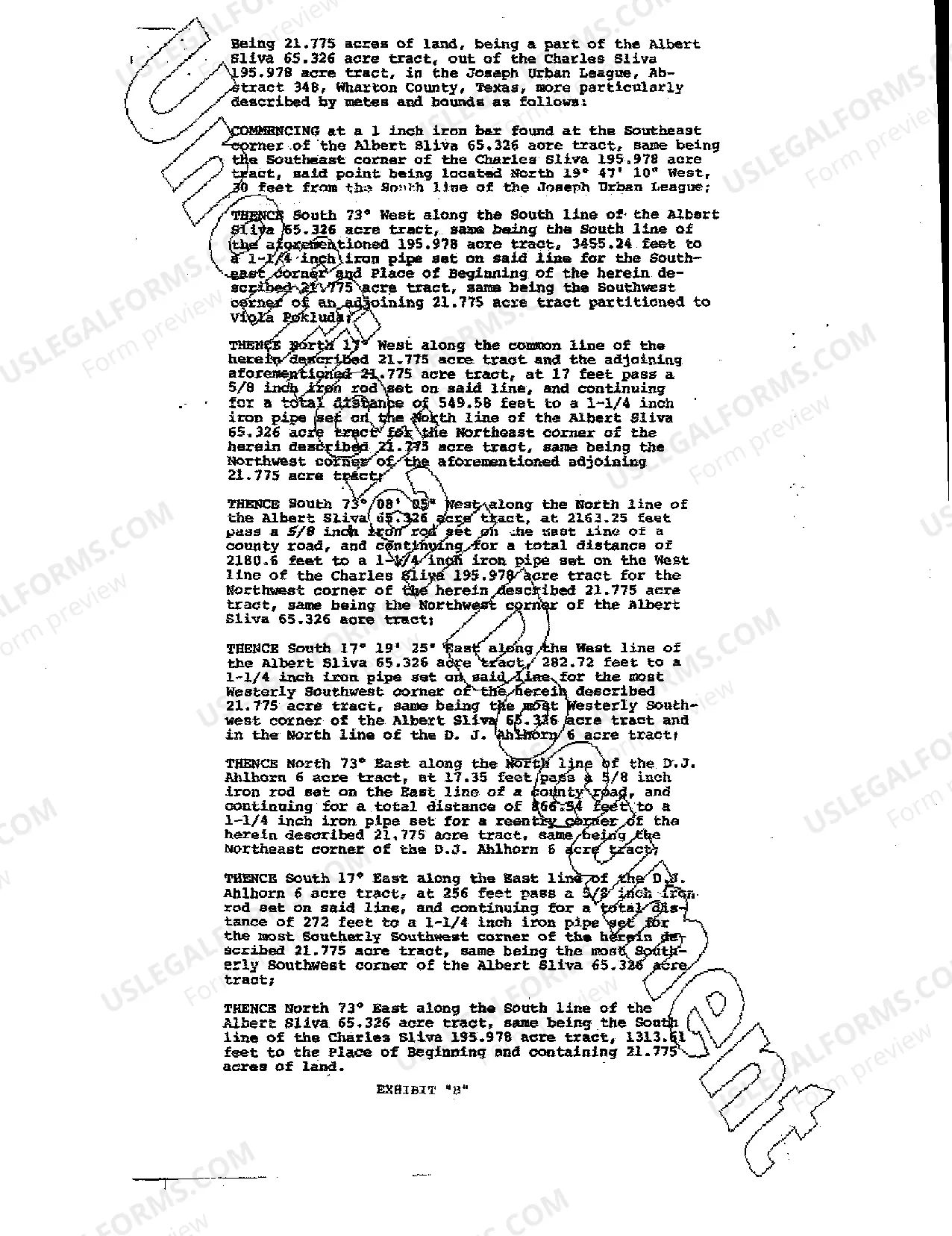

Round Rock Texas Acceptance of Trust Property by Trustees refers to the legal process through which trustees officially acknowledge and assume ownership and responsibility for assets held in a trust within the Round Rock, Texas jurisdiction. This process is essential for ensuring the effective management and protection of the trust property in adherence to the terms and provisions of the trust agreement. The acceptance of trust property by trustees involves several steps and considerations. Trustees must thoroughly review the trust agreement, which outlines their fiduciary duties and includes specific provisions regarding the management, distribution, and potential sale of the trust property. It is essential for trustees to fully understand these terms before accepting the trust property. Once trustees have comprehended the trust agreement, they may formally accept the trust property. Acceptance typically involves signing a written document or instrument confirming their willingness to act as trustees and acknowledging their responsibilities towards the trust property and its beneficiaries. This acceptance is legally binding and signifies the trustees' commitment to upholding their fiduciary duties. Different types of Round Rock Texas Acceptance of Trust Property by Trustees may include: 1. Real Estate: Trustees may be given the responsibility of managing and overseeing real estate properties held within the trust. This can involve residential, commercial, or agricultural properties located in Round Rock, Texas. 2. Financial Assets: Trust property may consist of various financial assets, such as stocks, bonds, mutual funds, or bank accounts. Trustees must ensure proper documentation and safekeeping of these assets. 3. Personal Property: This category can encompass a wide range of physical assets, like vehicles, artwork, jewelry, or collectibles. Trustees are responsible for protecting, valuing, and potentially selling these assets in accordance with the trust agreement. 4. Business Interests: In some cases, a trust may include ownership interests in Round Rock-based businesses or partnerships. Trustees may need to manage these business assets, make informed decisions, and address any legal or financial matters related to the business. 5. Intellectual Property: Trustees may be entrusted with intellectual property rights, such as patents, trademarks, or copyrights, which require diligent safeguarding and potential commercialization for the trust's benefit. It is crucial that trustees act in the best interest of the trust and its beneficiaries while carrying out their duties. They must adhere to Round Rock, Texas laws and regulations, keep meticulous records, communicate transparently with beneficiaries, and seek professional advice when needed. The acceptance of trust property by trustees marks the beginning of their vital role in protecting and managing the trust's assets for the present and future beneficiaries.

Round Rock Texas Acceptance of Trust Property by Trustees

Category:

State:

Texas

City:

Round Rock

Control #:

TX-C180

Format:

PDF

Instant download

This form is available by subscription

Description

Acceptance of Trust Property by Trustees

Round Rock Texas Acceptance of Trust Property by Trustees refers to the legal process through which trustees officially acknowledge and assume ownership and responsibility for assets held in a trust within the Round Rock, Texas jurisdiction. This process is essential for ensuring the effective management and protection of the trust property in adherence to the terms and provisions of the trust agreement. The acceptance of trust property by trustees involves several steps and considerations. Trustees must thoroughly review the trust agreement, which outlines their fiduciary duties and includes specific provisions regarding the management, distribution, and potential sale of the trust property. It is essential for trustees to fully understand these terms before accepting the trust property. Once trustees have comprehended the trust agreement, they may formally accept the trust property. Acceptance typically involves signing a written document or instrument confirming their willingness to act as trustees and acknowledging their responsibilities towards the trust property and its beneficiaries. This acceptance is legally binding and signifies the trustees' commitment to upholding their fiduciary duties. Different types of Round Rock Texas Acceptance of Trust Property by Trustees may include: 1. Real Estate: Trustees may be given the responsibility of managing and overseeing real estate properties held within the trust. This can involve residential, commercial, or agricultural properties located in Round Rock, Texas. 2. Financial Assets: Trust property may consist of various financial assets, such as stocks, bonds, mutual funds, or bank accounts. Trustees must ensure proper documentation and safekeeping of these assets. 3. Personal Property: This category can encompass a wide range of physical assets, like vehicles, artwork, jewelry, or collectibles. Trustees are responsible for protecting, valuing, and potentially selling these assets in accordance with the trust agreement. 4. Business Interests: In some cases, a trust may include ownership interests in Round Rock-based businesses or partnerships. Trustees may need to manage these business assets, make informed decisions, and address any legal or financial matters related to the business. 5. Intellectual Property: Trustees may be entrusted with intellectual property rights, such as patents, trademarks, or copyrights, which require diligent safeguarding and potential commercialization for the trust's benefit. It is crucial that trustees act in the best interest of the trust and its beneficiaries while carrying out their duties. They must adhere to Round Rock, Texas laws and regulations, keep meticulous records, communicate transparently with beneficiaries, and seek professional advice when needed. The acceptance of trust property by trustees marks the beginning of their vital role in protecting and managing the trust's assets for the present and future beneficiaries.

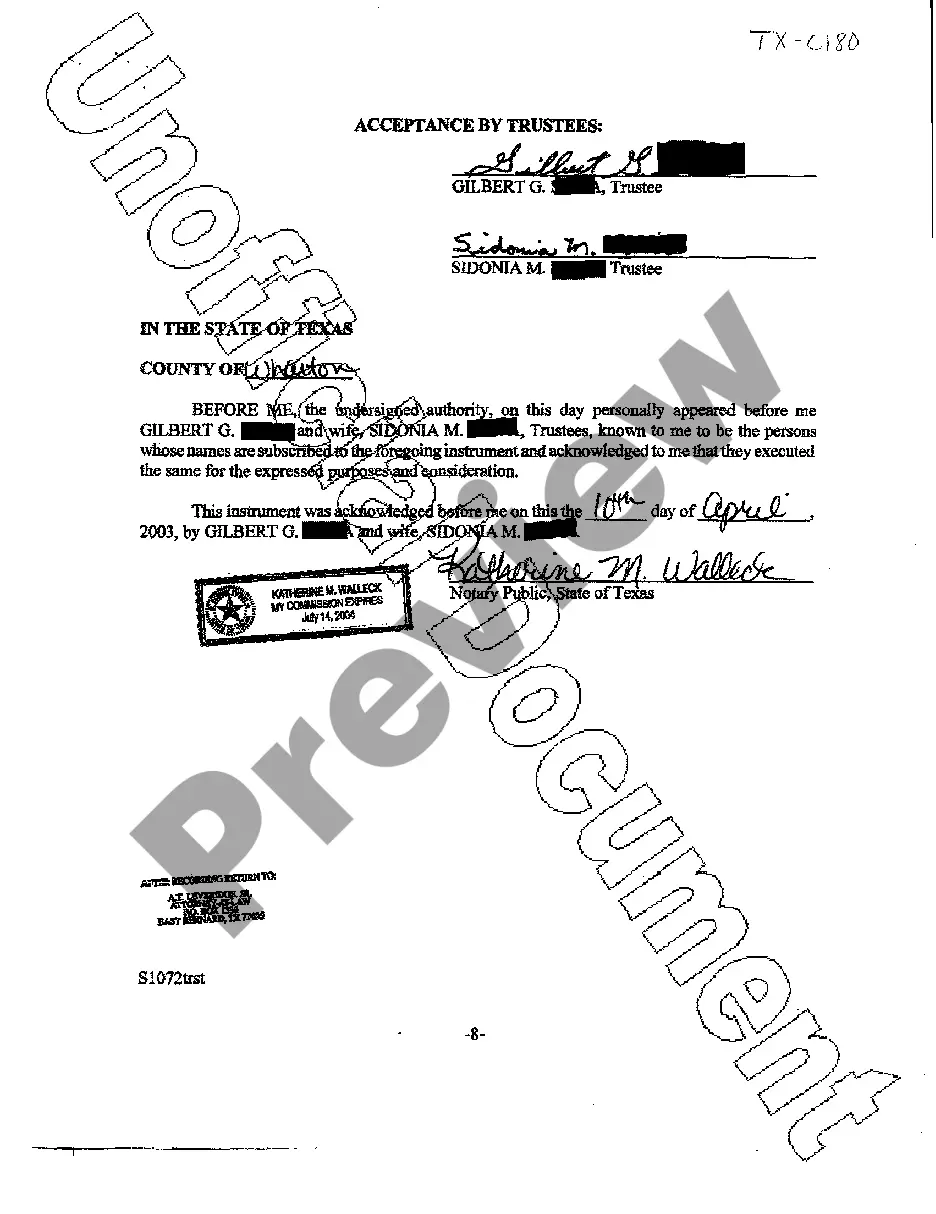

Free preview

How to fill out Round Rock Texas Acceptance Of Trust Property By Trustees?

If you’ve already utilized our service before, log in to your account and download the Round Rock Texas Acceptance of Trust Property by Trustees on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Round Rock Texas Acceptance of Trust Property by Trustees. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!