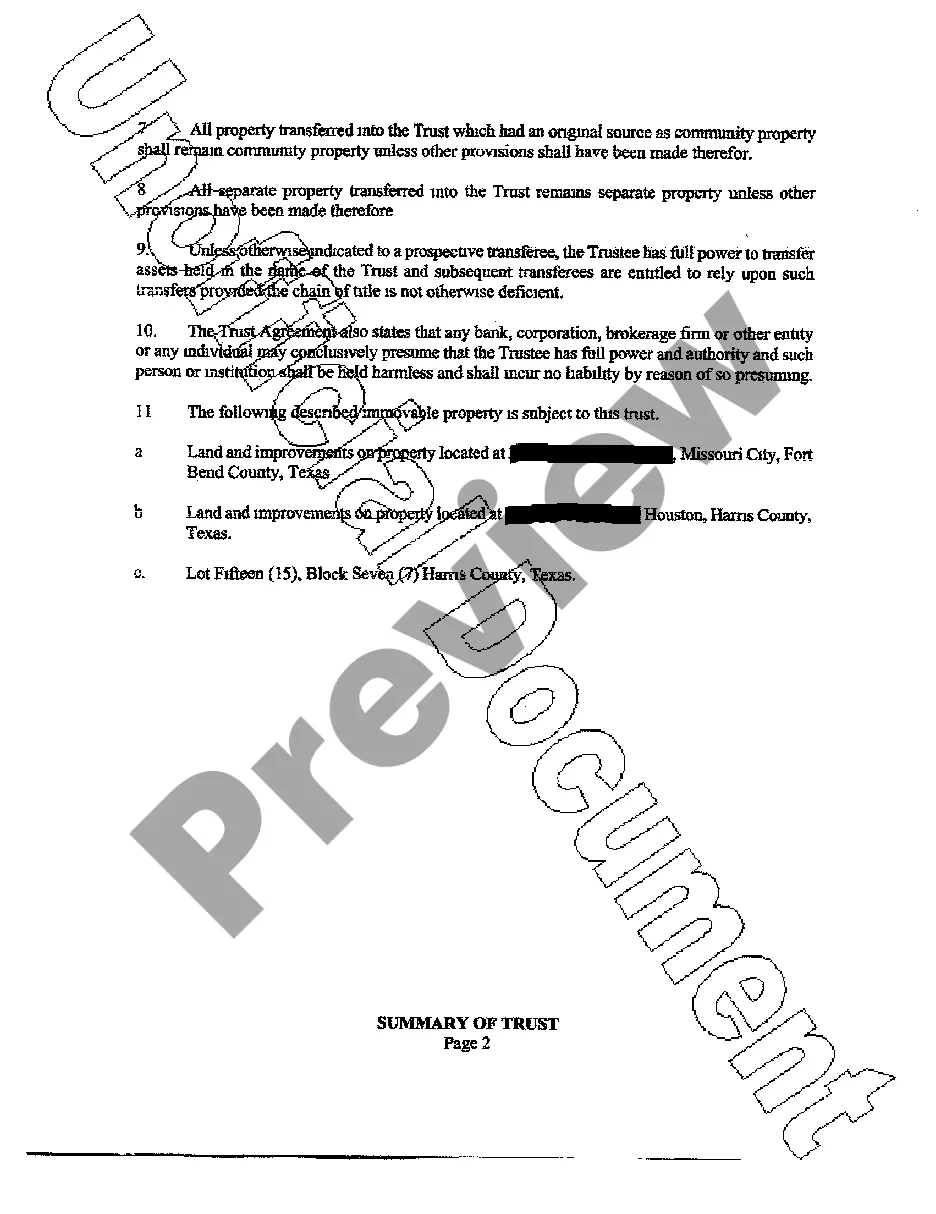

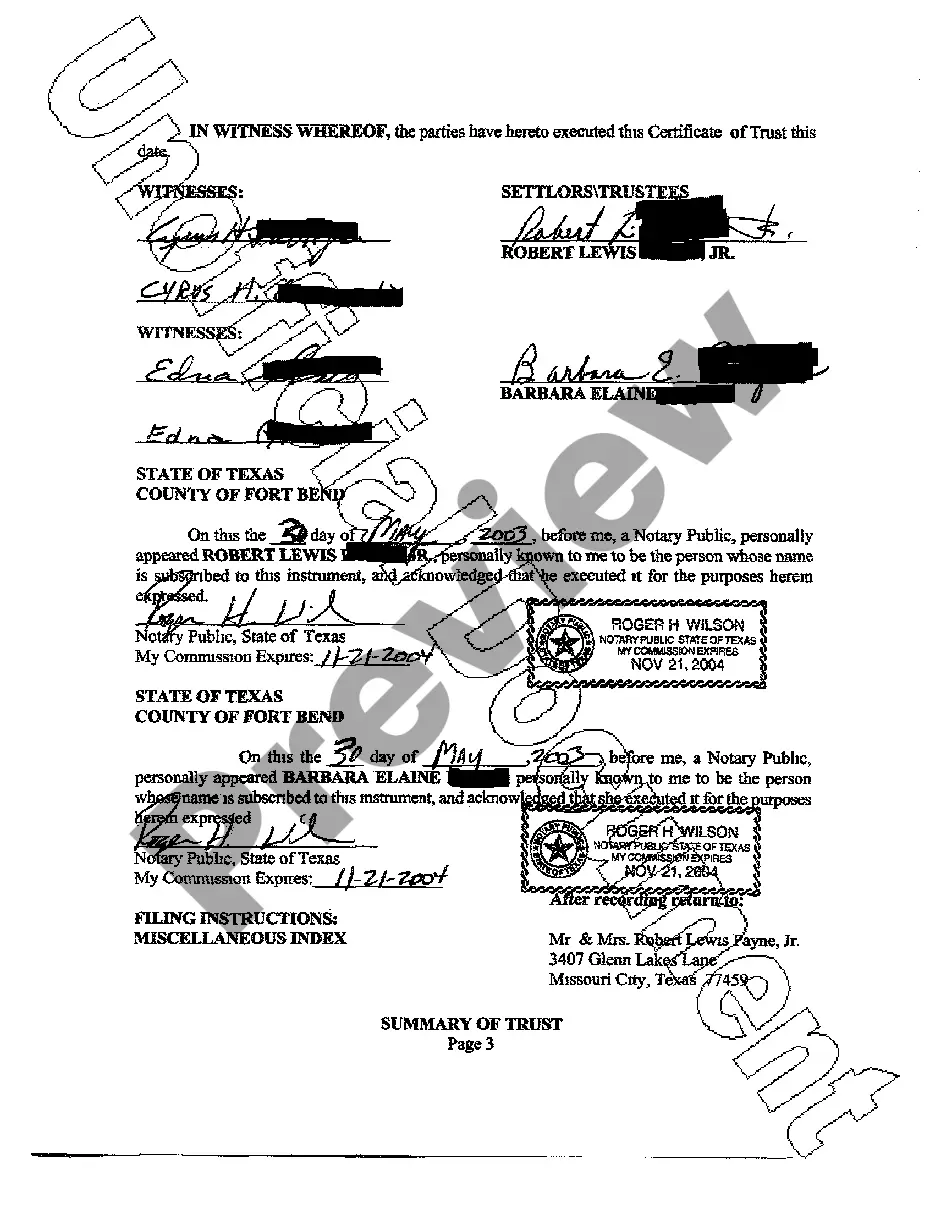

Title: Bexar Texas Summary of Revocable Living Trust Agreement: What You Need to Know Introduction: The Bexar Texas Summary of Revocable Living Trust Agreement is a legal document that allows individuals in Bexar County, Texas, to protect and manage their assets during their lifetime and ensure a smooth transfer of ownership upon their passing. This article provides a detailed description of this trust agreement, offering valuable insights into its significance and the different types available. 1. Understanding the Revocable Living Trust Agreement: The Bexar Texas Summary of Revocable Living Trust Agreement is a legal instrument that allows individuals (settler/granter) to establish a trust, transferring ownership of their assets into the trust, managed by a designated trustee. The trust can be altered or revoked by the granter during their lifetime as long as they are mentally competent. 2. Advantages of Revocable Living Trust Agreements: — Avoidance of Probate: Unlike wills, assets held within a revocable living trust bypass the probate process, ensuring privacy and efficient asset distribution to beneficiaries. — Asset Management: A trustee of thgranteror's choosing can effectively manage and protect assets if the granter becomes incapacitated or passes away. — Flexibility: The agreement allows for modifications or revocation during the granter's lifetime, adapting to changing circumstances. 3. Different Types of Bexar Texas Summary of Revocable Living Trust Agreements: a) Individual Revocable Living Trust: This type of trust is established by an individual, where they act as the granter and can designate themselves as the trustee during their lifetime. After their passing, a successor trustee takes over. b) Married Couple or Joint Trust: This trust is designed for spouses or partners to combine their assets within a single trust while retaining control and management of the assets together. Upon the passing of one spouse, the trust continues for the benefit of the surviving spouse. c) Testamentary Revocable Living Trust: This trust is created through a will and becomes active upon the granter's death. It allows the granter to retain control over their assets during their lifetime. Conclusion: The Bexar Texas Summary of Revocable Living Trust Agreement is a powerful tool that offers numerous benefits for individuals seeking to protect their assets, ensure efficient distribution, and maintain privacy. By understanding the various types available, individuals can make informed decisions regarding their estate planning, catering to their unique needs and circumstances. It is advisable to consult with an experienced estate planning attorney to establish a revocable living trust that aligns with your goals and objectives.

Bexar Texas Summary of Revocable Living Trust Agreement

Description

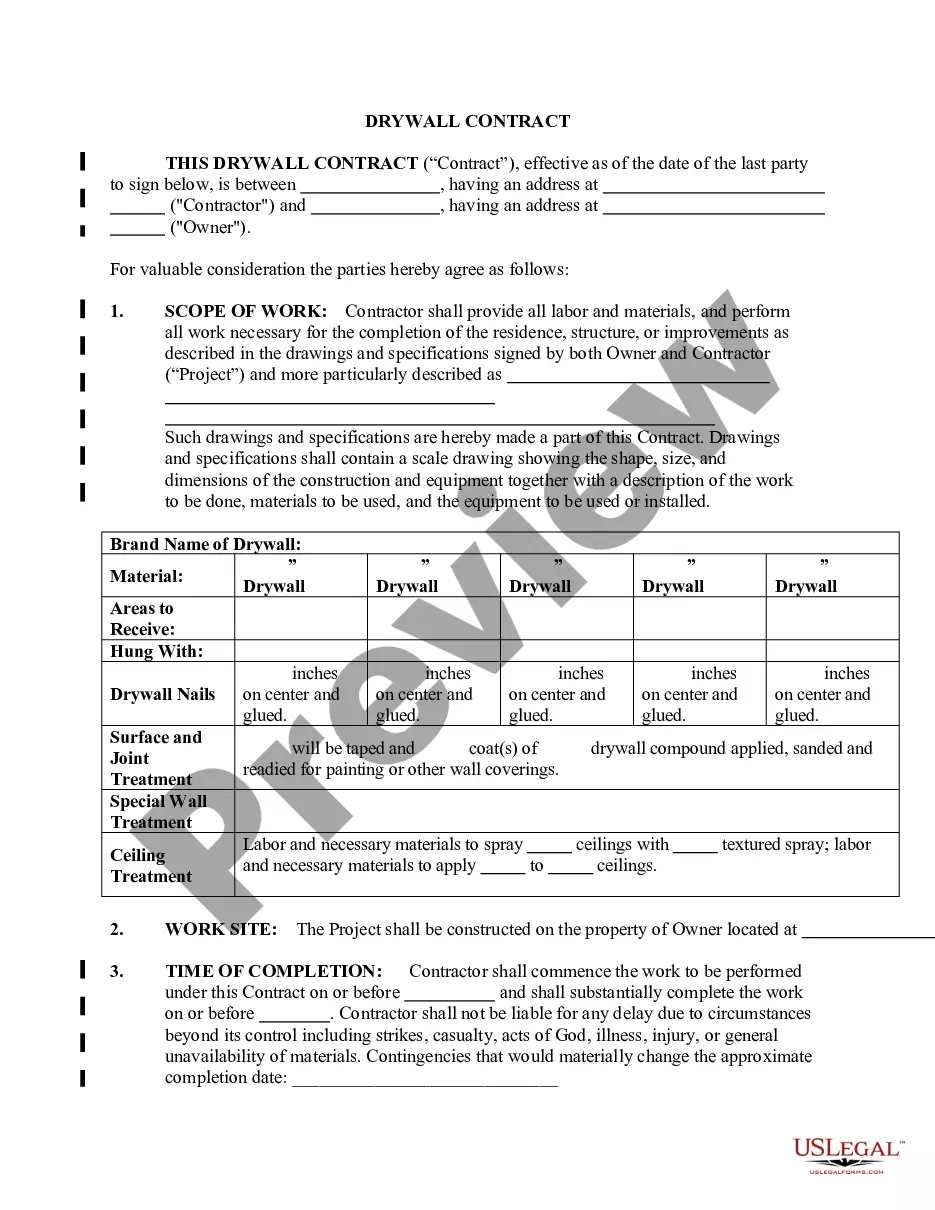

How to fill out Bexar Texas Summary Of Revocable Living Trust Agreement?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Bexar Texas Summary of Revocable Living Trust Agreement or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Bexar Texas Summary of Revocable Living Trust Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Bexar Texas Summary of Revocable Living Trust Agreement is proper for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Revocable Trusts Can Avoid Probate To avoid the necessity of probate, many people create revocable trusts. Assets transferred to the revocable trust can pass privately to the intended beneficiaries after the death of the trustmaker without the need for probate.

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

Wills must go through probate and become public record. A trust is not probated and does not become public record. Your beneficiaries, assets, and trust terms remain private.

The distinction between a will and a trust is that a will only becomes effective upon your passing while a trust is created while you are still living. You sustain control over the trust and all of the assets until you pass away. Once the trust is created, trustees are then appointed.

Anyone listed as a trust beneficiary will be entitled to receive a copy of the Trust. Additionally, an heir of the settlor is entitled to a copy of the Trust. When an heir's told, they are disinherited, receiving a copy of the Trust is particularly important.

Yes, a current beneficiary of an irrevocable trust generally has a right to see the trust instrument and receive a copy of the document. ?Beneficiary? means a person for whose benefit property is held in trust, regardless of the nature of the interest.

A trust, more formally known as a revocable living trust, is a legal entity set up to control your assets. To create a trust, you first set it up, and then take all of your assets ? your house, your car, your property, your accounts ? and re-title them in the name of the trust.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Interesting Questions

More info

So I've always been a lot more inclined to think of myself as a trustee. I've had a couple of experiences like this recently. I started out as a trustee for the Marine Corps Museum, and when I looked around I saw a lot of retired and active servicemen to be interested in coming here and interacting with our veterans. But the problem was, I didn't have the resources, I didn't have the expertise, I didn't have the financial know-how to run a museum this size. So I didn't want them to leave. But I wanted them to come here and enjoy something free of charge. And finally they were able to do that last Thursday. So, I went to the board of trustees meeting last week, and at that meeting they asked the staff members to come in. And so, I brought four of the Marine Corps' former commanders, and they came in and gave a presentation about the museum and the history of the Corps, and they were very happy to do it.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.