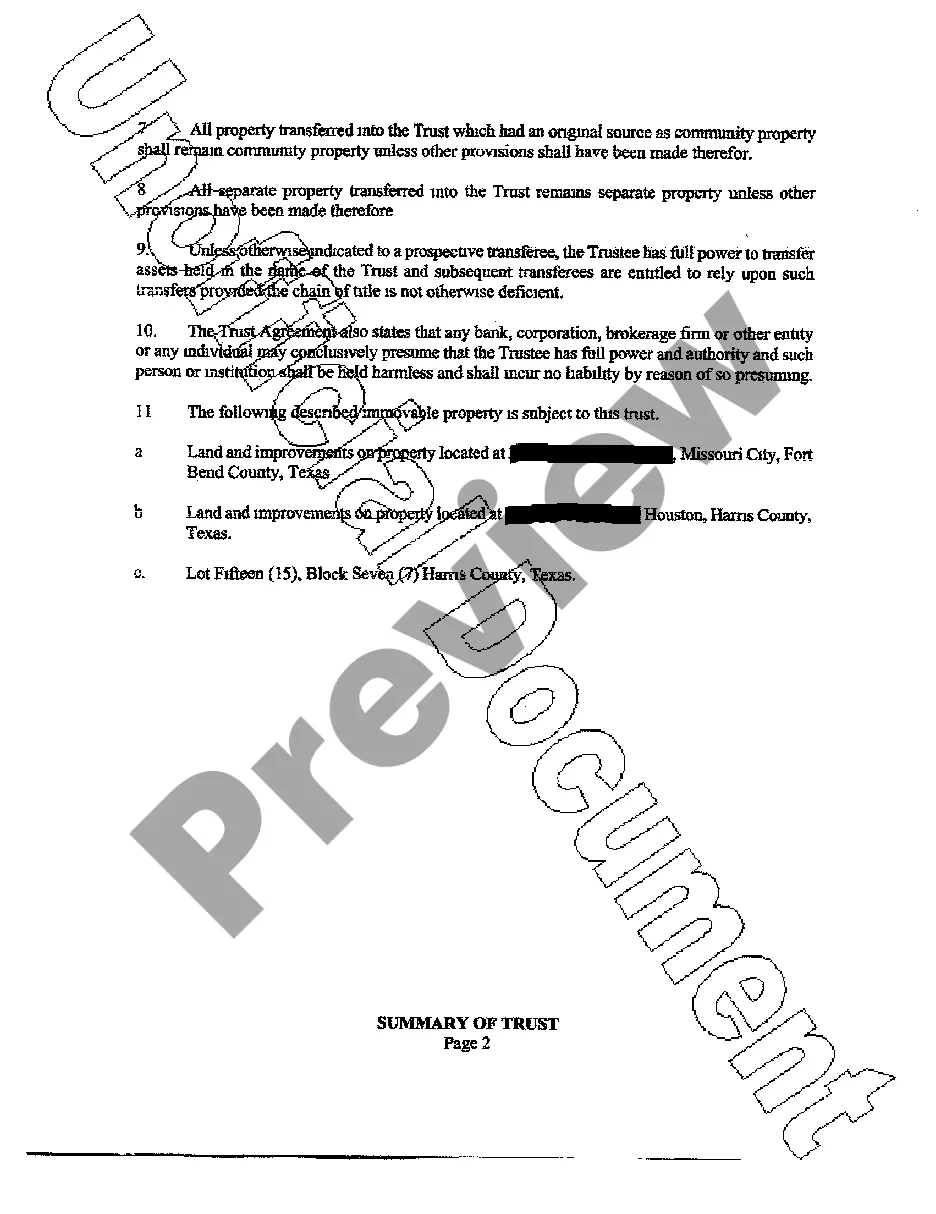

The Houston Texas Summary of Revocable Living Trust Agreement is a legal document that outlines the key provisions and terms of a revocable living trust established by an individual or a couple in Houston, Texas. This agreement acts as a summary of the trust, providing a concise overview of its purpose, beneficiaries, trustees, assets, and the desired distribution of those assets upon the creator's death. In general, a revocable living trust is a legal arrangement that allows an individual, referred to as the trust or granter, to transfer their assets into a trust during their lifetime. The trust or retains control and ownership of the assets while serving as the initial trustee. They also have the power to modify or revoke the trust as long as they are mentally competent. One of the main advantages of a revocable living trust is that it allows assets to be transferred to beneficiaries upon the trust or's death without going through the probate process. This can expedite the distribution of assets and minimize potential costs and delays. As a result, the summary of the trust agreement will typically cover specific details related to the assets, beneficiaries, and trustees involved. Key provisions outlined in the Houston Texas Summary of Revocable Living Trust Agreement may include: 1. Identification of the trust or: The agreement will clearly state the name and address of the trust or who is creating the trust. 2. Trustee(s): The document will identify the initial trustee(s) who will be responsible for managing the trust assets during the trust or's lifetime, as well as any successor trustee(s) named to take over trustee responsibilities upon the trust or's incapacity or death. 3. Beneficiaries: The summary will specify the beneficiaries who will be entitled to receive the trust assets upon the trust or's death. 4. Assets: The agreement will provide a detailed description of the assets that the trust or plans to transfer into the trust, which may include real estate, bank accounts, investments, personal belongings, and other valuable possessions. 5. Distribution of assets: The summary may outline the desired distribution plan for the trust assets, including any specific instructions or conditions to be followed. It is important to note that there may be variations of the Houston Texas Summary of Revocable Living Trust Agreement, each tailored to meet specific needs or preferences. For example, some individuals may opt for a specific type of revocable living trust such as an A-B Trust, which is designed to optimize estate tax planning for married couples. Additionally, the summary may be modified or customized based on the individual's unique circumstances and goals. In conclusion, the Houston Texas Summary of Revocable Living Trust Agreement serves as a concise document that summarizes the key aspects of a revocable living trust established in Houston, Texas. It includes essential information regarding the trust or, trustees, beneficiaries, assets, and the desired distribution plan. Different variations, such as the A-B Trust, may exist to cater to specific estate planning needs.

Houston Texas Summary of Revocable Living Trust Agreement

Description

How to fill out Houston Texas Summary Of Revocable Living Trust Agreement?

Finding verified templates tailored to your regional regulations can be tough unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both individual and business purposes, covering various real-world circumstances.

All the forms are organized by area of application and jurisdiction, making it simple and quick to locate the Houston Texas Summary of Revocable Living Trust Agreement.

Maintaining your documents organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you have chosen the correct document that aligns with your needs and fully meets your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to locate the appropriate document.

- If it meets your expectations, proceed to the subsequent step.

Form popularity

FAQ

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

A trust, more formally known as a revocable living trust, is a legal entity set up to control your assets. To create a trust, you first set it up, and then take all of your assets ? your house, your car, your property, your accounts ? and re-title them in the name of the trust.

Especially large or complex estates may be best for a living trust, but smaller estates can also benefit. However, if you expect your net worth to be less than $50,000 after you die, a living trust may not be necessary for Texas. The state offers a simplified probate process for all estates under this threshold.

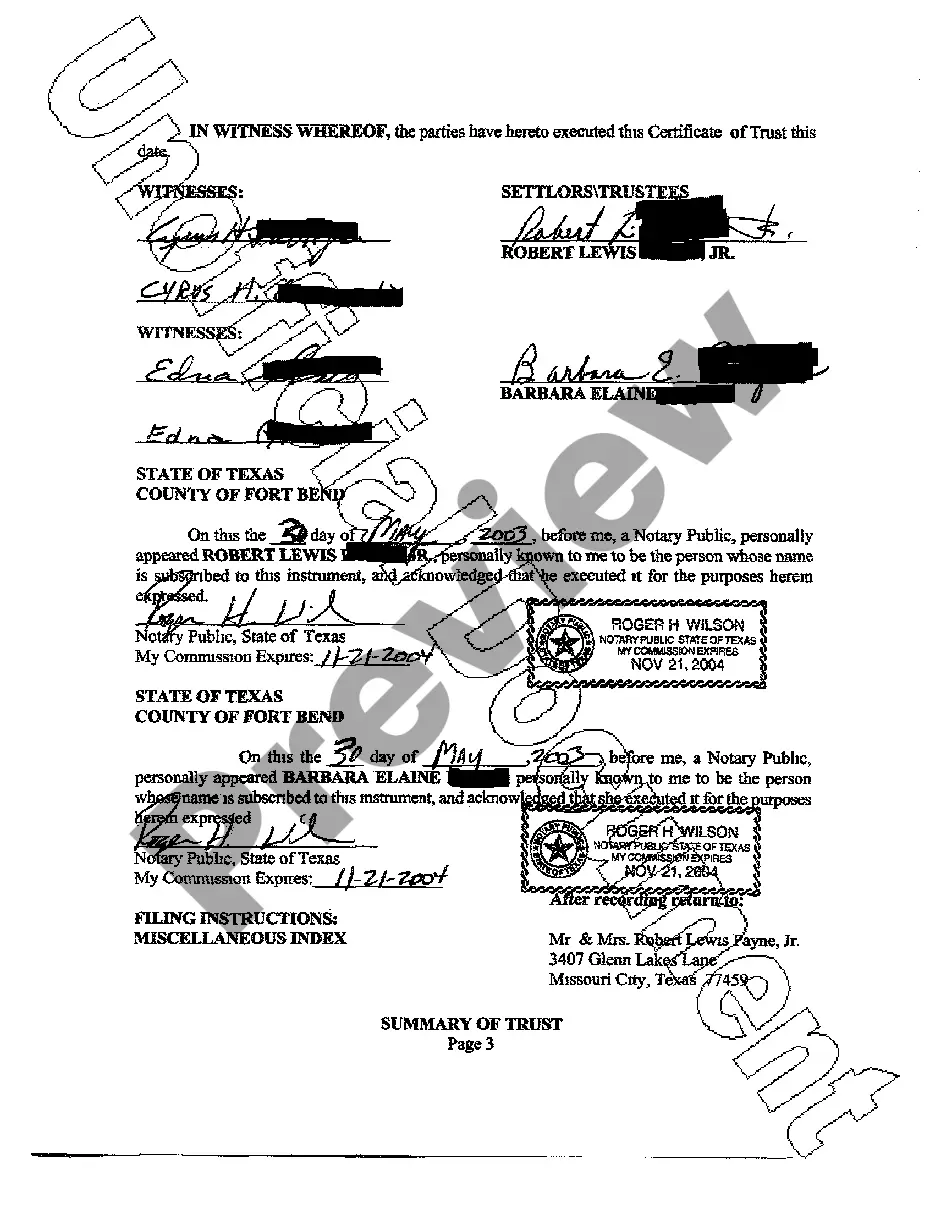

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

Under Texas trust laws, the following are required for a valid trust to be formed: The Settlor must have a present intent to create a trust. The Settlor must have capacity to convey assets to the trust. The trust must comply with the Statute of Frauds.

If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome ? and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death.

In general, a trust beneficiary has a right to get a copy of the trust document, receive accountings from the trustee, and expect that the trustee will perform all of its duties under the terms of the trust agreement and Texas law, but there are exceptions.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

Interesting Questions

More info

At that time, the plaintiff was the sole surviving parent and the defendant was the sole child. During the course of the marriage, both parties were highly invested in a mutual fund that they both paid into monthly. They traded this fund on an ongoing basis and were able to do so because the fund was diversified — meaning the assets in the fund were spread across a range of investments, none of which were specific to the other party. Both parties maintained the funds in a joint account in which one of their primary investment choices was to hold bonds and short-term money market accounts. Due to the diversification and the broad range of funds held in the joint account, the parties were confident that they would eventually receive their investment returns. However, just 5 years later, the plaintiff's death came and this diversification was put on hold.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.