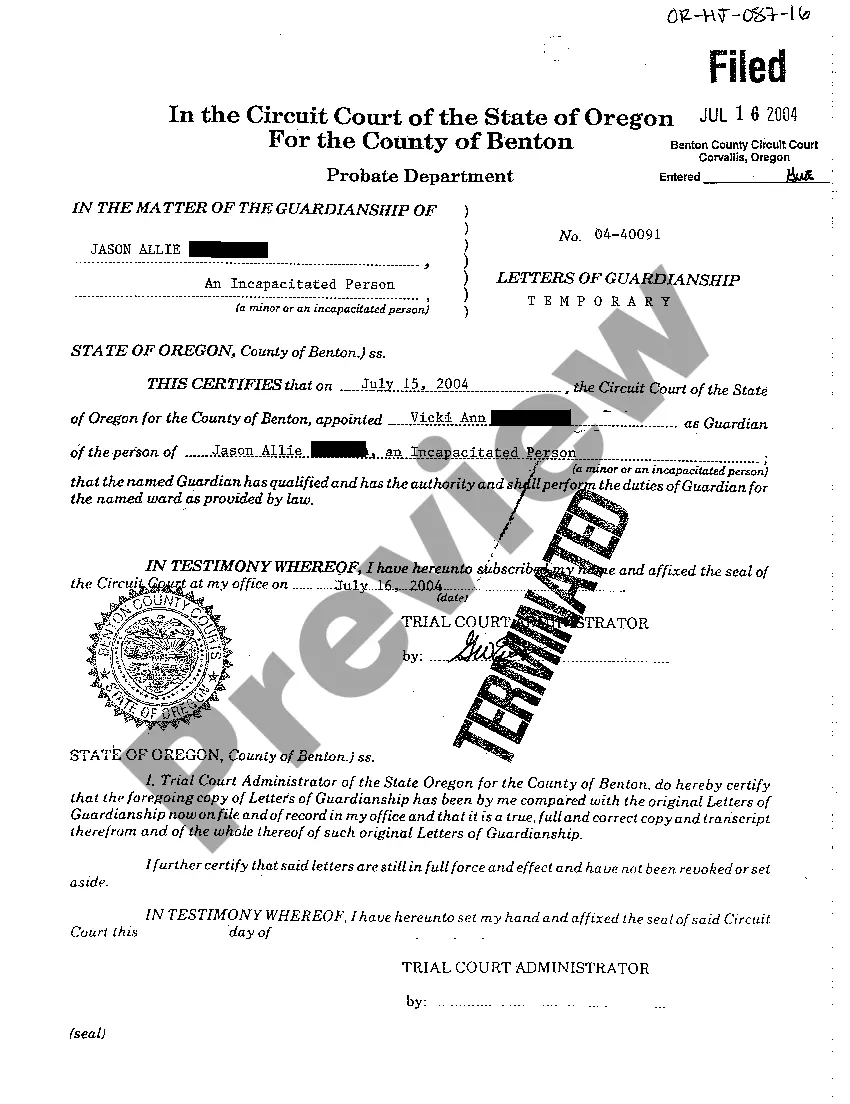

The San Antonio Texas Summary of Revocable Living Trust Agreement is a legal document that outlines the terms and conditions of a revocable living trust in the city of San Antonio, Texas. This agreement is an important estate planning tool that allows individuals to have control over their assets during their lifetime and provides for the distribution of their assets upon their death. The agreement typically begins with an introduction, stating the name of the trust, the name and address of the granter (the person creating the trust), and the date on which the trust is established. It also identifies the roles and responsibilities of the primary parties involved in the trust, such as the granter, trustee (person managing the trust), and beneficiaries (those who will receive the trust assets). The San Antonio Texas Summary of Revocable Living Trust Agreement includes provisions related to the management and distribution of the trust assets. It specifies the powers and duties of the trustee, including the authority to invest, manage, and sell the trust property. The agreement may also outline guidelines for the distribution of income and principal, ensuring that beneficiaries receive their allocated share in a fair and equitable manner. Furthermore, the agreement addresses contingencies such as the incapacity of the granter. In such cases, it will provide instructions for the appointment of a successor trustee who will step in to manage the trust if the initial trustee becomes unable to do so. Additionally, the San Antonio Texas Summary of Revocable Living Trust Agreement includes provisions for the amendment or revocation of the trust. This allows the granter to modify, revoke, or terminate the trust during their lifetime if they wish to make changes or have a change in circumstances. It is important to note that once the granter passes away, the trust becomes irrevocable. Different types of San Antonio Texas Summary of Revocable Living Trust Agreements may exist based on the specific requirements or preferences of the granter. This may include provisions for special needs trusts to benefit individuals with disabilities, marital trusts to provide for a surviving spouse, or charitable trusts for philanthropic purposes. In conclusion, the San Antonio Texas Summary of Revocable Living Trust Agreement is a comprehensive legal document that enables individuals in the city of San Antonio, Texas, to establish and manage a revocable living trust. It covers various aspects such as asset management, beneficiary distribution, successor trustees, and amendment or revocation provisions.

San Antonio Texas Summary of Revocable Living Trust Agreement

Description

How to fill out San Antonio Texas Summary Of Revocable Living Trust Agreement?

Utilize the US Legal Forms and gain immediate access to any form you need.

Our valuable platform containing thousands of documents simplifies the process of locating and acquiring nearly any document template you may require.

You can save, complete, and validate the San Antonio Texas Summary of Revocable Living Trust Agreement in just a few minutes instead of spending countless hours online searching for a suitable template.

Using our directory is an excellent method to enhance the security of your document management.

If you haven't created an account yet, follow the steps below.

Locate the template you require. Ensure it is the document you wanted: check its title and description, and utilize the Preview function when available. Alternatively, use the Search field to find the necessary form.

- Our skilled legal experts routinely examine all documents to ensure that the forms are appropriate for specific states and comply with current laws and regulations.

- How can you obtain the San Antonio Texas Summary of Revocable Living Trust Agreement.

- If you already subscribe, simply sign in to your account. The Download feature will be accessible for all the samples you view.

- Moreover, you can access any previously saved documents in the My documents section.

Form popularity

FAQ

The dissolution document should be signed, dated, witnessed and notarized. If the trust being dissolved was registered with a specific court, the dissolution document should be filed with the same court. Otherwise, you can just attach it to your trust papers and store it with your will or new trust documents.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

A trust, more formally known as a revocable living trust, is a legal entity set up to control your assets. To create a trust, you first set it up, and then take all of your assets ? your house, your car, your property, your accounts ? and re-title them in the name of the trust.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

There are no special requirements dealing with the proper execution of a trust other than it has to be ?written evidence of the trust's terms bearing the signature of the settlor or the settlor's authorized agent.?10 Additionally, a revocable trust does not require the presence of witnesses to be properly executed.

Under Texas trust laws, the following are required for a valid trust to be formed: The Settlor must have a present intent to create a trust. The Settlor must have capacity to convey assets to the trust. The trust must comply with the Statute of Frauds.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.