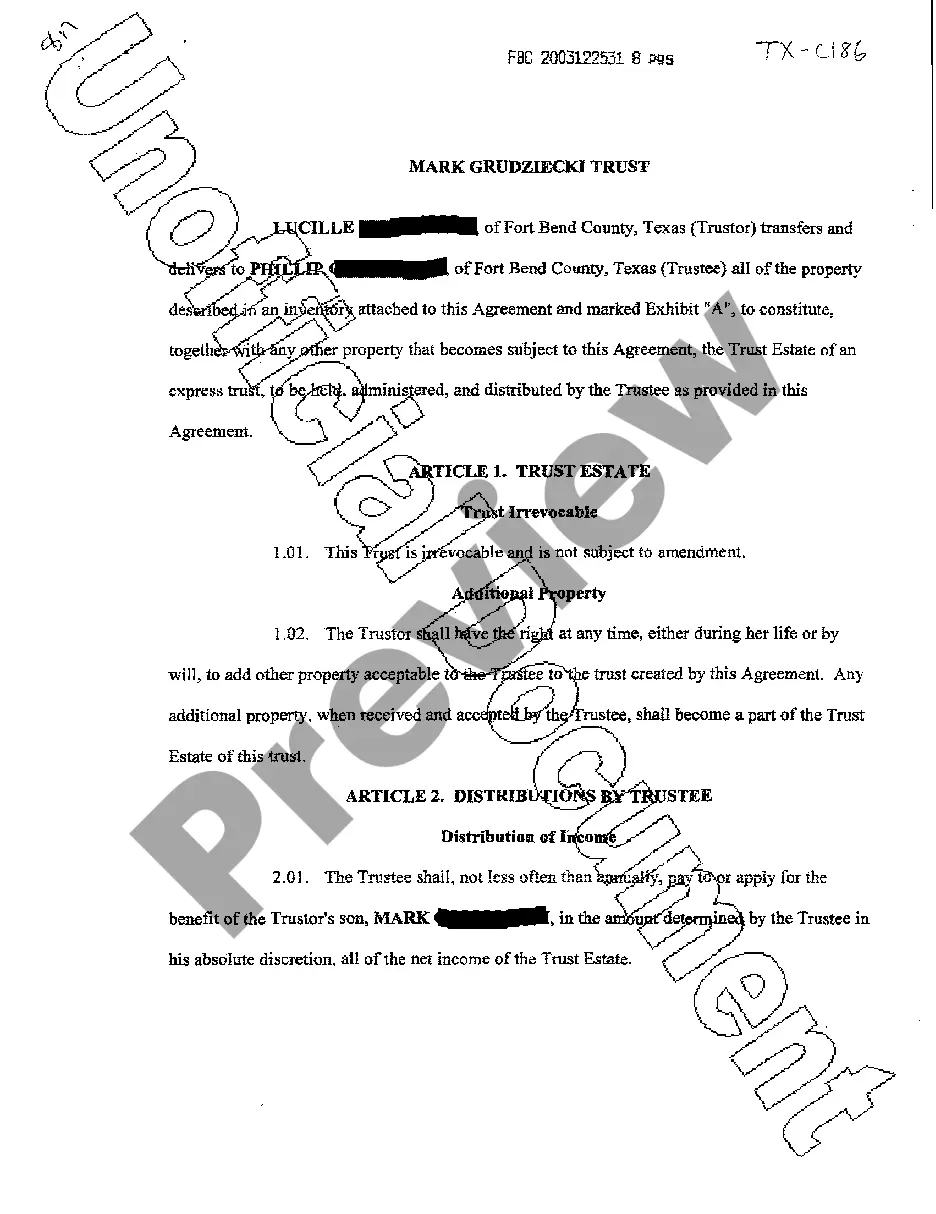

A College Stations Texas Trust Estate Agreement by Individual Trust or is a legal document that establishes a trust, wherein the trust or (also known as the settler or granter) transfers their assets to a trustee to manage and distribute them according to the terms outlined in the agreement. This trust agreement is created specifically by an individual trust or residing in College Station, Texas, and is commonly used for estate planning purposes. The College Stations Texas Trust Estate Agreement by Individual Trust or encompasses various important aspects such as asset protection, tax benefits, privacy, and smooth asset distribution after the trust or's passing. By implementing this agreement, the trust or can ensure that their assets are appropriately managed and distributed to the beneficiaries they designate, while minimizing the complexities of probate and potential disputes that can arise during estate administration. There can be different types of trusts established through the College Station Texas Trust Estate Agreement by Individual Trust or, based on the trust or's objectives and financial situation. Some common types include: 1. Revocable Living Trust: This type of trust allows the trust or to retain control over their assets during their lifetime. They can modify or revoke the trust at any time, making it a flexible option for estate planning. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once it is established. By transferring assets to this type of trust, the trust or effectively removes them from their estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Trust: This trust is created through the trust or's will and only takes effect upon their death. It allows for detailed instructions regarding distribution of assets, particularly when minors or individuals incapable of managing their own finances are involved. 4. Charitable Trust: This type of trust is established to benefit charitable organizations while providing potential tax advantages for the trust or and their estate. 5. Special Needs Trust: Created to support individuals with disabilities, this trust enables the trust or to provide for their loved one's long-term care without jeopardizing their eligibility for government assistance programs. 6. Marital Trust: Also known as a spousal trust, this trust allows the trust or to provide for their surviving spouse after their death while ensuring that the remaining assets are passed on to other beneficiaries as per their wishes. In conclusion, the College Station Texas Trust Estate Agreement by Individual Trust or is a crucial legal document for individuals residing in College Station, Texas, who seek to protect their assets, plan for the distribution of their estate, and potentially reduce tax liabilities. By establishing a trust through this agreement, one can have peace of mind knowing that their wishes will be carried out in a structured and efficient manner.

College Station Texas Trust Estate Agreement by Individual Trustor

State:

Texas

City:

College Station

Control #:

TX-C186

Format:

PDF

Instant download

This form is available by subscription

Description

Trust Estate Agreement by Individual Trustor

A College Stations Texas Trust Estate Agreement by Individual Trust or is a legal document that establishes a trust, wherein the trust or (also known as the settler or granter) transfers their assets to a trustee to manage and distribute them according to the terms outlined in the agreement. This trust agreement is created specifically by an individual trust or residing in College Station, Texas, and is commonly used for estate planning purposes. The College Stations Texas Trust Estate Agreement by Individual Trust or encompasses various important aspects such as asset protection, tax benefits, privacy, and smooth asset distribution after the trust or's passing. By implementing this agreement, the trust or can ensure that their assets are appropriately managed and distributed to the beneficiaries they designate, while minimizing the complexities of probate and potential disputes that can arise during estate administration. There can be different types of trusts established through the College Station Texas Trust Estate Agreement by Individual Trust or, based on the trust or's objectives and financial situation. Some common types include: 1. Revocable Living Trust: This type of trust allows the trust or to retain control over their assets during their lifetime. They can modify or revoke the trust at any time, making it a flexible option for estate planning. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once it is established. By transferring assets to this type of trust, the trust or effectively removes them from their estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Trust: This trust is created through the trust or's will and only takes effect upon their death. It allows for detailed instructions regarding distribution of assets, particularly when minors or individuals incapable of managing their own finances are involved. 4. Charitable Trust: This type of trust is established to benefit charitable organizations while providing potential tax advantages for the trust or and their estate. 5. Special Needs Trust: Created to support individuals with disabilities, this trust enables the trust or to provide for their loved one's long-term care without jeopardizing their eligibility for government assistance programs. 6. Marital Trust: Also known as a spousal trust, this trust allows the trust or to provide for their surviving spouse after their death while ensuring that the remaining assets are passed on to other beneficiaries as per their wishes. In conclusion, the College Station Texas Trust Estate Agreement by Individual Trust or is a crucial legal document for individuals residing in College Station, Texas, who seek to protect their assets, plan for the distribution of their estate, and potentially reduce tax liabilities. By establishing a trust through this agreement, one can have peace of mind knowing that their wishes will be carried out in a structured and efficient manner.

Free preview

How to fill out College Station Texas Trust Estate Agreement By Individual Trustor?

If you’ve already utilized our service before, log in to your account and download the College Station Texas Trust Estate Agreement by Individual Trustor on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your College Station Texas Trust Estate Agreement by Individual Trustor. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!