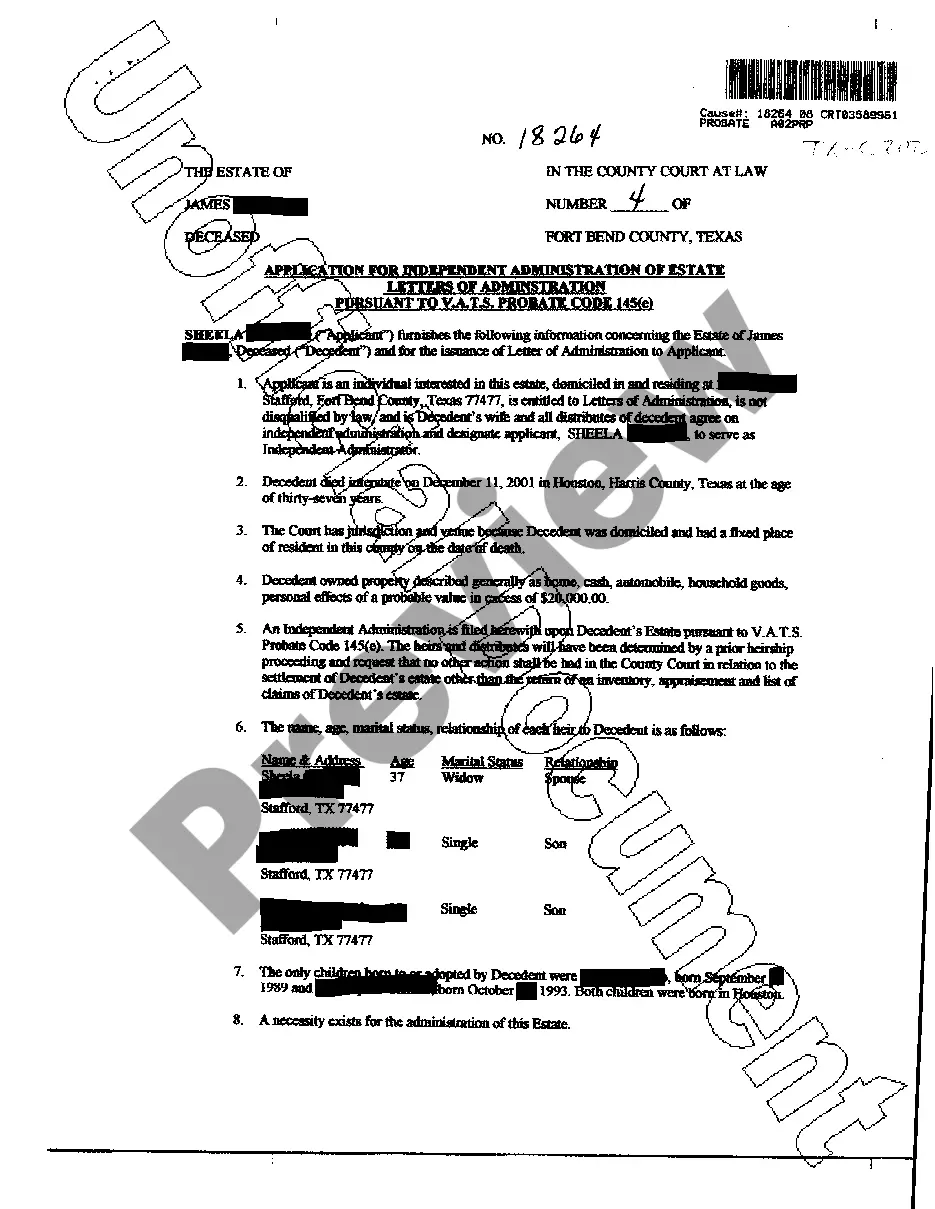

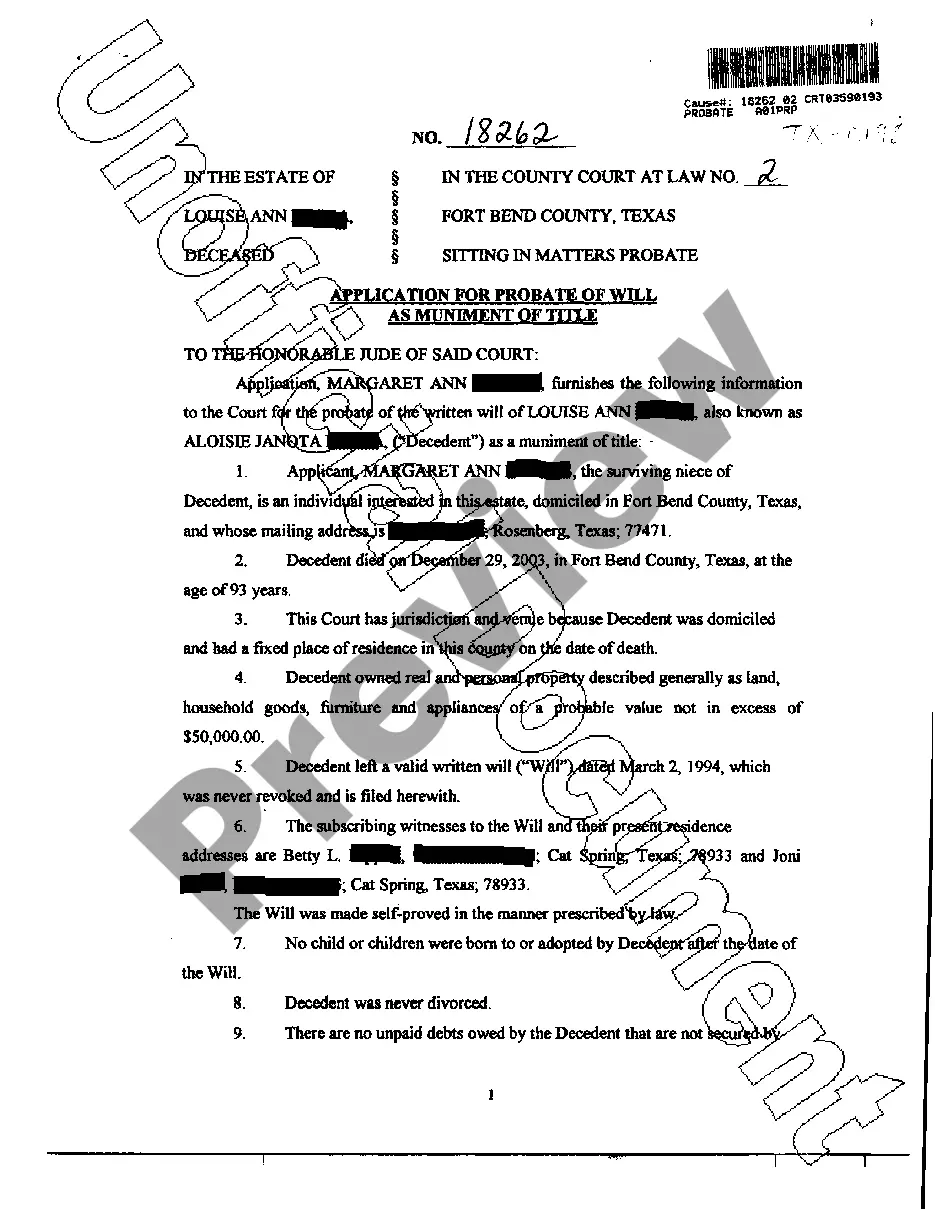

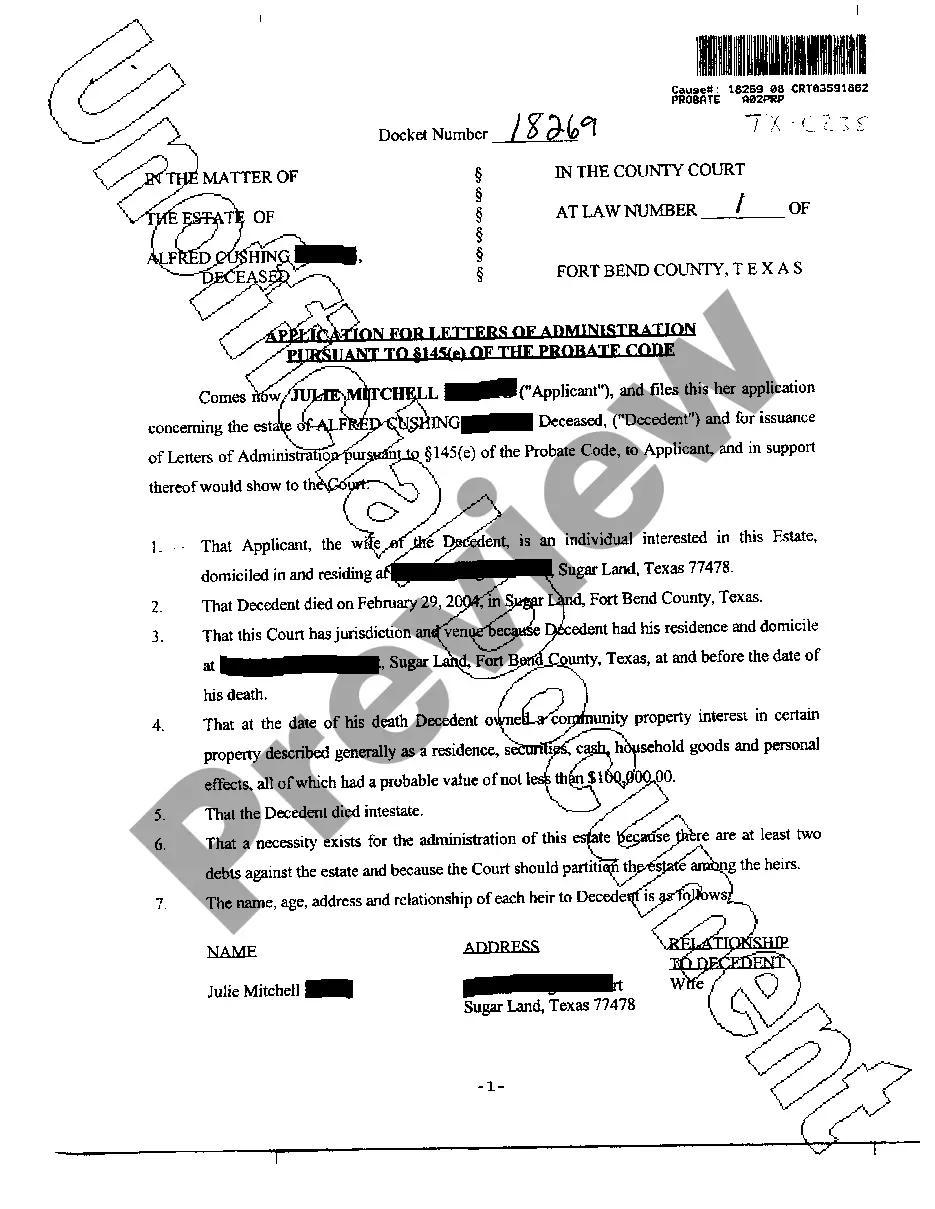

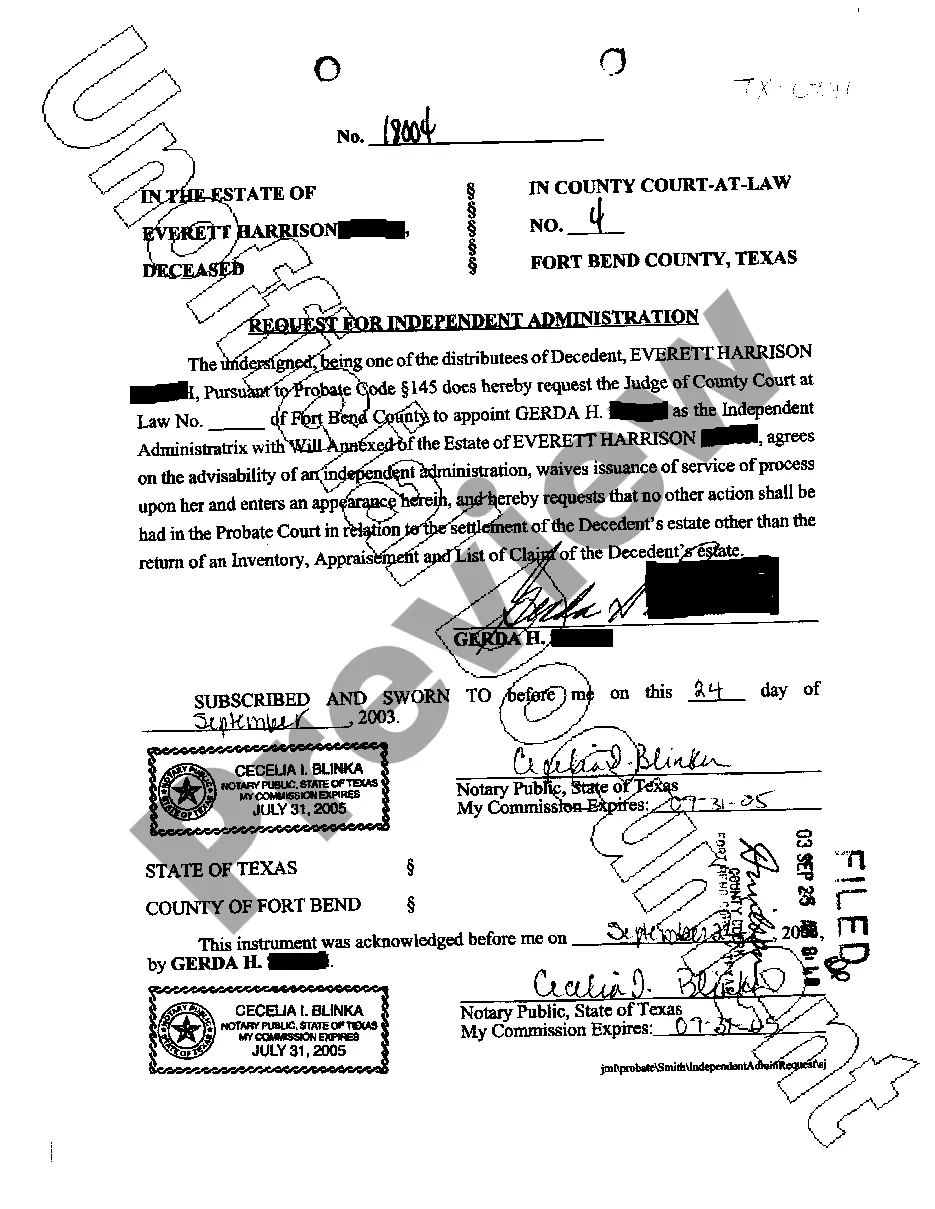

Collin Texas Application for Independent Administration of Estate

Description

How to fill out Texas Application For Independent Administration Of Estate?

Do you require a dependable and budget-friendly supplier of legal forms to obtain the Collin Texas Application for Independent Administration of Estate? US Legal Forms is your ultimate answer.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce process through the court, we have you covered. Our platform provides over 85,000 current legal document templates for personal and business use. All templates that we provide are not generic and are tailored according to the regulations of specific states and regions.

To download the form, you must Log In to your account, find the necessary form, and click the Download button next to it. Please be reminded that you can download your previously acquired document templates at any time from the My documents tab.

Is this your first visit to our platform? No problem. You can easily create an account, but before doing so, ensure you take the following steps.

Now you can set up your account. Then select the subscription option and proceed to payment. Once the payment is processed, download the Collin Texas Application for Independent Administration of Estate in any available file format. You can return to the website at any time and redownload the form at no cost.

Locating current legal documents has never been simpler. Give US Legal Forms a try today, and stop wasting your time searching for legal documents online forever.

- Check if the Collin Texas Application for Independent Administration of Estate aligns with the laws of your state and locality.

- Review the form’s specifications (if available) to understand who and what the form is designed for.

- Begin the search again if the form does not meet your legal needs.

Form popularity

FAQ

An independent administrator of an estate in Texas is an appointed individual who has the authority to manage the estate without requiring continual court supervision. This position is beneficial because it allows for greater flexibility and quicker decision-making. Using the Collin Texas Application for Independent Administration of Estate can help streamline your appointment as an independent administrator, making the estate process more efficient.

To become an administrator of an estate in Texas, you must be appointed by the court, typically by filing an application along with necessary documents like a death certificate. This process can involve filling out the Collin Texas Application for Independent Administration of Estate, which facilitates individual management without a lot of court supervision. Ensure you meet the qualifications, and consult legal resources for a smoother application process.

Certain assets in Texas do not go through probate, including life insurance proceeds with designated beneficiaries, retirement accounts, and jointly owned properties. Additionally, assets held in a living trust or those with a POD designation also bypass probate. Understanding how to navigate these exceptions can be crucial; hence, consider the Collin Texas Application for Independent Administration of Estate to manage the estate more effectively.

Bank accounts that have specified beneficiaries typically do not go through probate in Texas, as long as they are structured correctly, such as through a POD arrangement. The account will directly pass to the beneficiary without needing court proceedings. It is wise to consult resources like the Collin Texas Application for Independent Administration of Estate for a comprehensive approach to managing other elements of your estate.

Yes, a beneficiary on a bank account does help avoid probate if the account includes a payable-on-death designation. This setup allows the beneficiary to receive the funds directly upon the account holder's death, circumventing the lengthy and often costly probate process. When considering your options, keep in mind the importance of the Collin Texas Application for Independent Administration of Estate to address other estate issues.

In Texas, bank accounts generally do not have to go through probate if they are set up with a payable-on-death (POD) designation. This means that upon the account holder's death, the funds automatically transfer to the designated beneficiary without requiring court involvement. Thus, completing your Collin Texas Application for Independent Administration of Estate can streamline handling other probate matters more efficiently.

Getting a letter of administration for an estate involves a clear process. First, you need to complete the Collin Texas Application for Independent Administration of Estate and file it with the appropriate probate court. After filing, the court will assess your application, and if approved, grant the letter, which permits you to handle the estate's affairs in compliance with Texas law. Consider using US Legal Forms to access necessary documents and streamline your application process.

To obtain a Letter of Administration for an estate in Collin, Texas, you should start by filing the Collin Texas Application for Independent Administration of Estate with the probate court. This application will require specific forms and may need supporting documents that demonstrate your relationship to the deceased. Once submitted, the court will review your application and, if everything is in order, will issue the Letter of Administration, allowing you to manage the estate's assets and debts.

In Texas, an independent administrator can be an individual or a qualified institution that meets specific legal requirements. Generally, the individual must be of legal age and have no felony convictions. If you're unsure about eligibility, the Collin Texas Application for Independent Administration of Estate can provide the guidance you need to navigate these criteria effectively.

To file for an estate administrator in Texas, you must submit a petition to the probate court in the county where the deceased resided. This includes completing necessary forms, providing the death certificate, and paying applicable fees. Utilizing the Collin Texas Application for Independent Administration of Estate can simplify this process and guide you every step of the way.