The Dallas Texas Application for Independent Administration of Estate is a crucial legal document that allows for the streamlined administration of a deceased person's estate. This application type is commonly used when the deceased person's Will grants broad powers to the executor, and they are permitted to administer the estate without court supervision. The Application for Independent Administration of Estate in Dallas Texas serves as a means to simplify and expedite the probate process. This method is particularly sought after owing to its efficiency and reduced costs associated with court involvement. However, it is important to note that there are specific types of Dallas Texas Application for Independent Administration of Estate that cater to different situations and circumstances. These include: 1. Application for Independent Administration of Estate with Will Annexed: This application is utilized when the deceased person left a valid Will, but the named executor is unable or unwilling to fulfill their duties. In such cases, an alternate executor is appointed to administer the estate independently. 2. Small Estate Affidavit Application for Independent Administration: This type of application is applicable in situations where the value of the estate falls under a certain threshold, typically a few thousand dollars. It allows for a simplified and expedited probate process for smaller estates. 3. Application for Independent Administration of Estate with Heirs Not Titled: This application is used when there are heirs entitled to the deceased person's estate, but no formal administration or title transfer has occurred. It allows for the appointment of an independent administrator to oversee the estate administration in the absence of a named executor or administrator. By utilizing the appropriate Dallas Texas Application for Independent Administration of Estate, individuals can ensure a smoother probate process and efficiently fulfill their responsibilities as an executor or administrator. It is recommended to consult with an experienced attorney specializing in probate law to determine the most suitable application type based on the specific circumstances of the estate and the deceased person's Will.

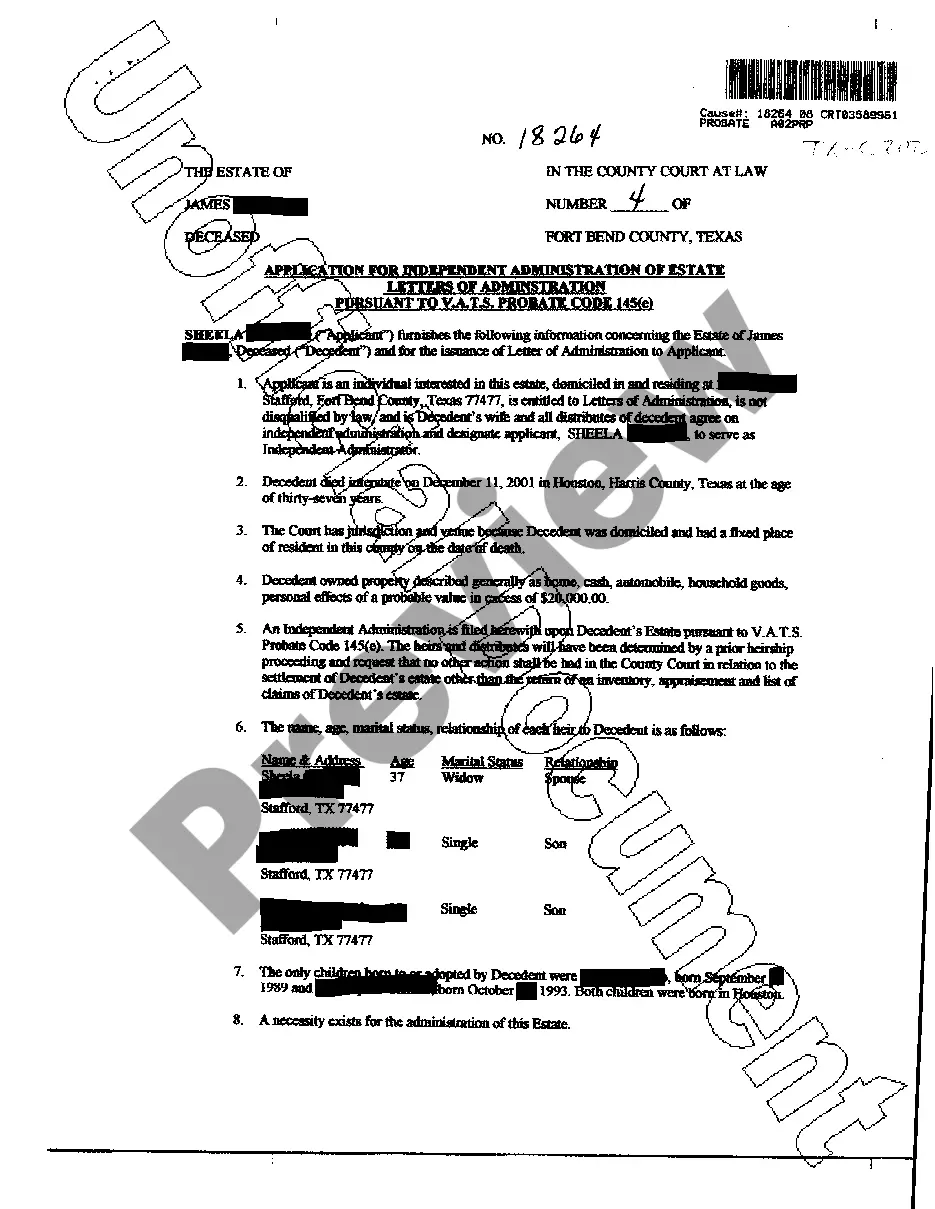

Dallas Texas Application for Independent Administration of Estate

Description

How to fill out Dallas Texas Application For Independent Administration Of Estate?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Dallas Texas Application for Independent Administration of Estate gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Dallas Texas Application for Independent Administration of Estate takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Dallas Texas Application for Independent Administration of Estate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

By far, the most popular method of probating an estate in Texas is the Independent Probate Administration. In this type of administration, the Court appoints the executor or administrator to work independently of the court's supervision.

You'll have to file a request in the county where the deceased person lived at the time of their death. The paperwork will ask for you to be officially acknowledged as the legal executor representing the estate. In addition to the petition, you'll need to file a valid will, if one exists, and the death certificate.

Texas estates are settled in two ways. In a dependent administration, the executor or representative must get court approval for most actions and report regularly to the probate judge. In an independent administration, the executor/representative is given more authority and autonomy to carry out his or her duties.

Application for Independent Administration The Application will include, among other things, the decedent's identity, domicile, and date of death, along with a list of all known heirs and the relationship of each heir to the decedent.

Letters testamentary or letters of administration give the personal representative the legal authority to administer the decedent's probate estate. The letters provide proof of appointment and qualification of the personal representative of an estate and the date of qualification.

How to get Letters Testamentary or Letters of Administration: First, file an application for probate. You'll need to file with the court in the county in which the decedent died. Notify interested parties.Appear at a hearing.Be appointed by a judge.Perform the duties as an Executor or Administrator.

An independent administration is a non-court administration. After a person has applied for letters testamentary and been qualified as independent executor by the court, the executor files an inventory of the estate's assets and their appraised value, and a list of claims of the estate.

Independent Administration An interested person may petition for his appointment as administrator of the intestate estate. In the alternative, all heirs may consent for the administrator to handle the estate; this option requires the agreement of all heirs who must signify their approval before the court.

Before you can probate an estate in Texas, you need to be appointed by a court. Once you are appointed, you file an oath of office and, in some cases, a bond. At this point you are considered ?qualified? to be the estate administrator and you can proceed by requesting letters of administration.

Normally, one or more of the executors named in the will applies for the grant of probate. Otherwise (if the person died without a will or the will did not appoint executors) a beneficiary or relative can be the administrator and can apply for letters of administration.

More info

Who Must File an Order of Independent Administration: Custodians. Who Can Sue on Independent Administration of the Estate: A person named in the will. A person under the age of 18 that inherits the assets of an adult named in the will. What Happens to the Assets of the Will's Administrators: At the death of the will's administrator, the assets of the beneficiaries become the property of the beneficiaries by will: The property of a parent, spouse, or person living jointly with the intestate by their spouse (the “parent or parent and spouse” rule×. An employee named in the will (this rule is different from most states×. The property in an account set up by the will (called a “mutual account”) The property, or a legatee interest in the property, of a dependent child after birth (also by law, but this must be a minor child×. (The common rule is that this rule does not apply, although the court can order it.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.