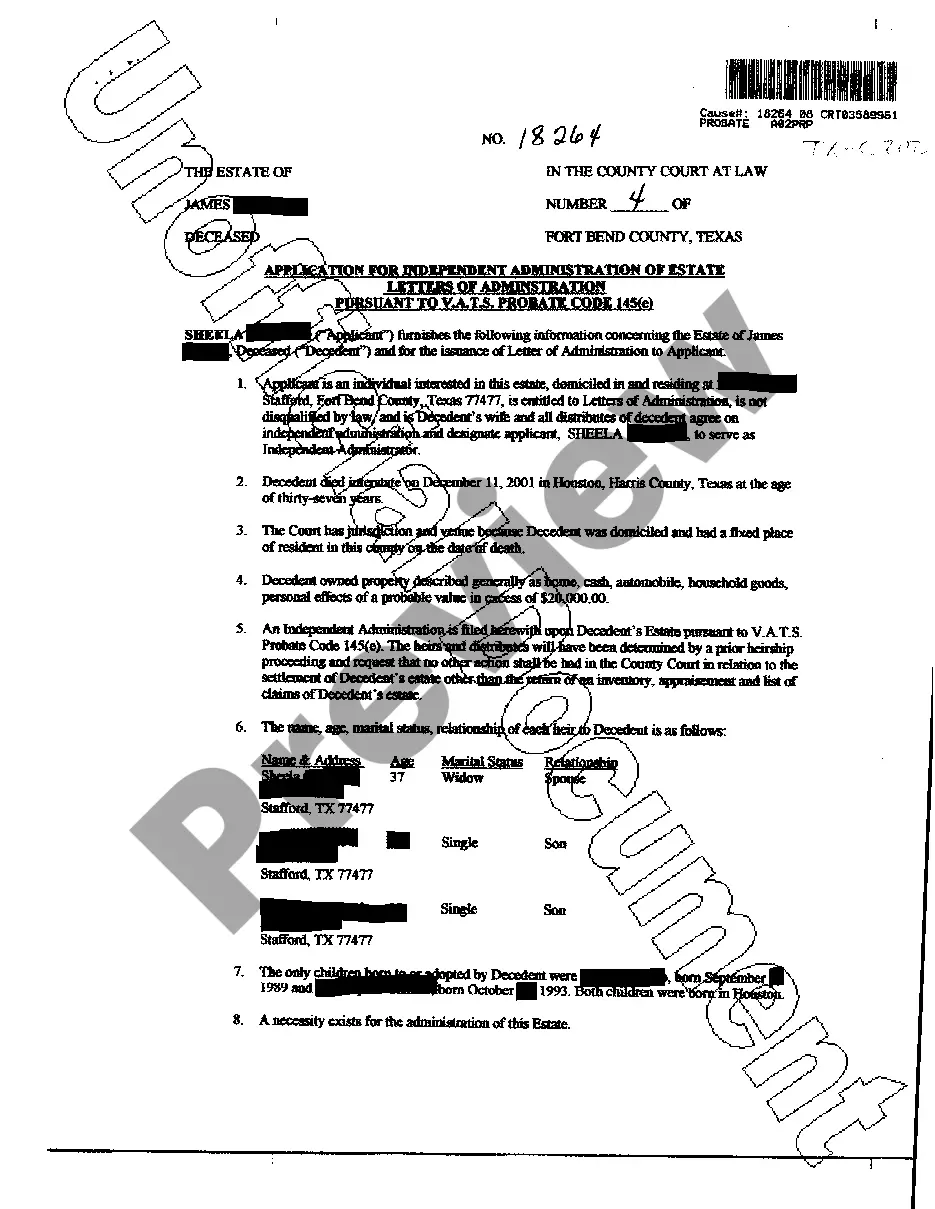

The McAllen Texas Application for Independent Administration of Estate is a legal document used to simplify the probate process for an estate in McAllen, Texas. This application allows the executor or administrator of the estate to administer and distribute assets without the need for extensive court supervision. This application is commonly used in cases where the deceased had a valid Texas will or when there is no will, but the heirs agree on the distribution of assets. To file a McAllen Texas Application for Independent Administration of Estate, certain criteria must be met. The applicant must first be appointed as an executor or administrator by the court. It is essential to gather all necessary documents and information regarding the deceased's assets, debts, and beneficiaries. This ensures a smooth and efficient administration process. The McAllen Texas Application for Independent Administration of Estate can be categorized into two types: Independent Administration and Independent Administration with Will Annexed. 1. Independent Administration: This type applies when the deceased left a valid will, and the named executor is applying for independent administration. In this case, the executor can act without court supervision, allowing for a faster distribution of assets. The executor will have the authority to sell, mortgage, or lease estate property, as well as manage and settle all debts. 2. Independent Administration with Will Annexed: This type of application is utilized when the deceased had a will, but no executor was named or the named executor is unable or unwilling to serve. In this situation, the court will appoint an alternate executor who can request independent administration. The process remains similar to the standard independent administration application, but the executor may need to provide additional documentation and explain the reason for the change in executor ship. When filing the McAllen Texas Application for Independent Administration of Estate, it is necessary to include important information such as the deceased's full legal name, date of death, and residential address. The applicant must also provide details about any existing debts, creditors, and known beneficiaries. Additionally, an inventory of assets, including bank accounts, investments, properties, and personal belongings, should be compiled. It is crucial to be thorough and accurate when completing this application to avoid any delays or legal complications. By choosing the appropriate McAllen Texas Application for Independent Administration of Estate and submitting all the required information correctly, the executor or administrator can streamline the probate process and efficiently fulfill their duties in accordance with Texas probate laws.

McAllen Texas Application for Independent Administration of Estate

State:

Texas

City:

McAllen

Control #:

TX-C202

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Application for Independent Administration of Estate

The McAllen Texas Application for Independent Administration of Estate is a legal document used to simplify the probate process for an estate in McAllen, Texas. This application allows the executor or administrator of the estate to administer and distribute assets without the need for extensive court supervision. This application is commonly used in cases where the deceased had a valid Texas will or when there is no will, but the heirs agree on the distribution of assets. To file a McAllen Texas Application for Independent Administration of Estate, certain criteria must be met. The applicant must first be appointed as an executor or administrator by the court. It is essential to gather all necessary documents and information regarding the deceased's assets, debts, and beneficiaries. This ensures a smooth and efficient administration process. The McAllen Texas Application for Independent Administration of Estate can be categorized into two types: Independent Administration and Independent Administration with Will Annexed. 1. Independent Administration: This type applies when the deceased left a valid will, and the named executor is applying for independent administration. In this case, the executor can act without court supervision, allowing for a faster distribution of assets. The executor will have the authority to sell, mortgage, or lease estate property, as well as manage and settle all debts. 2. Independent Administration with Will Annexed: This type of application is utilized when the deceased had a will, but no executor was named or the named executor is unable or unwilling to serve. In this situation, the court will appoint an alternate executor who can request independent administration. The process remains similar to the standard independent administration application, but the executor may need to provide additional documentation and explain the reason for the change in executor ship. When filing the McAllen Texas Application for Independent Administration of Estate, it is necessary to include important information such as the deceased's full legal name, date of death, and residential address. The applicant must also provide details about any existing debts, creditors, and known beneficiaries. Additionally, an inventory of assets, including bank accounts, investments, properties, and personal belongings, should be compiled. It is crucial to be thorough and accurate when completing this application to avoid any delays or legal complications. By choosing the appropriate McAllen Texas Application for Independent Administration of Estate and submitting all the required information correctly, the executor or administrator can streamline the probate process and efficiently fulfill their duties in accordance with Texas probate laws.

Free preview

How to fill out McAllen Texas Application For Independent Administration Of Estate?

If you’ve already used our service before, log in to your account and save the McAllen Texas Application for Independent Administration of Estate on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your McAllen Texas Application for Independent Administration of Estate. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!