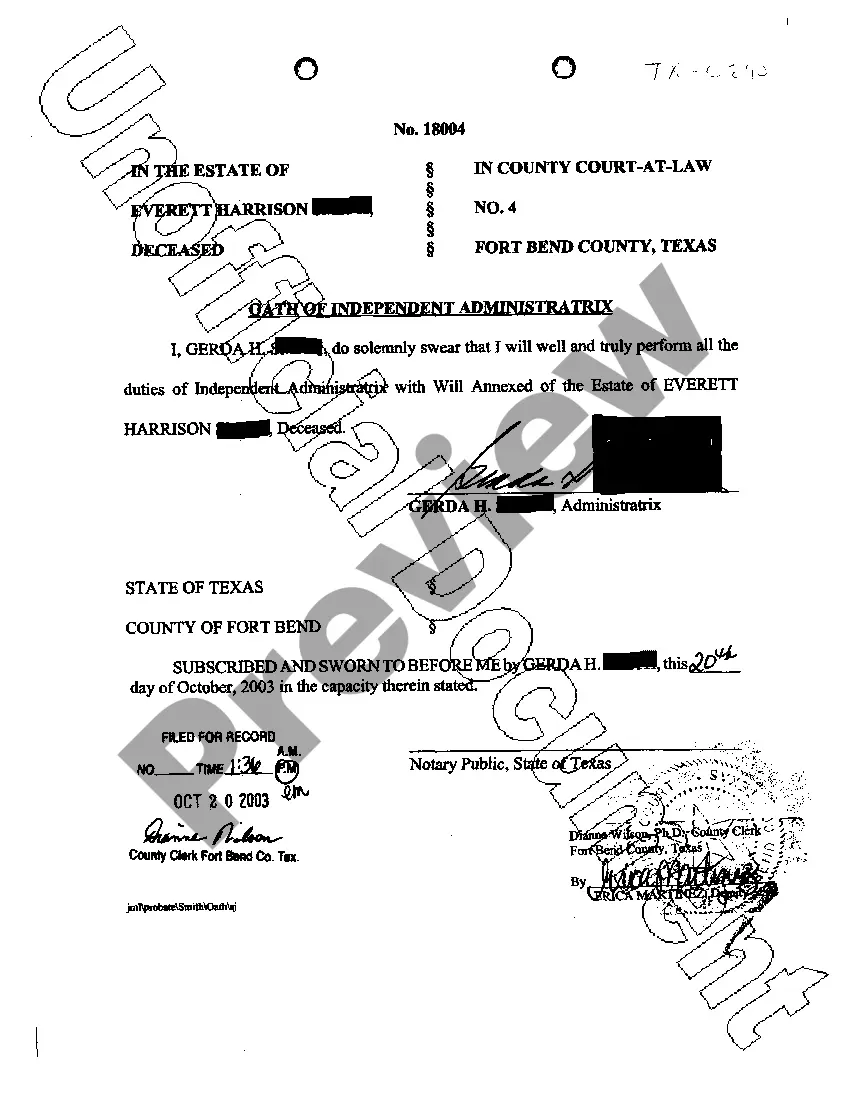

The Fort Worth Texas Oath of Independent Administration is a legal document that is completed when someone is appointed as an independent administration to handle the affairs of a deceased person's estate in Fort Worth, Texas. This oath is an official declaration made by the appointed administration, affirming their acceptance of the responsibilities and obligations associated with the role. Keywords: Fort Worth, Texas, oath, independent administration, legal document, appointed, deceased person's estate, responsibilities, obligations. There are different types of Fort Worth Texas Oath of Independent Administration, depending on the specific circumstances and requirements of the estate. These may include: 1. Independent Administration with Will Annexed: This type of administration is appointed when the deceased person has left a valid will, but the named executor is unable or unwilling to fulfill their duties. The administration takes over the administration of the estate according to the provisions outlined in the will. 2. Independent Administration Without Will: In cases where the deceased person did not leave a will or the will is deemed invalid, an independent administration without will is appointed. They are responsible for distributing the estate assets according to the laws of intestacy, which outline who inherits in the absence of a will. 3. Temporary Independent Administration: In some instances, a temporary independent administration may be appointed to manage the estate's affairs until a permanent administration can be named or until a pending matter is resolved. This temporary appointment ensures that the estate's operations continue during any delays or transitions in the administration process. 4. Emergency Independent Administration: This specific type of administration may be appointed in urgent situations where an estate requires immediate attention and there is a need to prevent potential harm or loss to the estate. The emergency independent administration has the authority to take immediate action to safeguard the assets and interests of the estate. By defining and understanding these different types of Fort Worth Texas Oath of Independent Administration, individuals involved in estate administration can better navigate the legal processes and fulfill their duties accordingly.

Fort Worth Texas Oath of Independent Administratrix

Description

How to fill out Fort Worth Texas Oath Of Independent Administratrix?

If you have previously utilized our service, Log In to your account and retrieve the Fort Worth Texas Oath of Independent Administratrix on your device by selecting the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business needs!

- Ensure you’ve found a suitable document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your needs. If it doesn’t suit you, use the Search tab above to locate the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process the payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Fort Worth Texas Oath of Independent Administratrix. Choose the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Unless limited by the terms of a will, an independent executor, in addition to any power of sale of estate property given in the will, and an independent administrator have the same power of sale for the same purposes as a personal representative has in a supervised administration, but without the requirement of court

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

An independent administration is a non-court administration. After a person has applied for letters testamentary and been qualified as independent executor by the court, the executor files an inventory of the estate's assets and their appraised value, and a list of claims of the estate.

When someone is named as the executor of a will they become responsible for performing a series of duties in order to complete the probate process. If you have more than one executor, then these co-executors must perform all these duties together.

Types of Property Exempt from Probate The asset is held in joint tenancy, such as a home where two people's names are on the deed; Community property with the right of survivorship; Payable-on-death bank accounts; Proceeds and benefits that are payable via a life insurance policy; and.

Can I serve as independent executor without an attorney representing me? Probably not. Most courts will not allow a person to act in a fiduciary capacity without an attorney.

Under the Probate and Administration Act 1959, an executor or administrator cannot sell any property that's still under the deceased's estate, unless he/she obtains a court order for sale.

Co-executors are legally required to work together It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died.

An executor is considered independent if the decedent (person who passed away) died without a Will OR if the decedent left a Will that specifically states that his executor should be independent. When the executor is independent, they are not dependent upon the Court for oversight and approval of all actions.

Clearly under new Section 145C an independent executor or independent administrator may sell real property if necessary to pay expenses, allowances and claims (Section 341(1)) regardless of whether the will contains a power of sale and so long as the terms of the will do not limit the power of sale.