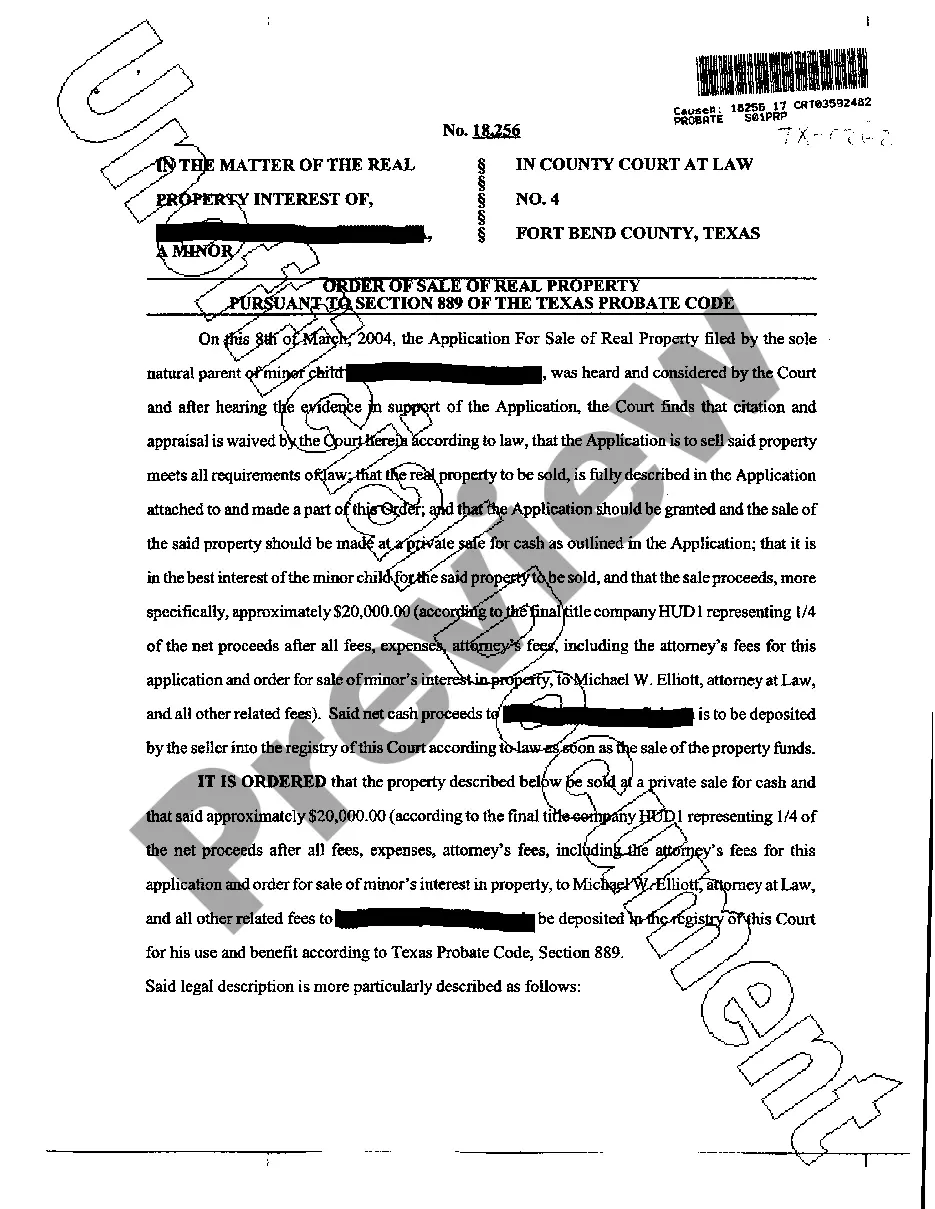

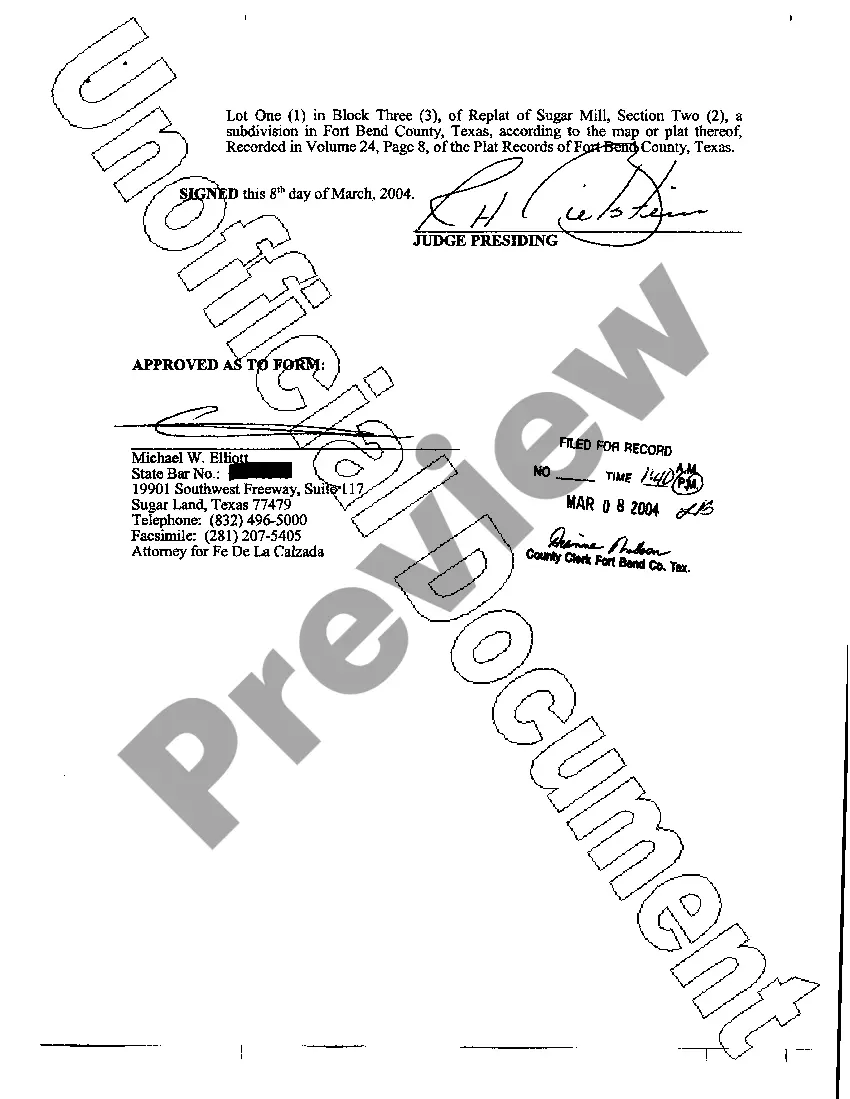

In Beaumont, Texas, an Order of Sale of Real Property is a legal document issued by a court that authorizes the sale of a property to satisfy a debt or satisfy a judgment against the property owner. This order is typically made in cases where the owner has been delinquent on mortgage payments, taxes, or other financial obligations related to the property. The primary purpose of the Beaumont Texas Order of Sale of Real Property is to initiate a foreclosure process, allowing the property to be sold at a public auction. The proceeds from the sale are then used to pay off the debts owed by the property owner. The order ensures that the sale is conducted in a fair and transparent manner, protecting the rights of both the creditor and the homeowner. There are various types of Beaumont Texas Orders of Sale of Real Property, depending on the specific circumstances of the property. These may include: 1. Mortgage Foreclosure: This type of order is issued when a property owner fails to make mortgage payments, leading to default. The lender can obtain an Order of Sale to reclaim the property and recoup the outstanding debt. 2. Tax Liens: When property taxes are left unpaid, the government can place a lien on the property. If the taxes remain unpaid over a certain period, an Order of Sale may be issued to auction the property, allowing the government to collect the unpaid taxes. 3. Judgment Liens: If a property owner has a court judgment against them due to unpaid debts, the creditor can file for an Order of Sale to recover the unpaid amount by selling off the property. 4. Trustee Sales: In some cases, homeowners may sign a deed of trust allowing a trustee to sell the property in the event of default. If the borrower fails to meet the terms of the loan, the trustee can obtain an Order of Sale to proceed with the foreclosure process. It is crucial for property owners facing foreclosure to seek legal counsel and understand their rights and options when confronted with a Beaumont Texas Order of Sale of Real Property. They may have the opportunity to redeem the property or negotiate repayment plans with the creditor to avoid losing their home. It is essential to act promptly to explore all available avenues and protect their interests during this complex legal process.

Beaumont Texas Order of Sale of Real Property

Description

How to fill out Beaumont Texas Order Of Sale Of Real Property?

Take advantage of the US Legal Forms and have immediate access to any form you require. Our useful platform with a large number of documents makes it simple to find and obtain virtually any document sample you want. You can export, complete, and certify the Beaumont Texas Order of Sale of Real Property in just a matter of minutes instead of surfing the Net for several hours searching for an appropriate template.

Using our catalog is an excellent strategy to improve the safety of your record filing. Our experienced attorneys regularly check all the records to ensure that the forms are relevant for a particular state and compliant with new laws and polices.

How can you obtain the Beaumont Texas Order of Sale of Real Property? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions below:

- Open the page with the template you require. Make certain that it is the form you were seeking: check its title and description, and utilize the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to get the Beaumont Texas Order of Sale of Real Property and change and complete, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy template libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Beaumont Texas Order of Sale of Real Property.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!

Form popularity

FAQ

To conduct a property search in Texas, you can start by visiting the county appraisal district's website or the local county clerk's office. Look for the section that deals with property records, which may include the Beaumont Texas Order of Sale of Real Property. You can search by address, owner name, or property ID to find relevant information. If you want a more streamlined experience, consider using platforms like US Legal Forms to assist you with your property search and legal documentation.

Yes, home sales are public record in Texas. This means you can access information about transactions, including details related to the Beaumont Texas Order of Sale of Real Property. To view these records, you can visit your local county clerk's office, or utilize online resources. These records are important for understanding property ownership and sale history.

Dependent administration is a type of estate administration in which the court plays a significant role in overseeing the process. This includes the management of the estate's assets and the authority to control sales of property. If you're handling such matters, understanding dependent administration is key to the Beaumont Texas Order of Sale of Real Property. US Legal Forms offers valuable resources to help streamline this administrative process.

Yes, an administrator can sell property in Texas, but specific procedures must be followed. Generally, the sale of real estate needs court approval, particularly if it falls under dependent administration. Knowing these requirements is essential for successfully managing the Beaumont Texas Order of Sale of Real Property. Utilizing US Legal Forms can simplify this process, providing the right documents and instructions you need.

A dependent administration sale refers to the process where a court oversees the sale of real property by an executor or administrator of an estate. This type of sale requires court approval, ensuring that all interested parties are considered. Understanding this process is crucial if you're involved with the Beaumont Texas Order of Sale of Real Property. Resources like US Legal Forms can provide necessary templates and guidance to navigate dependent administration effectively.

While you can sell property in Texas without an attorney, it is highly advisable to seek legal guidance. Selling property can involve complex issues, including contracts and disclosures. An attorney can help ensure you follow the Beaumont Texas Order of Sale of Real Property procedures correctly. This support can save you from potential legal troubles down the line.

To perform a title search on a property yourself in Texas, begin by gathering information like the property address and previous owner details. You will review public records at the county clerk’s office or online, focusing on the chain of title and any existing liens. US Legal Forms can support you in this process by providing templates and resources for the Beaumont Texas Order of Sale of Real Property, making your title search more efficient and manageable.

Conducting a deed search in Texas involves checking the county clerk’s records, either online or at their office. You will need relevant details such as the property's address, the owner's name, or the parcel number. For those seeking quick and easy access to records related to the Beaumont Texas Order of Sale of Real Property, the US Legal Forms platform offers streamlined tools that can assist throughout your search.

To look up a deed in Texas, start by visiting the county clerk's office where the property is located. You can access public records through their website or in person. Additionally, using a platform like US Legal Forms can simplify your search for the Beaumont Texas Order of Sale of Real Property by providing resources and guidance tailored to your needs.

Writing a sale of property involves creating a straightforward contract that outlines the sale terms, buyer and seller information, and property details. It's important to include any contingencies or obligations of both parties. For sellers looking to navigate the Beaumont Texas Order of Sale of Real Property, following a template can streamline this writing process.