Frisco Texas Order of Sale of Real Property is a legal process by which a property is sold to recover outstanding debts or to settle disputes. This order is typically issued by a court or a sheriff's office and is commonly used in foreclosure cases or when there are judgments or liens against the property. Keywords: Frisco Texas, Order of Sale, Real Property, Outstanding Debts, Foreclosure, Judgments, Liens, Court, Sheriff's Office. Types of Frisco Texas Order of Sale of Real Property: 1. Foreclosure Order of Sale: This type of order is issued when a homeowner fails to pay their mortgage payments, resulting in the lender initiating foreclosure proceedings. The property is then sold in an auction to recover the outstanding debt. 2. Tax Lien Order of Sale: When a property owner fails to pay their property taxes, the government may place a tax lien on the property. If the taxes remain unpaid, the government can obtain an order of sale to auction the property and recover the delinquent taxes. 3. Judgment Order of Sale: This type of order is issued when a court rules in favor of a creditor in a lawsuit and grants a judgment against the debtor. If the debtor fails to satisfy the judgment, the creditor can request an order of sale to force the sale of the property to collect the owed amount. 4. Mechanic's Lien Order of Sale: In cases where a contractor or supplier hasn't been paid for work done on a property, they can file a mechanic's lien. If the debt remains unpaid, they can seek an order of sale to sell the property and recover the owed funds. 5. IRS Order of Sale: The IRS can obtain an order of sale on a property if the owner fails to pay federal income taxes. This allows them to auction off the property to recoup the unpaid taxes. Overall, Frisco Texas Order of Sale of Real Property serves as a legal mechanism used to sell properties to settle financial obligations, clear title issues, and provide creditors with an opportunity to collect outstanding debts.

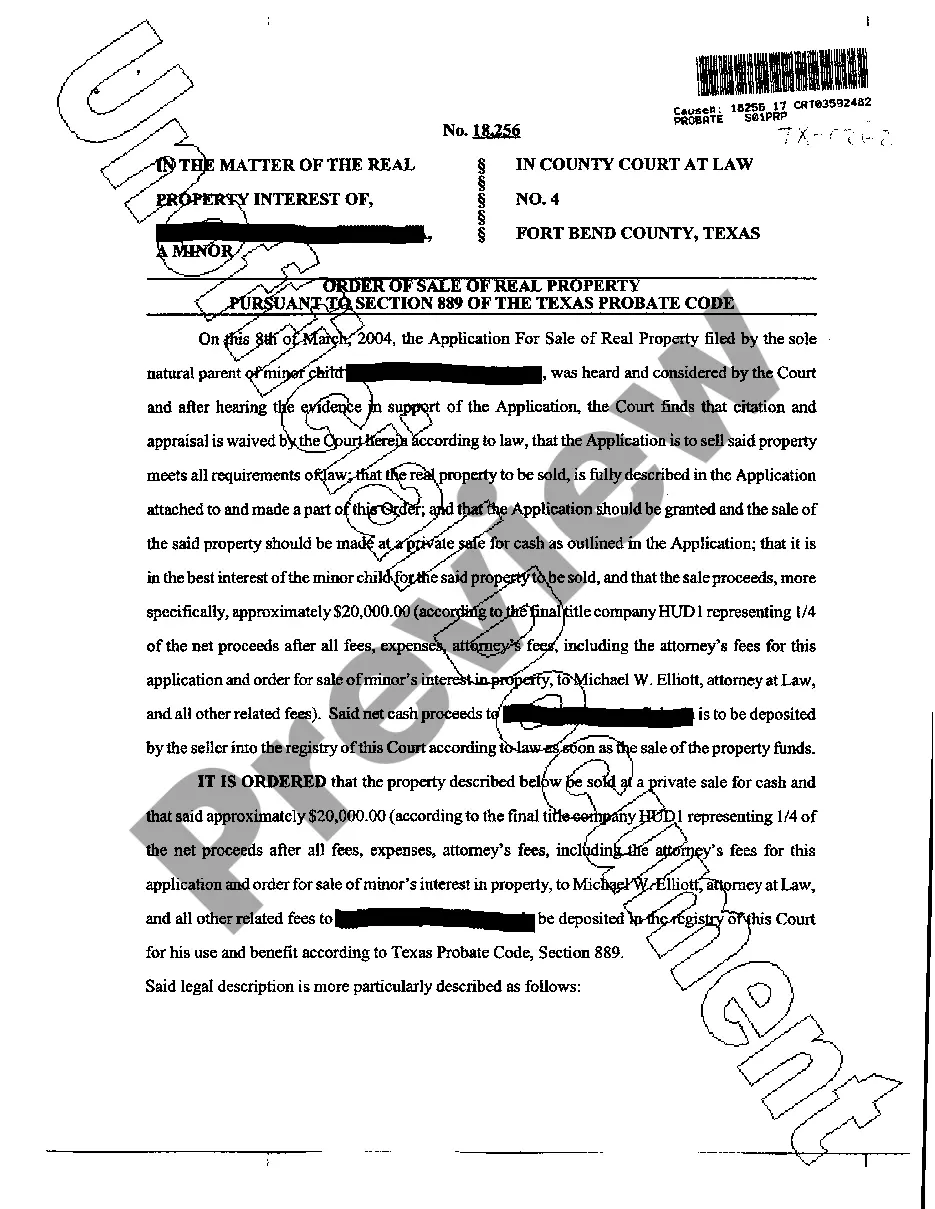

Frisco Texas Order of Sale of Real Property

Description

How to fill out Frisco Texas Order Of Sale Of Real Property?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to draft this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you need the Frisco Texas Order of Sale of Real Property or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Frisco Texas Order of Sale of Real Property quickly employing our reliable platform. In case you are presently an existing customer, you can go on and log in to your account to get the needed form.

However, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Frisco Texas Order of Sale of Real Property:

- Be sure the template you have chosen is specific to your location since the rules of one state or area do not work for another state or area.

- Review the document and read a quick outline (if provided) of cases the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Frisco Texas Order of Sale of Real Property once the payment is through.

You’re all set! Now you can go on and print the document or fill it out online. If you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.