Round Rock Texas Motion to Close Temporary Administration is a legal process that involves terminating a temporary administration and discontinuing the management of an estate or trust. It is an important step in the probate process and ensures the proper distribution of assets to beneficiaries. In Round Rock, Texas, the motion to close temporary administration is typically filed when the executor or administrator of an estate believes that all necessary tasks have been completed. This motion signals to the court that the temporary administration is no longer needed, and the estate can be closed. There are a few different types of Round Rock Texas Motion to Close Temporary Administration that may be applicable depending on the circumstances of the estate: 1. Motion to Close Temporary Administration after Final Distribution: This motion is filed when all debts, expenses, tax, and distributions have been accounted for and completed. It signifies that all necessary tasks have been fulfilled, and the temporary administration can be closed. 2. Motion to Close Temporary Administration due to Lack of Assets: In cases where the estate has insufficient assets to cover outstanding debts or administration expenses, the executor may file this motion to request the closure of the temporary administration. By demonstrating that there are no remaining funds or assets to manage, the court can close the estate. 3. Motion to Close Temporary Administration with Pending Litigation: If there is ongoing litigation or unresolved legal matters related to the estate, the executor may file this motion to close the temporary administration. It allows the court to review the progress of the litigation and make a decision regarding the closure of the estate accordingly. 4. Motion to Close Temporary Administration with Outstanding Tax Matters: In cases where there are outstanding tax issues, such as unresolved tax audits or pending tax refunds, the executor can file this motion. It brings attention to the fact that the estate cannot be fully closed until these tax matters are resolved. When filing a Round Rock Texas Motion to Close Temporary Administration, it is crucial to include relevant keywords such as "Round Rock Texas," "Motion to Close," "Temporary Administration," "Estate," "Trust," and "Probate." Additionally, including specific circumstances or issues, such as "Final Distribution," "Lack of Assets," "Pending Litigation," and "Outstanding Tax Matters," will help make the content more targeted and relevant.

Round Rock Texas Motion to Close Temporary Administration

State:

Texas

City:

Round Rock

Control #:

TX-C268

Format:

PDF

Instant download

This form is available by subscription

Description

Motion to Close Temporary Administration

Round Rock Texas Motion to Close Temporary Administration is a legal process that involves terminating a temporary administration and discontinuing the management of an estate or trust. It is an important step in the probate process and ensures the proper distribution of assets to beneficiaries. In Round Rock, Texas, the motion to close temporary administration is typically filed when the executor or administrator of an estate believes that all necessary tasks have been completed. This motion signals to the court that the temporary administration is no longer needed, and the estate can be closed. There are a few different types of Round Rock Texas Motion to Close Temporary Administration that may be applicable depending on the circumstances of the estate: 1. Motion to Close Temporary Administration after Final Distribution: This motion is filed when all debts, expenses, tax, and distributions have been accounted for and completed. It signifies that all necessary tasks have been fulfilled, and the temporary administration can be closed. 2. Motion to Close Temporary Administration due to Lack of Assets: In cases where the estate has insufficient assets to cover outstanding debts or administration expenses, the executor may file this motion to request the closure of the temporary administration. By demonstrating that there are no remaining funds or assets to manage, the court can close the estate. 3. Motion to Close Temporary Administration with Pending Litigation: If there is ongoing litigation or unresolved legal matters related to the estate, the executor may file this motion to close the temporary administration. It allows the court to review the progress of the litigation and make a decision regarding the closure of the estate accordingly. 4. Motion to Close Temporary Administration with Outstanding Tax Matters: In cases where there are outstanding tax issues, such as unresolved tax audits or pending tax refunds, the executor can file this motion. It brings attention to the fact that the estate cannot be fully closed until these tax matters are resolved. When filing a Round Rock Texas Motion to Close Temporary Administration, it is crucial to include relevant keywords such as "Round Rock Texas," "Motion to Close," "Temporary Administration," "Estate," "Trust," and "Probate." Additionally, including specific circumstances or issues, such as "Final Distribution," "Lack of Assets," "Pending Litigation," and "Outstanding Tax Matters," will help make the content more targeted and relevant.

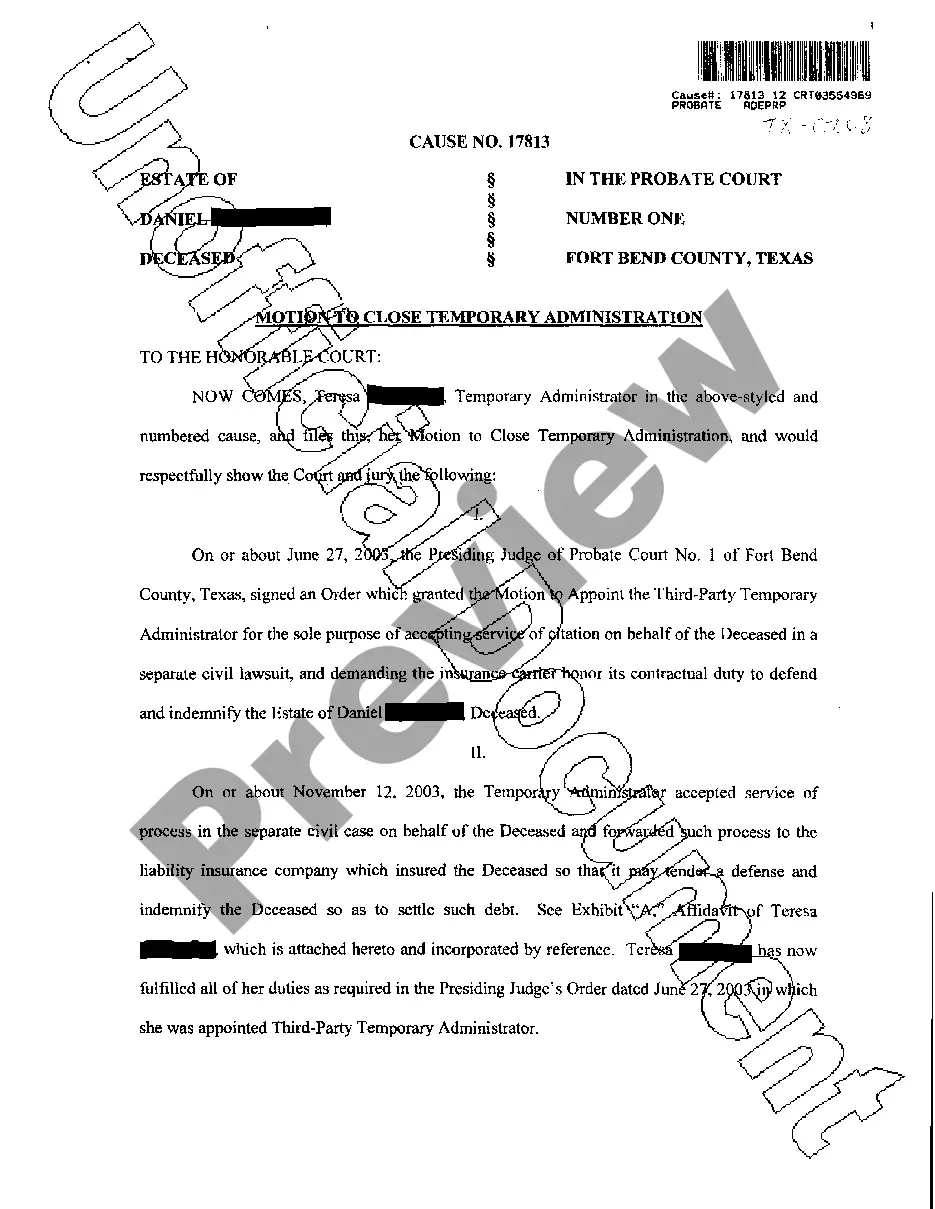

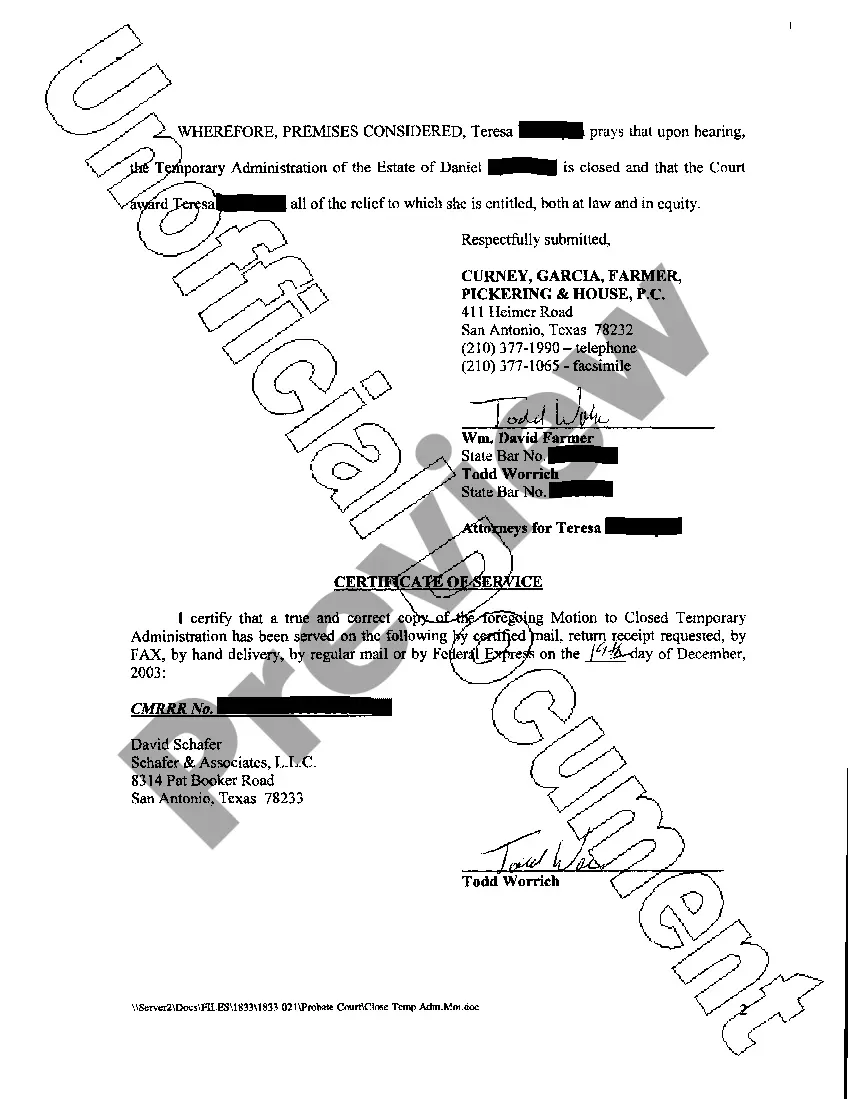

Free preview

How to fill out Round Rock Texas Motion To Close Temporary Administration?

If you’ve already utilized our service before, log in to your account and save the Round Rock Texas Motion to Close Temporary Administration on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Round Rock Texas Motion to Close Temporary Administration. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!