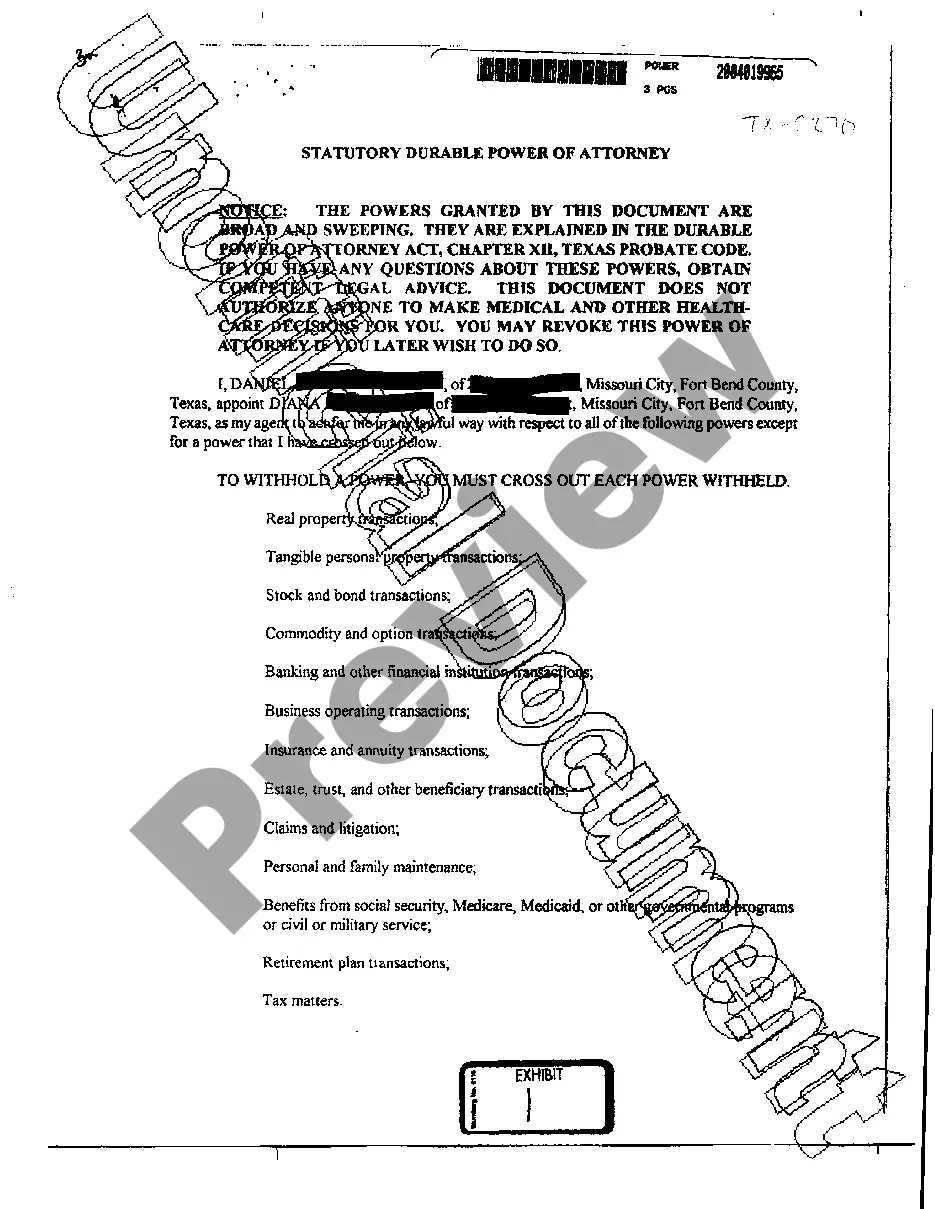

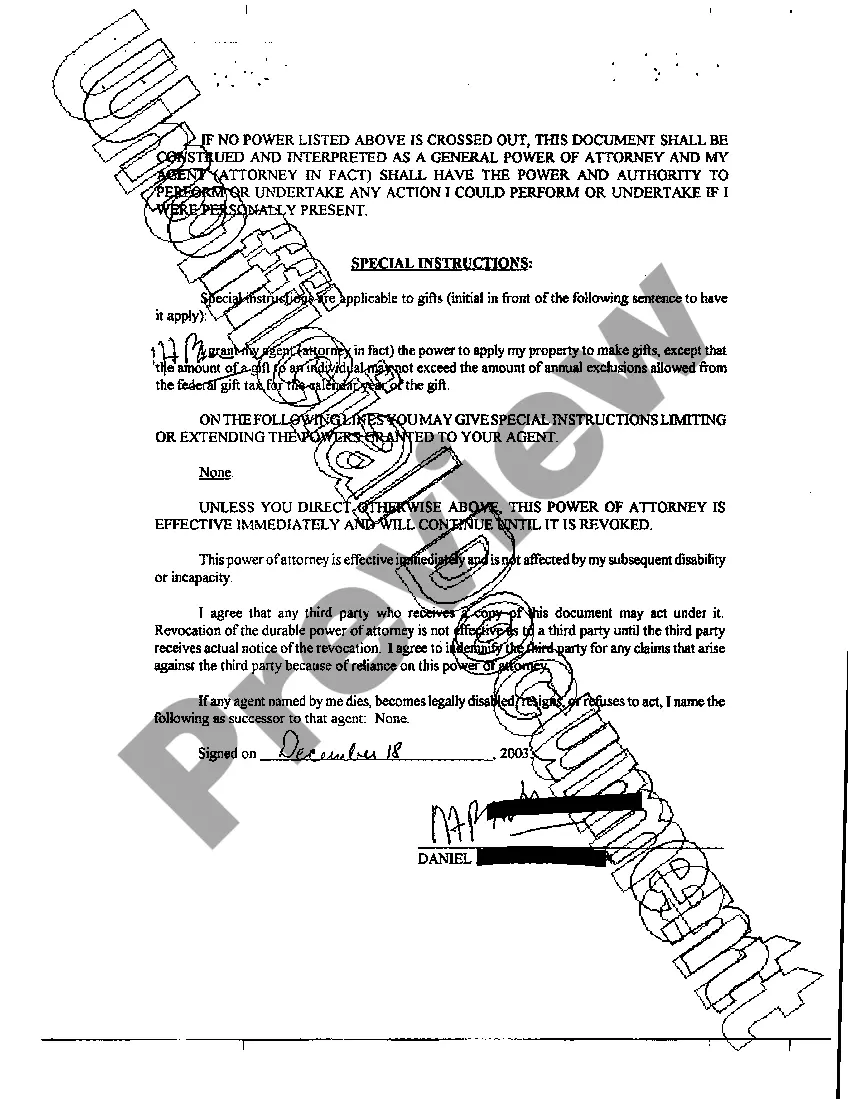

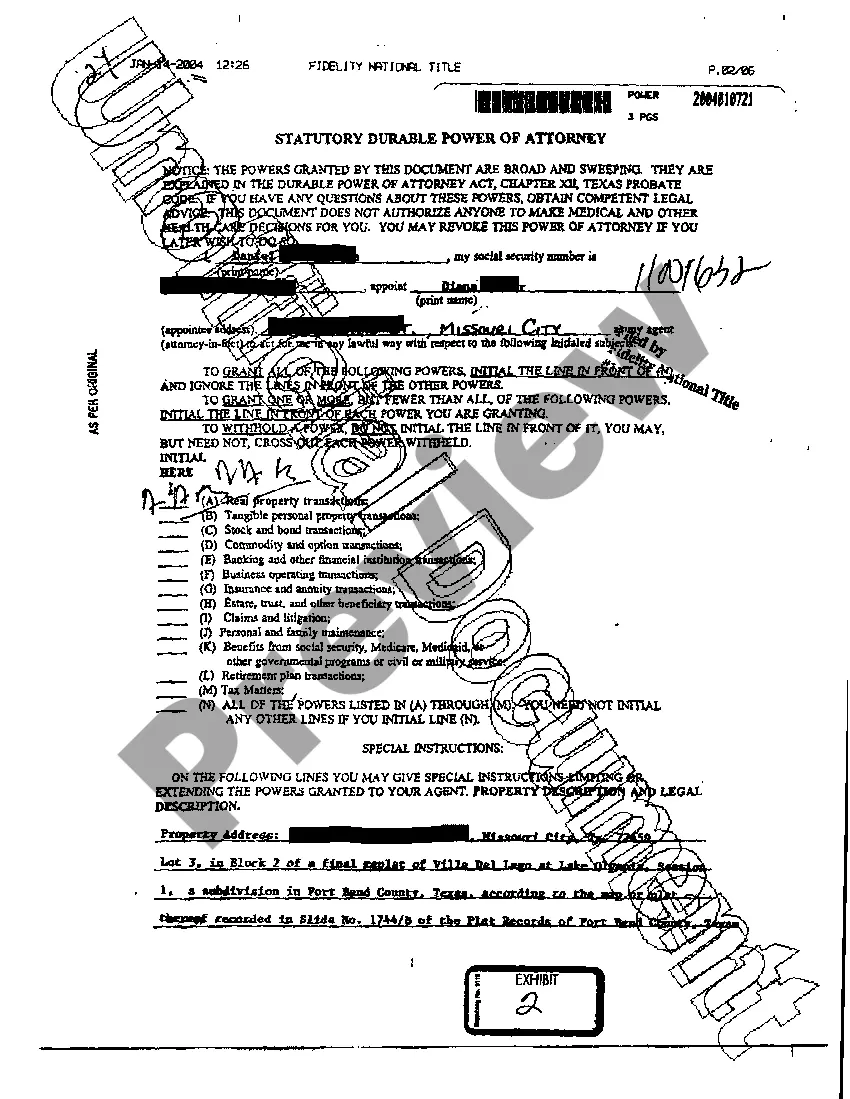

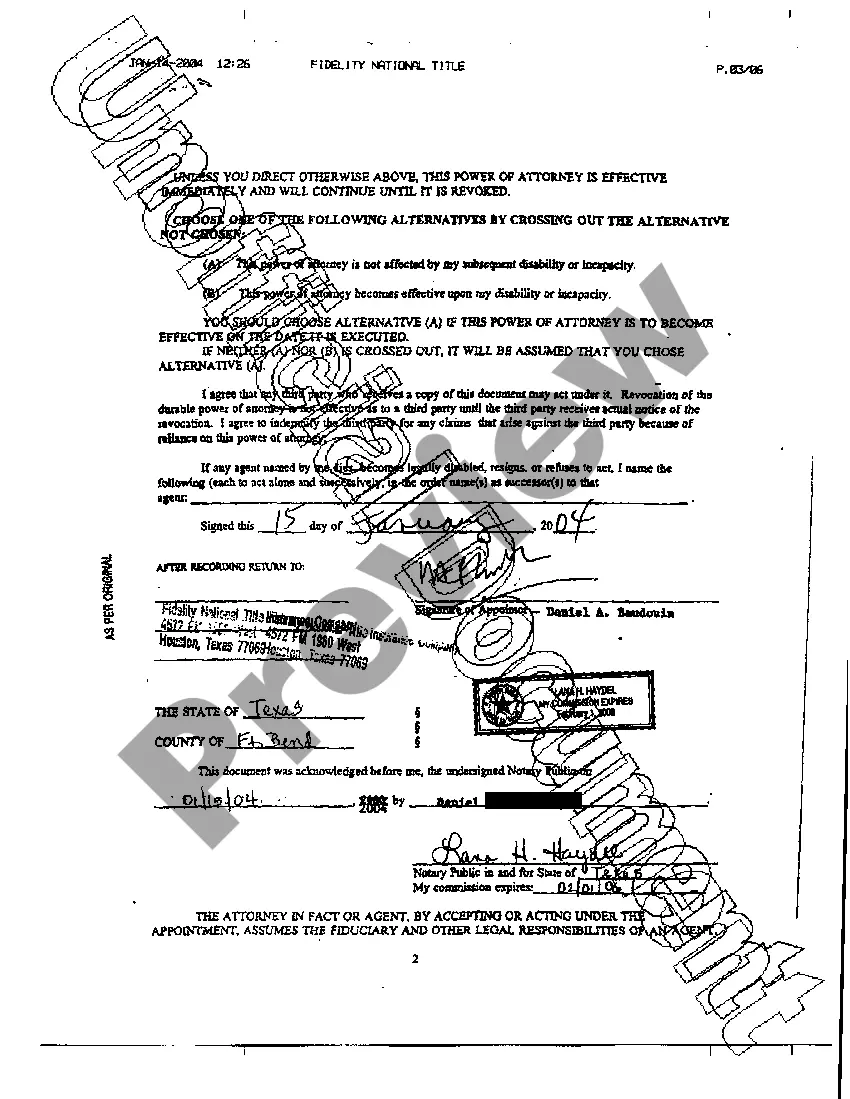

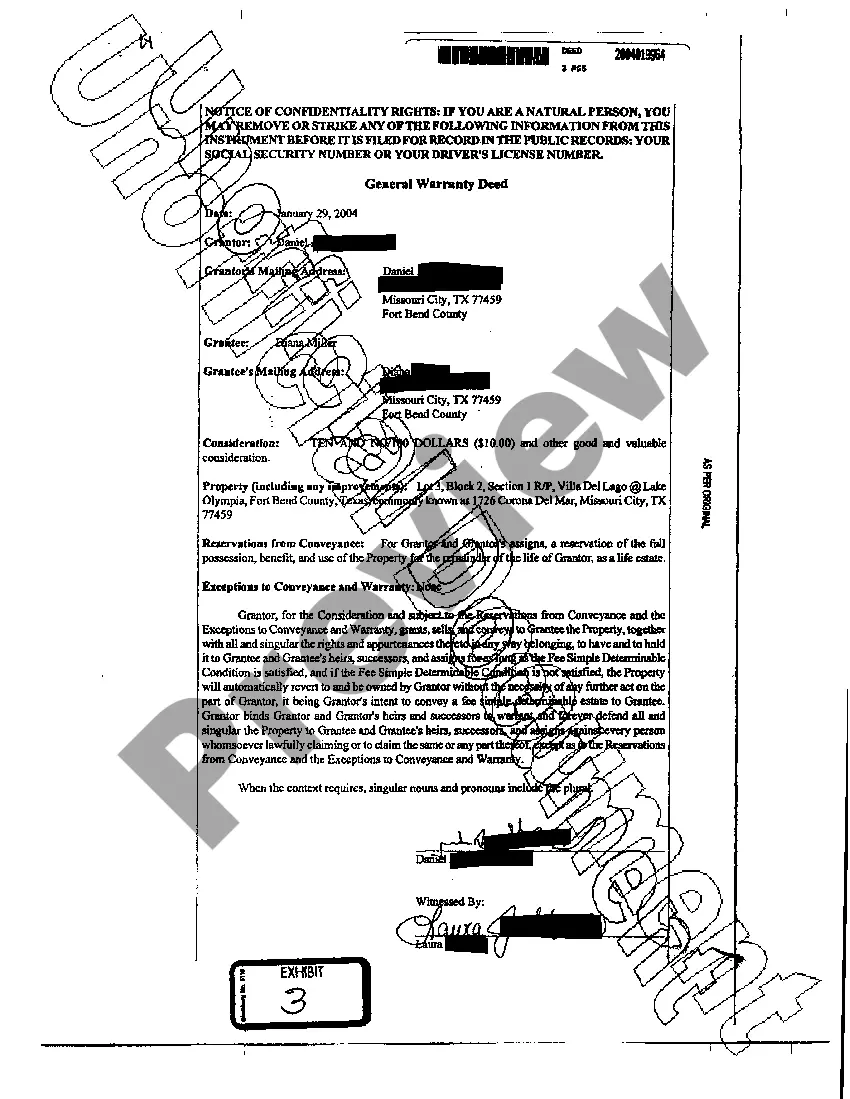

Pasadena Texas Statutory Durable Power of Attorney is a legal document that grants a designated individual or agent the authority to handle legal and financial matters on behalf of another person, known as the principal. This power can be effective immediately or when the principal becomes incapacitated and is designed to ensure that the principal's affairs are properly managed. One type of Pasadena Texas Statutory Durable Power of Attorney is the General Power of Attorney. This type grants the agent broad powers to act on behalf of the principal, including managing their finances, making legal decisions, handling real estate transactions, and more. Another type is the Limited Power of Attorney, which is more specific in nature. It grants the agent distinct powers for a limited period or specific purpose, such as dealing with a particular property or representing the principal in a specific legal matter. It is important to note that the Pasadena Texas Statutory Durable Power of Attorney must be created while the principal is mentally competent, and it continues to be valid even if the principal later becomes incapacitated, ensuring a seamless transition of decision-making authority. The agent chosen in the Pasadena Texas Statutory Durable Power of Attorney should be someone trustworthy and reliable, as they hold significant responsibility in managing the principal's affairs. The agent is legally obligated to act in the best interest of the principal, to keep accurate records of transactions, and to avoid any conflicts of interest. By creating a Pasadena Texas Statutory Durable Power of Attorney, individuals can have peace of mind knowing that their financial and legal matters are in the hands of someone they trust. It also provides a practical solution to situations where the principal is unable to handle their affairs personally due to incapacity or physical limitations. Overall, the Pasadena Texas Statutory Durable Power of Attorney serves as an essential legal tool for individuals in Pasadena, Texas, allowing them to plan for unforeseen circumstances and ensure their financial and legal matters are handled appropriately when they are unable to do so themselves.

Pasadena Texas Statutory Durable Power of Attorney

Description

How to fill out Pasadena Texas Statutory Durable Power Of Attorney?

Utilize the US Legal Forms and obtain prompt access to any form template you require.

Our user-friendly website featuring a vast array of templates simplifies the process of locating and acquiring nearly any document template you may need.

You can export, complete, and sign the Pasadena Texas Statutory Durable Power of Attorney in just a few minutes, rather than spending hours searching online for a suitable template.

Using our collection is an excellent approach to enhance the security of your document submissions. Our qualified legal experts routinely examine all the documents to ensure that the templates are suitable for a specific jurisdiction and comply with current laws and regulations.

If you haven’t created an account yet, follow the steps outlined below.

Locate the template you need. Ensure it is the template you were intending to find: verify its title and description, and utilize the Preview feature when available. Otherwise, use the Search field to identify the appropriate one.

- How can you acquire the Pasadena Texas Statutory Durable Power of Attorney.

- If you have a subscription, simply Log In to your account. The Download option will be visible on all the documents you review.

- Furthermore, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

While you do not need a lawyer to create a durable power of attorney in Texas, consulting one can provide added reassurance. A legal expert can help clarify the nuances of the Pasadena Texas Statutory Durable Power of Attorney, ensuring all legal requirements are met. If you prefer a self-service approach, platforms like USLegalForms can provide you with the necessary documents and guidance.

You can find Texas power of attorney forms at legal service websites or through local law offices. USLegalForms offers a straightforward solution, featuring downloadable templates for the Pasadena Texas Statutory Durable Power of Attorney. This resource can guide you in creating an effective and compliant document for your needs.

To obtain power of attorney forms in Texas, you can visit various legal websites or offices. Online platforms, such as USLegalForms, provide easy access to the Pasadena Texas Statutory Durable Power of Attorney forms. This option allows you to customize the document based on your needs and secure peace of mind.

Yes, you can write your own power of attorney in Texas. However, it is important to ensure that it meets state requirements. The document must include specific language to qualify as a Pasadena Texas Statutory Durable Power of Attorney. Consider using a trusted template or service, like USLegalForms, to simplify the process and ensure compliance.

A statutory durable power of attorney in Texas, notably the Pasadena Texas Statutory Durable Power of Attorney, is a legal document that allows you to appoint someone to manage your financial and legal affairs. This document remains effective even if you become incapacitated, ensuring that your chosen agent can act on your behalf without interruption. It is a crucial tool for anyone looking to secure their future and can be easily created with the help of platforms like USLegalForms.

A legal power of attorney, including the Pasadena Texas Statutory Durable Power of Attorney, cannot make certain critical decisions on your behalf. First, it cannot make decisions that conflict with your explicit wishes specified in a living will, such as end-of-life care. Second, it cannot alter your will or trust documents. Lastly, a power of attorney cannot make decisions regarding certain personal matters, such as marriage or divorce, which require personal consent.

While a durable power of attorney, including the Pasadena Texas Statutory Durable Power of Attorney, offers many benefits, there are potential disadvantages to consider. One major concern is the risk of abuse if the agent does not act in your best interest. Additionally, once you grant a durable power of attorney, you relinquish some control over your financial and legal affairs, which may be a source of worry for some individuals.

The key difference between durable and statutory power of attorney lies in the legal framework and authority granted. A statutory durable power of attorney, like the Pasadena Texas Statutory Durable Power of Attorney, is defined by Texas law and includes specific protections and limitations. In contrast, a regular durable power of attorney may lack these specific legal guidelines and might be limited in scope, making it essential to understand the type you are using.

The most powerful power of attorney is typically a statutory durable power of attorney, such as the Pasadena Texas Statutory Durable Power of Attorney. This type allows the agent to manage your affairs even if you become incapacitated. It grants significant authority, including handling financial transactions, managing property, and making healthcare decisions, ensuring that your preferences are honored when you are unable to express them.

In Texas, a durable power of attorney, including a Pasadena Texas Statutory Durable Power of Attorney, must be signed by the individual granting the authority and witnessed by at least two people or notarized. Notarization provides additional legal weight and helps avoid future disputes over the document's validity. Therefore, while it is possible to have a durable power of attorney that is simply witnessed, opting for notarization is recommended for added security.