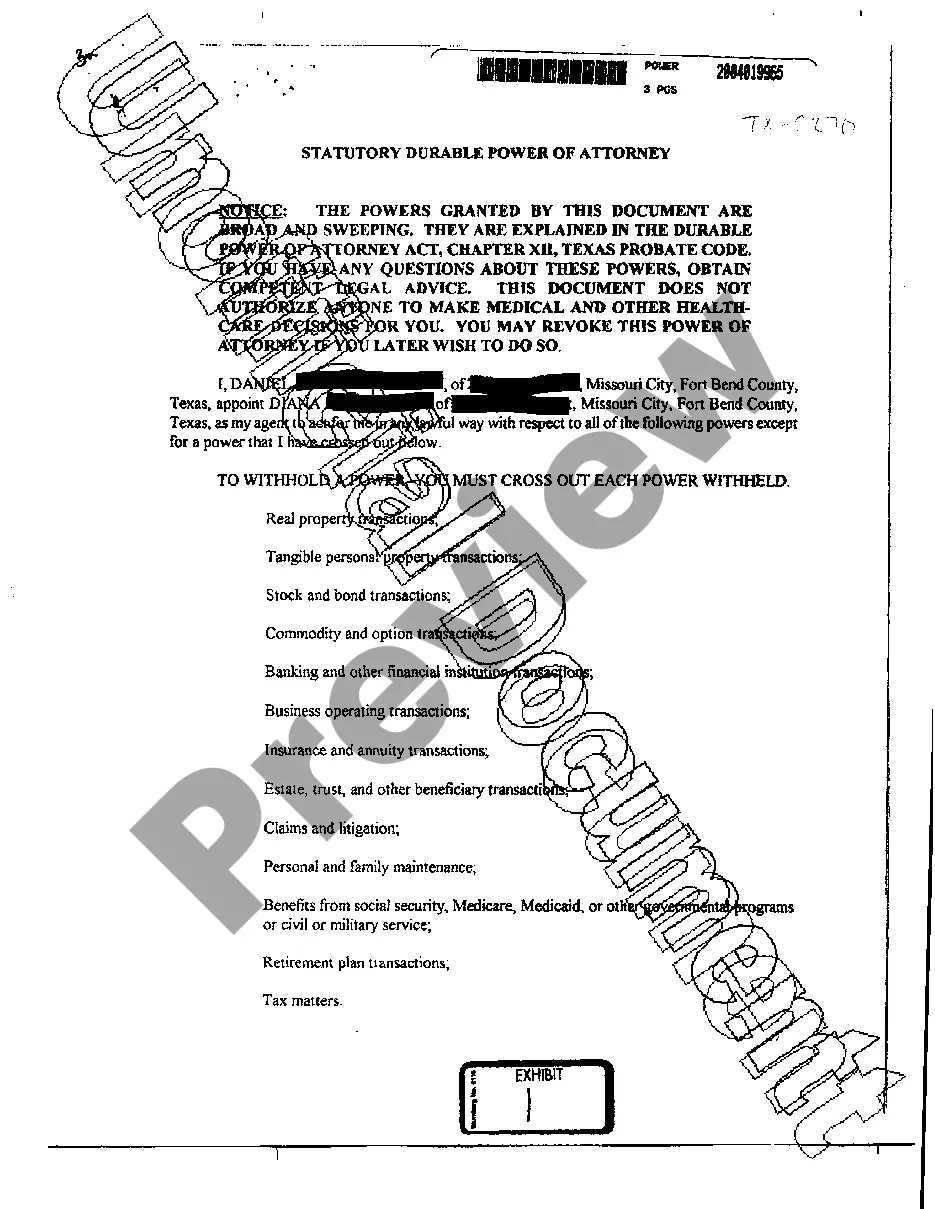

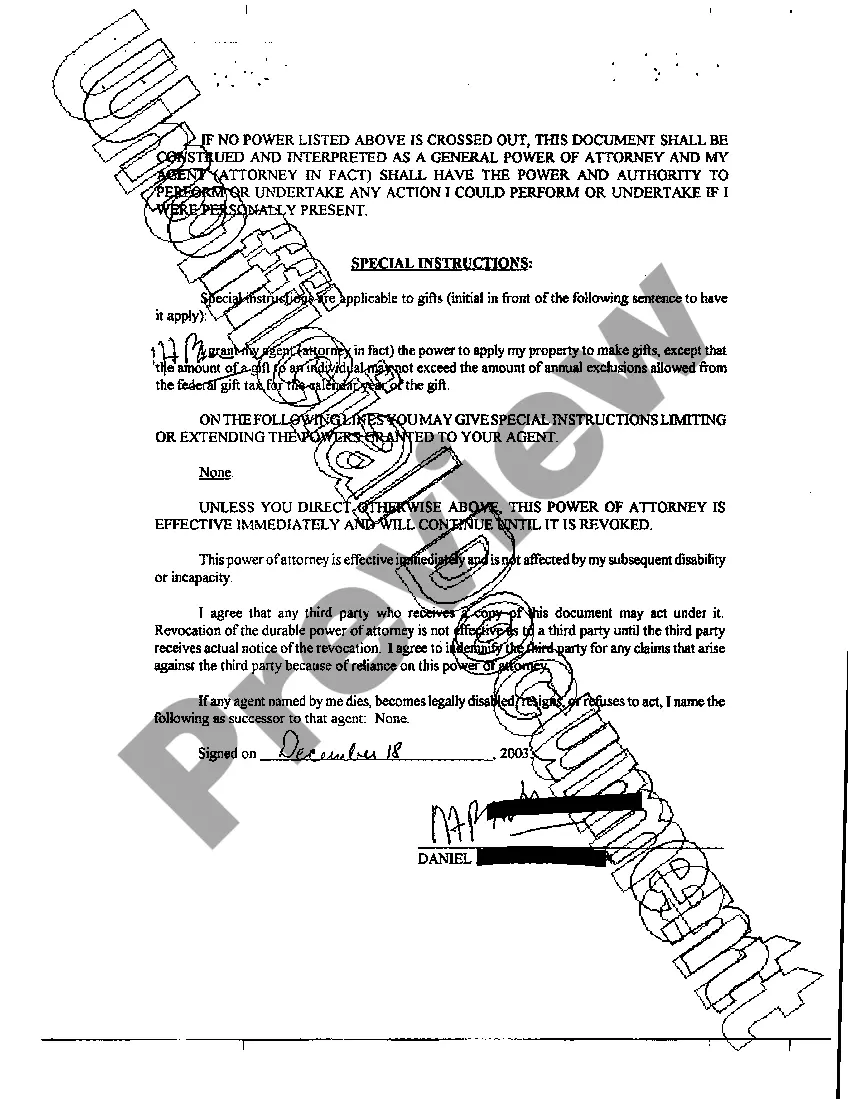

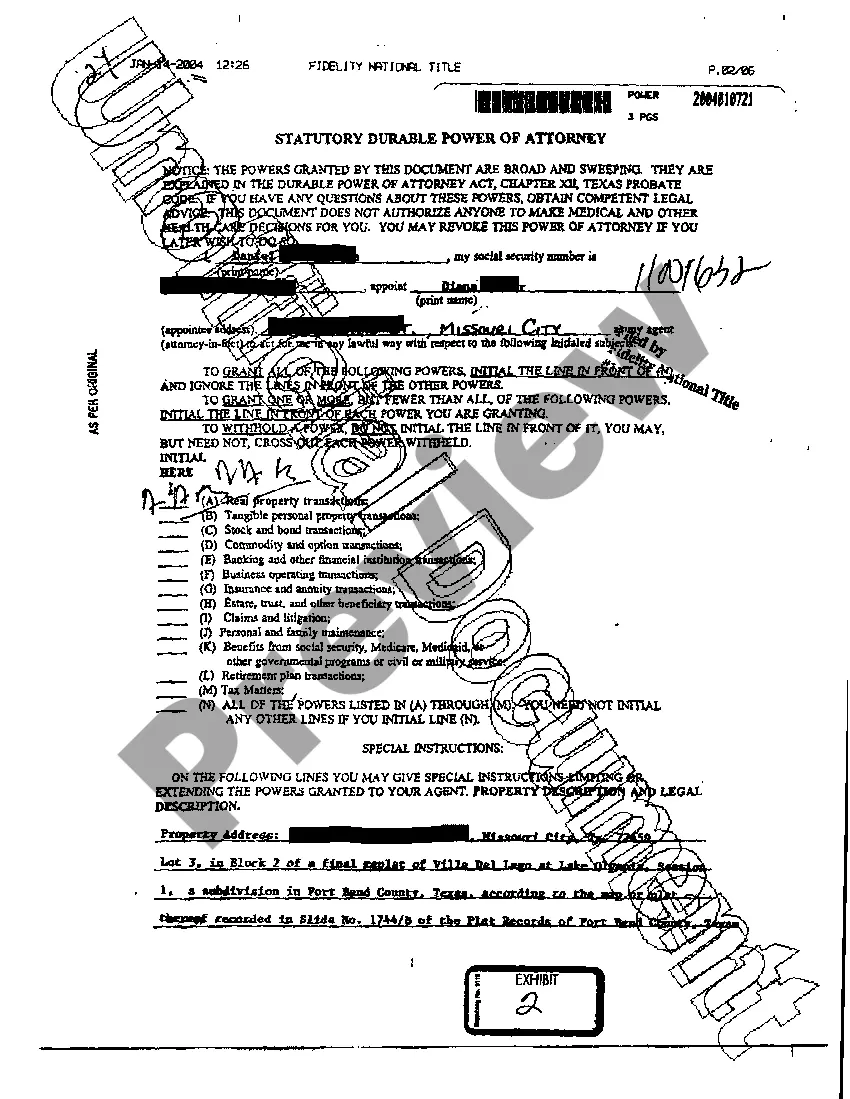

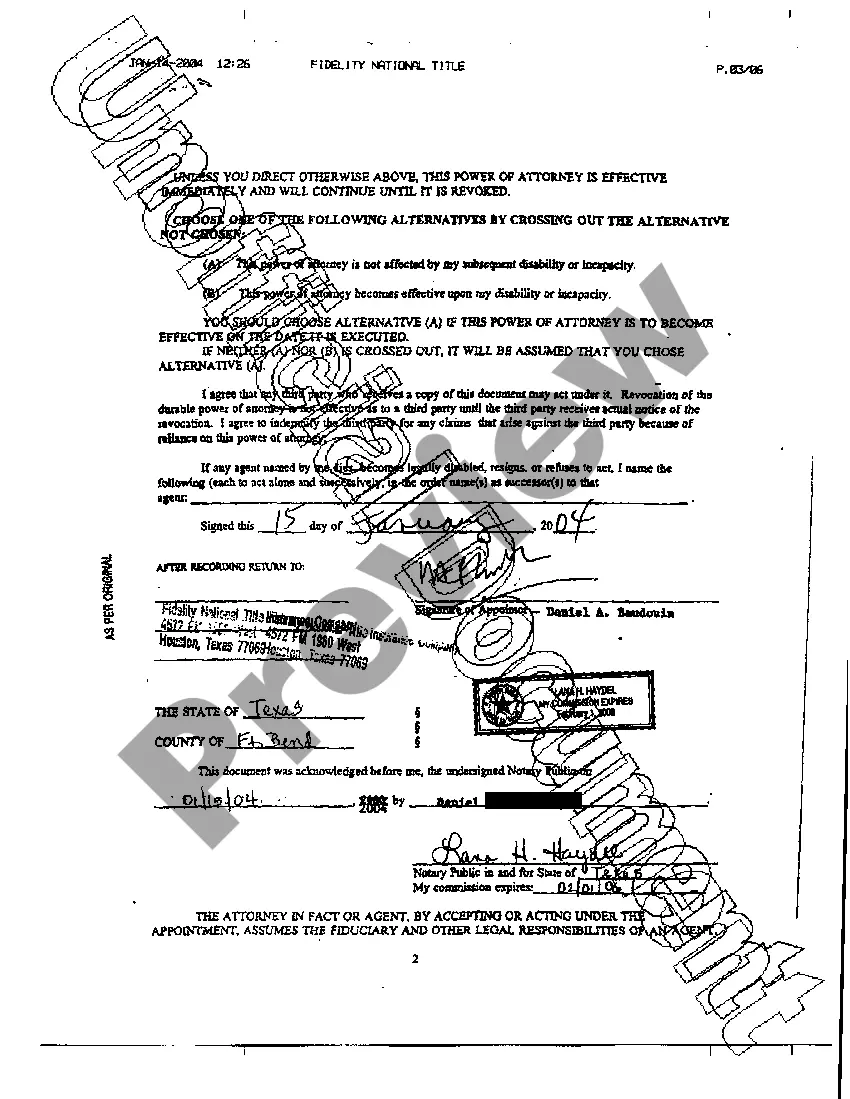

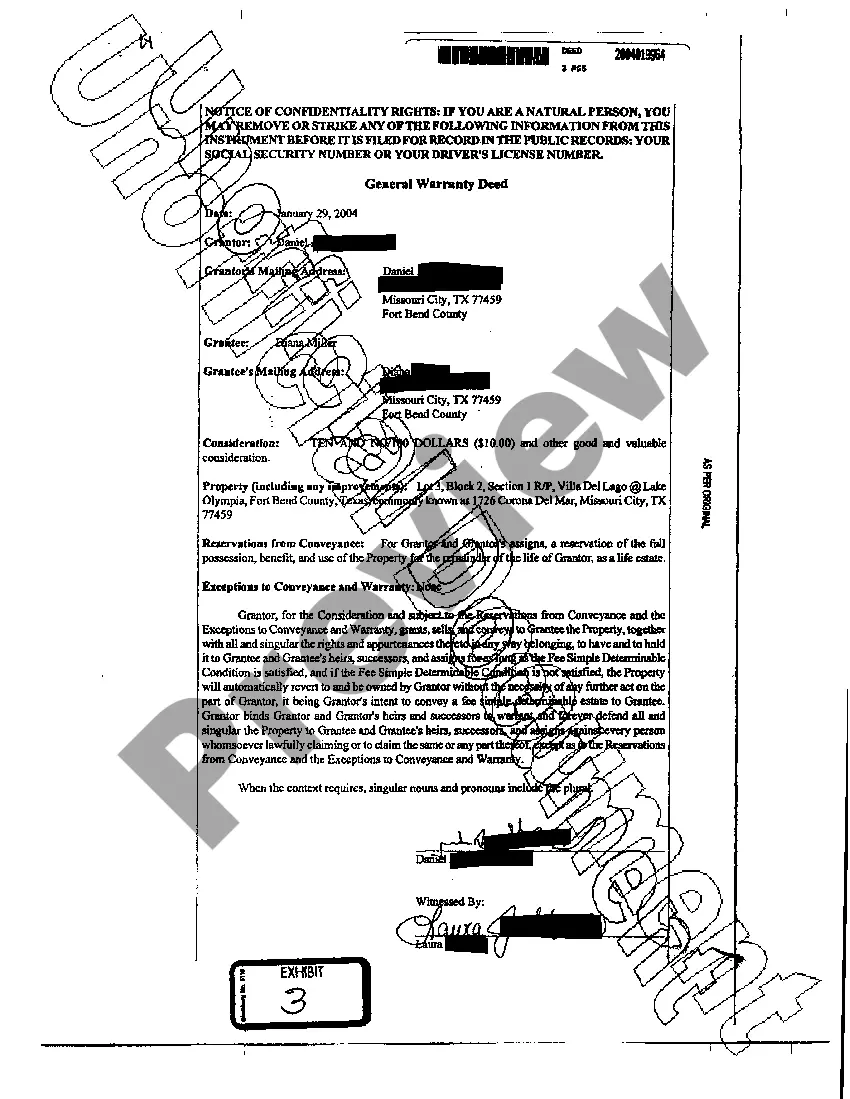

Plano Texas Statutory Durable Power of Attorney is a crucial legal document that grants authority to an individual (known as the "agent" or "attorney-in-fact") to make important decisions and handle various financial matters on behalf of another person (known as the "principal"). This document is designed to provide protection and ensure that the principal's affairs are efficiently managed even if they become incapacitated or unable to make decisions for themselves. The Statutory Durable Power of Attorney in Plano, Texas, is governed by the Texas Estates Code, specifically Chapter XII, and it outlines specific guidelines and requirements that need to be followed to ensure its validity. By executing this document, the principal ensures that their interests and assets are protected in the event of their incapacity or disability. The Plano Texas Statutory Durable Power of Attorney grants the agent broad powers to act on the principal's behalf in managing financial affairs, including but not limited to: 1. Banking and financial transactions: The agent can conduct banking activities, manage investment accounts, pay bills, file taxes, and handle real estate transactions. 2. Business affairs: The agent may manage the principal's business interests, make decisions regarding contracts, and handle other commercial matters related to the principal's businesses. 3. Asset management: The agent has the authority to buy, sell, or manage the principal's assets, such as real estate, stocks, bonds, and other investments. 4. Insurance and benefits: The agent can handle insurance claims, manage health care benefits, and make decisions regarding long-term care coverage. 5. Legal and litigation matters: The agent may retain legal counsel, initiate or defend lawsuits, and handle legal proceedings on behalf of the principal. It is important to note that the Plano Texas Statutory Durable Power of Attorney encompasses durable powers, meaning that it remains valid even if the principal becomes incapacitated. This ensures that the principal's interests are protected during challenging times. While there are no specific types of Plano Texas Statutory Durable Power of Attorney, individuals can customize their power of attorney documents to suit their specific needs. It is recommended to consult with an attorney experienced in estate planning or elder law to ensure the document meets all necessary legal requirements and addresses the principal's unique circumstances. In conclusion, the Plano Texas Statutory Durable Power of Attorney is a vital legal tool that allows an appointed agent to manage financial affairs on behalf of the principal in the event of their incapacity. By executing this document, individuals can ensure that their interests are protected and that appropriate decisions are made in their best interest.

Plano Texas Statutory Durable Power of Attorney

Description

How to fill out Plano Texas Statutory Durable Power Of Attorney?

If you have previously employed our service, Log In to your account and retrieve the Plano Texas Statutory Durable Power of Attorney onto your device by hitting the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you has bought: you can find it in your profile within the My documents section whenever you need to utilize it again. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or business purposes!

- Ensure you’ve found a suitable document. Review the details and utilize the Preview function, if available, to see if it fulfills your needs. If it doesn’t meet your standards, use the Search tab above to discover the right one.

- Purchase the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the payment.

- Receive your Plano Texas Statutory Durable Power of Attorney. Choose the file format for your document and store it on your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Power of Attorney Basics General power of attorney. This gives the agent authority to act in a broad range of matters. Limited or special power of attorney.Durable power of attorney.Springing power of attorney.Medical power of attorney.

How to make a Texas power of attorney Decide which type of power of attorney to make.Decide who you want to be your agent.Decide what powers you want to give your agent.Get a power of attorney form.Complete your POA form, sign it, and execute it.

How to Write 1 ? Download This Paperwork To Appoint An Agent With Power Of Attorney.2 ? Complete The Declaration Statement.3 ? Define How The Principal Power Should Be Used.4 ? Detail How These Powers Will Start.5 ? Execute This Appointment By Signing It.6 ? Additional Information Has Been Included For The Agent.

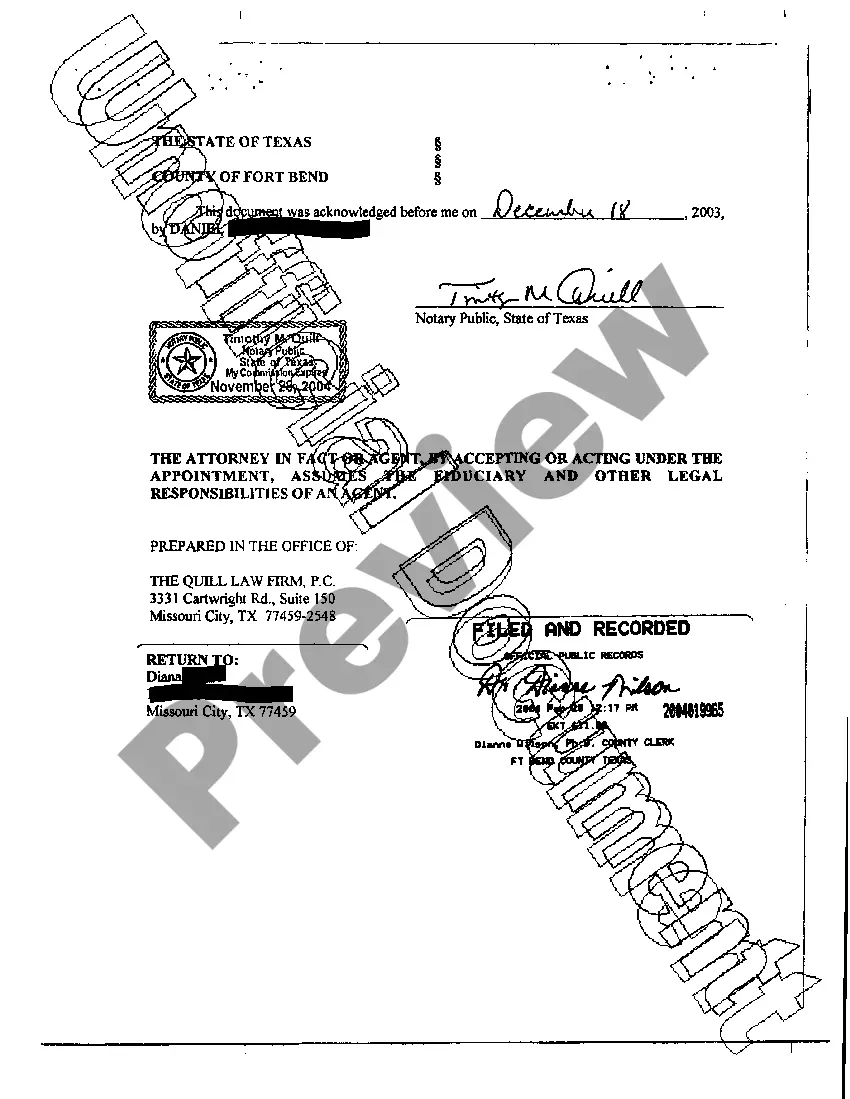

You do not need to file a power of attorney at the courthouse unless you want your agent to be able to act on your behalf in regards to a real estate transaction.

Section 489 of the TEXAS PROBATE CODE actually requires recording of the Power of Attorney when it is durable and the durability feature is being relied on in the transaction.

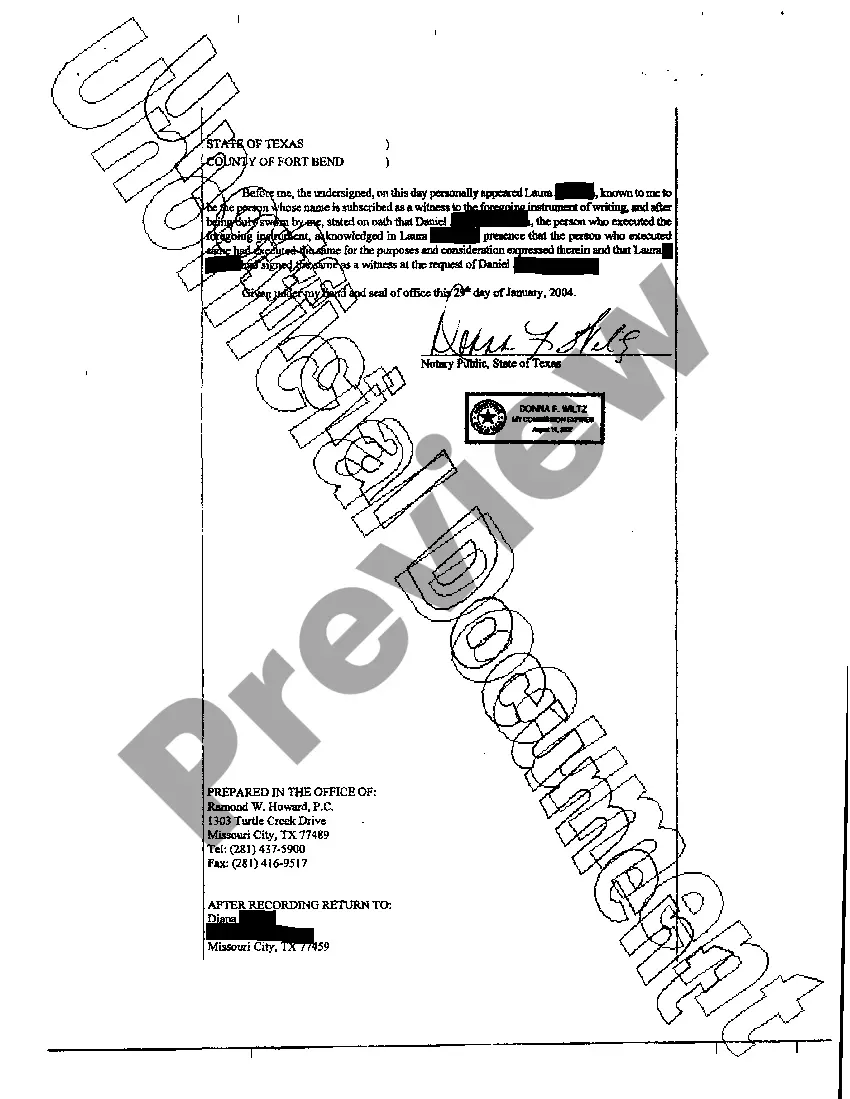

We often hear the question, ?does the power of attorney need to be notarized in Texas?? The answer is yes; the document and any changes to it should be formally notarized. Once these steps are completed, power of attorney is validly granted.

Texas's statutory form of durable power of attorney is found in Section 752.051 of the Texas Estates Code. It is a financial durable power of attorney - this means that it only allows the agent to handle financial matters. It does not permit the agent to make decisions about the principal's health care.

Yes. This is a special power of attorney that only allows your agent to sign a deed for the property. This kind of power of attorney must include a legal description of the property that you want to sell. You must record the power of attorney in the deed records of the county where the property is located.

Requirements of a Valid Texas Medical Power of Attorney If you sign the power of attorney in the presence of witnesses, the power of attorney does not require a notary. Likewise, if you sign the medical power of attorney in the presence of a notary, witnesses are not necessary.