Corpus Christi Texas Order for Authority to Expand Funds is a legal document that grants permission to increase the available funds for a specific project or initiative in Corpus Christi, Texas. This order is typically authorized by the appropriate governing body, such as the City Council or Board of Directors, to enable the responsible entity to acquire additional financial resources beyond the original budget allocated for a particular venture. The order ensures that the expansion of funds is done within the lawful framework and facilitates the implementation of vital projects to benefit the community. There are different types of Corpus Christi Texas Orders for Authority to Expand Funds, which vary based on the nature of the project or purpose of the funding. Some of these variations include: 1. Infrastructure Development: This type of order may be sought to expand funds specifically for the development or improvement of public infrastructure, such as roads, bridges, parks, or utility systems in Corpus Christi. 2. Economic Development: In order to stimulate economic growth and attract businesses, the authority may issue an order to expand funds dedicated to economic development initiatives. This can include efforts to promote entrepreneurship, attract investments, or enhance job opportunities. 3. Emergency Situations: In times of emergencies, like natural disasters or public health crises, the city may issue an order to expand funds to ensure a prompt and efficient response to the situation. This could include allocating resources for emergency relief efforts, rebuilding damaged infrastructure, or supporting affected community members. 4. Public Services Enhancement: Another type of Corpus Christi Texas Order for Authority to Expand Funds aims to improve the quality and accessibility of public services. This may involve expanding funds for education, healthcare, social welfare programs, or cultural initiatives to benefit the city's residents. The Corpus Christi Texas Order for Authority to Expand Funds plays a crucial role in empowering the responsible entities to secure additional financial means necessary for the progress and development of the city. By leveraging additional funds, Corpus Christi can proactively address its evolving needs and enhance the overall quality of life for its residents.

Corpus Christi Texas Order for Authority to Expand Funds

Description

How to fill out Corpus Christi Texas Order For Authority To Expand Funds?

Utilize the US Legal Forms and gain immediate access to any template you require.

Our advantageous website with a vast array of templates enables you to locate and acquire almost any document sample you desire.

You can export, fill out, and validate the Corpus Christi Texas Order for Authority to Expand Funds in just minutes instead of spending hours searching online for the proper template.

Employing our collection is a fantastic approach to enhance the security of your document submissions.

The Download button will show up on all the templates you view.

Moreover, you can find all your previously saved files in the My documents section.

- Our experienced attorneys routinely review all the documents to guarantee that the forms are suitable for a specific state and adhere to current laws and regulations.

- How can you acquire the Corpus Christi Texas Order for Authority to Expand Funds.

- If you hold a subscription, simply sign in to your account.

Form popularity

FAQ

The Corpus Christi Drought Resiliency Grant Program provides financial assistance for projects aimed at improving water sustainability and resilience in the community. This program supports innovative solutions like water reuse and conservation techniques to combat drought effects. Exploring options such as the Corpus Christi Texas Order for Authority to Expand Funds could benefit those seeking to apply for grants or develop drought-resistant projects.

A Stage 3 drought in Corpus Christi indicates severe water shortage conditions impacting the area's water supply and usage. During this stage, the city may implement strict water restrictions to preserve water resources. Understanding the implications of the Corpus Christi Texas Order for Authority to Expand Funds is crucial, as it may help in financing measures to address these critical situations.

The drought resiliency plan aims to prepare Corpus Christi for potential water shortages through sustainable practices and proactive measures. This plan includes developing alternative water sources and enhancing water conservation efforts. The Corpus Christi Texas Order for Authority to Expand Funds may play a role in funding these vital initiatives, ensuring the city remains resilient during dry spells.

The finance director of the city of Corpus Christi oversees financial operations and budgeting for the city. This role is essential for managing public funds in a way that aligns with community needs, including initiatives like the Corpus Christi Texas Order for Authority to Expand Funds. If you need more information about city finances or related requests, consider utilizing services from US Legal Forms.

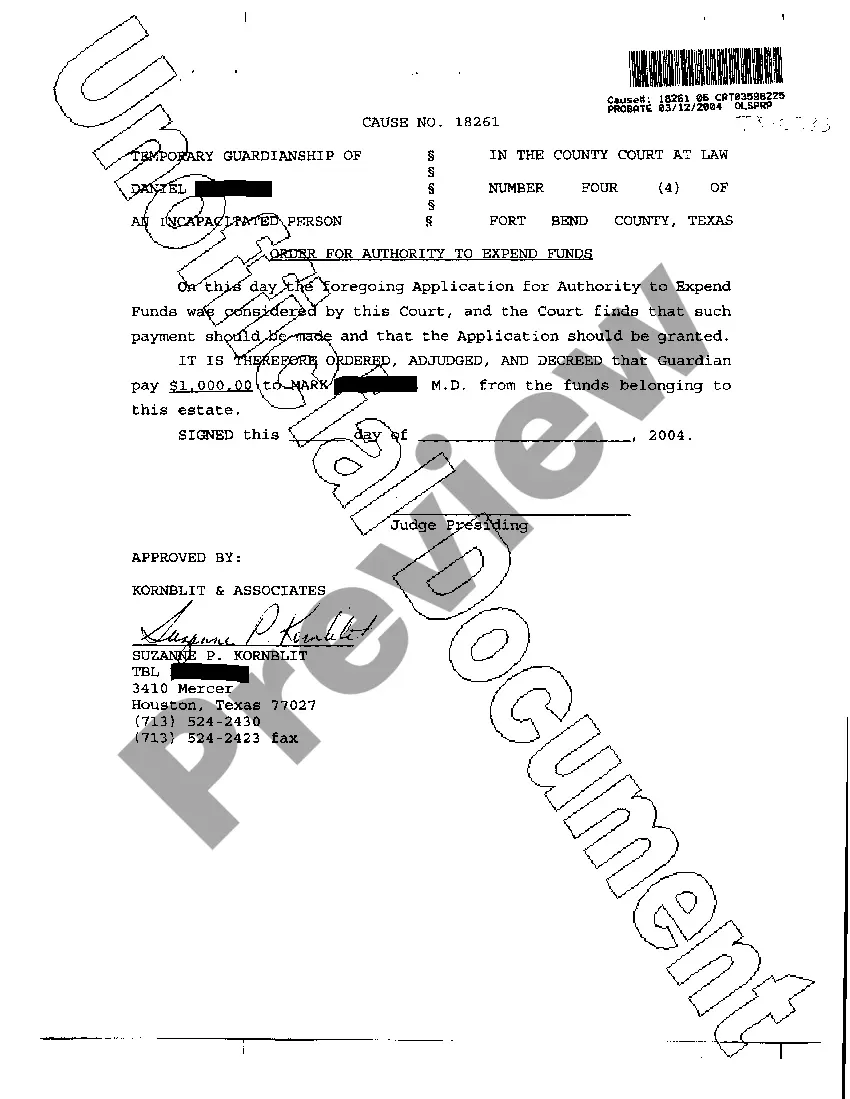

Section 771 of the Texas Estates Code outlines the administration and responsibilities of guardians concerning the management of their wards' estates. This section provides essential guidelines for how guardians should operate, ensuring the protection and proper handling of the ward's assets. Familiarizing yourself with this section may be beneficial when pursuing a Corpus Christi Texas Order for Authority to Expand Funds, as it reinforces guardian accountability.

Guardians in Texas may receive compensation for their services, but this depends on the court's approval and specific circumstances. The amount can vary based on factors such as the complexity of the case and the time invested in guardianship duties. A well-prepared Corpus Christi Texas Order for Authority to Expand Funds can help address these financial considerations and set clear expectations.

Yes, guardians of adults in Texas hold financial responsibility for managing their wards' funds. They must act in the best interest of the ward and maintain accurate financial records. Engaging in a Corpus Christi Texas Order for Authority to Expand Funds can help clarify and enhance the guardian's financial obligations, facilitating better management of resources.

In Texas, a guardian has the authority to make decisions regarding the ward's personal and financial matters. This includes managing assets, providing for the ward's basic needs, and making health care decisions. When you pursue a Corpus Christi Texas Order for Authority to Expand Funds, you ensure that the guardian can effectively oversee additional financial resources for the ward's welfare.