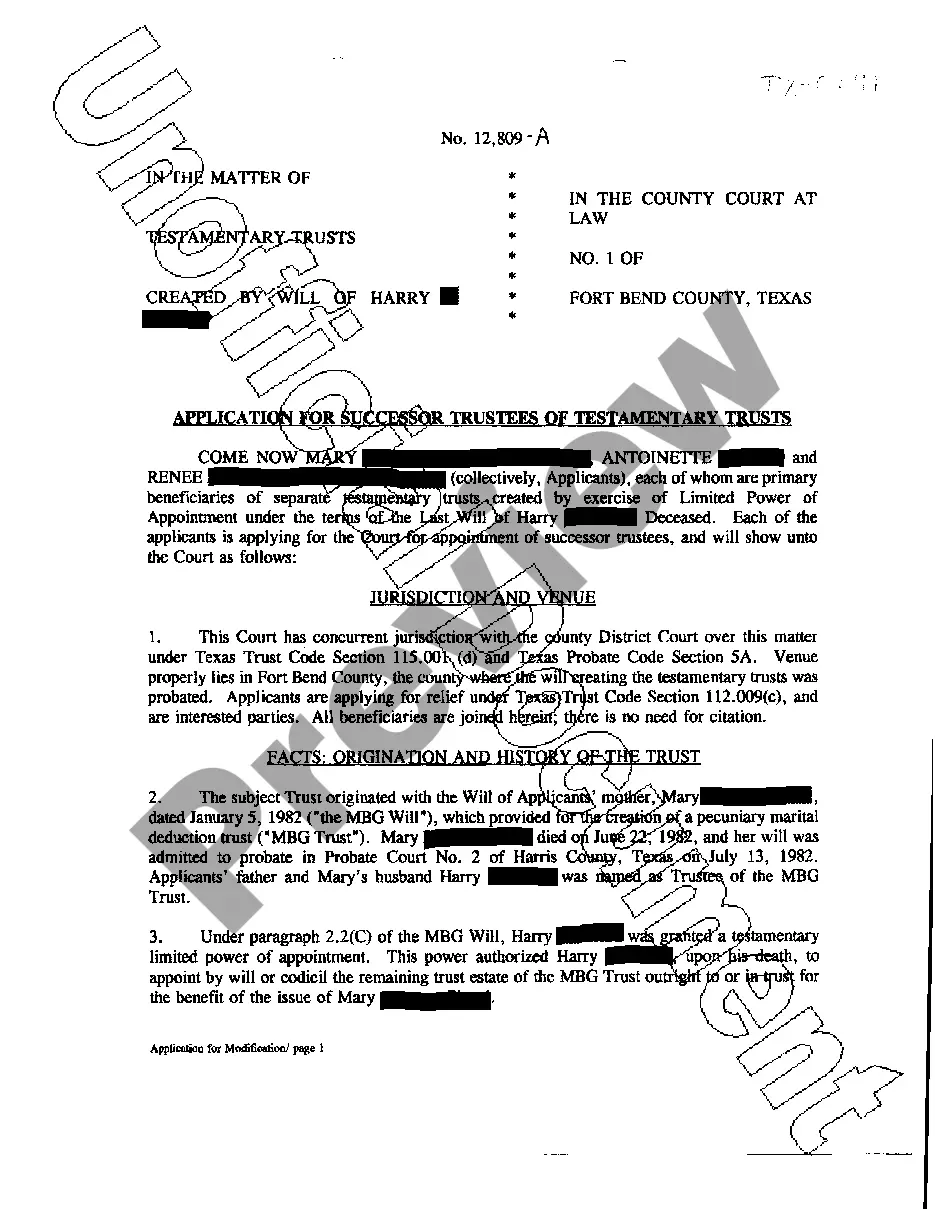

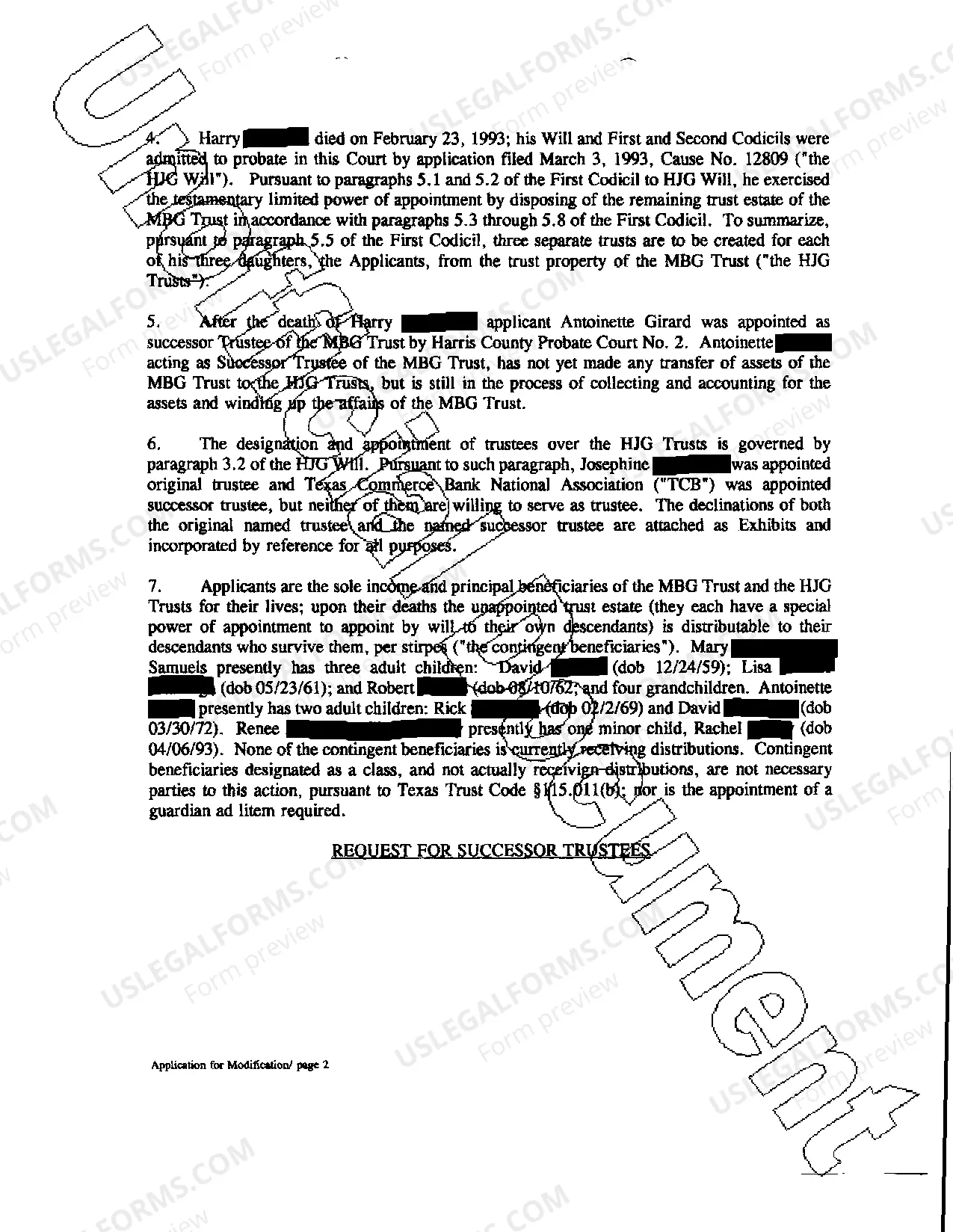

Harris Texas Application for Successor Trustees is a legal document that aids in the appointment of a successor trustee for a trust in Harris County, Texas. This application is crucial for individuals who wish to ensure a smooth transition of trustee responsibilities in the event of incapacity, resignation, or death of the current trustee. The application process requires providing essential information and several supporting documents for review and approval by the Harris County Probate Court. The Harris Texas Application for Successor Trustees involves multiple steps to ensure the selection of a qualified individual to oversee the management and distribution of trust assets. It is crucial to carefully follow the guidelines and include all necessary information to expedite the process. Some specific keywords relevant to this topic may include: 1. Harris County Probate Court: This is the legal authority responsible for reviewing and approving applications for successor trustees in Harris County, Texas. It is essential to adhere to the court's specific procedures and requirements. 2. Trustee: The trustee, either an individual or an entity, is responsible for managing and distributing the assets of a trust according to its terms and the applicable laws. 3. Successor Trustee: A successor trustee is an individual or entity designated to step into the role of trustee when the current trustee is unable or unwilling to fulfill their duties. 4. Trust: A trust is a legal arrangement where assets are held and managed by a trustee for the benefit of named beneficiaries, following the specific instructions outlined in the trust document. 5. Application Process: The process of applying to become a successor trustee involves submitting the necessary forms, supporting documents, and fees to the Harris County Probate Court for review. 6. Responsibilities: The successor trustee assumes various duties, such as managing trust assets, making investment decisions, paying bills, filing taxes, and distributing trust assets to beneficiaries as stipulated in the trust document. 7. Incapacity: This refers to the trustee's inability to carry out their duties due to physical or mental impairment, making the appointment of a successor trustee necessary. 8. Resignation: If the current trustee wishes to step down voluntarily from their position, they can do so by submitting a formal resignation and initiating the process of appointing a successor trustee. 9. Death: In case of a trustee's death, the successor trustee assumes control over the trust and carries out their duties as outlined in the trust document. Different types or scenarios of Harris Texas Application for Successor Trustees may include applications for individuals seeking to become successor trustees due to the trustee's incapacity, resignation, or death. Each situation requires specific documentation and may involve unique considerations, such as providing medical records, letters of resignation, or death certificates, respectively. It is crucial to identify the particular type of application one needs to pursue and gather the relevant information accordingly.

Harris Texas Application for Successor Trustees

Description

How to fill out Harris Texas Application For Successor Trustees?

If you’ve already used our service before, log in to your account and download the Harris Texas Application for Successor Trustees on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Harris Texas Application for Successor Trustees. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!

Form popularity

FAQ

An application has to be submitted to request letters testamentary and letters of administration. The clerk of the probate court then issues a citation to all interested persons of the estate. The citation is served by posting at the county courthouse.

Under Texas law, you can be removed as the executor of an estate for flagrant misconduct, mismanagement, or theft of the estate's assets. If enough evidence exists to believe you have stolen money or property under your control, you can be removed.

If the decedent left a will, then they will most likely name their chosen executor in the will. If there is no will or the decedent did not choose an executor, the court will appoint one.

To apply for probate or letters of administration by post, you'll need to fill in a number of forms. You'll need PA1P if the person left a will and PA1A if they didn't. These forms ask for details about the person who died, their surviving relatives and, the personal representative.

What are the Executor Fees in Texas? According to the Estates Code, an executor in Texas is entitled to up to 5% of the estate's total financial transactions.

The claimant must file this completed affidavit in the County Clerk's record in the county of the decedent's residence. The claimant must then upload a file stamped copy of the completed affidavit to ClaimItTexas.org.

For estates greater than $75,000, the probate process goes into action to ensure that the will of the deceased is executed as it was meant to be. The court appoints the executor who was named in the will to manage the estate.

HOW DO I GET APPOINTED EXECUTOR? Be at least 18 years old and of a sound mind ? that is, not judged incapacitated by a court.Not have been convicted of a felony under any state or federal law, unless he or she has been pardoned or had all civil rights restored.

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.

Interesting Questions

More info

1995×. The petitioners sued for declaratory and injunctive relief under Section 11-501 of the Code of Civil Procedure, seeking to compel the filing of a petition for probate, the filing of personal income tax returns as required by Chapter 8, Subtitle D of the Code of Civil Procedure or the issuance or amendment of bond as required by Chapter 8. The trial court's order denying relief on the basis that probate of the petition would constitute an unnecessary and unwarranted expense to the government was affirmed by the Court of Appeals for the 17th Judicial District. Rehnquist, J., delivered the opinion of the Court with respect to Parts I through II. The court ruled that the petitioners' arguments concerning the burden of the probate petition on the government and the propriety of a probate petition were not properly before the court. Rehnquist, J.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.