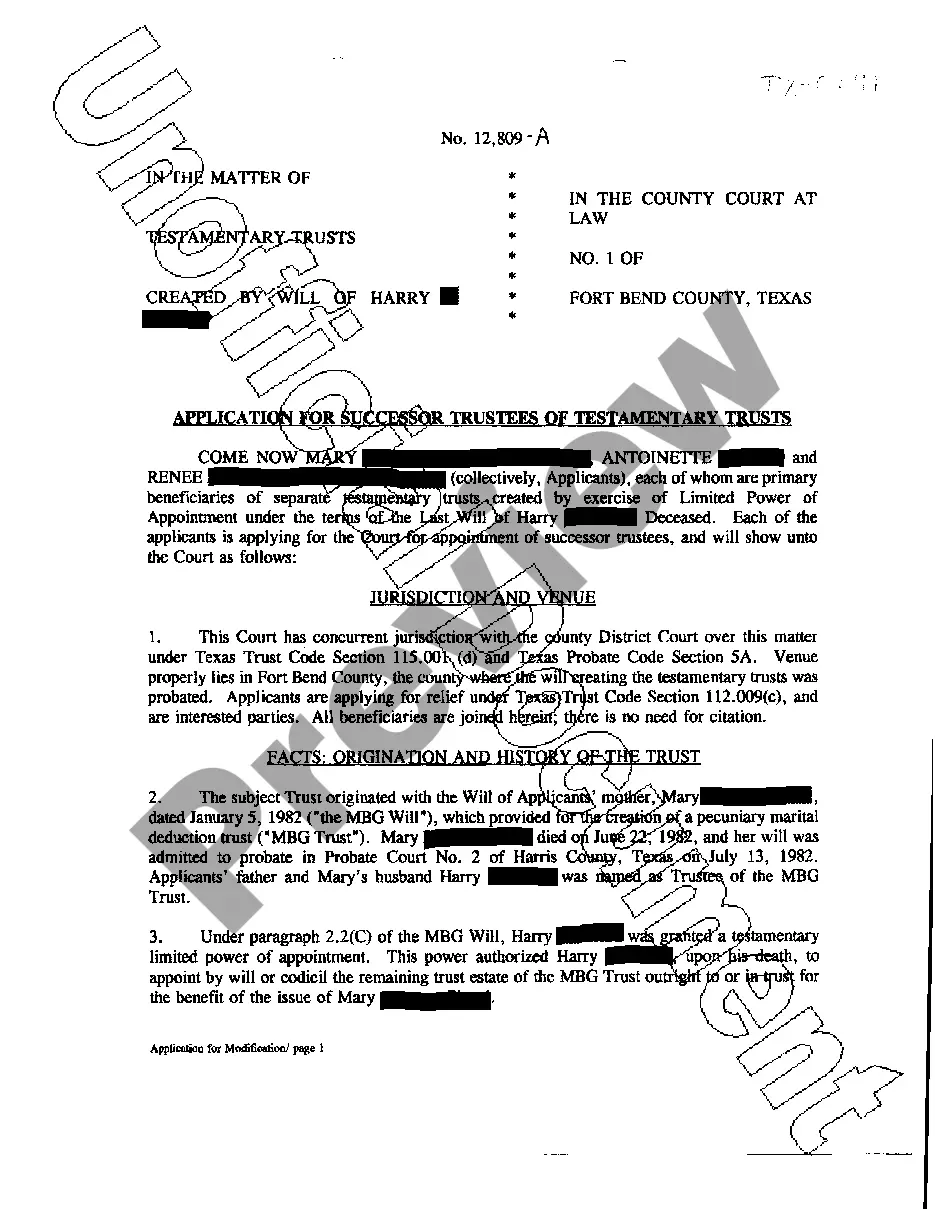

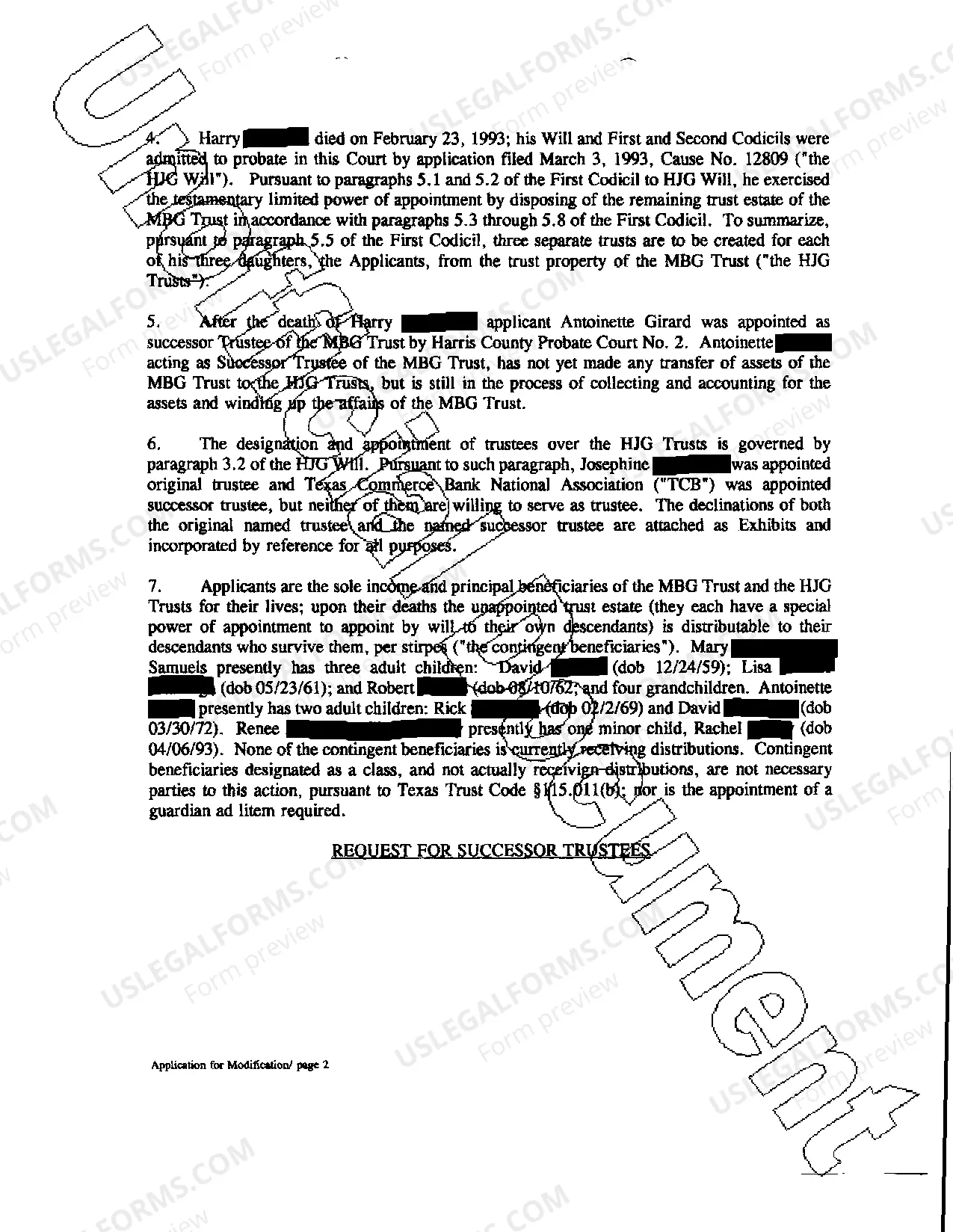

Pearland Texas Application for Successor Trustees is a legal document required by the Pearland Texas Probate Court for individuals seeking to become successor trustees. This application serves as an official request for the court to appoint them as trustees who will manage and administer a trust after the original trustee becomes incapacitated, resigns, or passes away. The application process for Pearland Texas Successor Trustees involves completing and submitting the necessary forms, providing detailed information about the prospective trustee's qualifications, and disclosing any potential conflicts of interest. The purpose of this application is to ensure that the successor trustee is capable of effectively managing and safeguarding the trust assets in accordance with the granter's wishes, state laws, and the court's requirements. Keywords: Pearland Texas, application, successor trustees, legal document, Pearland Texas Probate Court, trust, manage, administer, incapacitated, resigns, passes away, court appointment, qualifications, conflicts of interest, granter's wishes, state laws. Different types of Pearland Texas Application for Successor Trustees may include: 1. Individual Successor Trustee Application: This application is applicable when an individual intends to serve as the successor trustee and assumes full responsibility for managing the trust. 2. Corporate Successor Trustee Application: In cases where an individual or family trust prefers to appoint a corporate trustee, such as a bank or a trust company, this type of application is necessary. The application highlights the corporation's expertise, experience, and ability to effectively administer trusts in accordance with Pearland Texas laws. 3. Co-Trustees Succession Application: This application is utilized when the original trustee wants to appoint multiple individuals or a combination of individuals and corporate entities to act as successor trustees. Each co-trustee needs to complete their application form, disclosing their qualifications and other relevant details. 4. Limited Powers Successor Trustee Application: In certain situations, the original trustee may grant limited powers to a successor trustee. This application allows for the appointment of a successor trustee with specific authorities for managing only certain aspects or assets of the trust. Keywords: Individual Successor Trustee Application, Corporate Successor Trustee Application, Co-Trustees Succession Application, Limited Powers Successor Trustee Application, appointment, trust management, family trust, corporate trustee, co-trustees, limited powers.

Pearland Texas Application for Successor Trustees

Description

How to fill out Pearland Texas Application For Successor Trustees?

If you’ve previously employed our service, sign in to your account and acquire the Pearland Texas Application for Successor Trustees on your device by clicking the Download button. Ensure that your membership is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You enjoy unlimited access to all the documents you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Make the most of the US Legal Forms service to quickly locate and store any template for your personal or professional needs!

- Ensure you’ve found a suitable document. Browse the description and use the Preview feature, if available, to see if it meets your needs. If it doesn’t suit you, use the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Pearland Texas Application for Successor Trustees. Choose the file format for your document and save it to your device.

- Fill out your form. Print it or utilize advanced online editors to complete and sign it digitally.

Form popularity

FAQ

How should I choose a successor trustee? Most people select a spouse, a child, or another family member as their successor trustee for a personal trust. But for larger trusts, many trustors select an institution or a private trustee, like a private professional fiduciary, as their successor.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

Successor trustees are not the same as a co-trustees. Co-trustees duties are immediate, while a successor trustee waits until the trustee is incapacitated or dies to begin acting.

You also need to understand that there is a distinction to be made between who inherits a trust when someone dies (the beneficiaries) and who shall have the responsibility of administering the trust, paying the bills and taxes, and distributing what's left to the beneficiaries (the successor trustees).

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.

7 Different Types of Trustees Administrative Trustee. Independent Trustee. Investment Trustee. Successor Trustee. Charitable Trustee. Corporate Trustee. Bankruptcy Trustee.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.

The short answer is yes, a trustee can also be a trust beneficiary. One of the most common types of trust is the revocable living trust, which states the person's wishes for how their assets should be distributed after they die. Many people use living trusts to guide the inheritance process and avoid probate.