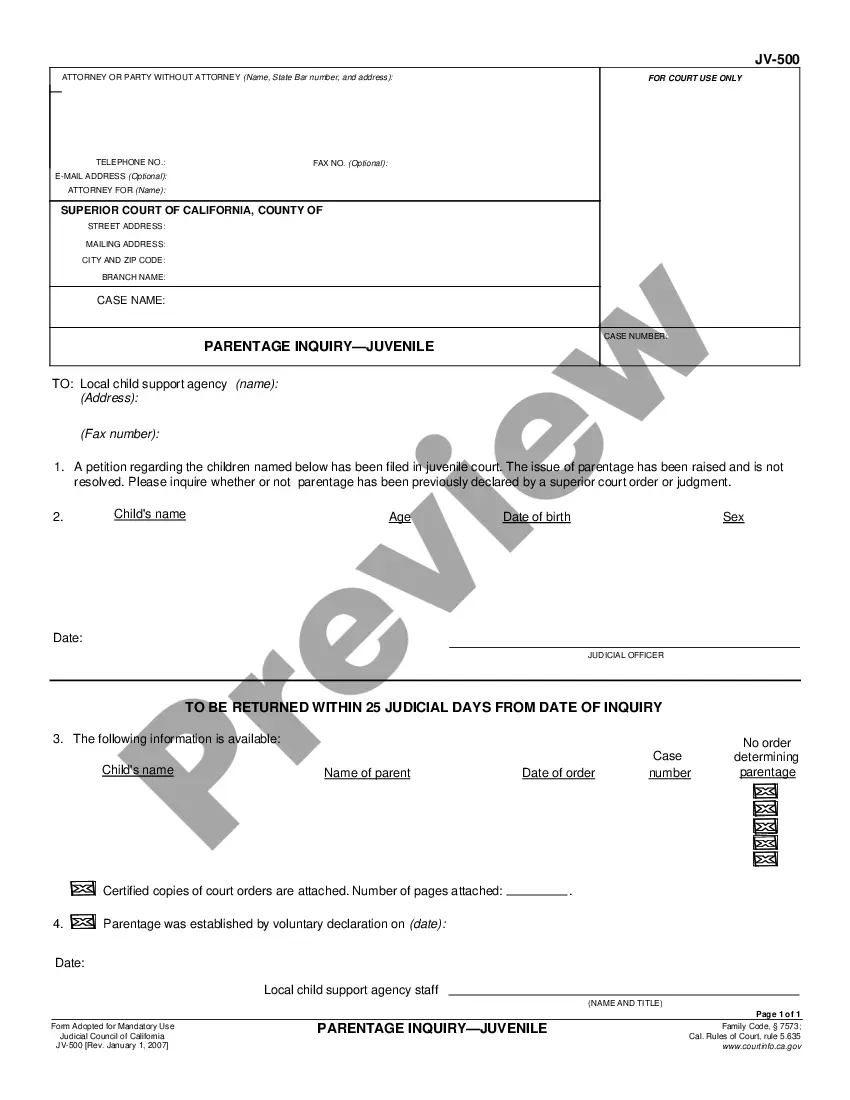

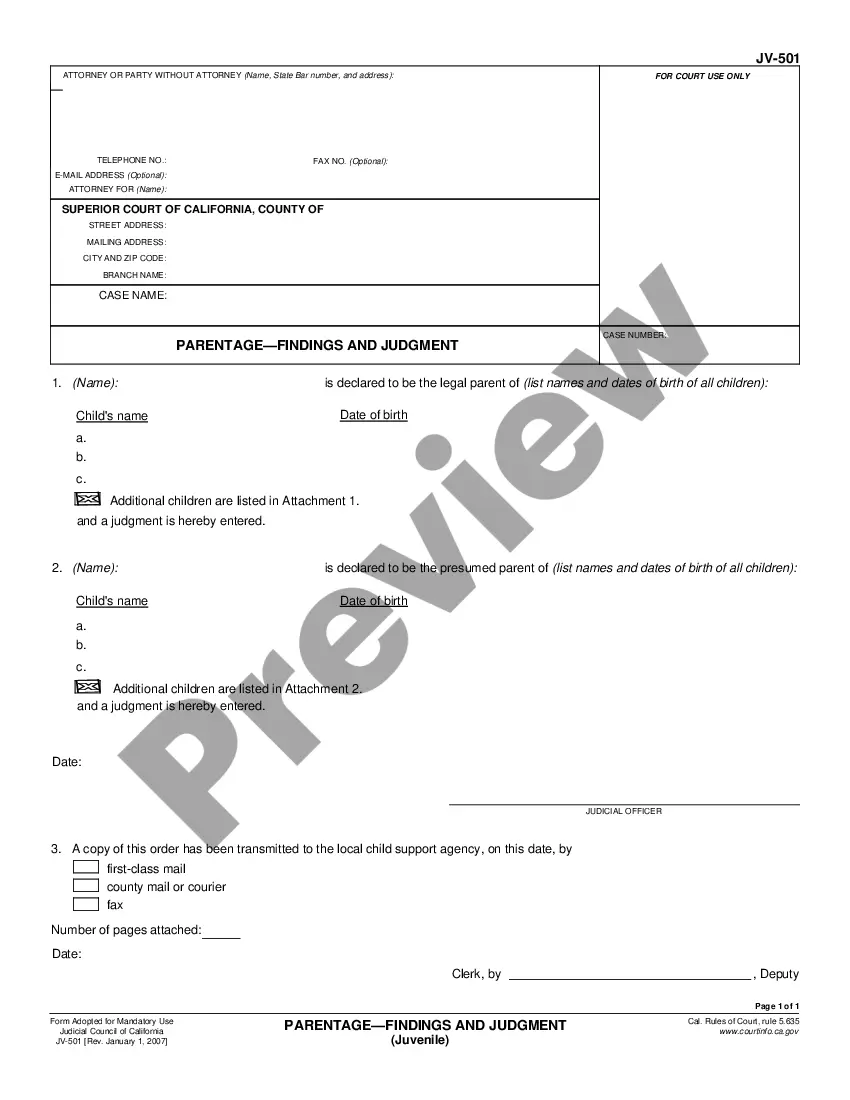

Austin Texas Recitals regarding Declination to Serve as Successor Trustee refers to a legal document or contractual arrangement that outlines the conditions and terms under which an individual or entity declines to fulfill the role of a successor trustee in a trust administration process in Austin, Texas. This document is particularly important in estate planning and ensures proper management and distribution of assets and properties upon the death or incapacitation of the initial trustee. The purpose of this document is to formally and comprehensively state the reasons for declining the role of successor trustee. It allows the designated individual or entity to decline the responsibility and obligations that come with being a successor trustee, ensuring transparency and efficiency in the trust administration process. Some relevant keywords associated with this document include: 1. Trust administration: The legal process of managing and distributing assets and properties held in a trust according to the wishes and instructions set forth in the trust document. 2. Successor trustee: An individual or entity appointed to take over the responsibilities of a trustee in the event of their incapacity, resignation, or death. 3. Declination to serve: The act of refusing or rejecting the position or role of a successor trustee. 4. Estate planning: The process of organizing and arranging an individual's assets and properties during their lifetime to ensure their efficient transfer and distribution upon death or incapacitation. 5. Legal document: A written contract or agreement that outlines the rights, obligations, and responsibilities of the parties involved. 6. Assets and properties: Refers to all belongings, investments, real estate, and other valuable items held within the trust. 7. Austin, Texas: The specific location or jurisdiction where the trust administration process and relevant legal documents are executed. Different types of Austin Texas Recitals regarding Declination to Serve as Successor Trustee may include variations based on the specific trust provisions, circumstances, and the preferences of the trustee. It is important to consult an attorney or legal professional to ensure the correct and appropriate content is included in the document.

Austin Texas Recitals regarding Declination to Serve as Successor Trustee

Description

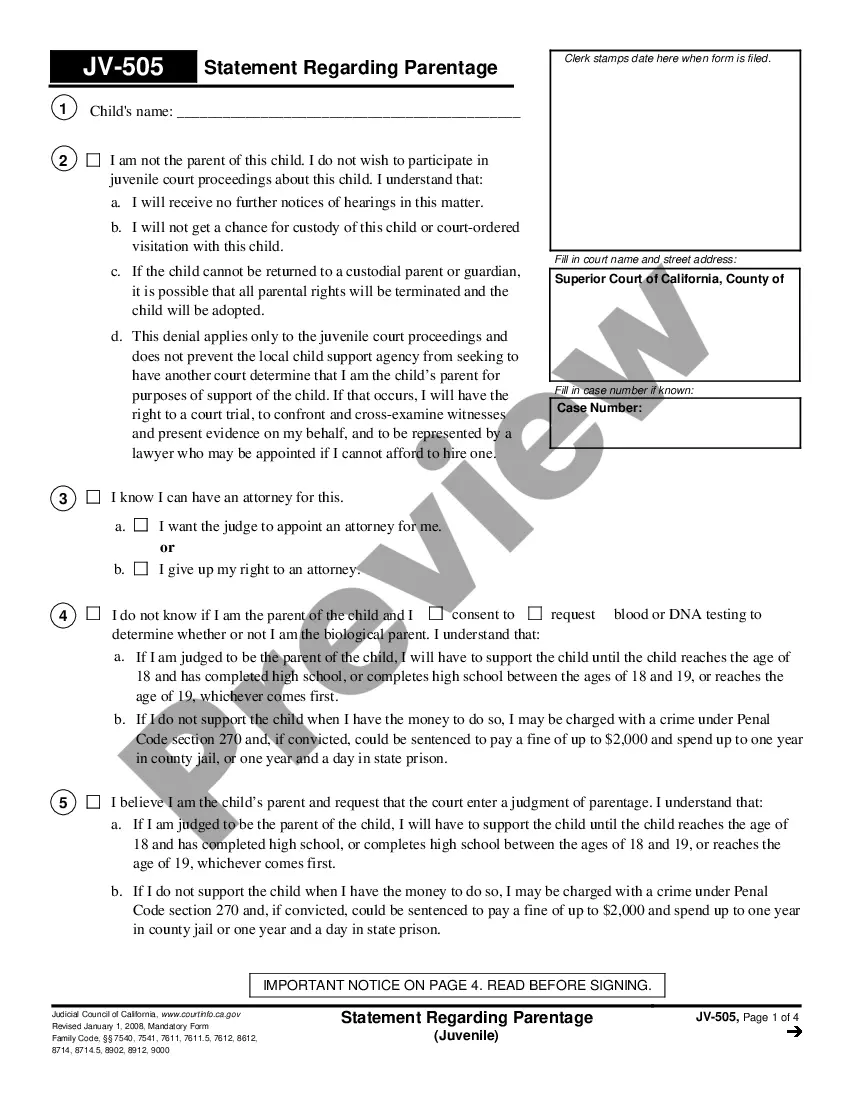

How to fill out Austin Texas Recitals Regarding Declination To Serve As Successor Trustee?

If you are searching for a valid form, it’s impossible to find a more convenient place than the US Legal Forms site – probably the most comprehensive libraries on the internet. With this library, you can find a huge number of form samples for organization and individual purposes by types and states, or keywords. With our high-quality search feature, finding the most up-to-date Austin Texas Recitals regarding Declination to Serve as Successor Trustee is as easy as 1-2-3. In addition, the relevance of every file is verified by a group of expert lawyers that regularly review the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our system and have a registered account, all you need to receive the Austin Texas Recitals regarding Declination to Serve as Successor Trustee is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the form you need. Look at its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the appropriate record.

- Confirm your selection. Select the Buy now button. Following that, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and save it to your system.

- Make changes. Fill out, modify, print, and sign the obtained Austin Texas Recitals regarding Declination to Serve as Successor Trustee.

Every single template you save in your profile has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to receive an extra copy for modifying or creating a hard copy, you may return and save it again at any time.

Take advantage of the US Legal Forms extensive collection to gain access to the Austin Texas Recitals regarding Declination to Serve as Successor Trustee you were seeking and a huge number of other professional and state-specific templates in a single place!