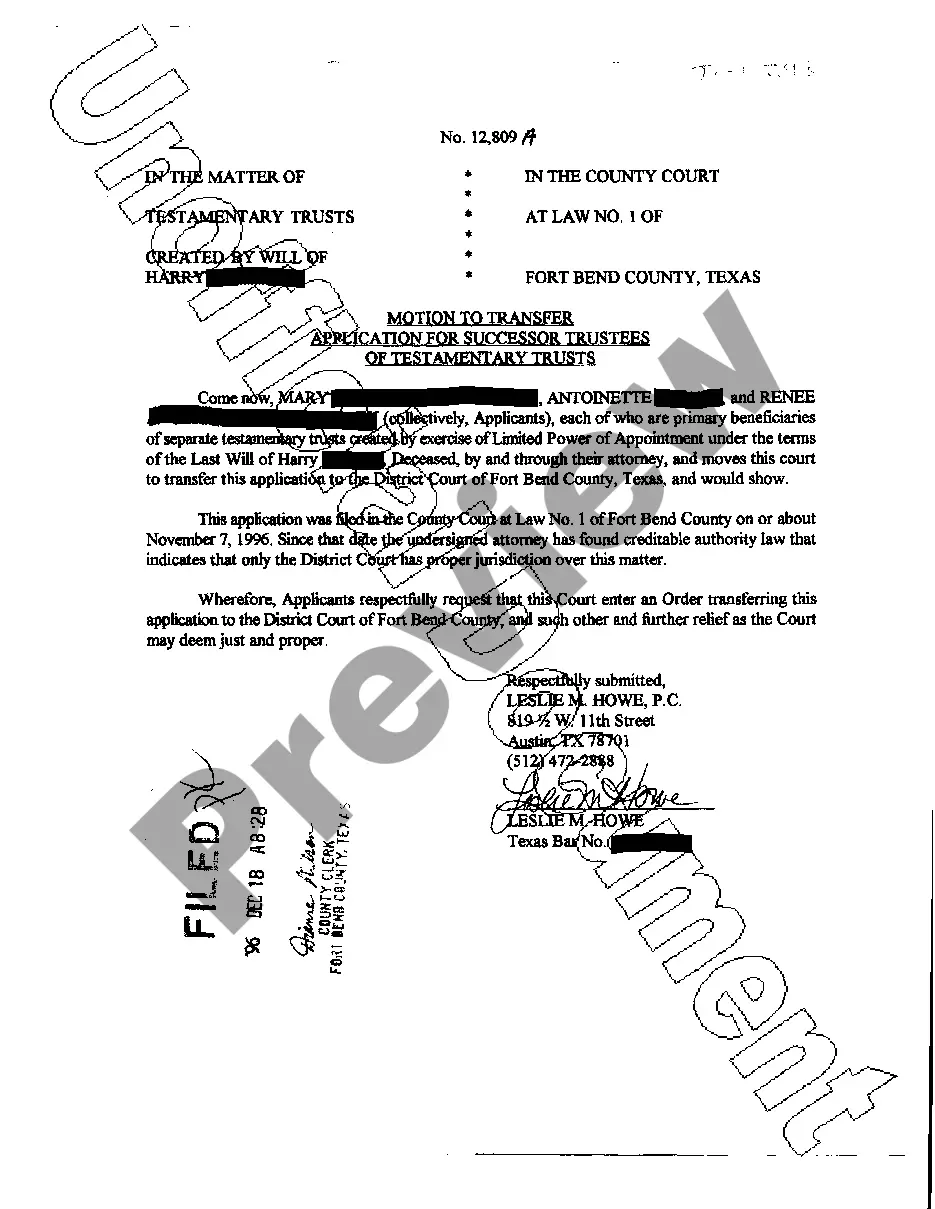

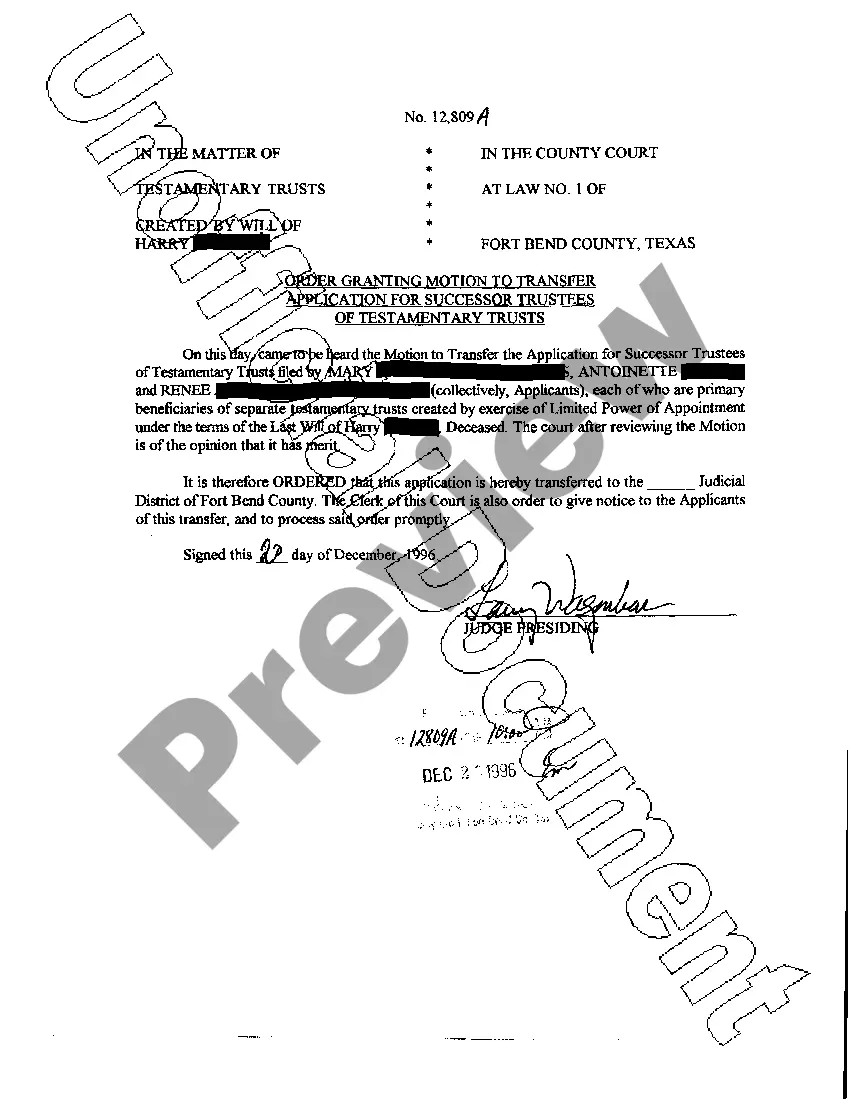

Plano, Texas Motion to Transfer Application for Successor Trustees is a legal procedure designed to request the transfer of trust administration from one trustee to another. This application is typically filed with the Probate Court in Plano, Texas, and is relevant for individuals or organizations seeking to become successor trustees. A Plano, Texas Motion to Transfer Application for Successor Trustees is submitted when the current trustee is no longer able or willing to fulfill their duties and responsibilities. The reasons for this transfer may vary, such as the death, resignation, or incapacity of the current trustee, or due to a desire to replace an underperforming trustee. To commence the transfer process, the petitioner, often the beneficiary of the trust, must file a Motion to Transfer Application for Successor Trustees. This legal document outlines the reasons for the transfer request, provides relevant details about the trust, and proposes a suitable successor trustee. In Plano, Texas, there are two main types of Motion to Transfer Applications for Successor Trustees: 1. Voluntary Transfer: In this type of application, the current trustee voluntarily agrees to transfer their responsibilities and powers to the proposed successor trustee. The voluntary transfer may occur due to various reasons, such as retirement, relocation, or the trustee's willingness to step down and pass on the trust administration duties. 2. Involuntary Transfer: This application is filed when the current trustee is unable or unwilling to fulfill their obligations, but they do not consent to the transfer. In such cases, the petitioner must provide compelling evidence to the court, showcasing the trustee's incompetence, misconduct, or failure to properly administer the trust. The court will then determine whether to grant the involuntary transfer and appoint the proposed successor trustee. When filing the Motion to Transfer Application for Successor Trustees in Plano, Texas, it is crucial to include all necessary supporting documents, such as the original trust instrument, any relevant amendments, and a declaration affirming the qualifications and willingness of the proposed successor trustee. Additionally, all parties involved should be properly notified, ensuring their right to contest the transfer if they so choose. In conclusion, a Plano, Texas Motion to Transfer Application for Successor Trustees is a legal mechanism to facilitate the transfer of trust administration from one trustee to another. By adhering to the specific rules and requirements of trust law in Plano, Texas, this application can help ensure the smooth and effective management of trusts within the jurisdiction.

Plano, Texas Motion to Transfer Application for Successor Trustees is a legal procedure designed to request the transfer of trust administration from one trustee to another. This application is typically filed with the Probate Court in Plano, Texas, and is relevant for individuals or organizations seeking to become successor trustees. A Plano, Texas Motion to Transfer Application for Successor Trustees is submitted when the current trustee is no longer able or willing to fulfill their duties and responsibilities. The reasons for this transfer may vary, such as the death, resignation, or incapacity of the current trustee, or due to a desire to replace an underperforming trustee. To commence the transfer process, the petitioner, often the beneficiary of the trust, must file a Motion to Transfer Application for Successor Trustees. This legal document outlines the reasons for the transfer request, provides relevant details about the trust, and proposes a suitable successor trustee. In Plano, Texas, there are two main types of Motion to Transfer Applications for Successor Trustees: 1. Voluntary Transfer: In this type of application, the current trustee voluntarily agrees to transfer their responsibilities and powers to the proposed successor trustee. The voluntary transfer may occur due to various reasons, such as retirement, relocation, or the trustee's willingness to step down and pass on the trust administration duties. 2. Involuntary Transfer: This application is filed when the current trustee is unable or unwilling to fulfill their obligations, but they do not consent to the transfer. In such cases, the petitioner must provide compelling evidence to the court, showcasing the trustee's incompetence, misconduct, or failure to properly administer the trust. The court will then determine whether to grant the involuntary transfer and appoint the proposed successor trustee. When filing the Motion to Transfer Application for Successor Trustees in Plano, Texas, it is crucial to include all necessary supporting documents, such as the original trust instrument, any relevant amendments, and a declaration affirming the qualifications and willingness of the proposed successor trustee. Additionally, all parties involved should be properly notified, ensuring their right to contest the transfer if they so choose. In conclusion, a Plano, Texas Motion to Transfer Application for Successor Trustees is a legal mechanism to facilitate the transfer of trust administration from one trustee to another. By adhering to the specific rules and requirements of trust law in Plano, Texas, this application can help ensure the smooth and effective management of trusts within the jurisdiction.