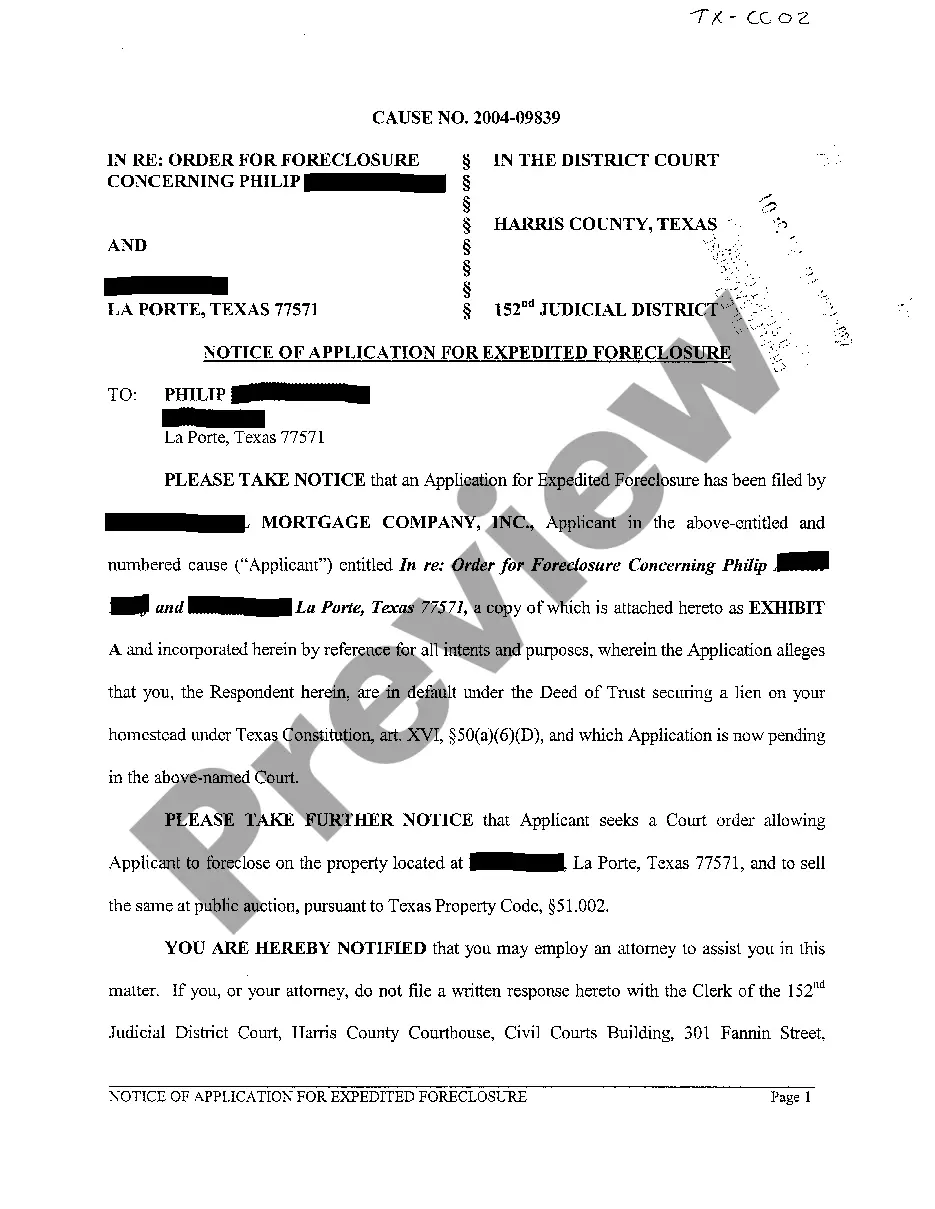

The San Antonio Texas Notice of Application for Expedited Foreclosure is a legal document that is filed by a lender or mortgagee to initiate the process of foreclosing on a property in San Antonio, Texas in an expedited manner. This notice serves as a formal declaration to notify the property owner, or the mortgagor, of the lender's intent to foreclose on the property due to default or non-payment on the mortgage loan. The purpose of the Notice of Application for Expedited Foreclosure is to inform the property owner about the lender's intention to foreclose and to provide them with an opportunity to respond or take necessary actions to prevent the foreclosure. The notice includes relevant information such as the name of the lender, the property owner's name, the property address, the mortgage loan or lien information, as well as the specific default or breach that has led to the foreclosure. The San Antonio Texas Notice of Application for Expedited Foreclosure must comply with state laws and regulations governing foreclosures, including the requirements outlined in the Texas Property Code. It may vary slightly depending on the specific circumstances of the case, but generally, it follows a standardized format to ensure accuracy and clarity. In San Antonio, Texas, there may be different types or variations of the Notice of Application for Expedited Foreclosure depending on the type of mortgage or lien involved. This could include notices for residential properties, commercial properties, or even agricultural properties. However, the purpose and essential details of these notices remain the same — to inform the property owner of the impending foreclosure and provide them an opportunity to respond or take action. It is important for the property owner to carefully review the Notice of Application for Expedited Foreclosure upon receiving it. They should consult with an attorney or legal professional to understand their rights, obligations, and potential courses of action to avoid or mitigate the foreclosure process. Taking prompt action and seeking legal advice can be crucial in protecting their interests and exploring alternatives to foreclosure, such as loan modification, asset sale, or refinancing.

San Antonio Texas Notice of Application for Expedited Foreclosure

Description

How to fill out San Antonio Texas Notice Of Application For Expedited Foreclosure?

If you are searching for a relevant form, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most considerable online libraries. With this library, you can find a large number of document samples for company and personal purposes by types and regions, or keywords. With our high-quality search function, getting the most recent San Antonio Texas Notice of Application for Expedited Foreclosure is as easy as 1-2-3. Moreover, the relevance of each file is verified by a group of professional lawyers that regularly check the templates on our platform and revise them based on the newest state and county regulations.

If you already know about our system and have an account, all you should do to get the San Antonio Texas Notice of Application for Expedited Foreclosure is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the sample you need. Read its description and use the Preview feature (if available) to check its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to discover the proper file.

- Affirm your decision. Choose the Buy now option. Next, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Indicate the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the obtained San Antonio Texas Notice of Application for Expedited Foreclosure.

Every single form you add to your account does not have an expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to receive an additional duplicate for editing or printing, you can come back and save it once more whenever you want.

Take advantage of the US Legal Forms professional catalogue to get access to the San Antonio Texas Notice of Application for Expedited Foreclosure you were looking for and a large number of other professional and state-specific templates on one platform!