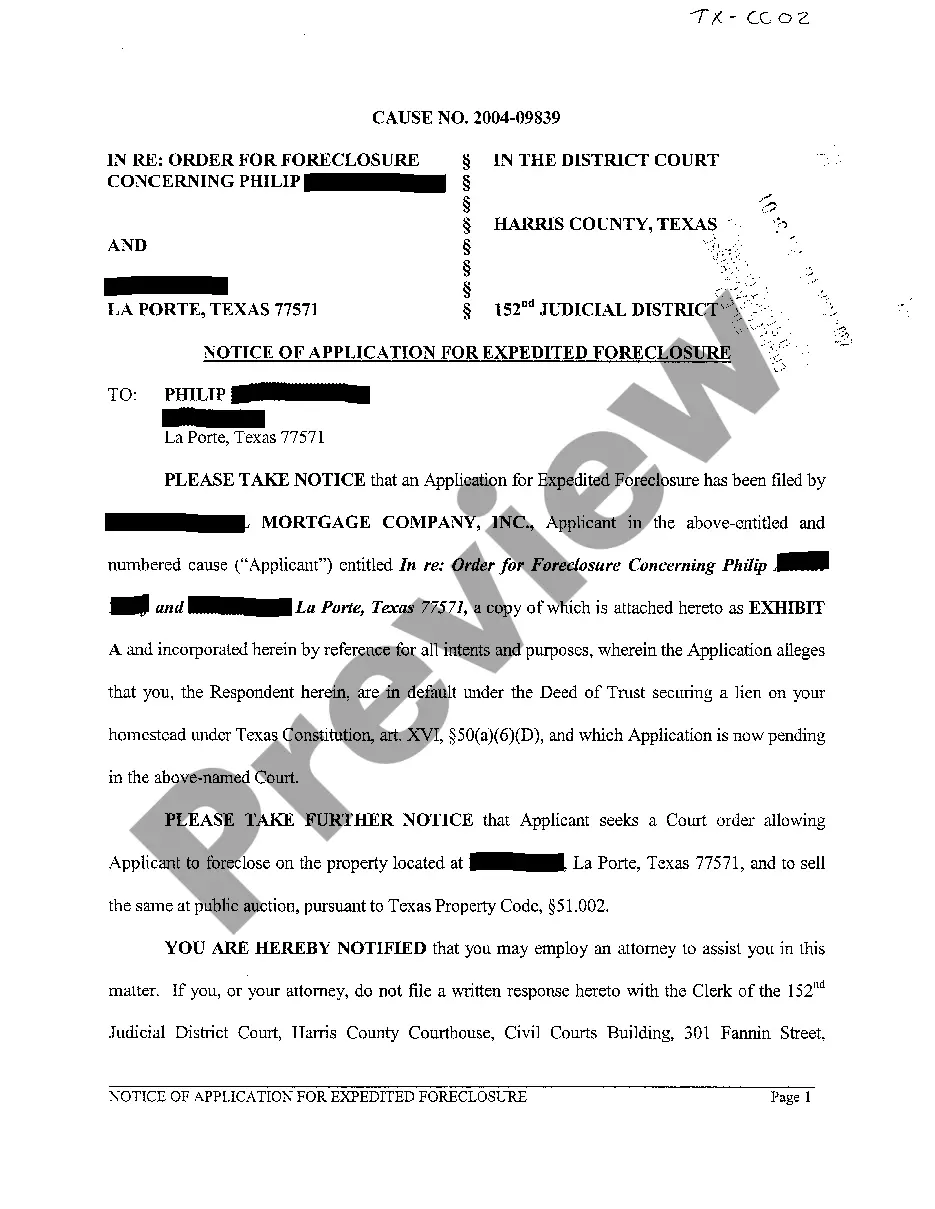

Title: Understanding the Sugar Land Texas Notice of Application for Expedited Foreclosure Keywords: Sugar Land Texas, Notice of Application, Expedited Foreclosure, foreclosure process, foreclosure laws, homeowner's rights, mortgage default, delinquency Introduction: The Sugar Land Texas Notice of Application for Expedited Foreclosure is a legal document that initiates the foreclosure process on a property in Sugar Land, Texas. This notice is typically issued by a lender or mortgage company when a homeowner defaults on their mortgage payments or fails to fulfill their loan obligations. Types of Sugar Land Texas Notice of Application for Expedited Foreclosure: 1. Judicial Foreclosure: This type of foreclosure involves filing a lawsuit against the homeowner, requesting the court's involvement to enforce the foreclosure. The lender initiates this process by filing a Notice of Application for Expedited Foreclosure, which ultimately leads to a court-supervised auction of the property. 2. Non-Judicial Foreclosure: In this type of foreclosure, the lender follows a predetermined set of procedures outlined in the deed of trust or mortgage. The Notice of Application for Expedited Foreclosure is filed with the county clerk's office and published in local newspapers, notifying the homeowner and interested parties about the intended foreclosure sale. Key Elements of the Notice of Application for Expedited Foreclosure: 1. Property Information: The notice includes detailed information about the property, such as the address, legal description, and parcel number. This ensures clarity and helps interested parties identify the specific property in question. 2. Borrower Information: The notice identifies the homeowner in default, including their full name and contact details. It also specifies the delinquent mortgage amount and the loan service or lender's information. 3. Default and Delinquency Details: This section outlines the reasons for default, including missed payments, loan modification denials, or other breaches of the mortgage agreement. It also highlights the outstanding debt and any penalties incurred due to non-payment. 4. Judicial or Non-Judicial Process: Depending on the type of foreclosure, the notice will provide information regarding whether the foreclosure will proceed through the court system (judicial foreclosure) or follow non-judicial procedures. 5. Right to Cure and Redemption Period: The notice may include a Right to Cure provision, which allows the homeowner a specific timeframe to rectify the default by catching up on missed payments and paying any associated fees. It also highlights the homeowner's rights regarding the redemption period, which allows them to reclaim the property after the foreclosure sale. Conclusion: The Sugar Land Texas Notice of Application for Expedited Foreclosure is a critical legal document that outlines the initiation of foreclosure proceedings on a property in Sugar Land. It serves to inform the homeowner, interested parties, and the public about the impending foreclosure sale, ensuring transparency and compliance with foreclosure laws.

Sugar Land Texas Notice of Application for Expedited Foreclosure

Description

How to fill out Sugar Land Texas Notice Of Application For Expedited Foreclosure?

If you are searching for a relevant form template, it’s impossible to choose a better platform than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can find a large number of document samples for organization and personal purposes by types and regions, or keywords. With our advanced search function, discovering the most up-to-date Sugar Land Texas Notice of Application for Expedited Foreclosure is as easy as 1-2-3. Moreover, the relevance of each and every file is verified by a group of professional attorneys that on a regular basis check the templates on our platform and revise them according to the latest state and county demands.

If you already know about our system and have an account, all you need to get the Sugar Land Texas Notice of Application for Expedited Foreclosure is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you want. Check its information and utilize the Preview option to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to find the proper file.

- Confirm your selection. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the form. Pick the format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Sugar Land Texas Notice of Application for Expedited Foreclosure.

Every single form you add to your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to get an additional version for enhancing or printing, you can return and download it once again at any time.

Make use of the US Legal Forms extensive collection to gain access to the Sugar Land Texas Notice of Application for Expedited Foreclosure you were looking for and a large number of other professional and state-specific samples on one website!