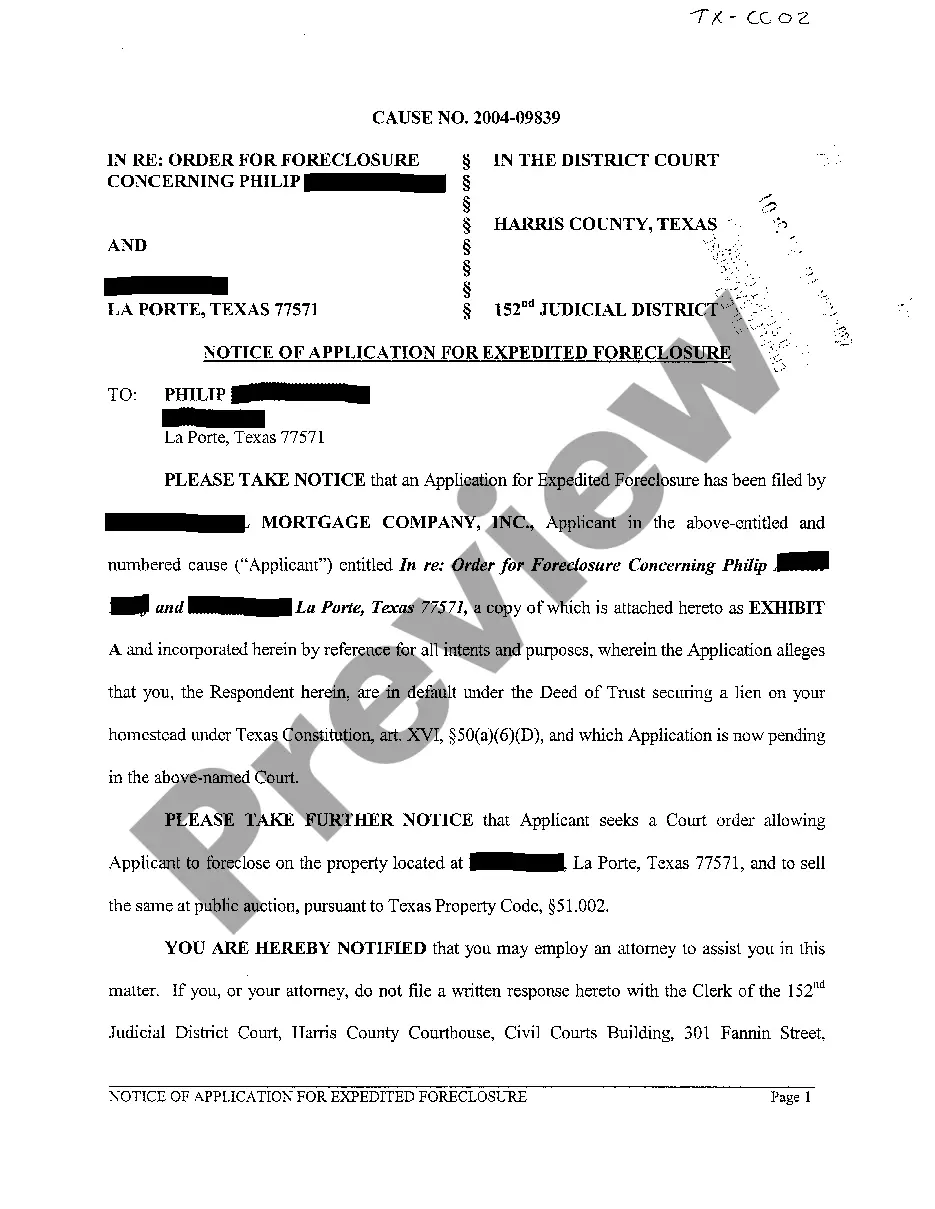

The Waco Texas Notice of Application for Expedited Foreclosure is a legal document that encompasses the process of a speedy foreclosure on a property in Waco, Texas. This Notice is typically filed by mortgage lenders or lien holders when a borrower defaults on their loan payments or fails to fulfill their obligations as outlined in the mortgage agreement. This application initiates the foreclosure process, allowing the lender to take legal action and eventually sell the property to recoup the outstanding debt from the borrower. The Notice of Application for Expedited Foreclosure serves as a notification to the borrower that legal proceedings have commenced and that their property may be seized and sold if they fail to rectify the default within a specified timeframe. In Waco, Texas, there are several types of Notices of Application for Expedited Foreclosure that may be filed, depending on the circumstances and the type of property on which the foreclosure is being pursued. Some common types include: 1. Residential Property Foreclosure: This is filed when a borrower defaults on their residential mortgage, leading to the possibility of their home being foreclosed. 2. Commercial Property Foreclosure: This type of Notice is applicable when a borrower defaults on a loan related to a commercial property, such as office spaces, retail buildings, or industrial warehouses. 3. Land Foreclosure: Filed when a borrower defaults on a loan secured by raw land, vacant lots, or undeveloped property within Waco. 4. Condominium or Townhouse Foreclosure: In cases where borrowers fail to fulfill their obligations related to mortgage loans taken for condominiums or townhouses, lenders file this Notice to initiate foreclosure proceedings. The Waco Texas Notice of Application for Expedited Foreclosure is an essential legal document that sets in motion the foreclosure process on a property when a borrower is unable to meet their financial obligations. It is crucial for borrowers to understand the implications and possibilities of foreclosure when served with such a Notice, as it can have a significant impact on their homeownership status and financial future. It is advisable for borrowers to consult with legal professionals specializing in foreclosure and explore potential alternatives to mitigate the consequences of foreclosure.

Waco Texas Notice of Application for Expedited Foreclosure

Description

How to fill out Waco Texas Notice Of Application For Expedited Foreclosure?

Finding authenticated templates relevant to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements, as well as various real-life situations.

All the paperwork is systematically organized by usage area and jurisdiction, so discovering the Waco Texas Notice of Application for Expedited Foreclosure is as swift and straightforward as ABC.

Keep your documents organized and compliant with legal standards is critically important. Utilize the US Legal Forms library to always have essential document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure you’ve selected the appropriate one that aligns with your needs and fully adheres to your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To expedite closing on a house, ensure that all required documents are prepared and submitted timely. Advanced planning, along with working with experienced professionals, enhances the likelihood of a quick closing. Consider using platforms like uslegalforms to streamline documentation and facilitate efficient processes.

In Arizona, the foreclosure process typically takes between 90 to 120 days. However, circumstances can vary based on the specifics of each case. Utilizing resources like the Waco Texas Notice of Application for Expedited Foreclosure can give you insights into managing timelines in different locations.

The most expedient method of foreclosure often involves filing a Waco Texas Notice of Application for Expedited Foreclosure, which allows for a streamlined process. By adhering to all relevant legal protocols, this option facilitates a faster sale and resolution. It is essential to work with legal professionals to ensure compliance.

An expedited foreclosure in Texas is a faster process intended for specific situations where immediate resolution is necessary. This involves filing a Waco Texas Notice of Application for Expedited Foreclosure, allowing homeowners to clear their financial obligations swiftly. This process minimizes waiting time and helps get properties sold more quickly.

In Texas, you must provide a notice of foreclosure sale at least 21 days before the sale date. This notice should include specific details such as the property address, sale date, and time. Using the Waco Texas Notice of Application for Expedited Foreclosure can help satisfy these legal requirements efficiently.

Yes, you can speed up a foreclosure by utilizing the Waco Texas Notice of Application for Expedited Foreclosure. By following the proper legal channels and providing the necessary documentation, you can shorten the timeline for the foreclosure process. This option provides homeowners a quicker way to resolve their situation.

To expedite a foreclosure, you must file a Waco Texas Notice of Application for Expedited Foreclosure with the court. This process typically involves providing necessary documentation and proof of hardship. Additionally, ensuring that all legal requirements are met will streamline the overall procedure, leading to a faster resolution.

In Texas, foreclosure sales are usually conducted by a trustee, who is often appointed in the deed of trust. This person facilitates the auction where the property is sold to the highest bidder. When dealing with a Waco Texas Notice of Application for Expedited Foreclosure, knowing who conducts these sales can help you prepare and react appropriately. Consider consulting with professionals who can navigate this process for you.

A notice of default is a formal notification from your lender indicating that you have fallen behind on your mortgage payments. This document is the first step toward foreclosure and typically provides you with important timelines for addressing the debt. If you receive a Waco Texas Notice of Application for Expedited Foreclosure, you must respond to avoid further legal actions. Knowledgeable legal assistance can help you understand your options at this stage.

In Texas, after your home has been posted for foreclosure, there is a crucial 37 day rule before the actual sale can take place. This period allows you to contest the sale or make arrangements with your lender. Being aware of the Waco Texas Notice of Application for Expedited Foreclosure is key during this time, as it provides information about your rights and next steps. Use this period to seek guidance and support.