Title: Brownsville Texas Application for Expedited Foreclosure: A Detailed Overview of the Process and Types Introduction: In Brownsville, Texas, an Application for Expedited Foreclosure is a legal process initiated by a lender to foreclose on a property. This comprehensive guide explains the purpose, process, and types of Brownsville Texas Application for Expedited Foreclosure. 1. What is Brownsville Texas Application for Expedited Foreclosure? The Brownsville Texas Application for Expedited Foreclosure is a legal procedure used by lenders in the city of Brownsville, Texas, to recover outstanding debts secured by a property. It allows lenders to expedite the foreclosure process and reduce the time between notification and the actual foreclosure sale. 2. Purpose of Expedited Foreclosure: The primary objective of the Brownsville Texas Application for Expedited Foreclosure is to ensure timely recovery of a mortgage loan by enabling lenders to foreclose on a property quickly. By minimizing the time-consuming aspects of the foreclosure process, lenders can recover debts more efficiently. 3. Process of Brownsville Texas Application for Expedited Foreclosure: 3.1 Preparing the Application: The lender must compile all necessary documents, including the original mortgage agreement, promissory note, any amendments, and evidence of default. They must also obtain information about the property and the borrower. 3.2 Filing the Application: The lender must file the Application for Expedited Foreclosure with the designated court in Brownsville, Texas, along with the required fee. The application should include all relevant documents and evidence of default. 3.3 Notice to Borrower: Once the application is filed, the borrower is served with a notice stating the intention to foreclose on the property. The notice includes information on the time frame and location of the foreclosure sale. 3.4 Foreclosure Sale: After the notice period, a foreclosure sale is scheduled by the court. The property is auctioned to the highest bidder, and the proceeds are used to pay off the outstanding debt. 4. Types of Brownsville Texas Application for Expedited Foreclosure: 4.1 Foreclosure of Residential Property: Specific application procedures apply to residential properties, allowing lenders to expedite the foreclosure process for non-performing borrowers who have defaulted on their mortgage payments. 4.2 Foreclosure of Commercial Property: For commercial properties, lenders can also utilize the Brownsville Texas Application for Expedited Foreclosure. The process allows for faster recovery of commercial debts, ensuring timely resolution. 4.3 Second Lien Foreclosure: In cases where there is a second lien on a property, a separate application may be necessary to foreclose on the subordinate lien. The Brownsville Texas Application for Expedited Foreclosure can be tailored to address such circumstances. Conclusion: The Brownsville Texas Application for Expedited Foreclosure provides lenders with an efficient legal tool to recover outstanding debts secured by properties. By streamlining the foreclosure process, this application expedites debt recovery and ensures a fair opportunity for potential buyers to acquire the property through auction.

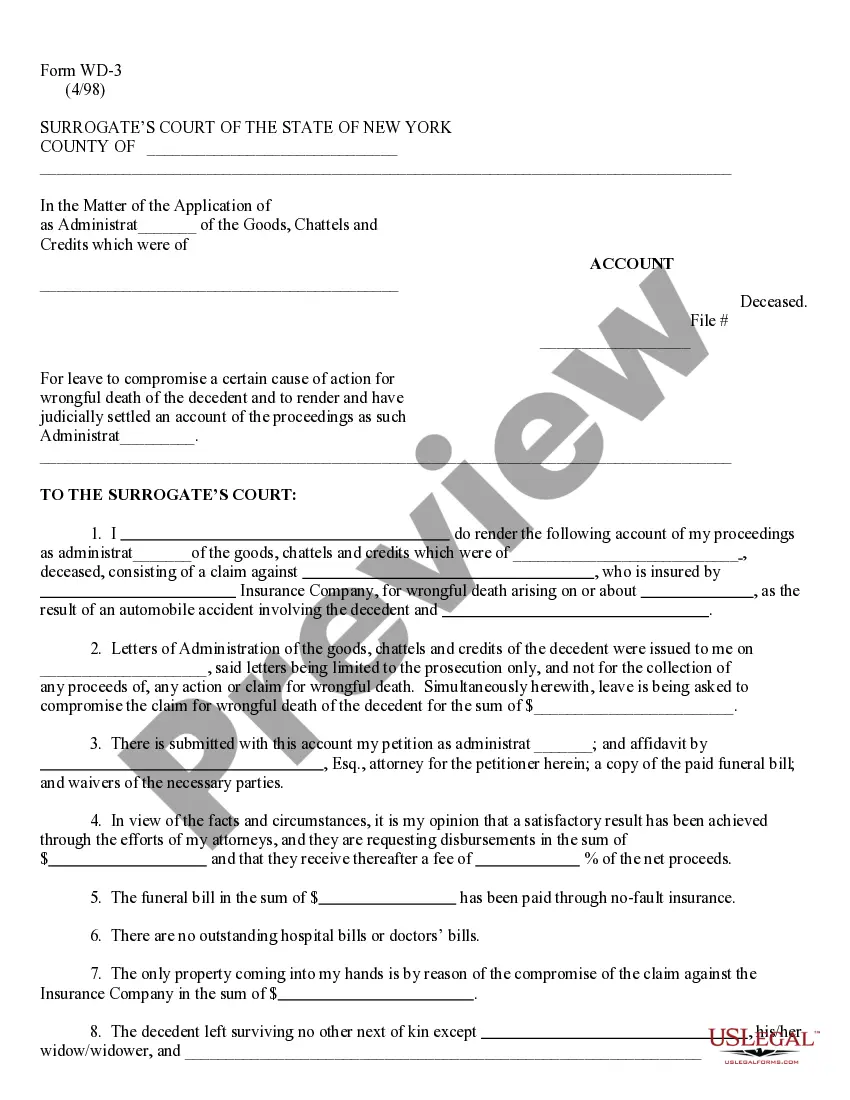

Brownsville Texas Application For Expedited Foreclosure

Description

How to fill out Brownsville Texas Application For Expedited Foreclosure?

If you are looking for a legitimate form, it’s unfeasible to select a more suitable service than the US Legal Forms website – one of the most extensive collections online.

Here you can acquire a vast array of form examples for corporate and personal uses categorized by types and regions, or specific keywords.

With our premium search tool, obtaining the latest Brownsville Texas Application For Expedited Foreclosure is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the document. Choose the format and download it to your device.

- Furthermore, the validity of each document is validated by a team of experienced lawyers who routinely assess the templates on our site and refresh them according to the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Brownsville Texas Application For Expedited Foreclosure is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have selected the sample you desire. Review its details and utilize the Preview option to examine its content. If it does not fit your requirements, use the Search field at the top of the page to locate the necessary document.

- Validate your selection. Choose the Buy now button. After that, select the appropriate subscription plan and enter your information to create an account.

Form popularity

FAQ

In Texas, the foreclosure process generally spans between 60 to 180 days. Factors influencing this duration include the specific circumstances of the case and any contests filed by the homeowner. For those looking to expedite or navigate this timeline, the Brownsville Texas Application For Expedited Foreclosure serves as a helpful resource.

Yes, you can stop a foreclosure in Texas, but it often requires quick and decisive action. Options include negotiating directly with your lender or considering filing for bankruptcy. Utilizing the Brownsville Texas Application For Expedited Foreclosure may also provide a more efficient way to address your circumstances.

The foreclosure process in Texas typically takes about 60 to 90 days once a notice of default is filed. However, this timeline can vary based on several factors, including whether the homeowner contests the foreclosure. If you are facing this situation, consider the Brownsville Texas Application For Expedited Foreclosure to streamline the process.

An expedited foreclosure in Texas allows lenders to speed up the foreclosure process, often for specific reasons, such as vacant properties. This process can dramatically shorten the timelines associated with standard foreclosure procedures. Understanding the expedited process is crucial if you’re facing financial hardship. Utilizing the Brownsville Texas Application For Expedited Foreclosure can help streamline this complex situation.

Texas does not offer a traditional redemption period after a foreclosure sale. However, homeowners may reclaim their property before the sale occurs by paying the full amount owed. Understanding your rights is essential in these situations. Explore the Brownsville Texas Application For Expedited Foreclosure for additional resources on navigating your options.

The 120-day timeline is often a misconception in Texas foreclosure practices. While lenders can take various steps before and during foreclosure, the overall timeline often falls between 60 to 180 days. This duration includes both the notice period and the auction. If you're unsure about the timeline, a Brownsville Texas Application For Expedited Foreclosure can clarify your options.

To claim foreclosure overage in Texas, you must file a claim with the court that processed the foreclosure. After selling the property, any excess funds beyond the mortgage balance may belong to you. It's essential to act quickly because there are deadlines for these claims. You can find assistance with the Brownsville Texas Application For Expedited Foreclosure to help navigate this process.

Typically, the foreclosure process in Texas takes about 60 to 180 days. This timeframe can vary based on several factors, including lender policies and borrower responses. If you're experiencing financial trouble, knowing this timeline can help manage your situation. Using the Brownsville Texas Application For Expedited Foreclosure allows for a swifter process if needed.

A bank can begin foreclosure proceedings as soon as you fall 30 days behind on payments. Once initiated, the process usually takes about 60 to 90 days. However, this timeline can vary based on whether you contest the foreclosure. If speed is your concern, look into a Brownsville Texas Application For Expedited Foreclosure for quicker resolution.

In Texas, missing just one payment can put you at risk of foreclosure. Lenders usually begin the foreclosure process after you are more than 30 days late on your mortgage payment. However, every lender operates differently, so it's wise to communicate with them. If you're facing difficulties, consider the Brownsville Texas Application For Expedited Foreclosure to expedite the process.