Dallas Texas Application For Expedited Foreclosure is a legal process through which a lender can seek a faster resolution to foreclose on a property in Dallas, Texas. It is important to note that this description is based on general knowledge, and it is recommended to consult with a legal professional for accurate information and specific details. Keywords: Dallas, Texas, application, expedited foreclosure, foreclosure process, lender, property. The Dallas Texas Application for Expedited Foreclosure is a tool used by lenders to streamline and expedite the foreclosure process in Dallas, Texas. This application is typically utilized when a borrower has defaulted on their mortgage payments and the lender seeks to recover the outstanding debt by initiating foreclosure proceedings. When a lender decides to pursue an expedited foreclosure in Dallas, Texas, they must file the application with the appropriate court and follow the necessary legal procedures. The application must include specific details about the property, the borrower, and the delinquent mortgage payments. It is important to understand that there may be different types of Dallas Texas Applications for Expedited Foreclosure, depending on the circumstances and the nature of the defaulted loan. These variations might include applications for residential properties, commercial properties, or even vacant land. In the residential context, the Dallas Texas Application for Expedited Foreclosure requires the lender to provide information about the property's address, legal description, and the owner's name. Additionally, the lender needs to outline the amount of outstanding debt, the number of missed payments, and any attempts made to resolve the delinquency. For commercial properties, the application process might involve a more comprehensive analysis of the borrower's financial situation, including information about the borrower's business, assets, and liabilities. The lender may also need to demonstrate that all required legal notices and attempts to resolve the delinquency have been made before applying for expedited foreclosure. In the case of vacant land, the lender must provide evidence that the borrower has failed to make payments, typically through delivery of written notices or other legal means. Additionally, the lender might need to present details about the land's potential value and any relevant zoning regulations. Once the Dallas Texas Application for Expedited Foreclosure is submitted, the court will review the documentation and assess whether the lender's request for an expedited process is justified. If approved, the foreclosure process can proceed more swiftly, potentially allowing the lender to reclaim the property and recoup their losses in a timelier manner. In conclusion, the Dallas Texas Application for Expedited Foreclosure is a legal tool utilized by lenders in Dallas, Texas, to accelerate the foreclosure process in cases of borrower default. While variations of this application might exist for residential, commercial, or vacant land properties, the overall objective remains the same: to facilitate a faster resolution to the foreclosure process in accordance with applicable laws and regulations.

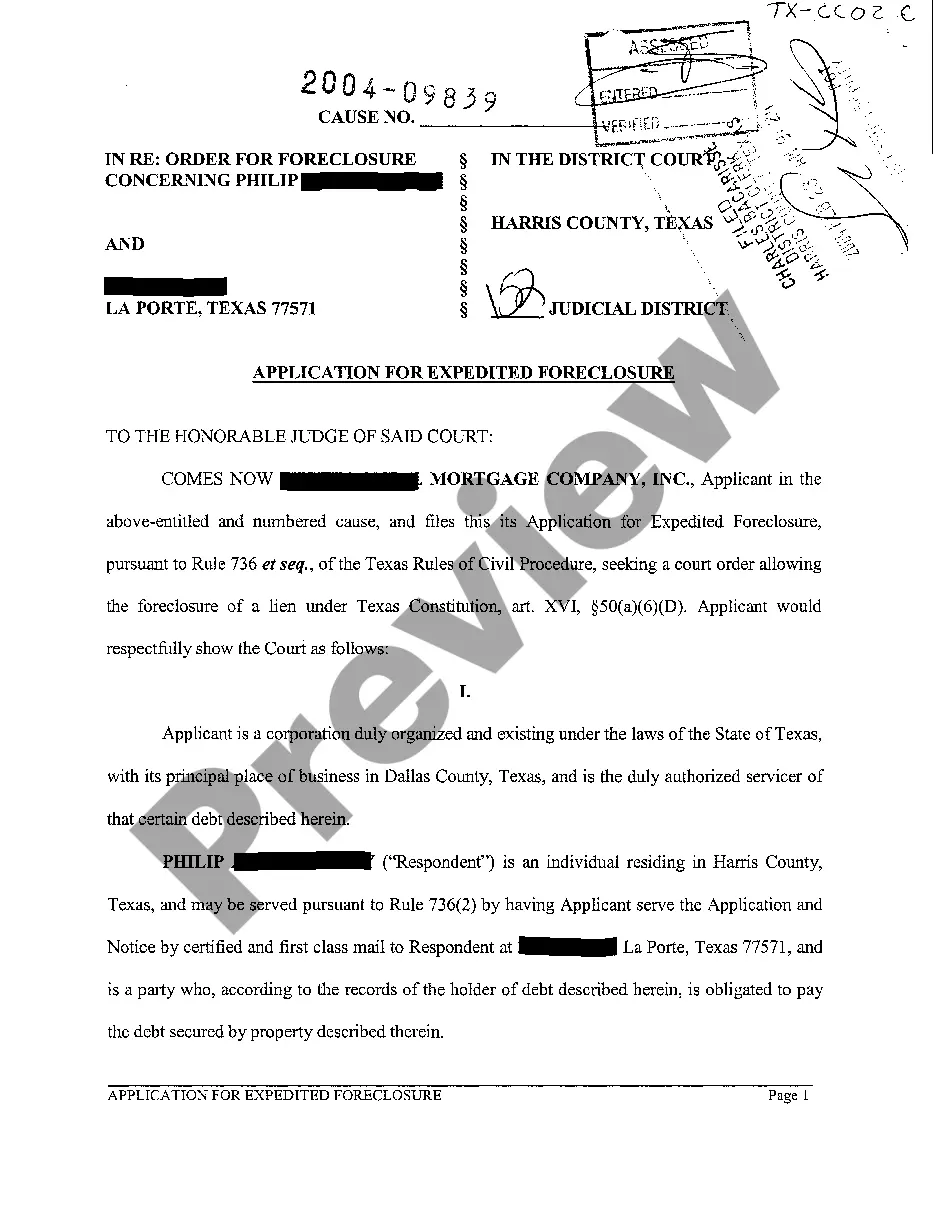

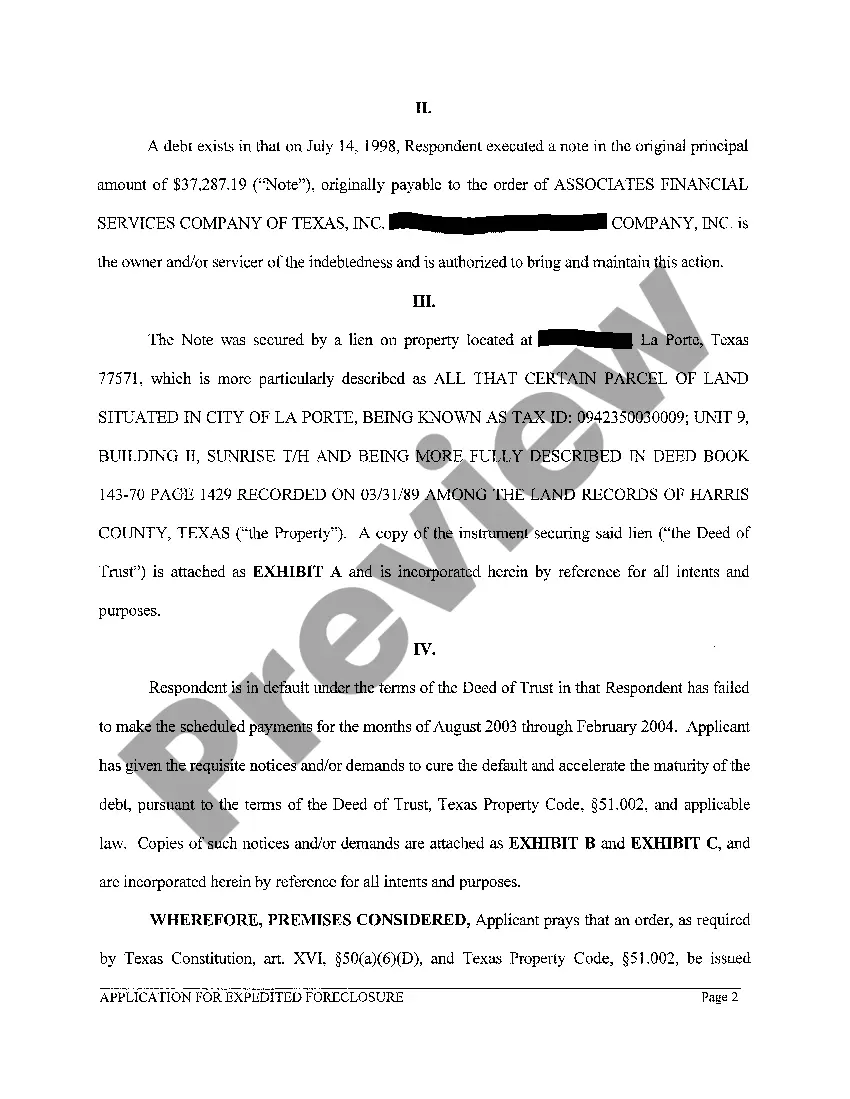

Dallas Texas Application For Expedited Foreclosure

State:

Texas

County:

Dallas

Control #:

TX-CC-02-04

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Application For Expedited Foreclosure

Free preview

How to fill out Dallas Texas Application For Expedited Foreclosure?

If you’ve already used our service before, log in to your account and save the Dallas Texas Application For Expedited Foreclosure on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Dallas Texas Application For Expedited Foreclosure. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

More info

The current assignment of the lien recorded in the real property records of the county where the property is located. Find Foreclosure Notices.Records Building - 500 Elm Street, Suite 2100, Dallas, TX 75202. A Practice Note discussing residential and commercial foreclosure procedures under Texas law. Foreclosure Proceedings. In Re: Order of Foreclosure IN THE DISTRICT COURT Concerning 810 West 12th Street, Dallas, TX 75208 Under Tex. What are the Limitations on HOA Collection and Foreclosure Suits in Texas? Passport Fees. FEES. Passport Application Fee - this fee varies based on age and the type of processing you choose (routine vs. expedite). Payments without a mortgage coupon should be mailed to: Flagstar Bank P.O. Box 660263.

Payment may be made by cashier's check, money order or wire transfer. Payment may also be made by credit card. Other payment methods available. For more information about Passport Processing, contact Passport Processing Services at. Foreclosed homes (Texas Department of Housing and Community Affairs) — contact the Dallas County Human Services Division at or visit their website AT FORT WORTH : Auctions: If you buy a foreclosure sale at auction, you must pay a 3,000 deposit to secure your property in the sale. You may use the money to pay your real estate taxes if you haven't already done so. Note that you may not use the money for any other purpose, even after the sale. (For example, you cannot put it in an escrow account for the seller to use for taxes.) As a general rule, a nonrefundable fee of 25 per lot is charged for each lot. This fee covers the cost of conducting the sale.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.

Payment may be made by cashier's check, money order or wire transfer. Payment may also be made by credit card. Other payment methods available. For more information about Passport Processing, contact Passport Processing Services at. Foreclosed homes (Texas Department of Housing and Community Affairs) — contact the Dallas County Human Services Division at or visit their website AT FORT WORTH : Auctions: If you buy a foreclosure sale at auction, you must pay a 3,000 deposit to secure your property in the sale. You may use the money to pay your real estate taxes if you haven't already done so. Note that you may not use the money for any other purpose, even after the sale. (For example, you cannot put it in an escrow account for the seller to use for taxes.) As a general rule, a nonrefundable fee of 25 per lot is charged for each lot. This fee covers the cost of conducting the sale.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.