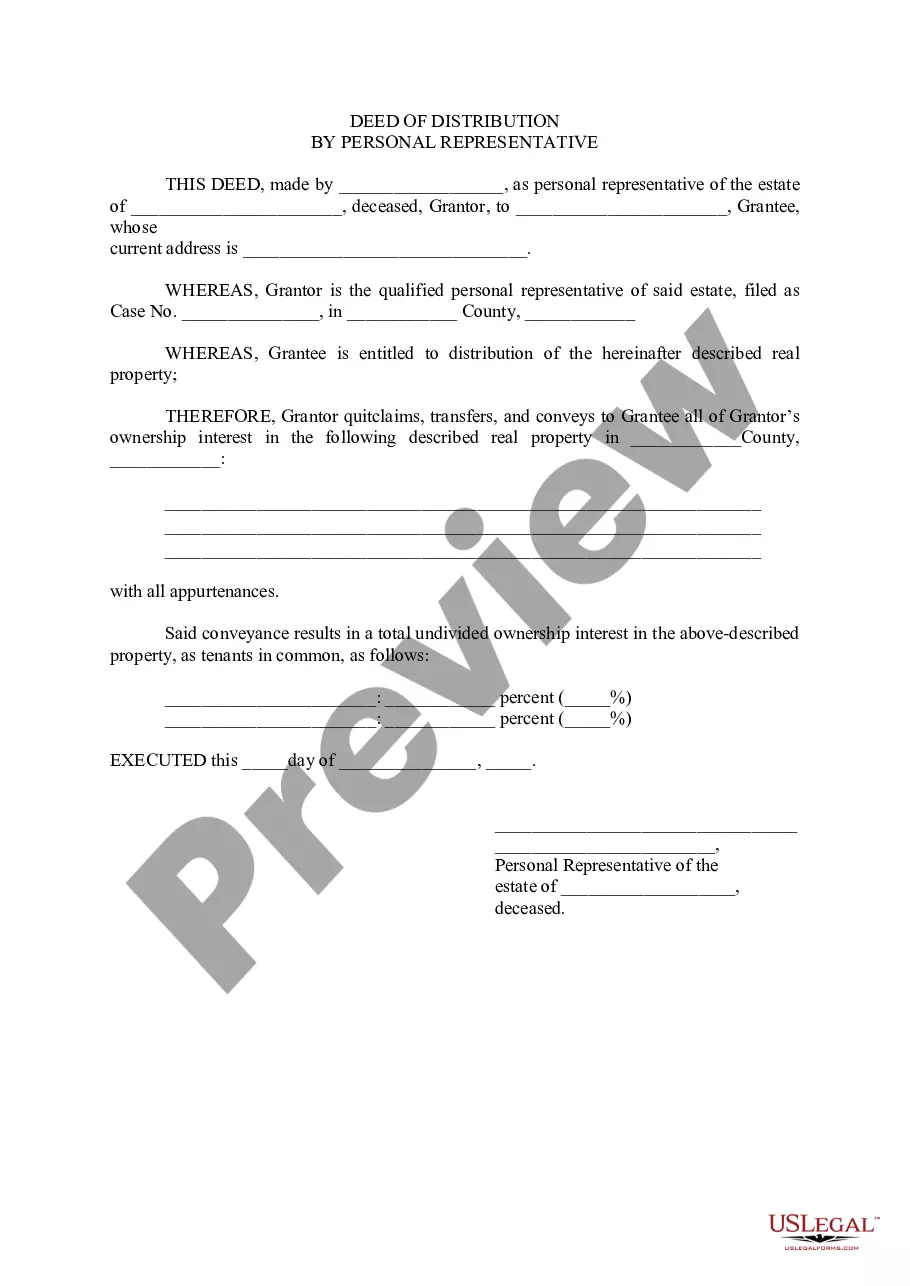

Irving Texas Application for Expedited Foreclosure is a legal process that allows lenders to request an accelerated foreclosure on a property in the city of Irving, Texas. This application is specifically designed to expedite foreclosure proceedings and help streamline the process for lenders and borrowers involved in cases of nonpayment or default on mortgage loans. The Irving Texas Application for Expedited Foreclosure aims to provide an efficient and timely resolution for lenders seeking to recover their investment in properties that have fallen into delinquency. By submitting this application, lenders can request the court's permission to proceed with a foreclosure sale without extensive delays. There are several types of Irving Texas Application for Expedited Foreclosure, each catering to specific circumstances: 1. Residential Property Foreclosure: This type of application is used by lenders when the property in question is a residential dwelling, such as a single-family home, townhouse, or condominium. It allows lenders to initiate the foreclosure process promptly in situations where the homeowner has failed to make mortgage payments. 2. Commercial Property Foreclosure: This application is specifically for lenders looking to expedite the foreclosure process on commercial properties, including office buildings, retail spaces, warehouses, and other non-residential properties. It enables lenders to quickly recover their investment in cases where the borrower has defaulted on the loan. 3. Vacant Land Foreclosure: When a borrower defaults on a loan specifically taken for the purchase of vacant land in Irving, Texas, lenders can utilize this application to obtain an expedited foreclosure. It facilitates a swifter resolution and allows the lender to take possession of the property. Key factors considered in the Irving Texas Application for Expedited Foreclosure process include the amount of outstanding debt, the duration of default, and the extent of efforts made by both the lender and the borrower to resolve the nonpayment issue. It is important to note that the Irving Texas Application for Expedited Foreclosure must comply with all applicable laws, regulations, and judicial requirements to ensure a fair and equitable process for all parties involved. Lenders must provide detailed documentation and evidence to support their application, including the loan agreement, payment history, and any attempts made to resolve the default before initiating foreclosure. In conclusion, the Irving Texas Application for Expedited Foreclosure is a legal mechanism that aids lenders in quickly resolving nonpayment issues related to mortgage loans on residential, commercial, and vacant land properties in Irving, Texas. By utilizing this application, lenders can seek permission from the court to expedite the foreclosure process and recover their investment efficiently.

Irving Texas Application For Expedited Foreclosure

Description

How to fill out Irving Texas Application For Expedited Foreclosure?

Irrespective of societal or occupational standing, filling out legal paperwork is an unfortunate requirement in the current professional landscape.

Often, it’s almost unfeasible for an individual lacking any legal expertise to generate such documents from scratch due to the intricate language and legal subtleties involved.

This is where US Legal Forms steps in to assist.

Ensure the document you've located is appropriate for your location, as the regulations of one state or area may not apply to another.

Review the form and examine a brief overview (if provided) of situations in which the document can be utilized.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms suitable for nearly any legal context.

- US Legal Forms is also a remarkable resource for colleagues or legal advisors seeking to save time by using our DIY forms.

- Whether you require the Irving Texas Application For Expedited Foreclosure or any other document relevant in your region, US Legal Forms has everything you need.

- Here's how to obtain the Irving Texas Application For Expedited Foreclosure within minutes through our dependable service.

- If you are an existing user, you can simply Log In to your account to download the necessary document.

- However, if you're new to our collection, please follow these steps prior to acquiring the Irving Texas Application For Expedited Foreclosure.

Form popularity

FAQ

An expedited foreclosure is a legal process that allows homeowners to foreclose more quickly than the standard timeline. In Irving, using the Irving Texas Application For Expedited Foreclosure enables a faster resolution, often benefiting both parties involved. This process can be suitable for those seeking to address their situation with efficiency. Exploring this option can yield faster outcomes in circumstances that warrant urgency.

The 37 day foreclosure rule in Texas mandates that a lender must provide a notice of default and a 21-day delay before a foreclosure sale. This means that from the day of notice, homeowners have at least 37 days to potentially resolve the outstanding debt. By understanding the Irving Texas Application For Expedited Foreclosure, you can streamline your options during this waiting period. Being proactive can help in seeking solutions sooner rather than later.

In Texas, the foreclosure process typically takes about 60 to 90 days from the time the lender files for foreclosure. However, with the Irving Texas Application For Expedited Foreclosure, the process can be significantly faster. Utilizing this application can help you navigate the requirements, leading to quicker resolutions. It's essential to understand local laws and your options to move forward effectively.

Nevada typically holds the highest foreclosure rate in the United States, reflecting economic challenges in that region. Homeowners in such situations can feel overwhelmed by the process. For those in Texas, the Irving Texas Application For Expedited Foreclosure offers a solution to potentially shorten the foreclosure timeframe and relieve some of that stress.

In some states, a bank can initiate foreclosure as quickly as three months after you default on your mortgage. However, factors like legal requirements and homeowner actions can influence this timeline. If you are located in Texas, the Irving Texas Application For Expedited Foreclosure can provide the opportunity to handle your situation more promptly.

New Jersey has the longest foreclosure process, often exceeding two years. This lengthy process can cause considerable stress for homeowners in financial trouble. Utilizing the Irving Texas Application For Expedited Foreclosure may offer a quicker resolution, thereby easing your burden.

The average foreclosure process in the United States typically takes around six months to over a year. However, this duration can vary significantly by state and individual circumstances. If you are facing imminent foreclosure, consider the Irving Texas Application For Expedited Foreclosure to help expedite the process and minimize delays.

In Texas, the foreclosure process typically starts 60 days after the homeowner misses their mortgage payment. Once the lender initiates the foreclosure, they must provide notice to the homeowner, which adds time to the timeline. The whole process, from the missed payment to the auction of the property, can take several months, depending on various factors. Utilizing the Irving Texas Application For Expedited Foreclosure can help streamline the process and reduce delays, allowing you to move forward more quickly.

The foreclosure process can vary in speed, but in Texas, it is often notably quicker than in many other states, sometimes taking as little as 21 days for expedited cases. Homeowners should stay informed about their options. Using the Irving Texas Application For Expedited Foreclosure can help accelerate the process and reduce uncertainties.

The most expedient method of foreclosure in Texas is the non-judicial foreclosure, which does not involve court intervention. This method typically allows lenders to move quickly in reclaiming properties. If you’re facing foreclosure, the Irving Texas Application For Expedited Foreclosure can guide you in choosing the best path.