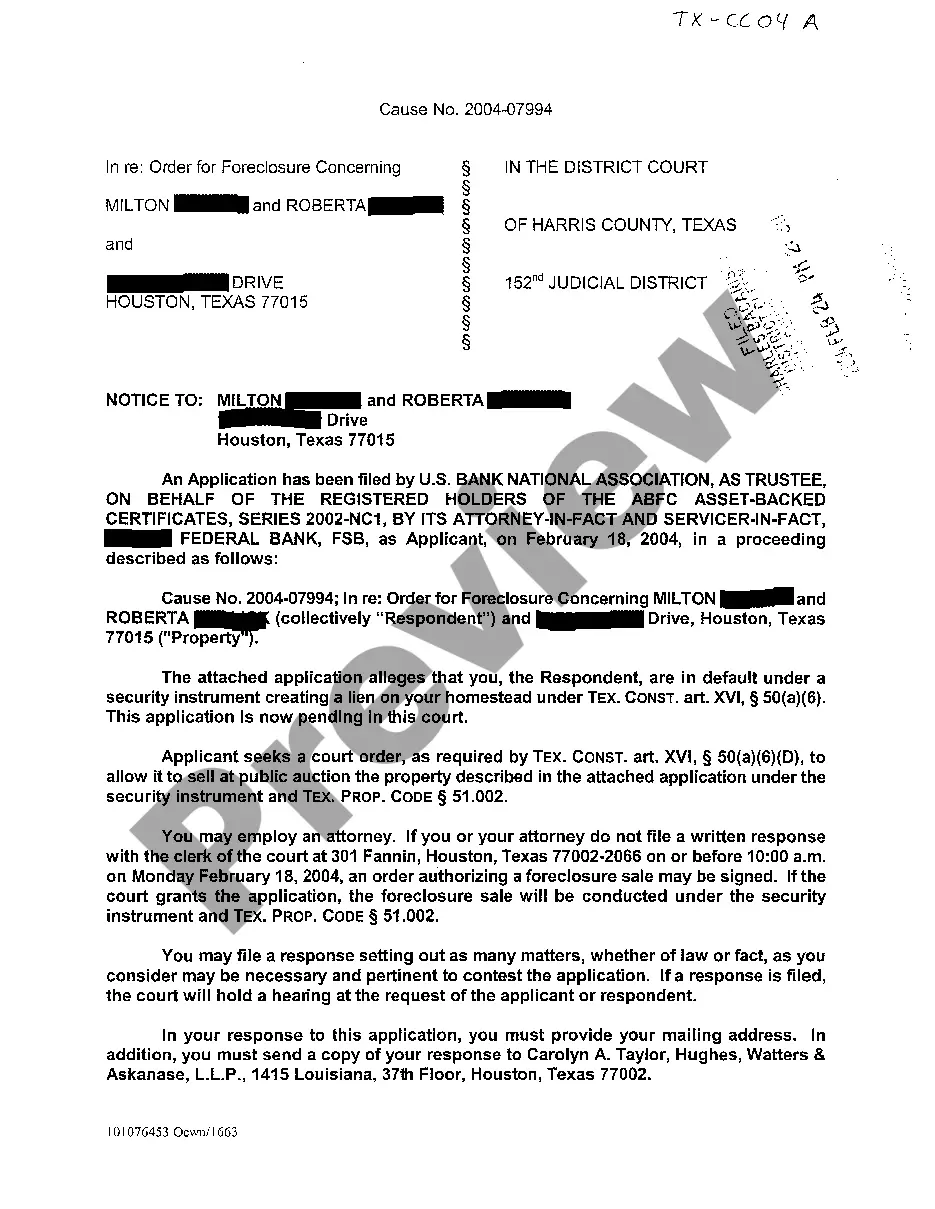

Waco Texas Application For Expedited Foreclosure

Description

How to fill out Texas Application For Expedited Foreclosure?

Locating validated templates tailored to your regional regulations can be daunting unless you access the US Legal Forms repository.

It’s a web-based collection of over 85,000 legal documents for both individual and business purposes and various real-life scenarios.

All the paperwork is accurately categorized by usage area and jurisdiction, making the discovery of the Waco Texas Application For Expedited Foreclosure as straightforward as pie.

Maintaining organized documentation that adheres to legal standards is crucial. Take advantage of the US Legal Forms collection to always have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and document explanation.

- Ensure you’ve selected the correct one that fulfills your needs and entirely aligns with your local jurisdiction criteria.

- Look for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- If it fits your criteria, proceed to the following step.

Form popularity

FAQ

There are some exceptions to the 120-day rule that can allow a lender to proceed with foreclosure sooner. For instance, if the borrower has abandoned the property or if the mortgage agreement specifies alternative timelines. Utilizing services like US Legal Forms provides guidance on navigating these exceptions and effectively applying for a Waco Texas Application For Expedited Foreclosure to protect your interests.

The 120-day rule is a key regulation impacting foreclosures in many states, including Texas. This rule mandates that a lender cannot initiate foreclosure proceedings until at least 120 days after a borrower has defaulted on their mortgage. By understanding this rule, property owners can consider a Waco Texas Application For Expedited Foreclosure, which may offer quicker resolutions.

Foreclosures in Tennessee primarily follow a non-judicial process. This means that once a borrower defaults, lenders may initiate foreclosure without going through the courts. It's important to understand that in Waco, Texas, applying for an expedited foreclosure can streamline this process, helping property owners regain their balance sooner.

In Texas, the timeline to foreclose on a lien can vary, but generally, lenders may have a specified time frame dictated by the contract terms. However, after a default, the lender must comply with the 120-day rule before proceeding with foreclosure. If you are dealing with liens and considering the Waco Texas Application For Expedited Foreclosure, being aware of these timelines can greatly impact your approach.

Yes, in Texas, lenders must wait at least 120 days from the first missed payment before initiating foreclosure. This waiting period allows homeowners to explore options for financial recovery. If you are facing foreclosure and looking into a Waco Texas Application For Expedited Foreclosure, understanding this timeline is essential for navigating your situation.

The 120-day rule applies to various mortgage contracts, particularly those involving residential properties. It is important to note that this rule can impact standard home loans but may not apply to all types of secured loans. When considering a Waco Texas Application For Expedited Foreclosure, knowing which contracts are affected can assist you in making informed decisions.

The 120-day foreclosure rule in Texas allows lenders to begin foreclosure proceedings no sooner than 120 days after a homeowner misses their first payment. This rule gives borrowers time to resolve their financial issues and potentially avoid foreclosure. Understanding this rule is crucial when considering a Waco Texas Application For Expedited Foreclosure, as it sets a timeline for actions related to the property.

Rule 736 of the Texas Rules of Civil Procedure establishes the legal framework for filing a Waco Texas Application For Expedited Foreclosure. This rule allows a lender to obtain a judgment for expedited foreclosure without a trial, streamlining the process significantly. By utilizing this rule, property owners can face a quicker resolution regarding their foreclosure status. For those navigating this complex situation, US Legal Forms offers resources that simplify the preparation and submission of your application.

Foreclosing on a property in Texas typically takes about 60 days after the lender has notified the borrower of missed payments. However, the entire process, from initial default to the final sale, can extend anywhere from three to six months, depending on multiple factors. For more detail on expediting this process, refer to the Waco Texas Application For Expedited Foreclosure to assist you in navigating the timeline effectively.

The timeline for foreclosure in Texas can vary widely, but it often takes between three to six months from the missed payment notification to the foreclosure sale date. Various factors, such as lender policies and the homeowner's responsiveness, can influence this timeline. To expedite the process and understand your rights, check out the Waco Texas Application For Expedited Foreclosure for helpful information.