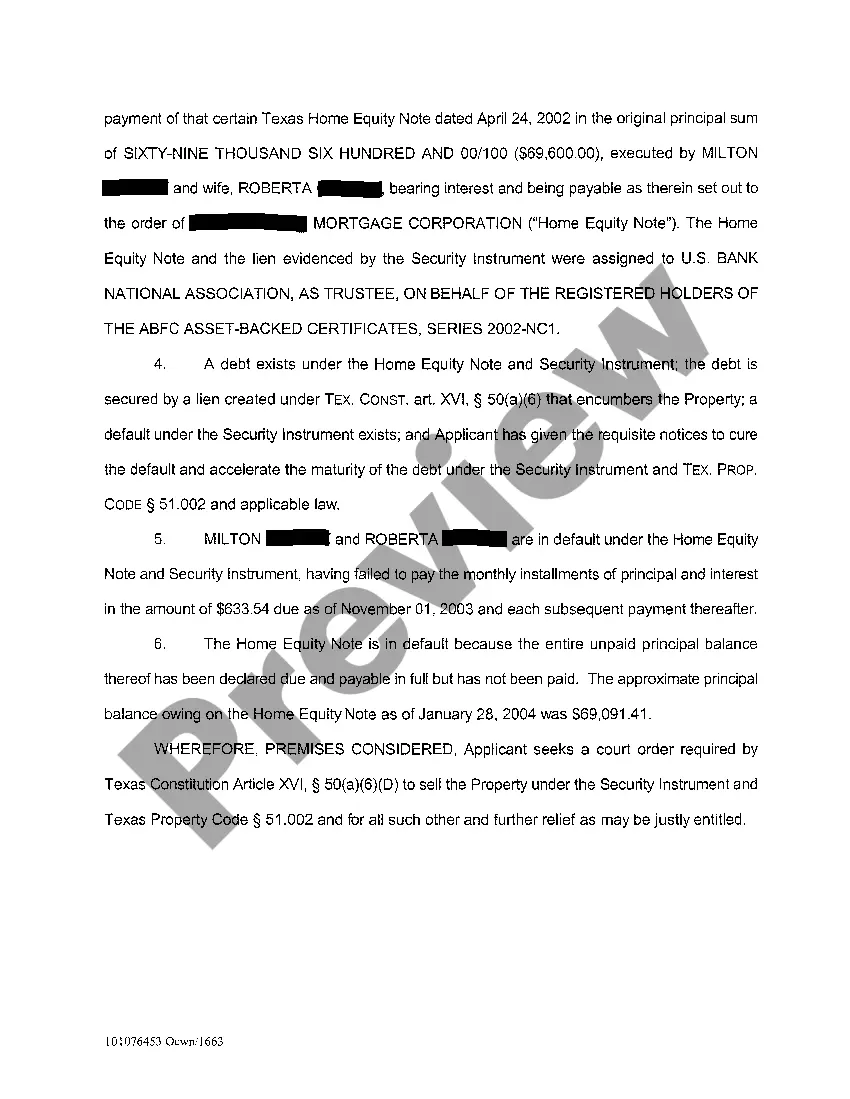

The Austin Texas Application for Expedited Foreclosure is a legal document that is used in Austin, Texas to request an accelerated process for foreclosing on a property. This application is typically submitted by a mortgage lender or lien holder who is seeking to regain possession of a property due to the borrower's default on their loan agreement. The purpose of an expedited foreclosure is to speed up the legal process and facilitate a quicker resolution for all parties involved. This can help lenders minimize their financial losses and ensure a prompt transition in property ownership. The application typically includes various sections that require detailed information about the property, borrower, and the reasons behind the foreclosure request. Relevant keywords that may be included in the application include: 1. Property Information: This section requires the applicant to provide the complete address of the property being foreclosed, along with its legal description, parcel number, and any other identifying details. 2. Borrower Information: Here, the application requests the full name of the borrower or borrowers, their contact information, and any additional details required for identification purposes. 3. Legal Basis: This section outlines the legal grounds on which the lender is seeking an expedited foreclosure. Common reasons may include non-payment of mortgage installments, violation of loan agreement terms, or abandonment of the property by the borrower. 4. Supporting Documentation: The application may require the applicant to attach relevant supporting documents such as the promissory note, the mortgage document, and any correspondence indicating foreclosure proceedings. These documents serve as evidence to substantiate the lender's claim. 5. Notification: This section addresses the requirement to notify all parties involved, including the borrower, any other lien holders, and any individuals with an interest in the property. 6. Requested Relief: The application generally provides a space to request specific relief sought, such as appointment of a trustee, the sale of the property, or any other actions needed to facilitate an expedited foreclosure. Different types or variations of the Austin Texas Application for Expedited Foreclosure may exist depending on local ordinances, changes in legislation, or specific circumstances. However, the basic purpose and structure of the application typically remain consistent, aiming to provide a streamlined process for foreclosure actions.

Austin Texas Application For Expedited Foreclosure

Description

How to fill out Austin Texas Application For Expedited Foreclosure?

Finding certified templates that align with your local laws can be difficult unless you access the US Legal Forms library.

This online resource boasts over 85,000 legal forms for personal and professional requirements and various real-world situations.

All documents are systematically categorized by usage area and jurisdiction, making it as simple as pie to find the Austin Texas Application For Expedited Foreclosure.

Utilize the US Legal Forms library to keep your paperwork organized and in accordance with legal standards. It’s essential to have crucial document templates at your fingertips for any necessities!

- Examine the Preview mode and document description.

- Ensure you've selected the appropriate one that fulfills your requirements and adheres to your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it suits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Cure Your Default Under New Jersey law, however, all foreclosures must be judicial, which means they go through the court system (and you can't file a separate lawsuit to challenge foreclosure). You can stop foreclosure by curing a default on your mortgage payments at any time up until the entry of a final judgment.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

4 Ways to Stop Alabama Foreclosure Catch up on past-due balances.Apply for a loan modification.Consider a short sale or deed in lieu of foreclosure.File Chapter 13 Bankruptcy.What about Chapter 7 Bankruptcy?

Typically, it takes about 90 days to foreclose on a Maryland property if the borrower does not object to the foreclosure. If a lender pursues a judicial foreclosure in Maryland then the time frame for foreclosure will vary depending on the court's schedule and orders.

If you are unable to make your mortgage payment: Don't ignore the problem.Contact your lender as soon as you realize that you have a problem.Open and respond to all mail from your lender.Know your mortgage rights.Understand foreclosure prevention options.Contact a HUD-approved housing counselor.

Federal regulation issued by the Consumer Financial Protection Bureau that states the mortgage loan obligation must be over 120 days delinquent before initiating a foreclosure action.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

You can stop a foreclosure in its tracks?at least for a while?by filing for bankruptcy. Filing for Chapter 7 bankruptcy will stall a foreclosure, but usually only temporarily. You can use Chapter 7 bankruptcy to save your home if you're current on the loan and you don't have much equity.