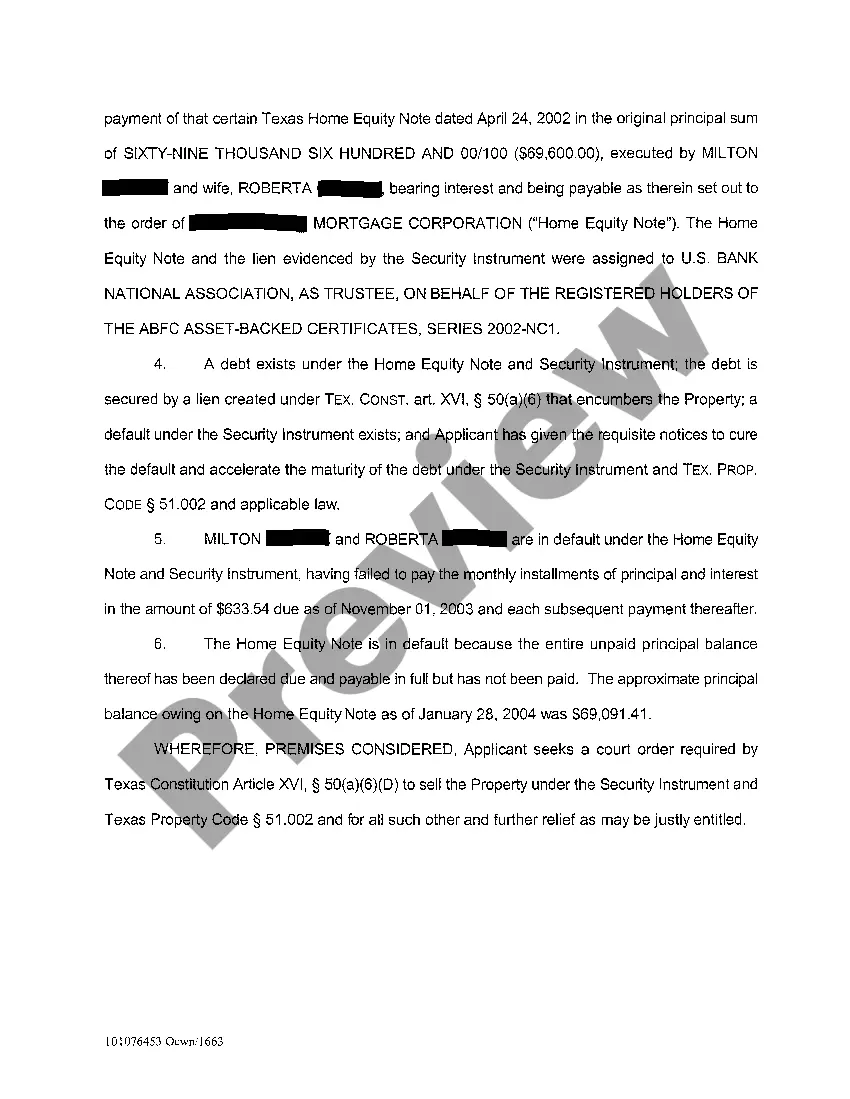

College Station, Texas Application for Expedited Foreclosure is a legal process designed to accelerate the foreclosure proceedings on a property. This type of application is filed with the court by a mortgage lender or lien holder to obtain a quicker resolution of a foreclosure case. Keywords: College Station, Texas, Application, Expedited Foreclosure, legal process, foreclosure proceedings, mortgage lender, lien holder, quicker resolution, foreclosure case. In College Station, Texas, there are two main types of Application for Expedited Foreclosure: 1. Residential Property Expedited Foreclosure Application: This application is specifically designed for residential properties, such as houses, condos, or townhouses, that are subject to foreclosure due to non-payment of mortgage or default on loan agreements. The purpose of this application is to expedite the foreclosure process, allowing lenders to regain possession of the property swiftly. 2. Commercial Property Expedited Foreclosure Application: Commercial properties, including office buildings, retail spaces, or industrial facilities, may also be subject to foreclosure. In such cases, the mortgage lender or lien holder can file a commercial property expedited foreclosure application to expedite the legal process and recover any outstanding debts tied to the property efficiently. To initiate an Application for Expedited Foreclosure in College Station, Texas, the lender or lien holder must provide a detailed petition to the court. This petition should include essential information such as the property address, the borrower's name, the outstanding debt amount, and evidence of the default or non-payment. Furthermore, the lender or lien holder should clearly state the reasons for requesting an expedited foreclosure, citing any potential financial losses or risks associated with delays in the foreclosure process. It is crucial to provide supporting documentation, such as copies of the original loan agreement, records of payment history, and any correspondence with the borrower regarding the default or non-payment. Once the application is filed, the court will review the petition and assess its validity. If approved, an expedited foreclosure order will be issued, setting a specific timeline for the foreclosure process. This timeline may vary depending on the complexity of the case and any potential legal challenges raised by the borrower. In conclusion, College Station, Texas Application for Expedited Foreclosure is a legal tool that allows mortgage lenders and lien holders to obtain a faster resolution for foreclosure cases. By filing this application, lenders can streamline the process of reclaiming the property and recovering outstanding debts tied to it. It is important to adhere to the specific requirements and guidelines outlined by the court to ensure a successful application and expeditious foreclosure process.

College Station Texas Application For Expedited Foreclosure

Description

How to fill out College Station Texas Application For Expedited Foreclosure?

Make use of the US Legal Forms and get instant access to any form template you require. Our helpful platform with thousands of templates makes it simple to find and obtain virtually any document sample you need. You are able to export, fill, and certify the College Station Texas Application For Expedited Foreclosure in a few minutes instead of surfing the Net for hours trying to find the right template.

Using our collection is a wonderful strategy to improve the safety of your form submissions. Our experienced attorneys on a regular basis check all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How do you get the College Station Texas Application For Expedited Foreclosure? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Find the template you require. Make certain that it is the form you were seeking: examine its headline and description, and make use of the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the file. Choose the format to get the College Station Texas Application For Expedited Foreclosure and edit and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. We are always happy to help you in any legal process, even if it is just downloading the College Station Texas Application For Expedited Foreclosure.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!

Form popularity

FAQ

The 120 day rule for foreclosure refers to the period in which you must initiate foreclosure proceedings after a borrower defaults on a mortgage. In College Station, Texas, the application for expedited foreclosure allows lenders to streamline this process, making it more efficient. Under this rule, lenders must provide notice to the borrower, giving them time to remedy the default before foreclosure proceedings begin. If you're considering pursuing a College Station Texas application for expedited foreclosure, understanding this timeline is essential.

In Texas, missing one mortgage payment can initiate the foreclosure process, but usually, lenders prefer to work with borrowers first. However, if you miss three payments, your lender may start the College Station Texas Application For Expedited Foreclosure. It's vital to communicate with your lender and seek assistance, like the services offered by US Legal Forms, to explore options before reaching this point. Staying informed can help you avoid foreclosure and find solutions early.

The foreclosure process in Texas typically takes between two to three months, depending on various factors. If you are considering a College Station Texas Application For Expedited Foreclosure, knowing the timeline helps you prepare financially. Using the right resources, such as the US Legal Forms platform, can simplify the application and clarify deadlines. This ensures you stay informed and proactive throughout the process.

The timeline for foreclosure in Texas can vary, but generally, it takes around 60 to 90 days from the notice of default to the foreclosure sale. Homeowners have options to mitigate this timeline, including the College Station Texas Application For Expedited Foreclosure, which can accelerate the process if you need to resolve issues quickly. By understanding the timeline, property owners can better prepare and respond effectively.

Texas does not offer a general foreclosure redemption period after a property is sold at auction. Once the sale completes, the previous owner typically loses all rights to the property. If you're facing foreclosure, using the College Station Texas Application For Expedited Foreclosure may provide a faster resolution, allowing you more control over your situation.

The 120-day foreclosure rule in Texas stipulates that lenders must not file a foreclosure suit until at least 120 days after the borrower defaults on their mortgage payment. However, this rule does not prevent the borrower from exploring options like the College Station Texas Application For Expedited Foreclosure to expedite the process if necessary. Understanding this rule can assist homeowners in better navigating their options.

In Texas, the process to foreclose on a lien typically lasts a minimum of 21 days after a notice of default is issued. Following that, the property can go to a foreclosure sale at least 21 days later. It's important to act quickly if you are considering the College Station Texas Application For Expedited Foreclosure, as this can shorten the timeline significantly.

While it is common to hear that the foreclosure process takes 120 days in Texas, actual times can vary widely based on the specific situation. Factors such as type of foreclosure and filings can influence the timeline. By utilizing the College Station Texas Application For Expedited Foreclosure, you can potentially streamline this process. Always review your case with a legal professional to get precise information.

Foreclosing on a property in Texas typically takes around 60 to 180 days after the notice of default is filed. If you choose to file the College Station Texas Application For Expedited Foreclosure, you may expedite the process. Understanding each step's timing is crucial for planning your next actions effectively. Working with an expert can guide you through the timeline and procedural requirements.

In Texas, the timeline to get foreclosed on can range from a few months to over a year, depending on various factors. However, by using the College Station Texas Application For Expedited Foreclosure, you may shorten this timeframe. The more you know about the process, the better you can prepare and respond. Consulting with a knowledgeable professional can provide greater insight into your specific situation.