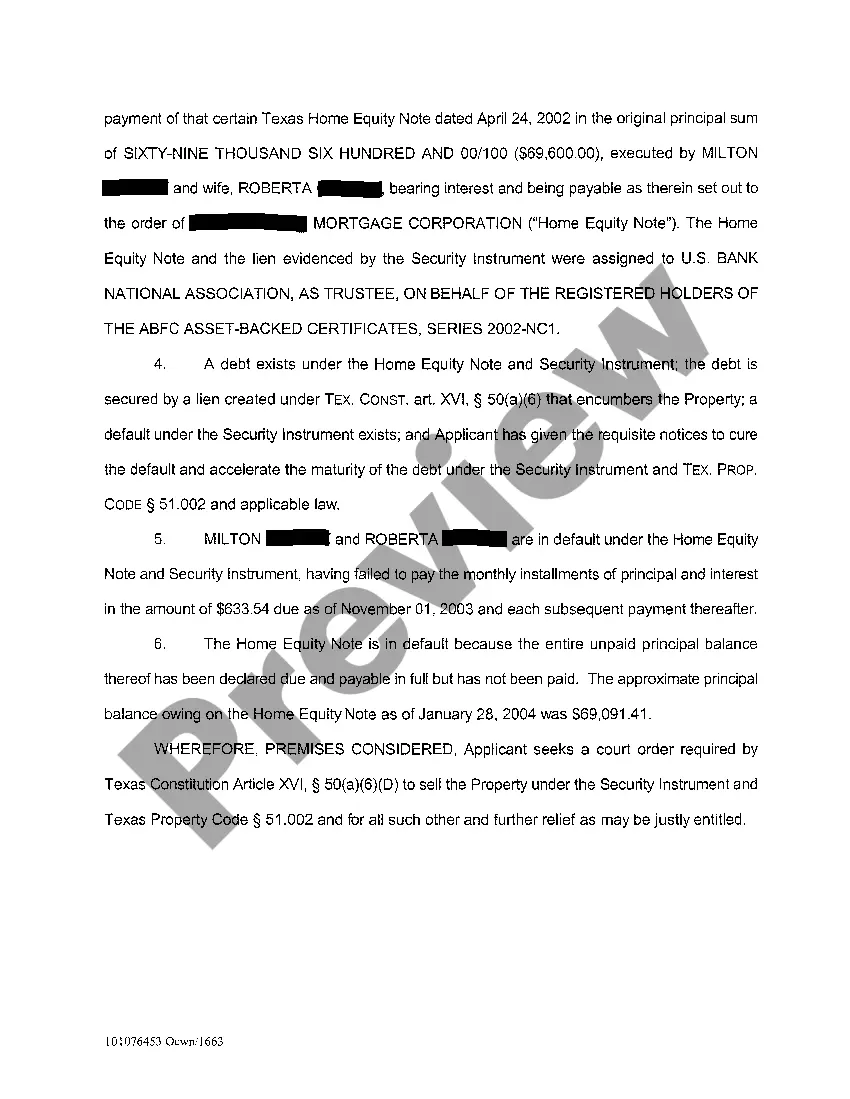

Dallas Texas Application for Expedited Foreclosure is a legal process initiated by the mortgage holder or lender to regain possession of a property due to the borrower's default on mortgage payments. This application is designed to streamline and accelerate the foreclosure process in the state of Texas. Keywords: Dallas Texas, application, expedited foreclosure, legal process, mortgage holder, lender, possession, default, mortgage payments, streamline, accelerate. In Dallas, Texas, the Application for Expedited Foreclosure is commonly used by mortgage holders to expedite the foreclosure process when borrowers fail to make timely mortgage payments. The application serves as a formal request to the court to expedite the legal proceedings and regain possession of the property to protect the lender's interest. There are several types of Dallas Texas Applications for Expedited Foreclosure, including: 1. Application for Deed of Trust Foreclosure: This type of application is utilized when the loan is secured by a deed of trust, which is a common form of securing a mortgage in Texas. It enables the lender to request an expedited foreclosure based on the terms specified in the deed of trust. 2. Application for Judicial Foreclosure: In certain cases where the loan is not secured by a deed of trust, the lender may file an Application for Judicial Foreclosure. This application seeks approval from the court to expedite the foreclosure process and recover the outstanding debt through a court-ordered sale of the property. 3. Application for Non-Judicial Foreclosure: Texas allows non-judicial foreclosure under specific circumstances. If the mortgage agreement contains a power of sale clause, the lender may file an Application for Non-Judicial Foreclosure. This application enables the lender to initiate the foreclosure without court involvement, following the procedures outlined in the mortgage agreement and relevant state laws. Regardless of the type of Dallas Texas Application for Expedited Foreclosure, the lender must provide evidence of the borrower's default on mortgage payments. This can include copies of the mortgage agreement, payment records, and any communication with the borrower regarding the delinquency. Once the application is filed, the court will review the request and assess its validity. If approved, the foreclosure process will proceed promptly, allowing the lender to regain possession of the property and sell it to recover the outstanding debt. In summary, the Dallas Texas Application for Expedited Foreclosure is a legal tool used by mortgage holders or lenders to accelerate the foreclosure process in cases of borrower default. It offers a streamlined approach to regain possession of the property and recover the outstanding debt efficiently.

Dallas Texas Application For Expedited Foreclosure

Description

How to fill out Dallas Texas Application For Expedited Foreclosure?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Dallas Texas Application For Expedited Foreclosure? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Dallas Texas Application For Expedited Foreclosure conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Dallas Texas Application For Expedited Foreclosure in any provided format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online for good.