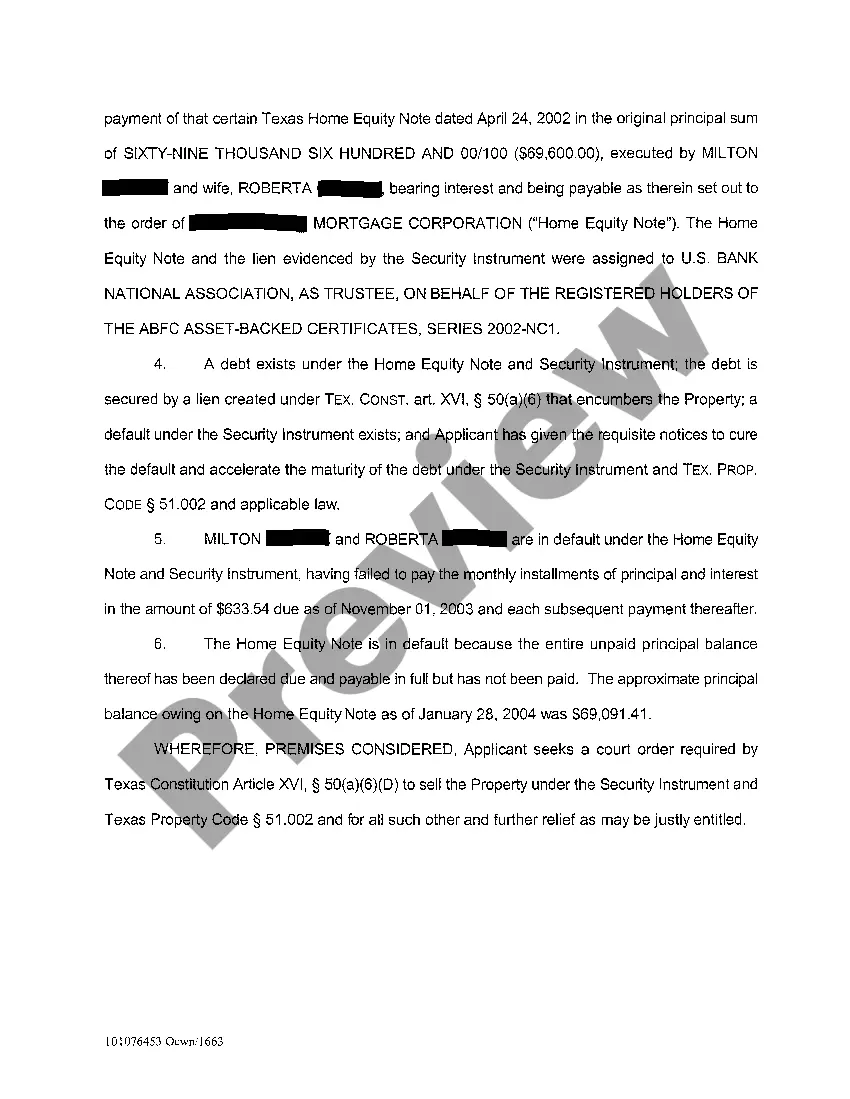

Frisco, Texas Application for Expedited Foreclosure is a legal process designed to expedite the foreclosure of properties within the city. This application enables lenders to quickly obtain possession of the property and recover their outstanding debt when borrowers default on their mortgage payments. The Frisco Texas Application for Expedited Foreclosure aims to streamline the foreclosure process, allowing lenders to swiftly reclaim their investment. Frisco, being a vibrant and fast-growing city in Texas, experiences a variety of foreclosure cases. The Frisco Texas Application for Expedited Foreclosure offers different types of applications tailored to specific circumstances. Some common types of Frisco Texas Application for Expedited Foreclosure include: 1. Residential Property Foreclosure Application: This application is used when a residential property, such as a house or a condominium unit, is being foreclosed due to the borrower's inability to meet their mortgage obligations. 2. Commercial Property Foreclosure Application: For commercial properties, such as office buildings, retail spaces, or industrial complexes, this application is filed when the borrower defaults on their loan payments, necessitating the foreclosure process. 3. Land Foreclosure Application: This type of application is applicable when undeveloped land or vacant lots are being foreclosed due to non-payment by the borrower. 4. Multi-Family Property Foreclosure Application: When foreclosure involves properties that contain multiple residential units, such as apartment complexes or duplexes, this application type is utilized. The Frisco Texas Application for Expedited Foreclosure requires several key documents and steps to be followed by lenders or their designated representatives. The application typically necessitates providing relevant information about the borrower, including their name, address, and contact details, as well as the property's details, such as its legal description and current market value. Moreover, lenders must substantiate their claim of default by submitting copies of the mortgage agreement, default notice, and any communication with the borrower regarding payment delinquencies. These documents are vital in establishing a solid case for expedited foreclosure. It is important to note that the Frisco Texas Application for Expedited Foreclosure should be filed with the appropriate city authorities, adhering to legal deadlines and requirements. Lenders or their legal representatives should consult with experienced attorneys specializing in foreclosure law to ensure compliance with all necessary procedures. In summary, the Frisco Texas Application for Expedited Foreclosure is a crucial legal tool for lenders to efficiently navigate the foreclosure process in Frisco, Texas. By utilizing specific application types tailored to various property categories, lenders can expedite the repossession of properties and recover their outstanding debt. However, it is essential to consult legal professionals to ensure proper adherence to all legal requirements during the foreclosure process.

Frisco Texas Application For Expedited Foreclosure

Description

How to fill out Frisco Texas Application For Expedited Foreclosure?

If you are searching for a relevant form, it’s difficult to choose a better service than the US Legal Forms site – one of the most extensive libraries on the internet. Here you can get a large number of form samples for business and individual purposes by categories and states, or key phrases. With our advanced search feature, getting the most recent Frisco Texas Application For Expedited Foreclosure is as elementary as 1-2-3. Furthermore, the relevance of each and every record is confirmed by a group of skilled attorneys that on a regular basis review the templates on our website and revise them in accordance with the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to get the Frisco Texas Application For Expedited Foreclosure is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you want. Read its information and utilize the Preview function to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the proper record.

- Confirm your choice. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Frisco Texas Application For Expedited Foreclosure.

Each template you add to your profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to get an additional duplicate for modifying or creating a hard copy, you can come back and download it once more at any time.

Take advantage of the US Legal Forms professional catalogue to get access to the Frisco Texas Application For Expedited Foreclosure you were seeking and a large number of other professional and state-specific samples on a single platform!